This article was last updated on September 18, 2019

This article will review some peer-to-peer lending options. It will focus on some platforms in the UK, with subsequent articles planned for other countries and regions.

I will answer some frequently answered questions (FAQs) and suggest some alternatives for investments.

This article is long. For the time-poor that are interested in asking me questions directly, or want to invest in alternative investments, please contact me on adamfayed@hotmail.co.uk or adamfayed@int-amg.com.

Table of Contents

What is peer to peer lending?

Peer to peer lending is when an investor is willing to give a loan to a borrower. Small businesses and individuals get loans from investors registered on these online platforms, and these investors get a return on those investments.

So explaining this investment is very easy. That doesn’t mean all peer to peer websites are the same.

What are the typical rates of return?

That varies, depending on the platform, but 5%-7% yearly returns are typical.

How about the risk?

There is an obvious risk. As you are lending money to people, they might default on those loans.

Of course, you can control that risk, by buying 10-20 loans, but the risk still exists.

Beyond that there is “relative risk”, meaning you will lose out to other investments.

Stock Markets like the S&P500 might be volatile, but they have produced an average performance of 10% for over 200 years – 6.5% above inflation.

In many ways, holding a stock market index for decades is lower risk than peer to peer lending, as the investments are liquid and tend to go up over time, regardless of the short-term volatility.

For expats and foreign-nationals, there is also the currency risk. Getting 5%-7% in GBP doesn’t make much sense, if the GBP continues to weaken against most currencies.

What is the regulation like?

This depends on where the platform is based. Assuming the platform is based in the UK, the Financial Conduct Authority (FCA) has announced new rules, to be enacted in December 2019.

These rules will tighten up the market. Most controversially, investors will no longer be able to invest more than 10% of their investable assets into such platforms, although it is unclear how this will be regulated and enforced.

There will also be a new “appropriateness test” for new investors. There will also be stronger investor protections in case platforms go bust, including new “minimal information” guidelines.

In effect, this means that platforms will need to give new investors a clearer view of any new investments they make.

Are there a lot of complaints?

Like everything which depends on co-operation between people, there are plenty of complaints.

This tends to depend on which platforms people use, however, and their expectations going on.

There aren’t as many “scams” as people assume, the risk is merely higher than many people believe on day one of investing their money.

What are some of the biggest websites for peer to peer in the UK?

Zopa is said to be the biggest peer to peer website in the UK, at the time of writing.

They have around 50,000 lenders, the minimal investment is just 10GBP. The average returns have been around 5%, even adjusted for defaults.

Some other platforms include:

- Rate setter

- Funding Circle

- Funding Secure

- Lendy

- Assetz capital

- Lend invest

What are the positives?

The positives of these investments are:

- You can start with low minimal investments

- The rates of return are higher than in the bank

- You can reduce your risk by buying 20-30 investments on the same platform. Meaning that even if 10% go wrong, your returns are still OK

- A small percentage of these platforms offer higher returns (10%+ per year) in return for more risk.

- It is easy to set up with good tech for making payments and withdrawing

- From the point of view of the person borrowing the money, they are getting a better deal than some commercial loans, due to the competition. This is a positive for them, rather than the investor, however.

What are the negatives?

Most importantly perhaps, investors are taking a big risk, given the returns. Taking a big risk for 15%-25% a year, makes sense, but not for 5% per year.

There are alternative “buy and hold” investments which might be more volatile than peer to peer lending, but have historically produced more than 5%-6% per year.

Exceptions exist, and 1-2 platforms do offer higher returns for higher risk, but the general point still stands.

Ultimately, many of the people applying for loans through these platforms, have a high credit risk and often can’t get good loans elsewhere.

If they were so credit worthy, surely other investors would be lining up to deal with them?

Option negatives include

- It isn’t always tax-advantageous. This further affects net returns

- It doesn’t give you broad, diversified, international exposure.

- In some cases, there are no insurance or government protections against defaults. This includes FSCS and other forms of government protections, although some exceptions exist.

Of course, in addition to the positives and negatives mentioned here, each individual peer-to-peer lending platform, has additional plusses and minuses to contend with.

What about tax?

As mentioned in the last section, the interest rates paid are considered taxable income.

Is peer to peer lending safe?

The processes are safe in terms of tracking the loans and the platforms that are used.

So most of these platforms are safe from scams, with just a few exceptions. The biggest risks are that the actual investment will go down in value.

How about compared to other investments like stocks and bonds?

Comparing peer to peer lending to stocks and bonds, is a bit like comparing apples with pears.

They are very different investments. However, the historical rate of returns on some markets, like the US S&P and Nasdaq, is much higher than peer-to-peer lending.

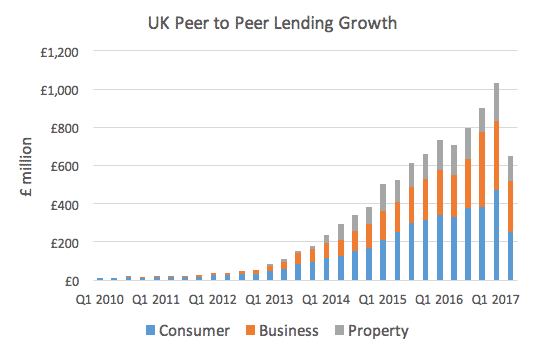

Is peer to peer lending growing in the UK?

Yes. As the statistics show below, there has been significant growth, in the era of 0% interest rates.

However, compared to more conventional investments, the market is still small.

Are there many good peer-to-peer lending outside of the UK?

There are many including Upstart and Lending Club. Not all platforms outside of the UK can take UK residents, however, and most of them have the same positives and negatives as discussed above.

What kind of investments do you do?

I am focused on long-term and low-costs investing, starting at $75,000 (about 40,000GBP) or $600 a month.

Most of these investments are linked to bond and index funds, and property-related investments.

Conclusion

Most peer-to-peer firms aren’t scams. In fact, you have a good chance of beating the bank despot rate.

However, there are usually better and safer ways to get higher returns.

Further reading

For people interested in investing in property without being a landlord, the following article would be useful:

How to invest in real estate online and without being a landlord?