In the fast-changing fintech universe, Revolut and Monzo are among the pioneers of the digital banking revolution. They are both challenging the traditional banks with their groundbreaking features and simplicity in operation.

But which one is most suited to you?

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for a second opinion or alternative investments.

Some facts might change from the time of writing. Nothing written here is financial, legal, tax, or any kind of individual advice or a solicitation to invest.

Let us explore an extensive comparison of the two digital banking firms to guide you toward an educated decision.

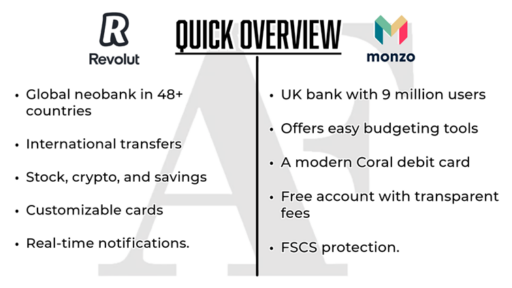

Monzo vs Revolut: What do they do?

What Exactly Does Revolut Do?

Established in July 2015 by Vlad Yatsenko and Nikolay Storonsky, Revolut is a global neobank with digital banking for consumers and corporates.

Based in London, the company has grown in more than 48 countries while its banking licenses are geographically diverse.

As per August 2024 valuation, Revolut is now at a staggering $45 billion, the most valued private European tech firm.

Like Monzo, Revolut offers services largely via a mobile app. Clients with the free “Standard” account receive a distinctive blue and pink two-tone card. The website’s extensive services are:

- Domestic and international bank transfers

- Debit cards and credit cards

- Stock and cryptocurrency exchange

- Savings accounts

- Loans

Revolut has obtained recognition for its capacity to exchange money and send funds worldwide.

Despite not having any brick-and-mortar offices, it compensates through robust digital features for financial management. These features include notifications of real-time transactions and the ability to freeze and unfreeze cards in a matter of seconds.

What is Monzo Famous For?

Monzo is a pioneering fintech business established in 2015. Founded by Tom Blomfield and his team, it has developed into the UK’s seventh largest bank by the number of customers, with 11 million+ users.

For beginners, its coral-colored debit card has been a badge of pride for digitally savvy consumers. But the actual appeal is understood when we dig in a little deeper:

- Easy-to-use budgeting and money management tools

- Smooth spending monitoring and trend observation

- Innovative savings instruments for future investments

CEO TS Anil guided Monzo to welcome two million new customers in 2023 alone, showing its steady growth pattern.

Monzo’s biggest achievement is teaming up with BlackRock to offer investment products with a minimum investment of only £1. The move attracted tens of thousands of customers within hours and had a waiting list of more than 280,000 customers.

And that is not all.

Monzo also includes some new features, such as:

- Call Status (intended to help fight impersonation scams)

- Features to support home ownership, such as presenting mortgage data in the app

Fees

What Fees Does Revolut Charge?

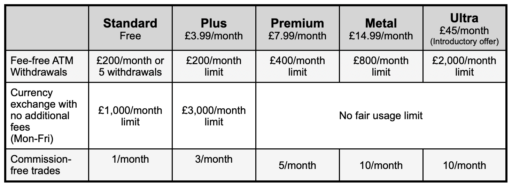

Revolut has different tiers, namely: Standard, Plus, Premium, Metal, and Ultra.

The fintech firm has a free subscription Standard plan but charges fees for some of its services.

Their fees are:

- Free bank deposits of base currency and locally issued UK/EEA cards

- Free single European Payments Area payments and base currency local payments

- 5 free ATM withdrawals or £200 monthly limit, then 2% fee with £1 minimum

- Currency exchange limit: £1,000 a month (1% fair usage charge is applied to additional exchanges)

- Free first Revolut card (delivery charge payable); further cards £5 each

- Cross-border payments in real-time variable fees, applied on each payment sent outside SEPA

- £2 a month administration charge for inactive accounts with a credit balance

- Free instant transfers between other Revolut users worldwide

The platform also supports Plus, Premium, Metal, and Ultra plans with greater limits and reduced fees.

To get detailed information, please go through Revolut’s “Fees” page.

What Fees Does Monzo Charge?

Monzo has an open fee policy on its existing accounts with a lot of free services.

Its fee policy is founded on no-fee core banking and charging only for specialty services and limits.

Key fees for Standard plans include:

- Free account holding with no charges for standard account services, such as declined payments and overdrafts

- No-fee UK banking with free direct debits, standing orders, and sending/receiving money within the UK

- Free spending on cards, both in the UK and abroad, irrespective of the currency

- Limits on ATM withdrawals depending on how you use your card:

- Eligible: Free unlimited withdrawals in the UK/EEA and first £200 free outside EEA in 30 days

- Ineligible: First £400 free within UK/EEA and first £200 free outside EEA in 30 days; after that, a 3% charge incurs

- Foreign currency fees consist of a 1% conversion charge (limited to £1,000) for accepting payments in EUR or other currencies which are converted to GBP.

- International payment fees consisting of a fixed charge (£0.50-£2.68) and a fee that depends on destination and currency (0-1.30%)

To be eligible for increased ATM withdrawals and complimentary replacement cards, you must:

- Receive at least £500 in your account via active Direct Debit

- Receive qualifying government benefits

- Receive student loan payments

- Have a joint account where at least one account holder meets those thresholds, or

- Upgrade your account type

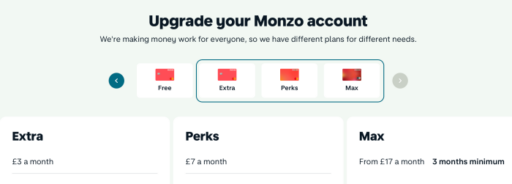

Monzo comes with other plans, namely Extra (£3 a month), Perks (£ 7 a month), and Max (from £17 a month).

The Extra plan offers advanced tools like monitoring all the bank accounts, credit health check, etc.

The Perks plan offers a weekly Greggs treat, annual Railcard, and 4% AER on Instant Savings Pots at Monzo.

Max is the high-end plan that includes everything in the Extra and Perks plans, and along with that, offers international travel and phone insurance. You also get UK and Europe breakdown cover, and you can add a family member for an extra £5 with this plan.

Monzo fees and charges are transparent and are listed on their website for further reference.

Which Card is Better, Revolut or Monzo?

Monzo Cards:

- Debit Card: Hot coral card (Bold coral or Burnt Coral for higher plans) linked to Monzo bank account with Financial Services Compensation Scheme (FSCS) cover up to £85,000

- Flex Purchase: Up to £10,000 limit credit card and 29% APR

- Flex Build: Up to £350 initial limit credit-builder card and 39% APR

- No foreign transaction fee on any card

- 0% interest charge for credit cards when paid by due date on next payment

- Section 75 cover (chargeback) for credit card purchases worth between £100 and £30,000.

- Credit cards require a Monzo current account to apply

Revolut Cards:

- Multiple levels: Standard (free), Plus (£3.99/month), Premium (£7.99/month), Metal (£14.99/month), Ultra (£45/month)

- Card ranges from plain plastic to high-end metal and platinum-plated

- Virtual cards for safe internet spending

- Customisation options (at an additional fee)

- Increased security with freeze/unfreeze in app

The Better Card Option:

Both provide apps with expense tracking, budgeting features, and travel features.

Monzo is a properly licensed UK bank account with sort codes and account numbers, so it can receive direct deposits and standing orders.

Revolut is generally more concerned about card selection and quality materials, while Monzo is more concerned with its banking and open terms of payment.

FAQs

Is Monzo Safer Than Revolut?

From a regulatory perspective, yes. Monzo is a proper UK bank with FSCS protection of up to £85,000. Revolut has customer money ring-fenced but no FSCS protection yet.

What Are the Benefits of Monzo?

Monzo provides easy-to-use budgeting features, spending abroad without fees, live notifications, instant control of cards, easy access to investments, and overdrafts.

Monzo also comes with high customer satisfaction scores.

Is Revolut a Real Bank?

Revolut is a neobank permitted to be made into a bank in the UK.

Yet, it functions as an electronic money institution with banking-type services, without the status of a traditional bank.

Is Revolut 100% Safe?

Even though it’s not FSCS protected, Revolut holds customers’ funds in ring-fenced accounts with approved UK banks, which is good. However, it’s not equivalent to government-guaranteed security.

Is Monzo 100% Safe?

Being a fully licensed UK bank, Monzo provides FSCS protection of £85,000, so it’s just as secure as the old banks when it comes to deposit protection.

Is Monzo Better Than Revolut?

Whether Monzo is superior to Revolut is up to your banking requirements and usage habits.

Security-conscious users:

Monzo leads the way in security under regulation with its UK bank license offering FSCS protection up to £85,000.

This is a clear benefit over the present status of Revolut as an electronic money institution without FSCS protection.

European travelers:

Monzo’s free unlimited spending abroad outside the UK and higher EEA ATM withdrawal limits make it the more affordable option.

For investors:

Revolut is better because its Metal variant comes with unlimited fee-free currency exchange. This aspect of revolut could be more economical for someone who is constantly exchanging huge amounts of currencies.

Revolut also provides other services, such as cryptocurrency trading and stock investment.

Revolut’s greater global reach within 48+ countries can prove to be of value to cross-border consumers.

Both companies persist in developing further and innovating in terms of offering services.

In this process, Monzo is taking significant steps towards investment channels through its BlackRock collaboration, and Revolut is pioneering international expansion.

Which account is best for you will be determined on various aspects such as whether your priority is on complete banking services or competitive exchange rates for currency and money transfer.

Take your time and think about the various services provided and calculate how best to spend your money on them. Fees and commissions paid on money exchange and currency conversion may vary, specifically based on the money you intend to exchange and method of sending the money, for instance.

A provider can be advantageous for a certain amount of money transfer in a foreign currency, but it is not necessarily going to do the same for another.

Do remember that Monzo insures consumers with full FSCS protection (up to £85,000) on their cash. However, Revolut isn’t currently covered by this protection scheme (though this is planned for 2025).

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.