Table of Contents

HOW TO BECOME RICH BY INVESTING:

RATIONAL INVESTING BASED ON EVIDENCE VS SPECULATION

HOW TO BECOME RICH BY INVESTING:

RATIONAL INVESTING BASED ON EVIDENCE VS SPECULATION

Millionaire, Dollar Cost Averaging, Good Investments For Beginners

How to get RICH from Investing | How to get RICH with Investing

Increase Passive Income, Private Equity, Wealth Planning, Wealth Solutions

If you don’t know what to do with your money and are pained by indecision, let’s talk.

Everybody ought to have a comfortable retirement, and most people want more choices and freedom in life.

Many people want to get rich too, or at least be comfortable. The good news is that you can become a millionaire investing just $500-$1,000 a month, and a multi-millionaire investing $1,000-$2,500 a month.

The bad news is that most people fail at investing. Even some highly knowledgeable investors fail, due to human nature.

Like a doctor who can’t stop smoking or overeating, many knowledgeable people can’t resist the urge to speculate, get greedy and/or feel fearful when markets are crashing.

I can help set up accounts that are:

Easy and speedy

Like you, I am frustrated by bureaucracy and time-wasting. Time is money. I am busy and I am sure you are too. My aim is to save you time and money by doing things online as quickly and effortlessly as possible.

Reasonable account fees

1% yearly management fees. 0.75% on accounts above $500,000, and 0.5% on accounts above $1m.

Have reasonable account minimums

Since March 30, 2021, I increased my minimums to deal with me directly. There are now three service levels. See more here.

Globally available

For everybody except people living in Americans (American expats are OK) and a few other countries. Accounts are particularly useful for expats who are moving from country to country, and locals living in emerging market countries, where there is not a stable currency and system in place.

In your company name if applicable

Accounts can be in your name or your company name. If you own a company investing through your firm can be tax efficient.

Based on the 80:20 principle

80% in core assets. 20% in assets that you can’t get access to directly (for example private equity).

Easy and speedy

Like you, I am frustrated by bureaucracy and time-wasting. Time is money. I am busy and I am sure you are too. My aim is to save you time and money by doing things online as quickly and effortlessly as possible.

Reasonable account fees

1% yearly management fees. 0.75% on accounts above $500,000, and 0.5% on accounts above $1m.

Have reasonable account minimums

Since March 30, 2021, I increased my minimums to deal with me directly. There are now three service levels. See more here.

Globally available

For everybody except people living in Americans (American expats are OK) and a few other countries. Accounts are particularly useful for expats who are moving from country to country, and locals living in emerging market countries, where there is not a stable currency and system in place.

In your company name if applicable

Accounts can be in your name or your company name. If you own a company investing through your firm can be tax efficient.

Based on the 80:20 principle

80% in core assets. 20% in assets that you can’t get access to directly (for example private equity).

Give you access to some of the biggest fund houses in the world

including Vanguard, BlackRock and iShares.

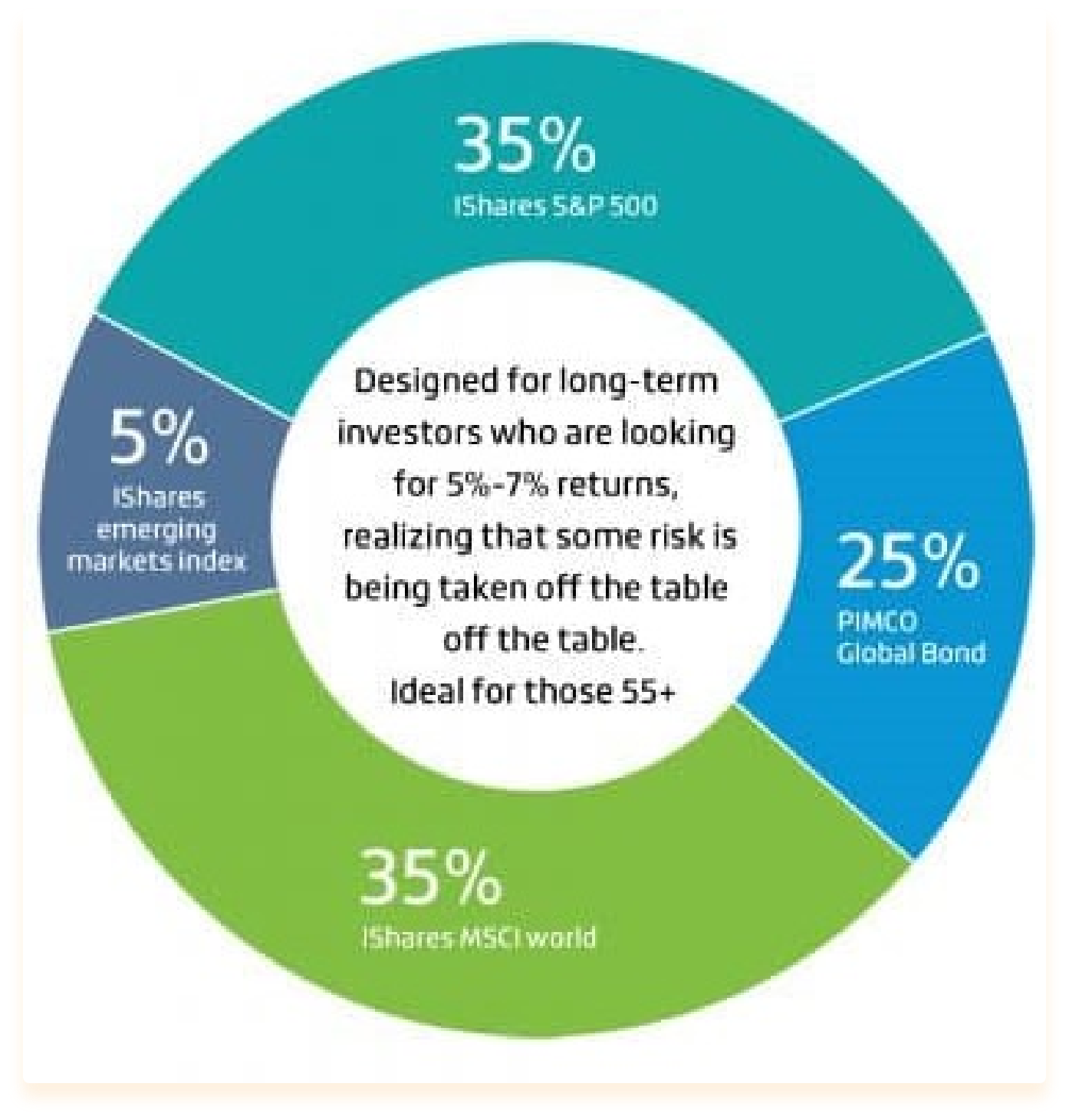

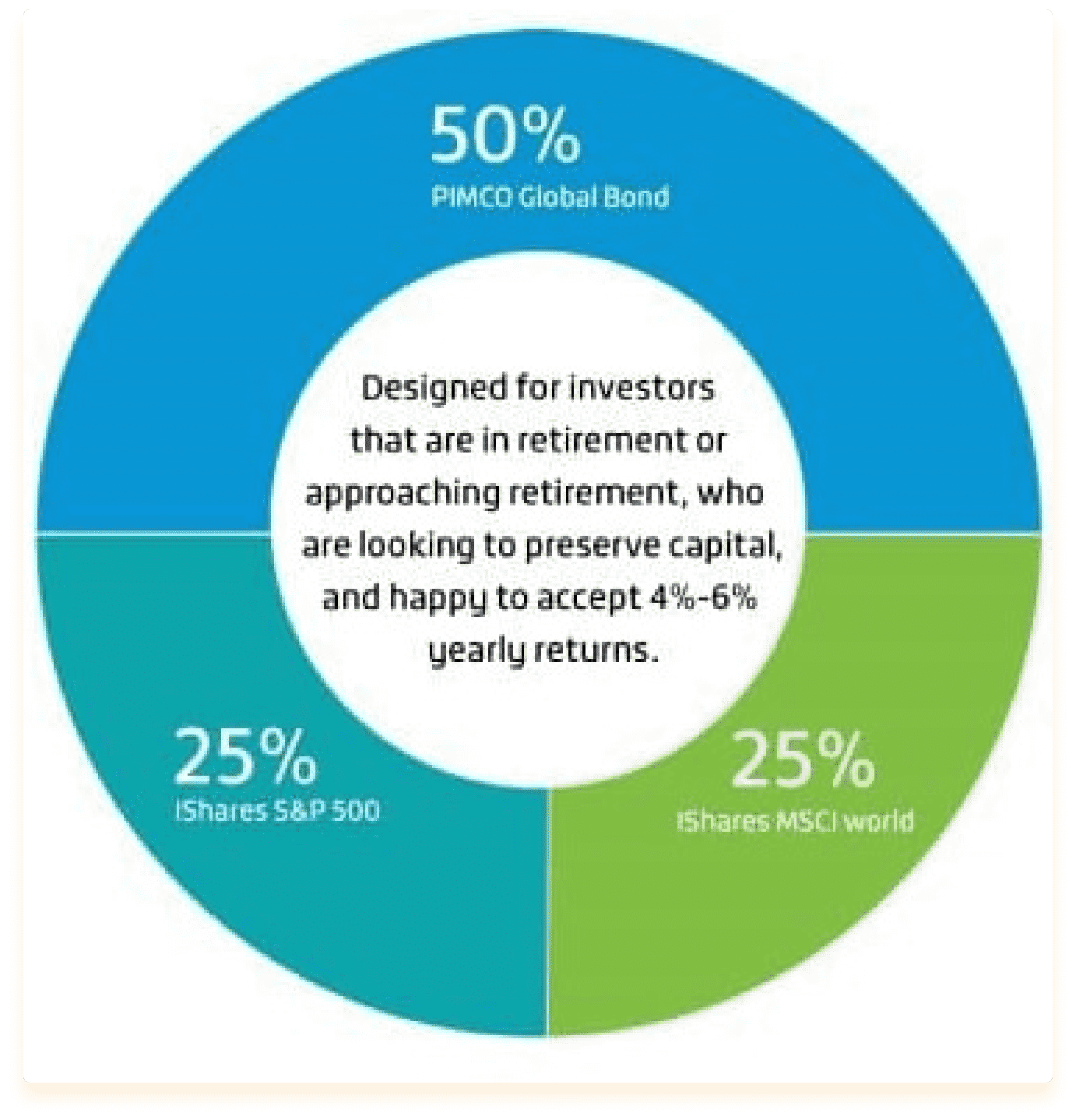

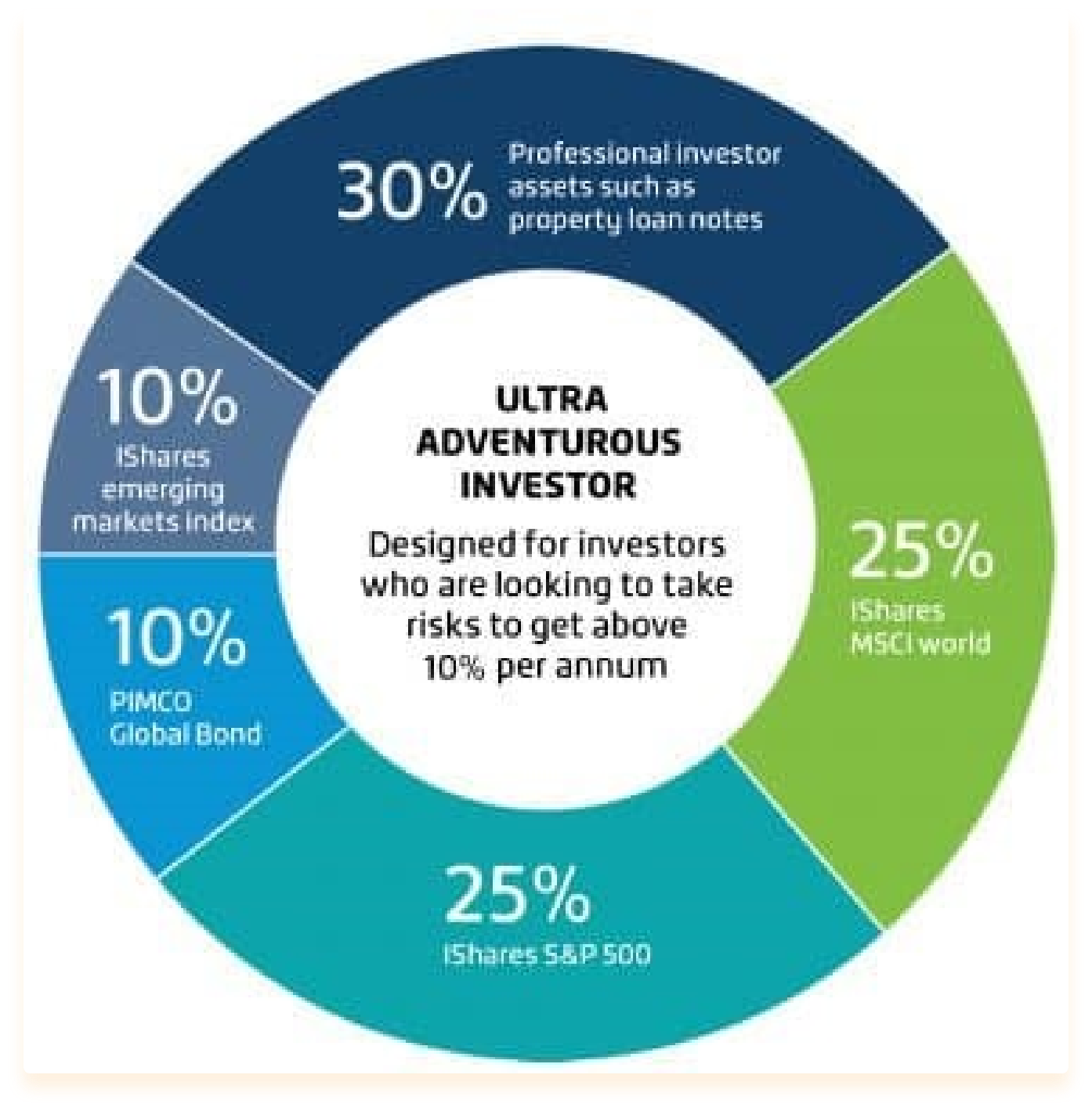

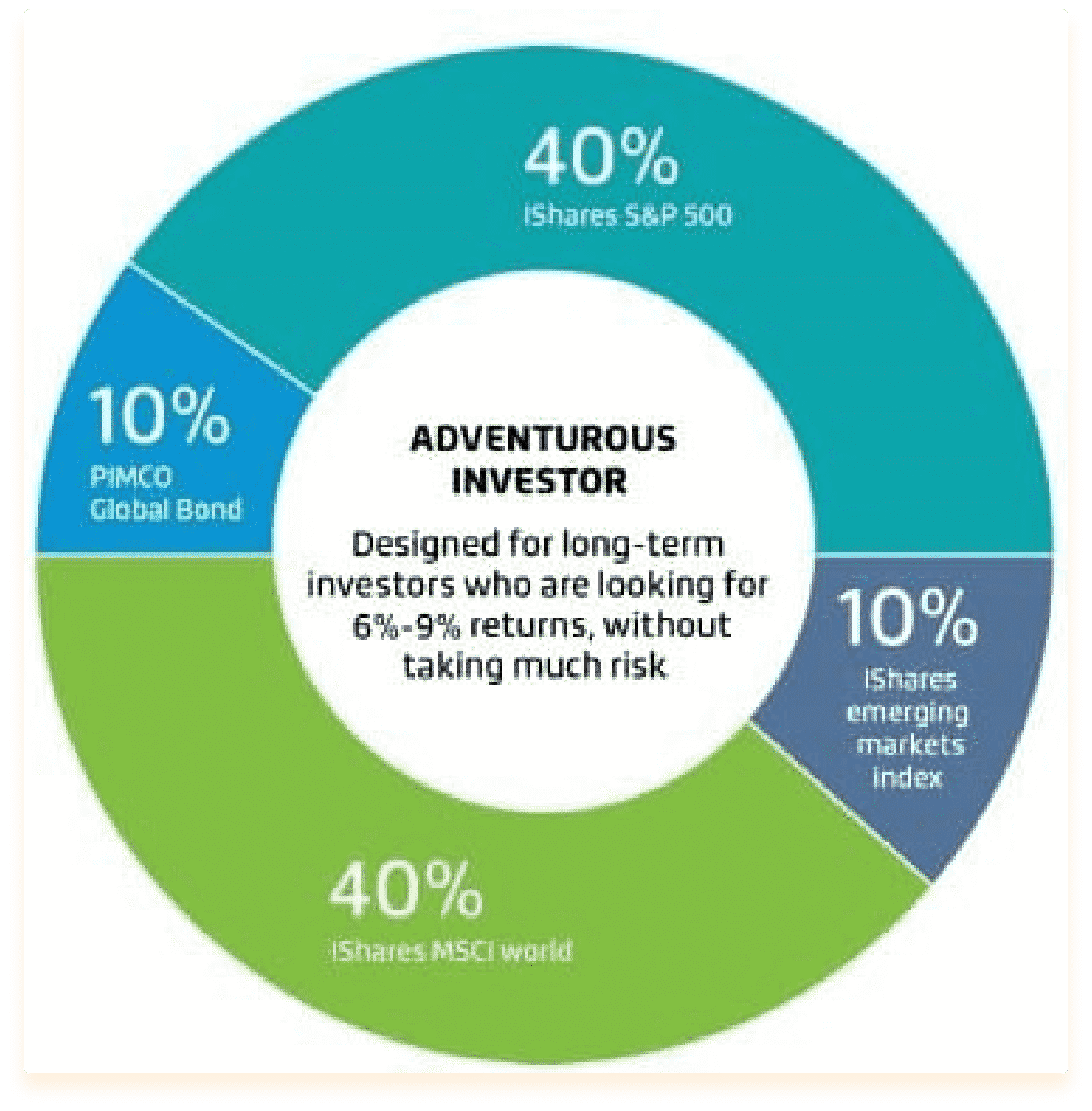

Adjusted to your risk tolerance

The four portfolios below are examples of past portfolios I have constructed, to adjust for client’s risk-appetite

Client recommendations and media exposure

Very precise with a positive attitude in helping many individuals to reach their goals.

Adam is a reliable professional; he is honest and keen to always find the best solution for each client and colleagues.[/hcode_testimonial_slide_content][hcode_testimonial_slide_content image=”33853″ title=”Catalin Daniel Despa”]Adam is helping me since about 6 months in order to invest better. The best about this is that I do not need a lot of time, I can see easy where the money are going, and that he answers really fast to any question that is comming from my side. Based on the experience until now for sure I would recomend him also to other persons.[/hcode_testimonial_slide_content][hcode_testimonial_slide_content image=”33855″ title=”Nicole Stewart”]I would highly reccomend Adam – in a short space of time he has already guided me through a lot and his regular group zoom calls are really educational. Thanks Adam. [/hcode_testimonial_slide_content][/hcode_testimonial]

Featured in:

Featured in:

Interesting read, something certainly worth looking more into

Adam can I get more information on this. I don’t have a lot of money to invest but definitely like to try and learn more about this and try to maximize my efforts to help my retirement.

Thanks Justin just emailed you

Adam, I am interested in investing, kindly send me info to startup

ok just emailed you

Dear Adam I am interested too. Would you be so kind to email me too?

Thanks in advance,

With kind regards, Mark

Thanks Mark, will do

I will love to invest I need more details thank you

Please can you email me how to invest from Africa

I’m from Argentina South America. May I ask you for more information? I’ve started investing in the stock market. But Im a beginner. I don’t see the big picture yet. Thanks!!

I would like to invest in the emerging market, especially in Africa (Nigeria in particular). Kindly email me for more information. Thank you.

Following, would like to learn how to invest 500uad and turn it around profitably

Hie Adam …… i would love to learn more about investing , can you please assist me

I very much interested to invest but my dear is how to get trustworthy and reliable invest body because there are so many dubious people in this present world.

Could I have the details too?

Thanks

sure, just emailed you

Can you also send me an email

I will email you

Need to in touch too

I need it also

Hi Adam, I am also interested in investing and would like to talk more. I can email anytime, thanks

I will email you

I’m interested please email the details

I love ur teaching

Thanks

Hello Adam, your portfolios are intriguing and I’d like to talk more. Please contact me anytime.

Please can you email me how to invest from Africa

Would like to learn more about investing

Hello Adam, the idea looks good. Can you send me the details to look further on this.

Thanks.

Pls send me more details

Hi Adam

I would like to know more about investing

I have small amount to invest but afraid of the losses due to previous experiences.

Please guide.

Thanks

Dr Kazim Ali

I wish to invest in legit businesses.

Thanks for the information sir

Very much interested in investing and i am a beginner.

I am interested and would like to know more, please send me more dwtaila to.my email.

Hi Adam, I would like to have more information about the services you provide. I’m very interested. Thank you!

Am a beginner and I have interest in investment…but i don’t know how to start

OK I just emailed you.

Hello Adam. I am interested in investments. Can I get a heads-up?

Hello Adam.

I have a very strong intuition and managed to make 2000$ in a matter of days through CFDs without a single negative trade.

But still, CFD wasn’t quick enough money, can you please suggest where can I make quick money just by predicting outcomes which is my speciality. Thanks 🙂

Thanks but I do long-term investing and don’t focus on “quick money”.

Much interested

Sir, l don’t have much money but l need your help and advice to enable me invest in stock market or simply to start a small company. Thank You Sir.

Can we talk

You can email me – advice@adamfayed.com

Hello Adam, I am interested in investing could you please send me an email too

will do

Would like to know more

Interested in investing

Hello Adam, I’m interested can you please email me some more info?

ure

Need to know more about the investment. From Africa Kenya particularly

Hi Adam, would love to know more as well.

Any tips or suggestions for investing would be appreciated

Ty Joe

Hello Adams, how are you today? I’d like you to enlighten me more on this subject matter. Thanks..

Please I will like to know more about your article

Please may I have more info on investing as an expat

I used to be with Vanguard while in the USA, but they dropped me when I moved to Ghana W Africa

I am 77 years old, have some money sitting in my USA bank.

I am a conservative investor

Thanks

I need your help

I would love to read more about such content.

Need to start investing with you.

It’s was so good, I like everything and has encouraged me alot. How can do since I’m interested but I come from Uganda

Please send me more info

I filled form for your books , I didn’t get any notification related to this

Which books? If I know which ones i can sort it out for you.

Hello I have seen your message and I will like to know more about the business thanks

Just waiting for your email..mr.adam

I tried to email you, but it didn’t send. adamfayed@hotmail.co.uk – if you want to be in contact

Mr.Adam, I’m from India but would like to invest in stable currency. I appreciate your work in this space. Please email me the details.

I have emailed you Jagadeesh

I have emailed you Jagadeesh

Hey Adam i can’t help but show my interest in imvesting. I live in the Gambia and we dont have financial systems for such. I’d like to hear more from you

Hello Adam,

I am also interested in investing, would you be so kind to also send me the startup info?

Apologies for my bad English, it isn’t my native language.

With kind regards,

Niek

No worries I will email you

I’m from India and would like to invest in stable currency. Please email me the details.

What a piece of article! It’s really great and i want to start investing. where do i start?

Interested

I really need to invest on this

I love this content and want to be part

Can l have the information too

Am interested in creating a business plan

OK but this is for investments not business plans.

Hi I and my brother want to engage ourselves in investing in stocks so we want to learn more about how it works

I really want to venture into investment, but don’t know which one to go for and also how to go about it. Please I need your help. Am interested in investment

Very interested sir…

I’m interested in investing in stock, want to start small as my salary is small.

I will email you but the above minimums do apply.

Hi Adam, I am interested, can you please email me? I understand the minimums apply and I have enough, but need a bit more information, thank you

Will do.

Hello! I’d really like to know more about investing and how to start up. I don’t have a lot of money but I’d appreciate any advice. Thank you.

Hi I emailed you.

Hi Adama, have just started a few months ago but I want to make sure I do it right with ROI,and ensure I buy worthy sticks, I need your expertise.

How do you mean you started a few months ago? You mean you started investing by yourself a few months ago?

i would like to know more

I stay in Nigeria. How can I invest and get paid back in Nigeria. Trust me, I am ready to go at your pace

You have made sound please let me know more

I want to learn and join business above

I am interested

I am interested

I am interested in creating an investment plan.

Hi Scott – just emailed you.

I’m a complete beginner in the stock market. I do not know how it works or how I should go about investing. I would love to learn more

I will email you

I have all the details you needed, message me on Whatsapp +1

I will WhatsApp you. I have edited out your full number for your own privacy.

Thanks for the article but I literally have no idea of what you’re saying so can you please assume I’m a novice and bring me up to speed.

Thanks.

Will email you Kelvin

Email me the details, will go through and confirm

Adam I live in Africa & would love to invest in america.i need more details on safest & productive options

I am not rich and still single at 40, maybe settled life next year but can’t say anyway I don’t have much capital to invest am average income indian or little above as our per capita income is only about 2k dollars I earned 5x by our indian per capita income but want to invest and learn from ,am a lousy spender anyway can I invest in S&P 500 ,do invest some in mutual funds and will start trading too cos my job doesn’t require to go everyday

Hi Adam. I’m looking to invest money in a reasonable but profitable way. Can please I get more information on your offerings?

Hello Adam, am from Nigeria .How can l invest from here.

Hi Adam

I’m retired and I’m interested to know more about investing. Can you help me please?

Rey

I will email you

Am from Uganda and I would like to know more about investing in detail.

Im the South African.i wanna know about US stock market espesialy small cap.it is good to invest in small cap or the big company’s like TESLA,AMD,BANK OF AMERICA or can I start with small cap?

Waiting for your email

I’m from Papua New Guinea I’d like to invest too,please help me

Helo Adam’s, I am very interested in investing …can you please

You can chat me up when you ready

Hi Adam,

I’m interested, but I’m American. I’m temporarily living in Morocco. We have property here. I could become resident here in future. We have bank acct in US and one in A Moroccan bank. Let me know what we could do. We have money to invest. Thanks you, Marcelle

Just emailed you.

Hello Mr Adam I am interested in investing from Swaziland, Africa.

My name is Eyitemi Aka Peter, from Nigeria.I must say ur article is quite impressive and innovative.I would like u to educate me on how to go abt low cost and low risk investment. Thanks

Depends how much you want to invest. If you have less than say 500usd a month, you are better off reaching out to a local broker in Nigeria.

I would like to try and invest. Need your inputs. Thanks

Hi Adam, can you give me more info please. Thank you!

How to start kindly guide?

I emailed you thanks Hads.

Hi, I’m also interested. Please send me an email

I’m interested can you please send me an email

I want to learn more

Hi Adam, l will like to know more about investing

Sure I will email you

I need it too, Adam. Please kindly email me? Thank you in advance.

Fast recovery

Hi Adam, it’s a wonderful article and sure caught my interest. I’m from India and I do some monthly investments in equity funds and crypto (just started this with $60 a month). I would like to extend my investments to have a comfortable future. Looking for both short and long term growth. Would love to know more on the options I have and how to start with it.

Looking forward to hearing from you.

Regards,

Bharat

$60 per month is too small given the minimums listed on the article but i would encourage you to carry on reading my content.

Hi, just came across your article and I will like to know how I can invest from Africa. Looking forward to your response sir. Thanks

Am a Uganda but your article has caught my mind, thanks Adam fayed for this wonderful article. I would love to ask because am an entrepreneur, l have my small business but lack capital, what can I do to increase my capital with the small one l started with. Thanks

Adam can you email me how to do smart investment with small amount of money. Thanks

I will do, but the minimums above apply.

Hello Sir, i want to know something about this, im starting again from Zero and i need advice from you if its possible, thank you very much.

Can I start with $200 monthly, which investment will be ok am 50 years old from Africa

No for $200, you will need to find a local broker.

Nee your advice and the way to get become comfortable life

Let me see,after comfortable way to became rich

Hi Adam,

I am a Zambian from Africa, I am so keen in learning about investment. Please take me through so I can start investing for my retirement.

Please do get in touch with me via my email

I want to learn on how to invest and get an account of investing with?

I will email you Jimmy

Hi Adam

I am looking for manageable investments between 5- -10%

No time constrains and retired need ti be as safe as possible

I have just emailed you.

I would like to invest too

I’m interested. How can I start, please?

Am intereste, am from Nigeria can I invest? What is the security of the investment.

Hi Adam – I am interested in this kind of account, especially as I am moving from country to country as an expat. But how does it work more specifically? I am interested in getting more information.

Thanks for your comment Mary. I will email you shortly.

I would like to know more about investment. I live in Nigeria.Is it possible to invest from here?

I will email you.

Hi Adam

Am interested, hw can I get started as a beginner.

i will email you.

Would I be able to get more information? Thanks

Sure

Can you please email me more info as well, thanks!

Hi Erich I just emailed you

I’m interested in knowing more about investment schemes. Please email me.

I will email you.

Am interested

Am from Nigeria and I have interest ,I need more explanation and where can I invested.

I like what I just read! WHO will I be giving the money to save? From Nigeria

Am Ethiopia, is there any way i can possibly have such account, Dear Adams? May monthly salary is 10400 ETB (385 USD). Need more info.

You may want to wait until your surplus is bigger, but I have emailed you anyway Girmay.

Very nice reading , appreciate for sharing such a valuable information

I would like to know more pls

Thanks

Can u email to me inf plz

I came across you in Quora. I am 62 years semi retired, with about $200,000 in a Robo investing account earning about 5% per annum Can I do better? I would like to start living off the income from the portfolio in about 3 years.

Thanks for reaching out Baba. Just emailed you.

Sir, I am 63 and a half year young, I have $890 a month disposable-income after rent is paid. Please send me where and how to begin Investing* I already have close to ten thousand in NYSE. Please send me your Insights, and know I “Thank You!” ~so very very much!!!

I will email you

Please get in touch with me

I would like to invest too

Hi Adam, can you please email me more info as well, thanks!

I emailed you Fayza.

Hi Adam

I am interested in this kind of account but I live in Dubai. Am I eligible?

Thanks

Geoff

Hi Geoff

Yes you can.

Adam

Hi Adam,

I lived & worked in Japan for 16 years…please send me your book via

pdf

Thanking you in advance & thank you for your honesty & simplicity.

Marti

Hi Marti

Thanks for your message. If you have PayPal or another mechanism then it should be a fairly easy procedure.

Thanks

Adam

Thanks Adam for this piece.

Kindly reach out to me and we can discuss this in length.

Thanks Samuel I emailed you

I WOULD LOVE FOR YOU TO EMAIL ME TOO FOR MORE INFORMATION

Hi Adam can you email me more about this please

Would love to invest but we are based in Nigeria

I like to know more on investment.soi I can prepare well for my retirement. Thanks.

Hi Adam. Would so much love to make an investment.

Hi Marti.

Please send me detailed information on how to set up an investment account in the US. I live in South Africa running a small business

Hi Adam,

This indeed is an intriguing read with a bunch of valuae books.

Is there a way for me to learn more considering the fact I am based in the Czech Republic?

Thanks.

Regards,

Mykyta

Hi Mykyta

Thanks a lot for your message. Sure, I will send you an email.

Thanks

Adam

Hello there.

I’ve always thought that is impossible to live from passives if you don’t have an initial big amount of money.

I’ve read around here that starting young (I’m a poor 25 man) it’s worth. Could you help me with that?

I could save around 150$ per month. How could I make it much bigger?

I live in Spain, btw.

Best regards 🙂

Thanks Elvio, I emailed you. Adam

Hi Adam,

I am based in the US as a Software Engineer making around 215k USD/year. I am 25 years old and just got into investing. I believe I could really use your knowledge and experience to help me invest better every month.

I got your email. I can’t take US clients but referred you on.

Hi i know nothing about investment but after reading this article, I want to start as soon as possible. So just email me bro

Thank you for this good investment

So may I know how is doing?

Kind regards.

Very interesting thanks Adam… I want to learn more am in Namibia ,send me the email??

Hi Adam, saw you in quora and I’m intrigued to know more and how to go about everything. I’m but 24 years old, I’m I eligible ?

Hi Adam,

I am retired and live in Mexico. I’d like to know more about the investment service you provide.

Thank you.

Regards,

Hi Magnus

OK I have emailed you.

Adam

Hello, pls send me an email abt your services and how I can avail of it. thanks,

Thanks Royskie I emailed you now

Hi Mr Adam. I’m also interested in learning more about safe, long term and wealth building investments. I’m still 20 and wish to gain your knowledge ASAP.

Please can I have the book via email too.

Which book are you referring to?

Hi Adam, i am 30 years old and would like to start to invest. But i can invest some around 200 eur per month. Please suggest some options

Hi Nagaraj – depends where you live. There might be some advisors that would take 200 euros a month and some of the DIY platforms will accept you if you are based in the EU.

I am interested, email me

I would like the know about the investment you provide?

Hi Maria I just emailed you

Wow, Adam thanks alot for your write up, please I really want to invest,but don’t have enough money since am searching for, please can you help me out speedily.

I would suggest staying tuned and reading more content.

Adam, Iam from Papua New Guinea, I over heard people on social media talking about quick money schemes but my real interest is about Stock Market, so please send me some information Regarding this investment

Thank very much

I would avoid any get rich quick schemes. I will email you.

Hello there,i am an Retiree with a USA Passport and a German working and staying permit ,,would like to know more about investing and Cypto currency.

Best regards

Your write up was very simple yet illustrative. I’m a Nigeria rearing to try my hands on investing. Pls I need ur direction

Thanks

Hai adam

Can you send the information about your service

Sure I have emailed you

Hello Adam:

I would appreciate reading more about your services.

Could you please email the information to me?

Sure. Sent now

Hi Mr Adam. I’m also interested in learning more about safe, long term and wealth building investments. I’m still 20 and wish to gain your knowledge ASAP.

Please can I have the book via email too.

Hi Adam,

I would like to get more information on how to invest.

Please give detailed information about you service and how to go about investing…

Regards

OK I emailed you

Would like to know more about the investment please.

I will email you.

Hi Adam,

Cufrently in Vietnam and a UK resident.

Please send me more information on your investment service.

Regards,

Paul

OK Paul I just sent you an email.

hi, i would like to know more,

OK Vedran – OK I just sent you an email

Hi Adam, I am interested in this service but would like more information as to how it works and the safety procedure. Do send me an email, would be highly appreciated.

Hi Adam, I don’t have lots of money or company, I am interested for investing I need to know more about investment, pls send me more information…

Thanks

Hi Adam,

I am a dual citizen- US and Philippine.

Could i avail of your services?

Thank you.

Yes, depending on your residency though. I will email you.

Hi…I am 57years old female lives in India. Want to invest for my grandchildren. Please suggest me. I want to invest 4000 rs per month…….Thanks Sir

i would like to know more about ur services.

Hi Adam,

Please send me a list of investment options you provide, with thresholds and your fees.

I live in Singapore.

Please share more details about this with me. I am interested and can invest about 750 USD per month

Hi Adam,

I would love to know more about your service!

Thanks in advance!

Hi Adam I would like to know more and how to make good investment decisions.

Am interested

Hi Adam, I’m very interested to learn more and invest long-term. Please would you tell me how to go about it? Thanks!

Hi Jules – I emailed you. Adam

I will like to learn how to invest directly by buying stocks ,share and forex

Hi Adam, this seems this seems like exactly what i might need, could you send me an email?

Sure thing

I am interested in shariah compliant investments.

Can you provide this service.

Regards

Not my specialist unfortunately.

Dear Adam!

Please have your information forwarded to me. I am eager to learn more about your investment strategy.

Thanks

Hi Adam, very happy to have read your post, would it be possible to get some extra info?

Best regards

Jonathan

sure just emailed you

Interesting. May I know more details ?

Sure Vinay I just emailed you

Hi Adam,

I’m entering college this year and I want to start investing early, I’d be happy to get your suggestions

Hi Arton – even small savings at such a young age makes a difference, due to compounding. Investing in low-cost funds for your entire life is one of the best things you can do.

Hi Adam,

Thanks for sharing this information. Can Canadians invest in your recommendations? If so send me all the options available.

Thanks.

Hi Sudano. Yes sure. I have emailed you now.

Kind regards Adam.

Kindly requesting for more details on your investment plans.

Thanks

Hi Adam,

Could I please also have more info?

Thanks

Sure

Please am a student at kwame Nkrumah university of science and technology at Kumasi Ghana (west Africa). Doing BSc business administration (logistics and supply chain management).

I want to go into real estate business after I complete school. What do I need to do now before I go into real estate business.

Hi Adam,

This sounds really interesting. Could you send me more info please?

Thank you

How can I invest? I’m from Colombia, my month salary USD 2000

Hi Camilo – I just emailed you. Adam

Hi Adam, kindly can i get more information about this.Thanks

Will do Carson

Hi Adam, I would like to know about the investment your are talking about.

Adam, could you please share some more information.I am interested!

Can I get information

Hi Adam

Adam could you please share some more information about the investment …I am interested

I just emailed you Daniel.

Hi there Adam

I m happy and delighted to come across to your post. I need more info on the investment and I m 27 years old trying to make the best of my life and save more before I reach 30 years old! And if you sell motivational books and how one can save and invest please I need more information.

Best regards

Juliet

Please provide more info. Many thanks

Hi Adams, I had like to know more about your offers and services. Much thanks

I am from India and currently residing in Malaysia, Does this works for me ?

I would appreciate reading more about your services.

Could you please email the information to me?

Sure i emailed you

How can I get more information Adam?

I emailed you Jose.

How do you build a company with nothing . How do you start building a portfolio with very little. How do you become an industrialist from scratch. In which kind of industries do you start.

I am in Mexico and have a company in the US. I am concerned to invenst in the US because I do not understand the tax implications. I would like to know more information about your service

Hi Antonio – Thanks for reaching out. I just emailed you. Adam

Hi Adam I am from India and want to invest . How will it work for me? Could you give me more information.

I just emailed you Simran

Hello Adam,

I am looking for a way to get invested in long term and forget about it style.

Also maybe you can explain the ways of investing through a company beeing more tax efficient than as a private person.

Maybe you could send me some more info, thank you in advance!

OK I will email you. Thanks, Adam

Adam please can you also send me an email as I’ll like to get further information on what’s really going on here

I would like your expertise advice to investing. I tried investing on my own and losing big time so will you email me your information? Thanks very much for any kind of help!

Sure Bridgette, I just emailed you

sounds good, could you please provide more info? thanks

Sure, will do Tom.

Hi Adam,

This was a very interesting read. I would love to get more information about the services that you provide.

Hi Adam. I know this post has been long but I need to know two things. 1. Am in Ghana, West Africa. Am I qualified to have an account there. 2. If I do, how do I get started.

Hi Daniel – Ghana is OK. I just emailed you.

I will email you Iweta

interested in knowing more but im in the US. any suggestions?

Hi Adam, I will like to find out more.

I am interested in this…please email me details. Thanks

It is nice reading this expository lesson from you. I stay in Nigeria, I am eligible? I am about retiring, how can I invest my funds. Can you invest for me or can I do it alone.Thank you

Hi Ojo – just emailed you

Hey Adam, could I please also get some additional information?

Greetings from Holland,

Pieter

Thanks Pieter I emailed you.

I will have to ask more questions. I need investment guide

Hello Adam, can we discuss on email how my company can start investing from Africa. Thanks

I will email you Jude.

Hi. I am from South Africa working as an expat. I am looking at a pension fund outside of South Africa. Could yo please send me more information. I am 56 years old and would be looking at investing between 2 and $3000 a month.

Hi Adam! I’m 32 years old and keen to learn more.

Thanks Lili I will email you

Hi Adam! I want to know more information about your post and interested to learn how to get started.

OK sure thing I will email you.

Can you email me and learn me how to invest on something nice please

hi adam,ive followed you on quora for a while and I’m interested. please let me know how through my email.

Hi Mr.Adam, I’m from India but would like to know more and then invest in stable currency. I appreciate your work in this domain. Please email me the details.

just emailed you

Hello Adam and good day.

I saw from the mail and comments section that you responded to comments on this post of yours even up till Nov, 2019, it shows you do quite a serious and consistent work on follow up and I do much appreciate this.

I’m not based in the USA, but have been thinking of the lowest cost options to maintain things like USA Bank Account, that I can easily operate via the internet, probably with branches in my domicile in Africa, for the purpose of Investments, I’m an ardent & smart worker, and would like some investment options in gold, futures and current stocks (or preferably other low cost with potentially high returns 🙂 realistically), with the returns linked to a (my) USA Bank Account and accessible once it’s up and running and in the long run.

In the event I can’t access a USA Bank Account what other options do I have to securely invest, my investment budget is between $300 – $1,000 monthly and consistently.

I hope this can materialise into a reality for me by God’s grace and by your aiding.

Thanks in anticipation of your response.

just emailed you

I’m 30 years old and keen to learn more, I am interested.

I just emailed you

Hi Adam, I have $75,000. I would like to start investing. Please send me more information. Thanks

Will email you Anitaicel

Please I will like to know more…

I will email you

Hello Adam,

Your article is quite impressive. Could you email me in return? I would love to know more.

Thanks

sure will do Uche

Can you get me also email? Thanks!

Will do Marek

Hi Adam am interested in this but I am a Nigerian how do I participate in this, waiting for your reply

I will email you.

Hi Adam, I’m a Nigerian and I’ll love to know more about investment. Please send the details. Thanks.

Hi Adam, Please can you also send me more details, Thanks.

Hi Adam, Please can you also send me more details, Thanks.

Sure will do Riccardo

Hi Adam, I’m a Bulgarian citizen living in Bulgaria. Can I get more details about the investment plans ? Thanks!

I’m a RN looking to invest some money from my 2nd job and other endeavors. Needing some guidance please.

Please email me with more info

Please email me more information. Thank-you!

Hi Adam,

I would like to start understanding some basic concepts of saving and investment and then would like to move further. Can you please send me some details.

Hi Adam, Please can you also send me more details, Thanks.

Hey Adam, i appreciate your work and information you give free to us.

I would like to learn to invest too. Thank you

Hello Adam

Can you please send me details too ? I am new in investment ..

Regards

Hitesh

I’m so much delighted to read this. And I’d really love to know more about investment.

Despite being 22, I still don’t know my bearing and how to develop a good investment,

Please send me more elaborate details to begin!

sure

Really interested in investing as a beginner. Could i have the details

Hey Adam, am intrigued at your article on investment and I had initial long for buying of shares and stock, would really want to learn before I make a decision. Many thanks!

Sir, I want more information about how to start investing money . Emailed me please

I need to invest with small capital i have

Did you read the investment minimums?

Hi Adam I really want to join as a beginner but I want you to take me through the journey as I’m clueless many thanks

I am in Uganda; Africa. How do I get in touch?

I will email you.

I would love to get in touch with you.

Will email you David

Investing alone will not make you rich you need a stable income and multiple streams of income before you can consider investing for wealth building

Yes it won’t alone. Wealth = net income – expenditure x compounded returns. So good investment returns are only one part of the equation. The point is, you don’t need a super rich income to get wealthy.

Adam,

I’m interested in investment. Kindly email me the notes about this subject.

Thanks,

Hezron

Hello Adam. Cank you send me détails about investment. I’m in Africa: BURUNDI

Hi, please email me. I’m interested in this venture.

Greetings to you

Hope this message will find you well I was interested to ask if I can invest in this investment plan as I am from Kosovo and have $ 300,000 to invest

thanks for your part i hope you will come back with an answer

Hi Alban I will email you

Hi Adam,

I am interested to invest for my kids

Hello Adam! Hope all is well during these opportunistic times. I have nothing saved for retirement I have 3 kids. Never thought about investing until now when I’m like crap if shit hits the fan i have nothing. Can you please share some more info on how i can get started, or help me get started please thank you and always God bless!

Would like more info please 🙂

Will you please send me more information. I don’t have a lot of money to invest but I really want to start. I am South African.

Hi Adam! I am interested in investing but knowledge about it is next to nil. Can you pls send me more information? Thank you.

Hi Mr. Adam Fayed,

Seems you are doing a great Job by helping the needy. I am from India and I want more information about how to start investing the money in a perfect way. As you are aware that we cannot invest huge amounts and presently I can invest an amount of USD 200 approximately per month. So please give the investment plan along with the returns which we get in return also. Hope Your reply will be helpful for me at this stage…….

Please send me all the details in a elaborated way to begin the investment

It’s amazing sir im very much excited to invest

Plzzzgive me more details have the start this thank q so much sir ji

Hi Adam, it was very interested article for the novice that I am! Is it only reserved to a very wealthy audience ? I have some money aside and currently living in South East Asian country and I would like to know if I can start from here, could you send me some more details please ? Thank you !

Hi Adam, Your portfolio construction is impressive. Can you please send me more details. I would love to know more. Thanks.

Hi Adam, quite an eye opener. Grateful if you send me more details.

Sure thing will do.

I am a beginner. I like to invest from Zimbabwe

Hi Adam.

For a couple of months back now, have been interested in investing but I don’t know how to go about it.

I’ll be happy if you can help me out.

Thanks.

I like your portfolio Pls share more details.

I have been looking for where to invest and how. Can you please email me the details. Thanks.

Email me more info about investing please.

Let me know more info for investment services offered by you

Hello, Adam:

I am a 42 years old software developer from Mexico and I came across with your article. Very interesting and I am trying my hand in making it in the investment world so I can retire and have my son go to a college he chooses with no problem at all. If we can chat about it to get more info it’ll Ben greatly appreciated.

Kind regards,

Julio Plascencia.

Sure Julio I will email you.

Can you please give me more info for investment services? Thank you

I am an avid investor and would like to accumulate wealth over time. I am in for the long haul.

Thank you for this information… please give me more details… thank you soo much

Hello Adam,

I don’t have much investment knowledge. But interested to know more and start saving some money. So if I could have some information on the investment to look after.

Thanks.

Hello Sir,

Would you mind assisting me w/investing? I don’t have a mentor. I’d be very grateful.

Hello, Please also email me details. Regards

I like the way of your investment, could please give me further details?

I will email you

Hi Adam, thank you for the wonderful article. Being from South Africa, I really would like more information on how to invest monthly out of the country. Care to share the information?

Dear Adam,

I am interested too. Would you be so kind to email me too?

Thanks in advance,

With kind regards,

Oscar

Hey Adam, am intrigued at your article on investment and I had initial long for buying of shares and stock, would really want to learn more, Many thanks!

I want to be part of this journey from India. Plz email me also

Hello Adam. This is a beautiful article. I’m interested in the services you offer. Please email me

Hello Adam.

I have just gone through your piece and I got caught up in the words you used in describing the services you provide. I would appreciate it if I am handed more information to enable me take action.

Regards,

Kosy.

I would like to invest on the the stocks . i don’t have any prior experiences . Could you please help me to start with it. Planing to invest $300 – $500 every month.

Very Nice info. Thanks for sharing.

Hi, just came across your article and I will like to know how I can invest from Africa. Looking forward to your response sir. Thanks

Hey Adam. I’m an Indian and as a student I want to start investing in stocks etc. Please provide me with a strategy

Maybe my minimums are a bit high if you are still a student. I would find a broker locally that has no minimums.

I came here from your ‘Quora’ reply to something else. I would like to know some more info on investing. Could you please email me.

Hello Adam.I’m interested in the services you offer. Please email me

Helo Adam,IAM a complete novice.However,IAM interested in investing.could you guide me through the whole process?I shall be grateful.

Hi Adam I am from India and want to invest . How will it work for me? Could you give me more information.

I will email you

What can I, a student, do to start investing?

Just start small

Hello Adam. I live in South America in a emergent economy country our currency is USD. I could invest $500 a month but I would appreciate if you are kind to tell me how long it would take to start making noticeable income investing that sum following your investing methods. Thanks in advance for your answer.

am very very interested but am in Nigerian how can i get to it.

Most nationalities don’t exclude you. Anyway, I will email you.

I will like to experience it too but I am low in funds

Goodday Mr.Adam, am so interested in your article and am so eager to invest but I don’t know how to go about it, cause am new to it. So pls email with all that there is to know about it because I want to learn how it works thank you.

Hi Adam I am from India and I would like to invest . Can you please help me with all the details on how to proceed?

Sure I will email you.

Hello Adam, how do I go about it? Please email me.

Will do.

Pls interested,but I’m a beginner how can I go about this especially from Nigeria.Thanks

Hi Adam, I’m new to investing but am interested if you could send me more details on how this would work. Thank you.

Hi Adam, I am from India. Thank you for the wonderful article. I would like to invest, but I’m new to investing. Can you please help me with all the details on how to proceed?

I will email you. Girish.

Can you send me more info Please

I read this article. I am interested in investing for the long time purpose. How can I start? Pls kindly send detail info

Am interested in investing for my children education. Am in Nigeria though. Do let me know if possible.

It is, I will email you.

Hello Adam

I’m interested… I’ll need for information.

Thanks in expectation.

I want to know more on how to invest wisely… especially in Africa (Nigeria precisely if possible). Please can you mail me so we could talk more?

Hallo Adam, I an interested to investing with you. Could you send me more details on how this would work? Thank you.

Hi Adam

I would like to know more about investing

Hello Adam. You say here: “… you can become a millionaire investing just $500-$1,000 a month, and a multi-millionaire investing $1,000-$2,500 a month”. The thing is, I reside in Russia, and the average salary here is around $500 a month. Residual amount is around $130. I mean, for real. Does this leave me any chance of becoming a millionaire with such salary levels?

Hi Archie – it depends how many years you have left to invest and how quickly you start.

Orientation please

Not sure I understand your comment?

Please Adam, I want to start this investing, so my question is how can I start? Am in Nigeria

Great article Adam! I would like to know more about what investment options are available to those who don’t have the minimums or low startup investment capital with sustainable growth over time. Thank you

😊 this is so great! Link me up and show me more ways am with you Boss…

UK based we want to invest in the emerging African Market of Nigeria.

What would be a safe spread in this volatile yet lucrative market? From experience on the ground (1982- 2010 and ongoing) the customary entry fee is somewhat complex due to local practices of having to give before receiving. Naturally,we are cautious yet intrepid.

please i’l like to know more on how and what to invest on, from Nigeria in Africa. you can email me .thanks

Pls I need more information. I’m in Nigeria.

Hello Adam

I’m interested… I need more information. Thank you

Hello, can I get more information about this? Thanks

Sure Juan, I will email you

Please let me know how I can contact you for some financial questions thank you.

I am from Nigeria, and interested in investing in global stock. How do I start? please email me.

Interested in investing, please email me asap. Thanks Adam.

Hi Adam, please I want to know the investment plans and strategies. Can you please email me because I want to start investing by the starting of March.

I will email you

Hi Adam, I have mainly invested in US stocks and ETFs, as well as in bank notes and cryptos. I am looking for diversification (I am not a US citizen). Being a long term investor, I am looking for the highest returns.

Could you send me more info on your plans, strategies and what could we do together on this direction? Thank you

Hi George – I will email you

Hello Adam. Can i get more information about this? Thank you

I will email you.

I would like to get more information please.Thank you

Dear Mr. Fayed, I am a 58 year old Belgian Citizen who recently moved to Japan. My whole life I worked in the hospitality business (21 years for French renowned chef Joel Robuchon) between Japan and the US. I would like to get your smart advise on how to invest $100.000 here in Japan. Your reply is much appreciated in advance, Bernard

Thanks, Bernard, I just emailed you now.

Hello Adam,

I need more information about this investment opportunity. I am interested too. Thanks

I will email you Akim.

Please am interested in your investment and would like to have more information

I have about £40,000 to invest. I’m one of those people that got burnt in 2010 and has been overly cautious ever since. I’d like to change that now.

Hi Femi. I emailed you.

Hello Adam, please I live in Ghana. I would love to start in an investment over here in Ghana. Please could you help me out with the right investment?

Adam can I get more information on this. I don’t have a lot of money to invest but definitely like to try and learn more about this and try to maximize my efforts to help my retirement.

Interested. Kindly reach out. I need to understand.

Hi Adam, is this on? I would love to understand how it works.

Hello Adam, I am interested in investing into big stock markets in the world. Please guide me how to. I am Africa, Tanzania

Hi I’m very much interested in this, and I would love your guides and advice for my future investments….Thanks

I just emailed you

Hello Adam I am very interested on how to invest and I would like to have your guidelines and advice to get going

I need more details please

I am really interested in this and would love to know more to invest. Iam from Papua New Guinea. This ia all new to me. Thank you

I will email you Ruth

Hi Adam ! I am interested send me a mail and briefs. Thanks.

I just emailed you Ernest

I am interested in investing in Africa and the world

im interested…I need more info please thanks

Am interested in investing

I am interested as well, would appreciate more info, thanks!

I need your advice more and the way to become more comfortable life via business life

I am interested…

I am interested… I would want to invest but actually confused on what invest on. Am a Nigerian

I would like more to know about how you can help people interested in investing. I am from Pakistan. How much capital is required to a minimum to start investing etc etc.

It is all in the article Saqib.

Link me up

Hi Adam, I very interested in investing could you please send me more information on how to invest wisely from Nigeria

Hi Adam I am interested and please could you email me how to invest from Papua New Guinea?

I will email you Yora.

Hi Adam

I am based in South Africa , kindly would you share more Information on how to get started into investing.

Hi Adam. This is the second time I come across your name in Quora. I suppose I have been wanting to give investing a try for a while, and have retirement pots and a stocks and shares ISA open, both via previous and currenr employers, but have never understood how they’re set up (especially my retirement pots). There never seems to be sufficient enough information that I can understand, and quite frankly that “you can get back less than you put in” only sounds terrifying. Your options are intriguing, but I would like more information. Feel free to reach out. I look forward to hearing from you. Thanks!

Sure, i will reach out to you.

Need alot of information about investment

How can i start erning.

These accounts are designed for accumulation not quick income, so may not be right for you.

Hi Adam, your article is really interesting. Could you kindly send me more information and direction please.

Kind Regards

Adams,am fully intrested in it

Pls,help me link me and guide me up

Please may I know more about investing.I’m new in investing.I can be guided or be linked to sites.I need more infornation on this.I’m from Papua New Guinea.Thankyou and appreciating your information and guides.

Kind Regards,

Herman Anugu

Dear Adam

Can anyone from another country invest safely? Kindly let me know very interested

I will email you.

I would like to invest may u give me a review

Hi Adam,

I’m interested to know more on investing. Can you please email and keep in touch? Thanks!

I am interested in your service can you buttress more on this? I’ll be happy to hear from you. Thanks and best regards.

Hi

Am interested and want to know how to invest and and the investments

I emailed you

Hi Adam can you send me more info I would like to invest

I’m interested

Please can you give me more details via email

Will do

I’m interested in this.

Please I like to invest

would like learn how to invest

Would like to learn how to invest

Would like to know more. Dont have much to invest but want to invest

Would like to know more. Am interested and want to know how to invest and and the investments

I read this article. I am interested in investing for the long time purpose. How can I start? Pls kindly send detail info

will do.

Would like to know more about the investment. Would you please give me a detailed explanation on how I can join and start investing as well, because am interested

Please send info as I’m interested in investing.

Hi Adam, how can I know more about the investments offered please? Thank you

Hello Adam.

I came across your name and posts/contents on investment in Quora alot. I suppose I have been wanting to give investing a try for a while, and considering am in my early thirties, it would be a wise decision for me to start early and harness the power compounding to my advantage. There never seems to be sufficient enough information to understand, but our options are convincingly appealing, but I would like more detailed information. Feel free to reach out. I look forward to hearing from you. Thank you!

Hey Adam! I’m in need of the services you provide. I’d appreciate if you could email me. Thanks!

Mr. Adam, please I’m interested to learn and see how you can me invest for a long term goal well manage by you. Please send me information on the way forward. Thank you very much. Cyril from Nigeria 🇳🇬

Interested…please email me the info. Thank you…

Thanks you very much

Adam can I get more information on this. I don’t have a lot of money to invest but definitely like to try and learn more about this and try to get something working to help my retirement.

I am very glad to be connected with you and also look forward to investing through your platform.

Hello Adam.

I’m interested in learning how to invest and see how you can help me manage.

Sure you can email me – advice@adamfayed.com