This article was updated on March 3, 2021

8 Reasons why you shouldn’t invest in Japan real estate projects – that will be the topic of today’s article

Japan has a surprisingly liberal system for foreigners owning property in the country, which flies in the face of the stereotypical notion that the Japanese economy is closed to the outside world.

This article, however, will list some reasons why you shouldn’t invest in Japanese real estate.

If you want to invest in a tax-efficient way or ask me some questions, you can contact me using this form, or use the chat function below.

For those that prefer visual content, the video below summaries the article:

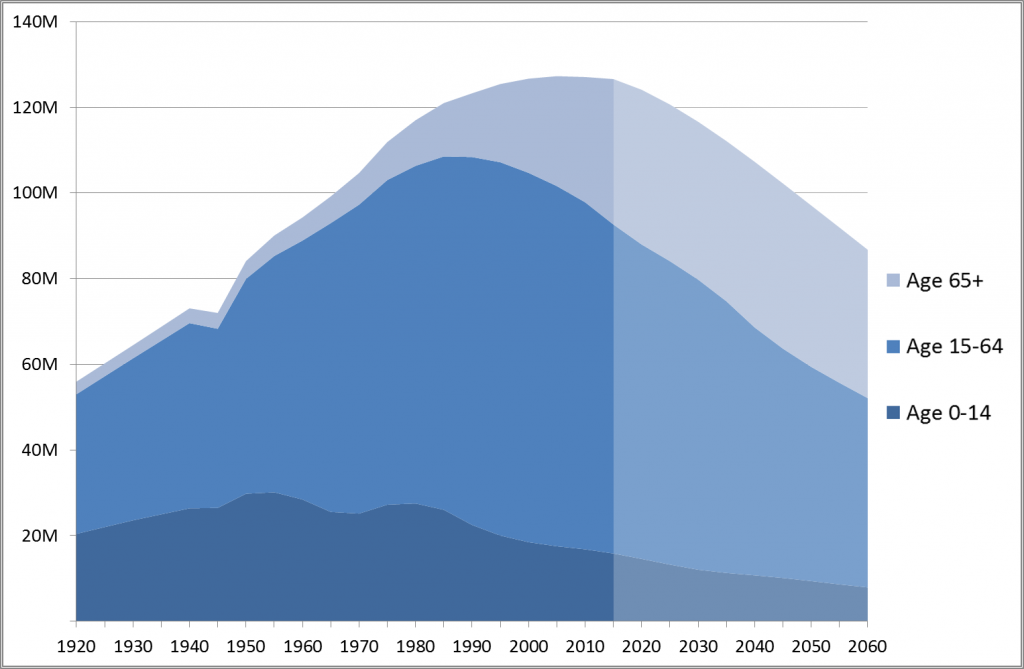

1.Japan’s demographic time bomb

Japan’s population could fall in half in the next few decades. In that context, and with a stagnant economy, it will be harder for property demand to sustain itself.

With interest rates already at zero, and numerous economic stimulus measures already enacted in the last 20 years, it is unlikely countermeasures will combat this demographic fact.

There might be a dramatic increase in Japan’s immigrant population in future years, but there is longstanding political opposition to this.

In recent years, the 2020 Tokyo Olympics (now 2021) has been a one-off stimulus for demand, but this won’t last, once the games come and go.

2. Depreciation

In most parts of the world, houses appreciate in value, even if they don’t appreciate as quickly as stock markets.

In Japan, it is taken as given, that real estate is a depreciating asset. That means that even real estate investors, can only hope to “win” from high rental yields.

What’s more, property is assumed to only have a lifespan of up to 30 years in the country, due to natural disasters and other issues, with families focusing on buying the land, and rebuilding the house.

Even if the house still stands after a huge earthquake, the repairs can be very expensive.

In all countries in the world, maintenance costs and taxes eat into the gross returns, to give you a significantly lower net return on your investment.

In Japan, it is merely a bigger issue.

3. Uncertain times

During times like the current global epidemic, having a significant percentage of your assets in just one or two illiquid assets, in a foreign country which has been stagnating for decades, isn’t low risk.

4. Big bureaucracies

Japan is not an “friendly” English speaking country as far as business and government goes.

I don’t mean that the local government workers won’t be friendly and try to help you, but merely there isn’t a lot of bilingual support.

This can be an issue, as there is a lot of paperwork associated with paying Japanese taxes, and if they make a mistake, it is still your responsibility to put it right.

Big bureaucracies also caused a problem a few years ago in Japan, when the government cracked down on airbnb rentals, partly to protect the hotel industry.

Overnight, many landlords reliant on good rental yields, struggled.

5. Language combined with family issues

Following on from the last point, many foreign buyers in Japan, are reliant on a native-Japanese spouse to do a lot of the legal and tax work.

This can often end in disaster if divorce takes place. This point is clearly not an issue for all foreign buyers in Japan, but does affect a significant percentage.

6. Mortgage system

Even if your house gets destroyed by a disaster, you are still liable to pay for the mortgages.

Of course, Japan isn’t the only country to have this system – the UK and others follow a similar system – and there is liability insurance.

Merely, for a country which is prone to natural disasters, this could become a big issue for you.

7. Retirement

I have met countless expats in Japan. Some are happy, and some aren’t.

One commonality is that I have seldom met a Japanese expat that plans to retire in Japan.

This fact, compared with the aforementioned short lifespan of most Japanese homes, means that it is harder to use housing in Japan as a home rather than an investment.

In comparison, in the UK and large parts of Europe, you can merely buy a home for the ultra long-term (literally death) and not care if the property goes up or down in value.

8. The alternative

There are many alternative expat investments, that are more liquid, and in most ways safer, than such a depreciating asset as Japanese real estate.

Conclusion

Using Japanese real estate as either a home or an investment, is fraught with dangers compared to the alternatives.

If you are living in Japan, it is better to rent. If you are an overseas buyer, there are better real estate markets out there.

Further Reading

If you live in the UK, what sort of property taxes do you have to pay, especially if you are an expat?