In the rapid digital economy of today, payment websites online are crucial modes of operation for freelancers, consumers, and businesses.

We explain in this article a comprehensive comparison of two giants in the market: PayPal vs Payoneer.

We examine their fee structure, international reach, security measures, and user experience to give you a complete, balanced view.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for a second opinion or alternatives.

Some facts might change from the time of writing, and nothing written here is financial, legal, tax, or any other kind of individual advice, or a solicitation to invest.

PayPal Background

PayPal was developed in 1998 (then Confinity) by Max Levchin, Peter Thiel, and Luke Nosek, before the merger with Elon Musk’s X.com in 2000.

It was the first online payment system widely utilized and later was acquired by eBay in 2002 before once again conducting business separately in 2015.

What PayPal does

- Domestic and cross-border fund transfers

- Online business payment processing services

- Buyer and seller protection programs

- PayPal Credit financing facilities

- Buying, holding, and selling cryptocurrencies

- PayPal Business accounts with enhanced features

- E-commerce solution integration

Payoneer Background

Payoneer was started in 2005 by Yuval Tal in New York.

The firm was founded to cater to the cross-border payment requirements of freelancers, small businesses, and digital marketplaces.

How Payoneer works

- Acceptance of payments from 200+ countries worldwide

- Mass payout facilities for businesses and marketplaces

- Multicurrency accounts with local receiving facilities

- Prepaid Mastercard for earnings expenditures

- Working capital and financing products

- VAT payment solutions for international businesses

- Wide marketplace integration such as Amazon, Airbnb, and Upwork

Which has better rates, PayPal or Payoneer?

What does PayPal charge?

PayPal operates on a model with flat fees along with percentage fees depending on transaction type and geography.

No charge for domestic personal payments from a bank account or PayPal balance, beneficial when sending money to family and friends.

But for card-based transfers, it charges a various percentage depending on the country (e.g. 2.9% or 3.4%) with a flat fee added on top of that ($0.30 in the US).

PayPal levies withdrawal fees from bank accounts in some locations, mostly non-US and European destinations.

The platform charges extra fees for merchants on chargebacks ($20) payment disputes ($15), and record requests ($10-30).

PayPal implemented its biggest fee hike in a decade on Jan. 13, 2025. It raised processing fees on Pay Later instruments to 4.99% plus flat per-transaction fees from 3.49%. This 43% price increase makes PayPal’s buy-now-pay-later (BNPL) financing its most profitable payment method, exceeding its standard credit-card-processing fees.

Merchant opt-out options continue to be accessible via account settings, though adoption issues continue because of checkout conversion rate dependencies.

Small companies must be careful about the cumulative effect of the charges because they will significantly lower margins on low-value products.

Convenience and general acceptance come through PayPal.

Nevertheless, percentage charges, fixed charges, and foreign exchange charges put international business in a fairly high-cost situation.

Refer to PayPal’s detailed fee overview for precise estimates.

What are Payoneer fees?

It is free, but Payoneer charges 29.95 USD annual account fee for all customers if your account is inactive after 12 months (less then 2,000 USD received).

Receiving payment via Payoneer’s Global Payment Service is free when consumers pay in currencies supported by the service via local bank transfer.

Receiving payment to your Payoneer account from another user’s Payoneer balance is free; however, receiving money with debit or credit cards incur a charge of 1%~3.99%.

These options for receiving money are flexible but with different cost implications.

Payoneer withdrawals to a bank account usually incur $1.50 for in-country withdrawals (up to a threshold of 50,000 USD/GBP/EUR) and up to 3% of transaction amount for international withdrawals.

The Payoneer Mastercard for spending account balances directly charges a $3.15 ATM withdrawal fee in addition to any fees imposed by the ATM operator.

Card purchases involve a foreign transaction fee of 3.5% if purchases are being made in a currency other than the native currency of the card.

Enterprise accounts (> $1M volume) get dedicated FX hedging instruments and batch payment APIs with 0.3% conversion fees.

Investments in 2025 by the company address real-time payment capacity in 15 emerging economies, which might lower correspondent banking expenses.

Refer to Payoneer’s fee overview for precise estimates.

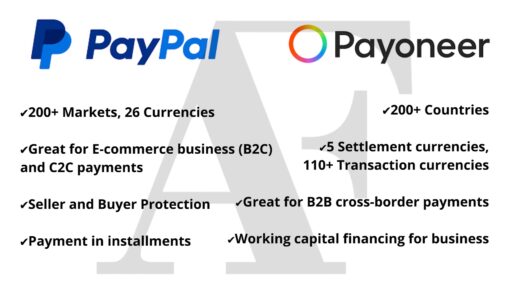

Which is better, PayPal or Payoneer?

PayPal can be used in over 200 countries and 26 currencies, so it is among the most available payment systems in the globe.

The service facilitates instant PayPal-to-PayPal transfers, while bank transfers occur within 1-3 business days.

PayPal Seller Protection helps businesses deal with fraud risk, while Buyer Protection ensures purchase protection for buyers.

The firm has expanded its services significantly to provide point-of-sale solutions through PayPal Here and QR code payments.

Payoneer is dedicated to supporting the international freelance economy and cross-border e-commerce.

Its Global Payment Service offers customers local bank-receiving accounts in various currencies. Hence, it enables them to receive payments as a local business.

This greatly lowers fees for those who receive foreign payments on a regular basis.

The Payoneer Mastercard offers access to direct funds without bank transfers, although it does have foreign transaction fees.

Conclusion

Our comparison highlights the point that both PayPal and Payoneer possess unique strengths to offer.

PayPal’s global acceptance and ease of integration with many online platforms make a strong argument for everyday transactions and e-commerce enterprises.

On the other hand, Payoneer’s cost-effective solution and customized solutions for global businesses and freelancers provide robust benefits.

Particularly for those that are involved with multiple international markets.

But ultimately, the best choice is dependent upon your individual needs and transactional habits.

As is the case with any significant financial choice, be sure to research in advance before deciding on a platform.

We hope this last comparison to be the strong foundation that will guide your decision, allowing you to choose the payment solution that best supports your strategic objectives.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.