This article will review Simple Crowdfunding to help interested investors weigh the pluses of the platform as well as its risks, and give more information on the offerings. Let’s start by getting to know the firm.

If you have been proposed this option and want a second opinion, you can email me (advice@adamfayed.com) or contact me here.

Table of Contents

Who is Simple Crowdfunding?

Simple Crowdfunding is a UK property finance platform that is regulated by the Financial Conduct Authority (FCA). The platform enables investors to invest directly in UK property and simultaneously supports developers in delivering more homes throughout the UK.

Simple Crowdfunding provides investment opportunities in both equity and peer-to-peer lending, accepts Individual Savings Account (ISA), pension, and international investors, and offers a program to learn while investing. The platform received authorization in 2013 and has since experienced growth.

The platform provides access to UK property for anyone, bridging the gap between investors and property professionals through projects. Investors can take advantage of investment opportunities in property and learn about various property strategies through live projects. Fundraisers are also able to receive funding for their projects, which allows them to deliver more homes, increase brand awareness, and expand their reach to a larger investor community.

Simple Crowdfunding Investments

To start being an investor on the Simple Crowdfunding platform, you must provide certain required details to qualify. Since the investments are not open to the general public, you will have to wait for approval from the firm. You will get access to the project offerings when your application as an investor gets approved.

What are the property investment opportunities offered?

Investors can choose from a variety of property investment alternatives, such as ones that include loans as well as those that involve equity, on the Simple Crowdfunding platform.

The rate of return on peer-to-peer loans is fixed within a set time frame. Meanwhile, equity investments involve acquiring shares of either the firm or the special purpose vehicle (SPV) it has established.

Investors can also take advantage of tax-free returns by setting up an Innovative Finance ISA (IFISA) with Simple Crowdfunding and investing in peer-to-peer lending opportunities. Additionally, they can open a Trust or Pension Scheme account and invest their small, self-administered pension schemes (SSAS) in various real estate developments.

It is up to you to choose which projects are most suitable for you to put your money to.

Peer to Peer Lending (P2P)

Simple Crowdfunding acts as the intermediary between the lender and the fundraiser in order to facilitate the P2P loan or loan-based crowdfunding. The firm is accountable for making sure all the necessary paperwork is completed, handling the loan, and overseeing any repayments that are taken by the fundraiser.

How does Simple Crowdfunding decide whether or not to include a P2P loan?

To safeguard investors, the company maintains a duty of care responsibility to make sure that all projects adhere to the regulations set forth by the Financial Conduct Authority (FCA). The company also meticulously evaluates each project using a variety of criteria that are broken down as follows:

- Monetary variables, include profit margin, loan to value (LTV), and loan to gross development value (GDV).

- Company background and management history and capabilities

- Record of accomplishments, including the total number of completed projects and GDV successfully delivered.

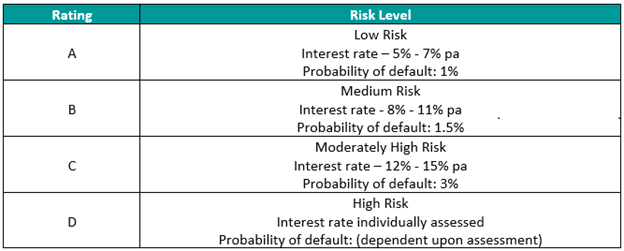

After analyzing the results, a Credit Rating Score Band is assigned to each listed loan. This is how the bandings are categorized:

If the likelihood of default is 1%, then it is projected that 1 loan in every 100 will go into default. If the likelihood of default is 3%, then it is assumed that 3 out of every 100 loans will go bad.

So a loan gets paid late or remains unrepaid, what happens then?

When it comes to recovering debt, Simple Crowdfunding takes a flexible strategy that takes into account the borrower’s circumstances and behavior both before and after the financial crisis to determine the best course of action for investors. The borrower’s record of default and chasing activities is tracked by the firm.

Simple Crowdfunding does not think a “one-size-fits-all” strategy can work, and instead believes that they need to tailor their efforts to each individual fundraiser in order to get the greatest possible outcome.

This involves establishing a positive relationship with the borrower at the start of the loan, utilizing automated pre-chasing of repayments, promptly chasing monies due upon receipt, appropriately communicating with both the borrower and investors in the case of delays, and avoiding hasty or delayed use of formal legal letters.

Is there a secondary market for P2P?

There is no secondary market for P2P deals on Simple Crowdfunding, and the price is established just once, at the outset.

In the case of a default or prospective default, the firm will notify all investors of the situation and its assessment of the potential implications on their loans, including the loss of potential interest and the basic capital.

Should investors want to get out of a loan before it matures, the company will let the other existing investors on the platform know. The investors opting out may also on their own try to find another investor to take over their shares.

Equity Crowdfunding

After all of the necessary money have been collected for a project, the group that was responsible for pooling those funds is now accountable for executing the project. They are accountable for delivering updates on the development in accordance with the agreements made, as well as for overseeing the project through to its completion.

Simple Crowdfunding serves as the venue for communication between investors and project creators by way of the private project discussion boards to which investors have access. In addition to this, they will make sure that the updates page of the project is kept up to date with any new information that the fundraiser obtains.

Who can invest?

Interested investors who are not residents of the UK are welcome to apply. However, they must be able to submit appropriate paperwork to help Simple Crowdfunding comply with identification, anti-money laundering, and tax reporting duties.

Provide your Tax Identification Number (TIN), proof of present address, and a certified copy of your passport. A non-EEA declaration will also need to be signed if you are not a resident of the European Economic Area.

It is your duty if you are located outside the UK to:

- Make sure that there are no limitations on your ability to invest on the platform.

- Declare any income or profits to your relevant tax authorities.

- Simple Crowdfunding specifically states that those from the US are currently not permitted to invest in any offering.

Is a company allowed to invest?

Yes. There are three different registration options available to you when you register: individual, company, and trust/pension plan.

In order to complete the registration of your firm, you will need to provide KYC (Know Your Customer) papers, such as:

- the Articles of Association and the Certificate of Incorporation.

- beneficiary designation

- proof of identity papers for anybody with voting rights in the company (such as a board member, shareholder, etc.)

How much can I invest?

Investments starting from 100 pounds are accepted, although the minimum amount may be higher for certain projects. On the other hand, the maximum investment amount is determined by subtracting the amount invested by other investors from the total fundraising goal. Well, if you are the first and so far only investor, you can just fund the entire project on your own (although that defeats the purpose of crowdfunding).

Diversifying your investments by distributing smaller amounts across multiple projects is a wise risk management strategy. Detailed information about each investment opportunity is available in the project particulars.

What are the investment fees?

Investors are not charged any fees by Simple Crowdfunding to establish their account or invest in projects. This also includes the establishment of their Innovative Finance ISA account. However, Simple Crowdfunding may levy a 100 pound administrative fee when investors move their IFISA to another provider.

Registered investors will be notified in advance in the event of a fee change.

Can I get my funds anytime?

In most circumstances, selling your assets will not be a simple process for you.

The money that is invested is not easily accessible since it is illiquid. It is often unavailable for the life of the project. There is a possibility that you will have the chance to sell your loan or shares if there is a new investor who is interested in matching the amount of money that you have already invested. Nevertheless, this is not definite and you should not rely on it anyway.

Are my investments protected?

Investments made through Simple Crowdfunding are not protected by the Financial Services Compensation Scheme (FSCS). However, your funds will be maintained by the recipient in a dedicated client bank account and will be afforded the additional safeguards given to credit institutions and banks prior to being invested or upon release of investment earnings.

For equity investments, it is crucial that you have a clear understanding of your position in case of unfavorable outcomes. As per Company Law, minority shareholders are entitled to certain rights that safeguard them against unjust actions. Depending on the type of investment, you may have complete voting and pre-emption rights, providing you with additional protection. These details are specific to each project, and the shareholder documentation will be handed over to you.

The available security for a project will also be specified in the project details for peer to peer loans. In case of unforeseen circumstances, Simple Crowdfunding will collaborate with the fundraiser to address any issues and recuperate the funds. Although the P2P loan is directly between you and the fundraiser, Simple Crowdfunding assumes an essential administrative function, so it will pursue the retrieval of your investment when there is a reasonable prospect of doing so, after considering any associated expenses.

What would my investments look like if new shares are sold?

If a company issues new shares, it could dilute the value of existing shares, including those held by investors. This means that the percentage of ownership in the company that you hold as an existing shareholder would decrease. As a result, the value of your investment may decrease in proportion to the new shares issued.

However, the impact on individual investors would depend on the size of the new share issuance and the terms of the new shares and the basis on which they are issued. If the new shares are issued with the same rights and conditions as your existing shares, your investment may not be affected. However, if the new shares are issued with additional rights, such as preferential voting rights or preferential rights to dividends, your investment may be affected.

It’s important to review the terms and conditions of your investment to understand how new share issuances could potentially affect your investment.

If the target funding total isn’t met, what then?

If the financing goal isn’t met by the deadline, Simple Crowdfunding may give the project more time to raise the necessary funds, or the project may be discontinued. When this threshold is met, the project will go forward. The baseline target must at least be met in order for a project to proceed.

All investment money will be refunded if the project is scrapped.

Where would my investments go if I pass away?

Upon your demise, your investments will become part of your estate, and the responsibility of administering the transfer to your intended beneficiary will fall to your appointed executors.

What are the tax considerations?

Although both equity and P2P loan investments may generate taxable income or profits, their respective tax treatments differ and are addressed independently. Simple Crowdfunding provides an IFISA option for P2P loan investments, with any returns earned from investments held in the IFISA being exempt from tax.

Interest earned on P2P loan investments is considered savings income for most UK individual tax filers and is subject to Income Tax. When investors lend money to several borrowers, they may be considered to be engaging in the business of money lending.

The government implemented the Personal Savings Allowance in April 2016 to establish a threshold below which interest earned on savings accounts is not subject to taxation. The interest accrued through P2P loans is covered under this allowance.

Dividends are considered income and are subject to taxation in the same way that interest is. To clarify, the Personal Savings Allowance, which does apply to interest on P2P loans but not dividend income, is distinct from the yearly dividend allowed of 2,000 pounds under current UK tax regulations.

Depending on your tax bracket, you’ll pay either 7.5%, 32.5%, or 38.1% on any dividend income you get in a given year that exceeds your yearly limit.

In addition, capital gains tax (CGT) may be due on any earnings, although losses may be deducted from CGT. HM Revenue & Customs classifies interest and capital gains from any loan or equity investment as investment income. The tax will not be withheld from the gross amount, so you’ll get your investment yield in full.

Investors must pay any applicable marginal tax rates directly to the HMRC.

Simple Crowdfunding Raise Funds

It’s quite simple if you are interested to use Simple Crowdfunding for capital raising. You merely need to fill up the form on the platform with your personal details – name, email, phone number – and your project information – the kind of real estate project you’re raising funds for, the target funds, the length of financing, if it’s equity or loan, your ownership of the project, as well as your exit strategy.

What are the upsides and downsides of Simple Crowdfunding?

Advantages

- Ease of Use: Simple Crowdfunding Platform is easy to use and navigate, making it simple for anyone to set up and run a campaign.

- Low Cost: Simple Crowdfunding Platform typically charges lower fees than traditional fundraising methods, such as banks or venture capitalists, making it an affordable option for startups or smaller projects.

- Increased Exposure: Simple Crowdfunding Platform can provide increased exposure to your project or business, as it is often promoted through social media and other marketing channels, which can help to reach a wider audience.

- Validation: Crowdfunding can provide validation for your idea, as it allows you to gauge interest and gather feedback from potential customers or investors before launching a product or business.

- Community Building: Simple Crowdfunding Platform can help to build a community around your project, as backers can become advocates for your business and help to spread the word about your campaign.

Disadvantages

- High Competition: Due to the popularity of Simple Crowdfunding Platform, there is often high competition for funding, making it challenging to stand out from other projects and attract backers.

- Limited Funding: Simple Crowdfunding Platform campaigns are often limited to a certain time frame and funding goal, which can make it challenging to raise sufficient funds for larger projects or businesses.

- Time-Intensive: Running a successful Simple Crowdfunding Platform campaign can be time-consuming, as it requires significant effort to promote the campaign and engage with backers.

- Accountability: Crowdfunding campaigns are subject to public scrutiny, and you’ll need to be accountable to your supporters. You’ll need to keep them informed about your progress, address their concerns, and deliver on your promises.

- No Guarantee of Success: There is no guarantee of success with Simple Crowdfunding Platform, as campaigns can fail to meet their funding goals, leaving the project or business without the necessary funding to move forward.

Simple Crowdfunding Review: Final Thoughts

It is important to diversify your investments and consider the possibility of loss of principal and limited market liquidity when considering investments via Simple Crowdfunding. Investors who do not accept and are not ready for these risks should not use the platform.

Any potential investor who is not a UK resident must make sure they are not breaking any laws in their own country by investing in a UK company.

Make sure the material presented is accurate, comprehensive, and not intended to mislead in any way since this is crucial to gaining an understanding of each project. Every financial choice requires careful thought and analysis on your part as an investor.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.