The recent market falls have got people thinking – When will stocks and crypto recover in 2022?

Before speaking about that, it is important to remember that not all stock markets are down for the year.

When I wrote this article on May 18, 2022, the UK’s FTSE100 was up by 0.18% for the year, in addition to the dividends which has been paid, bringing the total to around 2% for the year.

This is partly due to the big oil&gas players, such as BP and Shell, performing well so far. Other “commodity heavy” indexes, such as the Canadian and Australian markets, are only marginally down.

Even the Dow Jones is only down by 10%. The biggest victims of the market sell-off have been technology, with the Nasdaq down 24.31% so far in 2022.

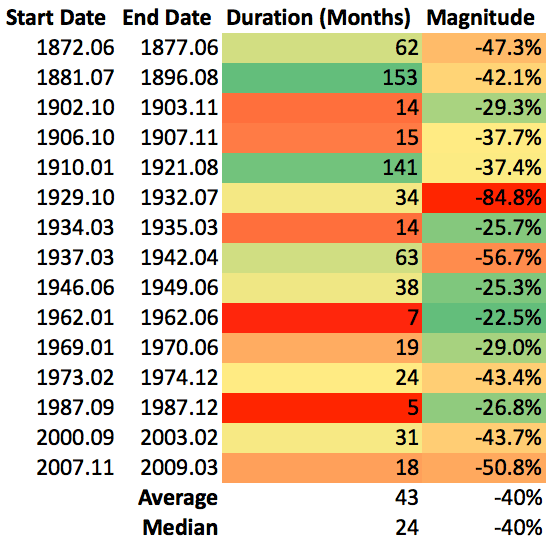

The question is, how long is this likely to last? If we look historically, most bear markets (usually defined as a price fall of 20%+), only last for 9-15 months, with 9.6 months being the average.

Even longer bear markets don’t usually last for a decade:

This was certainly the case during late 2018/early 2019 falls, and the 2020 Covid-related recovery.

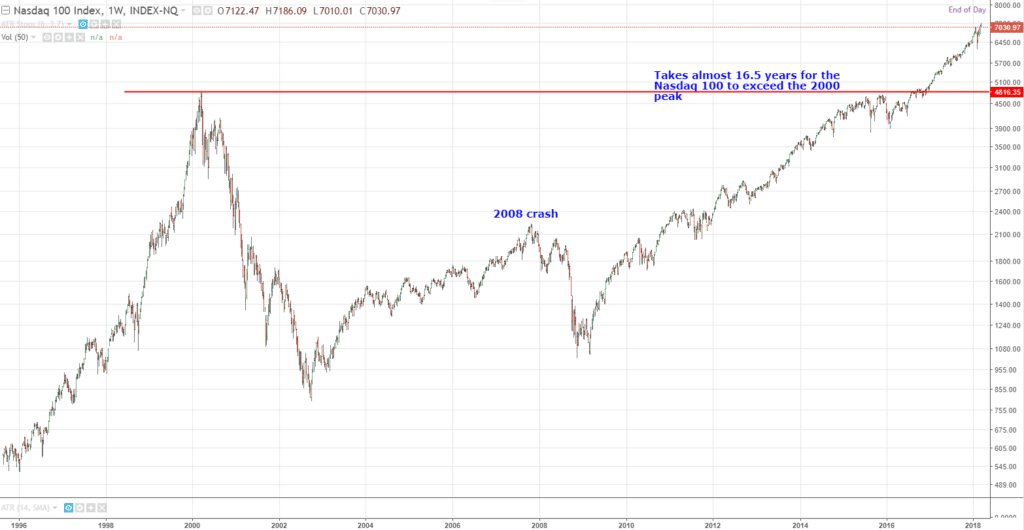

However, that doesn’t mean that all bear markets end quickly. It took the Nasdaq about 14 years to recover from the 2000 crash, and the Dow Jones had a lost decade from 2000-to 2010. 1965-1982 was an even longer period of stagnation for the markets.

The simple answer is nobody knows when a bear market will stay, and end, but most people should want it to last for a long period.

I once heard a great quote that said that younger investors should get on their knees and hope the market stays in bear market territory for years.

Warren Buffett also said that except for investors within five years of retirement, everybody else should hope for falling markets.

This might sound counterintuitive, but the maths is simple.

Let’s take two investors. Both invest $1,200 a month for 30 years. Investor one gets 14% in the first fifteen years, and then 2% thereafter from years 16 until 30.

Investor two, in comparison, receives 0% from years 1 until 15, and then 12% from years 16-30.

Investor one’s final figure, after thirty years, is $1,018,875.11. Investor two receives $1,486,281.20 – over 40% more for investing the same amount.

How is this possible, considering the returns look lower? The reason is simple. Investor one got very impressive returns during the early years of the account.

Getting 14% when your account is only worth $20,000 isn’t that much money. In comparison, investor two got 12% returns, on average, when his or her account was worth hundreds of thousands.

A good investors should see themselves as a collector. It is good to collect more units when you are a net buyer (young or middle-aged), whereas when you are a net seller (close to retirement or later) you should only want the price to increase.

So, in much the same way that we should want the price of housing to go down if we are looking to buy a house, it makes sense to celebrate if the markets are falling.

Most investors, unfortunately, do the opposite. Net inflows into many funds, including Vanguard, hit the highest in 1999, after eighteen years of strong stock market performance.

Net sales, or outflows, hit a record in 2008. A rational investor should have been happier in 2008 than in 1999.

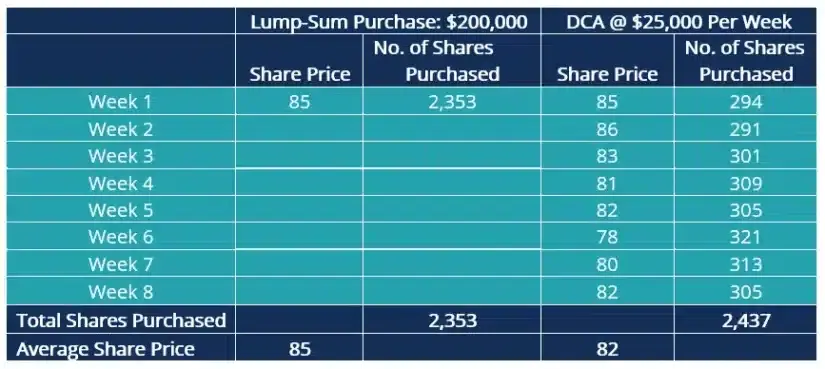

It is for this reason that plenty of stock investors try to “dollar-cost-average”, which is just a fancy way of investing every month, to even out the risk.

Crypto is different. It is a new asset class. Bitcoin might have been around for over a decade, but it has only been significant in the last two or three years.

The 2013-2018 bear market for crypto was overcome, but this could be the first protracted bear market where the asset class is in more investors’ portfolios.

Unlike the stock market, we don’t have a 200-year+ history of this asset class always recovering. This is likely to be the asset class’s biggest test yet.

Research has indicated that at least 30% of crypto investors are now sitting on a decline, having purchased Bitcoin (and other coins) at significantly higher levels than we see today.

If interest rates keep rising, and the coins stay low for longer, some of these investors might give up and sell.

Ultimately, unlike stocks that have dividends and business earners, crypto is a speculative asset, which should only be a maximum of 10% of your portfolio.

Some of these coins could go to zero, which will never happen if you buy the stock market…..unless is a nuclear war.

Therefore, with the stock market, I know it will recover, as it always has done for hundreds of years.

I will merely enjoy the lower valuations, and hope they last for a long time until the recovery. I have no idea if crypto will never recover, or be 10x higher in five years, due to the speculative nature of the asset.

The bottom line is this – you shouldn’t base your investment decisions on short-term price movements.

Many people bought crypto just because the price was going up, which is the worst reason to buy an asset class.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.