The Malaysia expat tax system undergoes periodic revisions, with 2023 being no exception. As expatriates residing in Malaysia, it’s imperative to be aware of these changes to ensure compliance and make the most of the available tax benefits.

This article provides insights into the pivotal updates in the Malaysia expat tax for 2023.

Being well-informed about the Malaysia expat tax changes is not just about compliance; it’s about financial optimization. By understanding the latest tax regulations, expats can potentially reduce their tax liabilities.

Moreover, with the Malaysia expat tax landscape evolving, staying updated helps expats make informed financial decisions, ensuring they maximize their income while living in Malaysia.

At its core, Malaysia employs a territorial tax system, which implies that it taxes income generated within its boundaries. For expatriates, this system can be intricate, especially when they have income sources from various countries.

If you want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

Table of Contents

Key Changes in Malaysia Expat Tax for 2023

Revision in Tax Rates

2023 introduces notable revisions to the Malaysia expat tax rates. These changes are not merely numerical but represent the country’s evolving economic strategies and priorities.

While some expats might find themselves on the beneficial side of these changes, others might need to recalibrate their financial plans.

Comparison with 2022 Rates

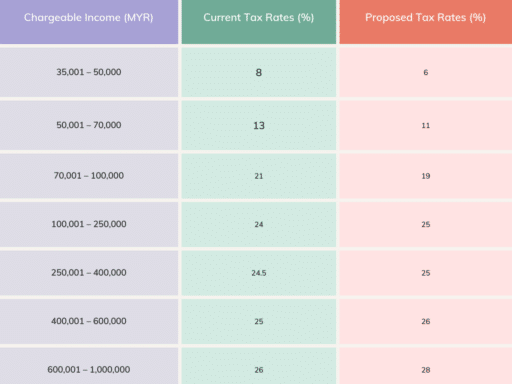

When we juxtapose the Malaysia expat tax rates of 2023 with those of the previous year, 2022, a discernible shift is evident. Specifically, there’s a reduction of the individual income tax rate by 2% for middle-income resident individuals.

However, the tax rate has increased by 0.5% to 2% for higher-income resident individuals. This strategic adjustment aims to align the tax system with the country’s economic objectives, ensuring a balanced approach that caters to various income groups.

Implications for Different Income Brackets

The implications of these changes in Malaysia expat tax rates vary across income brackets:

- Middle-Income Residents: Those falling within the chargeable income band of MYR 35,001 to MYR 100,000 will experience a reduction in their individual income tax rate by 2%. This move is a part of the government’s initiative under the “Care and Compassion” drive to support vulnerable groups.

- Higher-Income Residents: On the contrary, individuals in the chargeable income band of MYR 100,001 to MYR 1,000,000 will see an increase in their individual income tax rate ranging from 0.5% to 2%. This increment is a reflection of the government’s strategy to ensure equitable tax distribution.

For companies with international assignees, this could mean a slight uptick in their assignment-related costs.

It’s essential for expats and their employers to be aware of these changes, as they can influence the overall cost of international assignments, especially for those who qualify as tax residents in Malaysia.

Detailed Breakdown of the New Tax Rates

Here’s a more detailed breakdown of the proposed tax rates for resident individuals for the Year of Assessment (YA) 2023:

Source: KPMG in Malaysia

It’s worth noting that the tax rate for nonresident individuals remains unchanged at 30%.

New Deductions and Exemptions

The Malaysia expat tax system in 2023 introduces new deductions and exemptions. These changes aim to provide relief to expats in specific situations, making it essential for them to stay updated with the latest modifications.

Criteria for Eligibility

To benefit from these new deductions, expats must meet certain criteria. The Malaysia expat tax department has laid out clear guidelines, which expats should review carefully.

For instance, some reliefs are specifically designed for individuals with dependents, while others cater to those with medical expenses or those investing in education.

How to Claim These Deductions

Claiming these deductions requires submitting specific forms and documents. Expats should ensure they provide all necessary information to benefit from the Malaysia expat tax reliefs.

It’s crucial to keep all relevant receipts and certifications, as these will serve as evidence for the claims made.

Notable Deductions and Exemptions for 2023

Medical Treatment and Special Needs for Parents

Expats can claim up to RM8,000 for expenses related to the care and treatment of their parents by a nursing home or for non-cosmetic dental treatment. This relief was increased from RM5,000 in YA 2021.

Education Fees in Malaysia

A relief of up to RM7,000 can be claimed for courses of study undertaken in recognized institutions in Malaysia. This includes courses at the Masters or Doctorate level and specific courses at the tertiary level.

Medical Expenses

Expats can claim up to RM8,000 for various medical expenses, including treatments for serious diseases, fertility treatments, and vaccinations. This also covers mental health examinations, a relief introduced to address the psychological impacts of the Covid-19 pandemic.

Lifestyle Purchases

A relief of up to RM2,500 can be claimed for expenses related to books, personal computers, sports equipment, and internet subscriptions.

Electric Vehicles (EV) Charging Equipment

Those who purchase, install, or rent EV charging equipment can claim up to RM2,500. This relief was introduced to promote the use of electric vehicles and is applicable for YA 2022 and YA 2023.

Childcare Fees

Parents can claim up to RM3,000 for childcare fees for children aged 6 years and below. This relief was increased from RM1,000 as part of the government’s Covid-19 economic recovery program.

Net Deposit in SSPN

Parents saving for their children’s higher education can claim a relief for the net deposit in the National Education Savings Scheme (SSPN).

SOCSO

Contributions to the Social Security Organisation (SOCSO) can be claimed as relief, with the limit increased to RM350 under Budget 2022.

Updates on Double Taxation Agreements

The year 2023 marks a significant phase for the Malaysia expat tax system, especially concerning double taxation agreements.

These agreements play a pivotal role in ensuring that expats don’t face taxation in both their home country and Malaysia for the same income. Let’s explore the latest updates in this domain.

Countries Added to the Agreement List

The Malaysia expat tax landscape has expanded its horizons by adding new countries to its double taxation agreement list. Notably, two significant additions in 2023 include:

- China: A new agreement with China came into effect from 1 January 2023 for Withholding Tax (WHT) and from 1 March 2023 for other taxes.

- Poland: A renewed tax treaty with Poland, which replaces the 1977 tax treaty, entered into force on 12 January 2023.

- Maldives: On 24 May 2023, officials from Malaysia and Maldives signed a Double Taxation Agreement, further strengthening the ties between the two nations.

These additions mean that expats from these countries can now enjoy the benefits of the double taxation agreements, ensuring they aren’t taxed twice on the same income.

Benefits for Expats from Specific Countries

With the inclusion of new countries in the double taxation agreement list, expats from these nations can reap several benefits under the Malaysia expat tax system.

Reduced Tax Rates

One of the primary advantages of these agreements is the potential for reduced tax rates. Expats from countries with these agreements might find that they owe less in taxes in Malaysia, thanks to the stipulations of the treaty.

Specific Exemptions

Beyond just reduced rates, the Malaysia expat tax system offers specific exemptions for expats from treaty countries. These exemptions can relate to certain types of income or financial activities, providing relief from potential tax burdens.

Clearer Tax Liabilities

These agreements also provide clarity. Expats can have a clear understanding of their tax liabilities in both their home country and Malaysia, ensuring they remain compliant and avoid any legal complications.

Compliance and Reporting Updates

Changes in Tax Filing Deadlines

Every expat should mark their calendars with the new tax filing deadlines for the Malaysia expat tax in 2023. As the financial landscape evolves, the Malaysia expat tax system adapts to ensure clarity and efficiency in its processes.

Consequences of Late Filing

Late filing can result in penalties. The Malaysia expat tax department takes compliance seriously, and expats should ensure timely submissions.

With the introduction of the Finance Act 2023, there have been several adjustments to the tax measures, emphasizing the importance of adhering to the stipulated deadlines.

Extensions and Exceptions

In certain situations, expats can apply for extensions or exceptions under the Malaysia expat tax system. However, these are not guaranteed and depend on individual circumstances.

It’s crucial to be aware of these provisions and apply for them if necessary, ensuring you remain compliant with the Malaysia expat tax regulations.

Digitalization of Tax Reporting

2023 witnesses a significant move towards digitalization in the Malaysia expat tax reporting process. This transition aims to streamline the tax filing process, making it more efficient and user-friendly for expats.

How to Use the New Online Portal

The new online portal simplifies the Malaysia expat tax filing process. Expats can now submit their documents, track their submissions, and even make payments online.

The Finance Act 2023 has introduced electronic filing requirements for various tax returns, including those filed by individuals, trust bodies, and cooperative societies.

This move towards digitalization ensures that the Malaysia expat tax system remains up-to-date with global standards.

Security Measures in Place

With digitalization comes the need for robust security. The Malaysia expat tax department has implemented state-of-the-art security measures to protect expats’ data.

These measures ensure that personal and financial information remains confidential and safe from potential threats. Expats can confidently use the online portal, knowing that their data is in safe hands. Furthermore, the Finance Act 2023 has introduced several other notable changes.

For instance, there’s an increase in the personal deduction limits for certain medical expenses from MYR 8,000 to MYR 10,000.

Additionally, there’s a new personal deduction for the diagnosis, early intervention, and treatment of learning disabilities in children, subject to an MYR 4,000 limit. The Act also provides revised individual income tax brackets, with various rates depending on the income range.

These changes, among others, highlight the importance of staying informed and updated on the Malaysia expat tax regulations.

Tax Residency and Its Implications

Tax residency plays a pivotal role in determining how much an expat owes in taxes to the Malaysian government. The Malaysia expat tax system has specific criteria that define tax residency, and these criteria have undergone some changes in 2023.

Criteria for Tax Residency in 2023

The Malaysia expat tax system uses a set of guidelines to determine an individual’s tax residency status. These guidelines primarily focus on the duration of an individual’s stay in Malaysia.

Duration of Stay Requirements

Previously, the general rule was that if an individual stayed in Malaysia for more than 182 days in a calendar year, they were considered a tax resident. However, in 2023, the criteria have been refined.

Now, according to the updated Malaysia expat tax guidelines, there are two main ways to establish tax residency:

- 90 Days Rule: An individual is considered a tax resident if they are present in Malaysia for at least 90 days during the calendar year and have been resident or present in Malaysia for 90 days in any three of the past four years.

- No Physical Presence Rule: An individual who has been a Malaysian resident for the past three calendar years and will continue to be a resident in the subsequent year is also considered a tax resident.

Expats should be aware of these changes to ensure they correctly determine their tax residency status under the Malaysia expat tax system.

Impact on Tax Liabilities

The implications of being a tax resident are significant when it comes to Malaysia expat tax liabilities. As a tax resident, an individual is subject to different tax rates and can access various deductions that non-residents cannot.

Tax residents, in most cases, enjoy lower Malaysia expat tax rates. This is because the Malaysian government aims to encourage long-term stay and investment in the country.

Furthermore, tax residents can also claim a wider range of deductions, which can substantially reduce their overall Malaysia expat tax liabilities.

Benefits for Tax Residents

The Malaysia expat tax system offers several advantages to those who qualify as tax residents.

Lower Tax Rates

One of the primary benefits of being a tax resident in Malaysia is the access to reduced tax rates. The Malaysia expat tax system is structured in a way that rewards long-term residents with more favorable tax rates, making it financially beneficial for expats to spend more time in the country.

Access to Special Deductions

In addition to lower tax rates, tax residents also have the privilege of accessing special deductions. These deductions can range from personal reliefs, such as medical expenses and education fees, to specific investment-related deductions.

By taking advantage of these special deductions, tax residents can further decrease their Malaysia expat tax liabilities.

Common Mistakes to Avoid

When dealing with Malaysia expat tax, avoiding common mistakes is crucial to ensure you stay on the right side of the tax authorities. In this section, we’ll delve into some of the most frequent errors expats make and how to steer clear of them.

Incorrect Reporting of Global Income

One of the most common pitfalls expats encounter when dealing with Malaysia expat tax is incorrectly reporting their global income. This can lead to complications and even legal issues down the road.

How Malaysia Taxes Global Income for Expats

Malaysia taxes global income according to the source principle. This means that any income earned within Malaysia’s borders is subject to taxation, regardless of the expat’s nationality or the source of the income.

It’s crucial to understand that Malaysia expat tax authorities are vigilant about ensuring that all global income is accurately reported.

Expats must report income from various sources, such as employment, investments, and rental properties, among others. Failure to do so can result in penalties and legal consequences.

Common Misconceptions

To avoid falling into the trap of incorrect reporting, it’s essential to dispel common misconceptions about Malaysia expat tax.

Some expats mistakenly believe that they only need to report income earned within Malaysia. However, as mentioned earlier, Malaysia taxes global income, so all sources of income must be accounted for.

Another misconception is that certain types of income, such as gifts or inheritances, are exempt from taxation. While there are exemptions and deductions available, they must be correctly applied according to Malaysia expat tax regulations.

To prevent errors, expats should educate themselves on the intricacies of Malaysia expat tax law or consult with a tax professional who specializes in expat taxation.

Overlooking Tax Treaty Benefits

Another critical aspect of Malaysia expat tax planning is understanding and leveraging tax treaties between Malaysia and other countries. Unfortunately, some expats overlook the benefits these treaties offer.

How to Determine Eligibility

To take advantage of tax treaty benefits, expats must first determine their eligibility. Eligibility criteria can vary depending on the specific treaty and the expat’s home country. Factors such as residency status and the type of income may come into play.

Claiming Treaty Benefits

Once eligibility is established, expats must follow specific procedures for claiming treaty benefits under the Malaysia expat tax system. This typically involves submitting the necessary forms and documentation to the tax authorities.

Failing to recognize the potential advantages of tax treaties can result in expats paying more taxes than necessary. It’s essential to research and understand the tax treaties applicable to your situation and ensure that you take full advantage of any benefits they offer under the Malaysia expat tax system.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.