The financial markets of the Middle East have observed an ascending trajectory of sukuk in the UAE. This prominence raises the question: What makes sukuk in the UAE so essential?

If you want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

This article is here for informational purposes only, and doesn’t constitute formal legal or financial advice. What is more, the facts might have changed since this article was made.

Table of Contents

What are Sukuk?

Sukuk, colloquially known as Islamic bonds, present a distinct approach to investment compared to their conventional counterparts. Unlike conventional bonds that focus on promised returns, sukuk entitles the investors to a portion of an underlying tangible asset.

This unique structure ensures that the returns from sukuk come from the tangible asset’s actual productivity or leasing rather than mere interest, which is prohibited in Islamic finance.

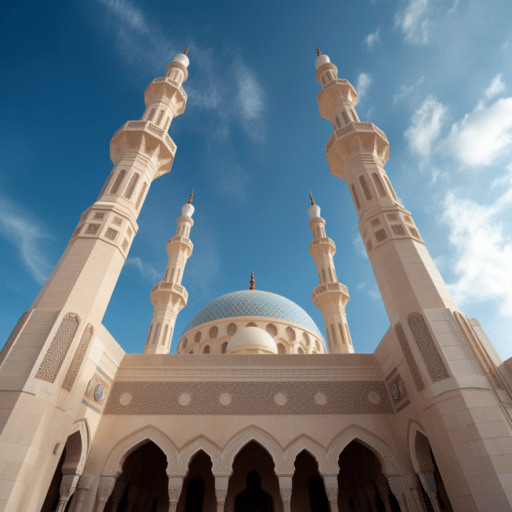

Ensuring adherence to Islamic principles, sukuk in the UAE maintains a strict code of Shariah compliance. This compliance means that the operations, agreements, and even the types of assets associated with the sukuk in the UAE align with Islamic laws.

This alignment not only ensures ethical investments but also caters to a vast demographic that wishes to invest according to Islamic principles.

The UAE’s Financial Landscape

The prominence of sukuk in the UAE isn’t a mere coincidence. It results from the nation’s proactive measures and its embracement of Islamic finance principles.

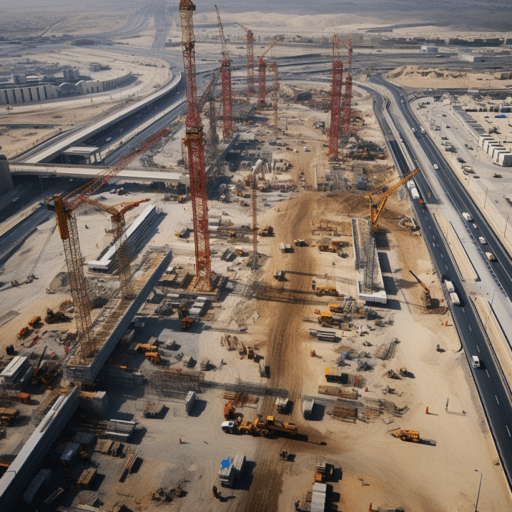

Sukuk in the UAE contributes significantly to the infrastructure projects, financial stability, and liquidity management of the country. Their role in financing massive projects, from airports to skyscrapers, accentuates their significance.

UAE as the Hub of Islamic Finance

Over the years, the UAE has fortified its position as a central player in the Islamic finance industry. A combination of favorable regulations, innovative financial products, and a booming economy amplifies the role of sukuk in the UAE.

Furthermore, global investors have consistently recognized the potential of sukuk in the UAE, considering them a viable and lucrative investment avenue.

The resilience of sukuk in the UAE is evident in their ability to evolve and adapt. With green sukuk focusing on sustainable and environmentally friendly projects and hybrid sukuk merging traditional structures with innovative features, sukuk in the UAE has continuously evolved.

This adaptability ensures that they remain relevant and attractive to a wide range of investors, both regionally and globally.

Benefits of Investing in Sukuk in the UAE

Investing in sukuk in the UAE presents a promising opportunity for those looking to merge ethical considerations with solid returns. These financial instruments, grounded in Islamic principles, offer a host of benefits that go beyond mere profit.

Higher Levels of Trust and Security

At the heart of any investment lies trust. With sukuk in the UAE, this trust stems from their intrinsic design.

Asset-backed Securities Offer Tangible Assurance

Unlike many conventional bonds, sukuk represents a share in an underlying asset, offering investors tangible security. This feature mitigates risks, ensuring that should any financial discrepancies arise, an actual asset can cover the investor’s stake.

Rigorous Oversight by Governance and Shariah Supervisory Boards

The regulation and oversight of sukuk in the UAE rank among the best globally. The Governance and Shariah Supervisory Board supervises these instruments, ensuring they adhere to Islamic laws.

This meticulous oversight boosts the trustworthiness and transparency of sukuk in the UAE, providing added confidence to investors.

Steady Returns with Low Volatility

The financial world respects consistency, and sukuk in the UAE fits this bill perfectly.

Historical Performance as a Testimony

Past performance data reveals that sukuk in the UAE consistently delivers commendable results. Their resilience, especially during economic downturns, is noteworthy.

Investors who prioritize stability find sukuk in the UAE appealing due to their track record of steady yields and minimized fluctuations.

Safe Haven During Economic Uncertainties

Global economic uncertainties can rattle many financial instruments. However, the inherent structure and backing of assets mean that sukuk in the UAE typically weather such storms with minimal disruption.

This resilience provides peace of mind to investors seeking shelter from extreme market volatility.

Diversification for an Investment Portfolio

Diversification stands as a cornerstone strategy for seasoned investors, and sukuk in the UAE seamlessly integrates into this approach.

Array of Regional and Global Options

Sukuk in the UAE is not limited to local ventures. Investors have access to both regional and global sukuk options, enabling them to spread their risks and seize opportunities in different markets geographically.

Opportunities Across Various Industries

From infrastructure projects to commercial ventures, sukuk in the UAE spans various sectors.

Investors can target specific industries or diversify within their sukuk portfolio, tapping into the growth potential of different segments of the economy.

The 7 Top-Performing Sukuk in the UAE

The UAE’s financial market, known for its innovation and dynamism, presents a range of sukuk options for discerning investors.

We’re focusing on the cream of the crop, the top-performing sukuk in the UAE, which has carved a niche for itself due to its unparalleled performance and adherence to Shariah principles.

1. Al Hilal Bank’s Sukuk

Al Hilal Bank, with its headquarters in Abu Dhabi, holds a prominent position in the UAE’s financial landscape. When discussing top-tier sukuk in the UAE, Al Hilal’s offerings frequently feature prominently.

Their dedication to upholding Islamic principles, combined with a modern approach to banking, sets them apart.

Performance Metrics

Financial experts often regard the performance of a sukuk as a reflection of the bank’s overall health and strategy. Al Hilal Bank’s Sukuk showcases impressive metrics.

Historically, Al Hilal’s sukuk consistently offers competitive returns compared to other sukuk in the UAE. Despite economic fluctuations, the sukuk maintains a steady performance, making it a reliable investment avenue.

The regular oversubscription of Al Hilal’s sukuk issues signifies investor confidence and its popularity among those keen on investing in sukuk in the UAE.

Features and Benefits

Investing in Al Hilal Bank’s sukuk provides a range of benefits. By focusing on tangible assets, Al Hilal ensures that the sukuk remains grounded, reducing risks and offering a sense of security to investors.

Regular updates and disclosures about the performance of the sukuk offer clarity and foster trust. Al Hilal Bank believes in keeping its investors informed, distinguishing their sukuk in the UAE.

Al Hilal Bank introduces varied sukuk tenures and structures, catering to the diverse needs of both institutional and individual investors.

A dedicated team assists investors with their queries and concerns, reinforcing the bank’s commitment to superior customer service.

Recent Achievements and Recognition

Al Hilal Bank’s sukuk doesn’t just stand out due to its performance metrics and features. Over the years, its sukuk has received accolades and recognition, solidifying its position as a leading sukuk in the UAE.

Prestigious financial publications and platforms have awarded Al Hilal for its innovative sukuk structures and consistent performance.

Leading credit rating agencies often assign high ratings to Al Hilal’s sukuk, indicative of its reliability and low risk.

2. Dubai Islamic Bank’s Sukuk

Established as the world’s first Islamic bank, Dubai Islamic Bank (DIB) has firmly positioned itself at the forefront of the Islamic finance sector.

It is no surprise that DIB’s sukuk ranks as a premier investment choice for those keen on sukuk in the UAE.

Performance Metrics

A deep dive into the financial data reveals that Dubai Islamic Bank’s Sukuk frequently surpasses market benchmarks.

The bank’s impressive annual reports and financial disclosures indicate a pattern of resilience and profitability.

This reliable performance signals DIB as a compelling option for anyone looking into sukuk in the UAE.

Governance and Transparency

Dubai Islamic Bank adheres to international standards of transparency.

Regular disclosures and detailed reports ensure that investors have all the information they need, fostering a sense of trust in the bank’s operations.

Features and Benefits

DIB prioritizes the selection of assets that not only adhere to Islamic principles but also offer lucrative returns.

Their commitment to due diligence in asset selection and a robust auditing mechanism makes them a preferred choice for those considering sukuk in the UAE.

The bank’s dedication to upholding Shariah principles, combined with its promise of substantial returns, is a testament to its excellence in the field of sukuk in the UAE.

3. Noor Bank’s Sukuk

Noor Bank, with its modern approach to Islamic banking, has made significant inroads in the UAE’s financial landscape. Their sukuk, in particular, draws the attention of both seasoned and novice investors looking at sukuk in the UAE.

Performance Metrics

Analyzing Noor Bank’s financial trajectory over the years, we find a consistent uptrend. The bank’s investments, rooted in thorough market research and strategic foresight, have resulted in commendable yields for their sukuk. Investors keen on sukuk in the UAE will appreciate Noor Bank’s blend of steady growth and risk management.

Governance and Transparency

Noor Bank places a high premium on ethical governance. Their periodic financial disclosures, conducted in adherence to global standards, provide a clear picture of the bank’s financial health and the performance of their sukuk.

Features and Benefits

One of the standout features of Noor Bank’s sukuk is its adaptability. Recognizing that investors have varying needs, the bank offers customizable solutions that cater to different investment objectives.

Moreover, Noor Bank emphasizes investor empowerment. Their range of educational resources and workshops ensures that investors make informed decisions regarding sukuk in the UAE. This blend of flexibility and empowerment makes Noor Bank’s sukuk an attractive proposition for those interested in sukuk in the UAE.

4. ADIB’s Sukuk

Abu Dhabi Islamic Bank (ADIB), one of the formidable players in the UAE’s banking sector, elevates its standing through its high-performing sukuk. Both local and international investors have ADIB’s sukuk on their radar, marking it as one of the prominent sukuk in the UAE.

Performance Metrics

Tapping into ADIB’s financial prowess, the sukuk commands an impressive return rate. This positive financial trajectory makes it a focal point for many aiming to invest in sukuk in the UAE.

The Composition of ADIB’s Sukuk

The backbone of ADIB’s sukuk lies in its diverse, high-value assets. These range from real estate to commercial endeavors, each handpicked to ensure not just Shariah compliance but also investment profitability.

Features and Benefits

ADIB values the trust investors place in its sukuk. Ensuring transparency, the bank frequently shares insightful reports on its sukuk’s performance. Furthermore, their rigorous asset management practices and unwavering commitment to Shariah principles underline its merits. By organizing regular seminars and webinars, ADIB fosters a culture of knowledge-sharing about sukuk in the UAE, guiding investors toward informed decisions.

5. Emirates Islamic Bank’s Sukuk

Emirates Islamic Bank, with its legacy of financial excellence, presents its sukuk as a blend of tradition, innovation, and performance. As a forerunner in the Islamic banking sector, its sukuk has garnered attention, marking it as a premier option for sukuk in the UAE.

Performance Metrics

Emirates Islamic Bank has recorded consistent annual growth, a testament to its financial acumen. The sukuk, reflecting the bank’s overarching performance, stands tall with commendable annual returns. This consistency strengthens its position among the top sukuk in the UAE.

The Composition of Emirates Islamic Bank’s Sukuk

Investors often seek diversified portfolios, and this bank delivers just that. Their sukuk comprises a varied array of assets, from burgeoning sectors like technology to the more traditional ones like infrastructure. Each asset is meticulously vetted for its potential return and Shariah compliance.

Features and Benefits

For Emirates Islamic Bank, the sukuk isn’t just a financial instrument; it’s a commitment to its stakeholders. Upholding the highest standards of Shariah compliance, the bank ensures its sukuk aligns with Islamic tenets. Moreover, to reinforce investor confidence, the bank has initiated regular stakeholder engagements and thorough quarterly reports. These endeavors offer investors clarity and the latest insights on sukuk in the UAE.

6. Sharjah Islamic Bank’s Sukuk

Sharjah Islamic Bank, having firmly established itself within the UAE’s intricate financial tapestry, proudly presents its sukuk as a premium option for discerning investors.

Performance Metrics

Historical data and recent financial analyses spotlight the undeniable prowess of Sharjah Islamic Bank’s sukuk. Investors find consistent returns bolstered by a diversified and resilient asset portfolio, a testament to the bank’s adept risk management. Thus, when it comes to sukuk in the UAE, this offering holds its ground as a reliable choice.

Underlying Principles and Approach

What sets this sukuk apart is Sharjah Islamic Bank’s dedication to intertwining sustainability with finance. Frequently, the funds raised through their sukuk channel into projects with lasting societal benefits. This integration of ethical considerations and financial growth makes their sukuk a compelling proposition for those keen on sukuk in the UAE.

7. Mashreq Al Islami’s Sukuk

When we talk about robust offerings among sukuk in the UAE, it’s hard not to mention Mashreq Al Islami. Representing the Islamic facet of the revered Mashreq Bank, it brings forth a sukuk that commands attention.

Features and Benefits

Recent financial statements and investor reviews confirm Mashreq Al Islami’s sukuk as a top performer. The unwavering support from Mashreq Bank, known for its financial acumen, provides the sukuk with a sturdy foundation. Such consistent performance positions it as a standout option for individuals and institutions eager to engage with sukuk in the UAE.

Offerings

Mashreq Al Islami takes pride in the diversity of assets backing its sukuk. But more than that, the bank’s unwavering commitment to uphold Islamic principles lends credibility and trust. Investors also laud the bank’s state-of-the-art digital interface, making portfolio management a breeze. These attributes further solidify its position and attract more individuals to consider this sukuk in the UAE.

Risks and Considerations when Investing in Sukuk

Investing in sukuk in the UAE, like all other investments, comes with its set of risks. Being proactive in recognizing and understanding these risks helps in making informed decisions.

Market Risks

Market dynamics can be volatile, influenced by a myriad of economic factors. The performance of sukuk in the UAE doesn’t remain isolated from these influences.

Economic indicators such as GDP growth, inflation rates, and unemployment can impact investor confidence and, consequently, the attractiveness of sukuk in the UAE. A robust economy usually boosts sukuk performance, while economic downturns may pose challenges.

The UAE, being in the Middle East, occasionally finds itself at the crossroads of geopolitical tensions. These situations can impact investor sentiment and influence the performance of sukuk in the UAE. Monitoring regional stability becomes vital for sukuk investors.

Currency Risks

The value of the currency plays a pivotal role in investments, and sukuk in the UAE is no exception.

Currency fluctuations, especially for those investing from abroad, can either enhance or diminish returns. An appreciation of the dirham can increase returns for foreign investors in sukuk in the UAE, while depreciation can lead to potential losses.

Many investors consider hedging strategies to protect their investments in sukuk in the UAE from adverse currency movements. Financial instruments such as forwards or options are commonly used for hedging currency risks associated with sukuk in the UAE.

Default Risks

The potential for an issuer to default on their obligations is a risk associated with all bond types, including sukuk in the UAE.

Unlike traditional bonds, where the issuer guarantees interest payments, sukuk in the UAE involves shared ownership of an underlying asset. In case of a default, the process may differ based on the structure of the sukuk. Investors should familiarize themselves with these structures.

Though defaults on sukuk in the UAE have historically been rare, they are not non-existent. Assessing the historical data on defaults provides insights and prepares investors for potential future scenarios concerning sukuk in the UAE.

Steps to Invest in Sukuk in the UAE

The potential and growth of sukuk in the UAE have captured the attention of investors globally. For those eager to be part of this financial evolution, the journey begins with a structured approach.

When considering any investment, clarity on your goals is paramount. The same holds true for sukuk in the UAE.

Are you targeting short-term or long-term investments? Sukuk in the UAE caters to a wide range of time horizons, so identifying your preferred duration will streamline your selection.

Every investor has a unique risk threshold. Sukuk in the UAE, like other financial instruments, comes with varying degrees of risk. Gauge your comfort level and select a sukuk in the UAE that aligns with it.

Choosing the Right Sukuk

Selection is more than just picking at random. It’s about making an informed decision based on a thorough understanding of the sukuk in the UAE market.

Evaluating Ratings

Credit rating agencies, such as Moody’s and Standard & Poor’s, regularly rate sukuk in the UAE. These ratings, based on the creditworthiness of the issuer and the structure of the sukuk, can guide you in making a prudent choice.

Researching Issuers and Assets

Sukuk in the UAE is backed by assets. Investigate these underlying assets for their performance and potential. Furthermore, studying the issuer’s financial health and reputation in the market is equally important. The strength of sukuk in the UAE often mirrors the robustness of its issuer.

The Purchase Pathway

Now that you have armed yourself with knowledge and made your choice, the final phase involves the actual purchase of the sukuk in the UAE.

An experienced financial advisor familiar with sukuk in the UAE can offer tailored advice, ensuring that you make decisions in line with your financial aspirations.

There are also several digital platforms and banks in the UAE that facilitate the purchase of sukuk. These platforms often provide a seamless experience, simplifying the process for investors interested in sukuk in the UAE.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.