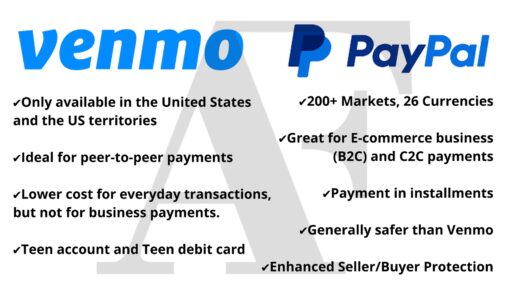

PayPal and Venmo are among the most widely used digital payment services in the rapid cashless era of today.

While PayPal remains ahead of online business and international payments, Venmo has found its footing well in peer-to-peer payments with social functionalities.

PayPal Holdings Inc. owns both companies, but they are separate services with unique user needs.

They provide different electronic money transfer, receipt, and storage modes with different fee rates, security mechanisms, and geographic coverage.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for a second opinion or alternative investments.

Some facts might change from the time of writing. Nothing written here is financial, legal, tax, or any kind of individual advice or a solicitation to invest.

Understanding the main distinctions among them enables users to choose the right service to suit their payment requirements: remittances, business transactions, or online payments.

PayPal vs Venmo

Let us have a detailed overview of the different aspects of PayPal and Venmo to have a better understanding of what each company has to offer.

What is PayPal and how does it work?

PayPal is a secure online payment service that enables you to send and receive money quickly and securely.

It links your bank account, credit card, or debit card to an online wallet so you don’t need to give out sensitive information to merchants.

Think of an easy, safe, and fast method of paying online. That’s PayPal!

With millions of clients globally, it’s ideal for businesses and individuals alike. You can register using your email address and confirm your account.

Then, you can purchase items, split payments, or even transfer money internationally.

The online payment processing firm‘s strong fraud protection and buyer/seller protection policies contribute to the confidence factor.

- Quick setup: Connect your bank or card.

- Secure transactions: Get sophisticated encryption and fraud tracking.

PayPal is an e-business cornerstone due to its stability and worldwide outreach.

What is Venmo and how does it work?

Venmo is a peer-to-peer mobile payment service that is very popular among young adults due to its simplicity and sociability. You can transfer money almost instantly to friends and family members.

Similar to texting, you can include emojis and comments on your transactions, making it fun.

Getting Venmo up and running is a breeze: download the app, connect your card or bank account, and you’re good to go.

You can keep the money received in your Venmo account or forward it on to your bank. The same applies to sending money as well.

Venmo’s social stream displays your transactions (if you make them publicly visible), injecting a little community into mundane money transfers.

- Mobile convenience: Everything is done on your phone.

- User-friendly interface: Simple design makes sending money easy.

Although Venmo concentrates on local transactions within the US, it still ranks among the top solutions for rapid informal payments.

What fees do PayPal charge?

PayPal has a tiered pricing structure that depends on the transaction type. Here’s a quick summary of the digital financial services provider’s rates in the US:

- Domestic Transactions: Free with a bank account or PayPal balance and approximately 2.90% + a flat fee per card transaction (0.3 USD if the money is received in USD).

- International Transfers: an additional 5% with a minimum of USD 0.99 and a maximum of USD 4.99, which is irrelevant to the payment method

Currency conversion spread can be 3% or 4%, depending on the type of transaction.

You can have the most suited payment option from its comprehensive table of fees.

You can pre-emptively avoid unpleasant fees by thoughtfully choosing the method of payment or currency etc.

What fees do Venmo charge?

Venmo keeps things simple when it comes to fees:

- Online purchases: Free

- Standard Transfers: Free to send from Venmo balance, bank account, or debit card.

- Credit Card Payments: Payments made with a credit card have a fixed charge of 3%.

- Instant Transfers: If you need your funds in a pinch, an instant transfer is 1.75% (with a minimum charge of $0.25 and a maximum charge of $25).

- Venmo Debit Card acquisition: $0.00

- ATM withdrawal (in-network): $0.00

- ATM withdrawal (out-of-network/international): $2.50

- OTC cash withdrawal (bank and other financial institutions): $3.00

Referring to the fee overview of Venmo may help you understand the exact amount you’ll be paying.

By making use of free sources of funds and by allowing simple transfers, you can save costs. Venmo’s simple fee system is the reason it dominates most transactions.

PayPal vs Venmo: Cards Offered

When diving into online payments, one of the biggest differences between PayPal and Venmo is the cards provided.

If you want plenty of options in debit and credit products with flexible financing, PayPal’s card products may be your best option.

Or, if you want easy peer-to-peer transactions with cashback benefits, Venmo’s card products – particularly the credit and debit cards – can reward you a little bit more.

💳 PayPal Cards

- Withdraws funds directly from your PayPal balance.

- Offers 5% cash back on a specific monthly category (up to $1,000 spent).

- It can be added to mobile wallets for mobile contactless transactions.

- A 3% cash-back credit card using PayPal to pay and 1.5% on everything else.

- No annual fee.

- It includes added benefits like Mastercard’s Zero Liability protection.

- No interest if paid in full within six months.

- A revolving line of credit ideal for paying for high-ticket purchases ($149 or more).

- Minimum monthly payments are required.

- Functions like a credit card with various payment terms (subject to approval).

PayPal Business Debit Mastercard

- Available if you have a PayPal Business or PayPal Balance account.

- Unlimited 1% cashback on eligible purchases paid weekly.

- Bonus rebates at partner businesses (Mastercard Easy Savings)

💳Venmo Cards

- Directly linked to your Venmo balance for everyday spending.

- Provides customizable cashback rewards – up to 5% in chosen spend categories (e.g., dining, groceries, gas, or health & beauty).

- Perfect for day-to-day, personal transactions with instant access to cash.

- A Visa credit card that works alongside your Venmo account.

- Has a dynamic rewards structure that automatically boosts your cash back – usually gaining up to 3% back on your active spend category, 2% on the second, and 1% everywhere else.

- For consumers who wish to split bills with friends and benefit from the protections of a credit card.

- For teen users aged 13-17 to hone money management skills without the risk of overspending.

- Parents and legal guardians have access to monitor and control the Teen account.

PayPal vs Venmo Purchase Protection

Purchase protection between Venmo and PayPal is different in the following manner.

🛎️PayPal:

- Provides reliable Buyer Purchase Protection for qualified purchases, and Seller Protection for Merchants.

- Protects items that do not arrive or are significantly different from how they are represented.

- Necessitates you to initiate a dispute within 180 days of payment.

- Best for online purchasing and commercial transactions.

🛎️Venmo:

- Limited protection only if payments are treated as purchases.

- Best used for personal goods and services purchases, not for paying friends.

- When paying via the friends and family option, protection does not come into force.

- Best for small personal purchases but not as comprehensive as others.

FAQs

Q. Are Venmo fees less than PayPal?

Yes, for the majority of everyday transactions. Venmo has free transfers with bank accounts and debit cards, while PayPal will generally charge 2.9% in addition to a flat fee when using these. But both charge for credit card payments as well as instant transfers.

Q. Which is safer, PayPal or Venmo?

PayPal is the safer of the two. It employs high levels of encryption and fraud protection technologies in addition to strong buyer and seller protection programs.

Q. PayPal vs Venmo for business

For business purposes, PayPal excels. It offers a comprehensive lineup of merchant services, including online checkout, invoicing, and bulk payouts, and even enables cross-border transactions.

Q. Why is everyone using Venmo instead of PayPal?

It’s popular among many due to the fact that it’s convenient and social. Its mobile-first approach allows for easy money and bill splitting with friends. The app’s feed, complete with emojis and short comments, has a social touch that appeals to millennials.

Q. Is Venmo owned by PayPal?

In fact, Venmo is owned by PayPal Holdings Inc.

While both have the same parent company, they are different entities with different attributes.

Q. Did Venmo replace PayPal?

No, Venmo did not substitute PayPal. Both coexist and have different functions.

Q. Is Venmo only in the US?

Yes, Venmo is currently only available in the United States. It is designed for domestic payments only between US users.

Q. How to avoid a 3% fee on Venmo?

To avoid Venmo’s 3% fee, limit yourself to paying from your debit card or bank account rather than a credit card.

Additionally, choose standard bank transfers rather than instant transfers because the latter has an added fee.

This keeps your transactions affordable and your money in the target location without the added fee.

Conclusion

The decision between PayPal and Venmo depends on your particular needs.

If you need strong security, international support, and business-level features, PayPal is the obvious choice.

But if you want a lightweight, social, and inexpensive method for making regular peer-to-peer transactions in the US, Venmo is the way to go.

Think about your types of transactions and preferred features before making a decision; both services offer different strengths that suit different payment requirements.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.