🌐 Ver en Español | Vedi in Italiano

Looking for countries with no corporate tax? Explore the top jurisdictions offering zero corporate tax in 2025, along with conditional exemptions and low-tax alternatives.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (hello@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for a second opinion or alternative investments.

Some facts might change from the time of writing. Nothing written here is financial, legal, tax, or any kind of individual advice or a solicitation to invest.

Popular Tax Haven Countries

As of the latest October 2024 data, the following countries continue to dominate the global landscape as popular tax havens.

- The British Virgin Islands

- The Cayman Islands

- Bermuda

- Switzerland

- Singapore

- Hong Kong

- The Netherlands

- Jersey

- Ireland

- Luxembourg

- The Bahamas

- Isle of Man

- Guernsey

- Cyprus

- Mauritius

- China

- The United Arab Emirates

- The United Kingdom

- France

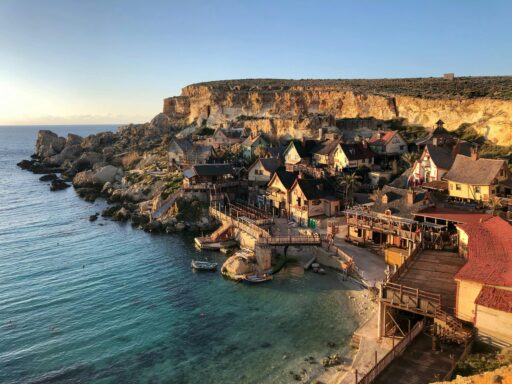

- Malta

These countries are known for their investor-friendly tax policies, confidentiality, and flexible regulations—but not all of them offer true zero corporate tax. So, how do they actually compare?

Let’s break them down into three key categories:

- True zero corporate tax countries

- Jurisdictions with conditional or partial tax exemptions

- Low-tax countries that are not zero, but still competitive

True Zero Corporate Tax Countries

No corporate tax means these countries impose no levies on profits, making them attractive destinations for businesses and individuals looking for favorable tax environments.

Here are some of the most well-known countries with no corporate tax:

British Virgin Islands (BVI)

The British Virgin Islands is a renowned tax haven offering no corporate income tax, making it a top destination for international businesses and holding companies.

The territory’s simplicity and ease of doing business have made it a popular choice for financial services, trust companies, and offshore entities.

BVI remains an attractive option due to its robust legal framework, stable economy, and the ability to set up companies with minimal regulatory burdens.

Cayman Islands

Similar to the British Virgin Islands, the Cayman Islands boasts a 0% corporate tax rate.

This makes it a favorite location for hedge funds, investment firms, and multinational corporations.

Additionally, the absence of capital gains tax, inheritance tax, and other taxes provides a significant advantage for businesses looking to maximize profitability.

The Cayman Islands is widely regarded for its strong financial services industry, and its government continues to foster an investor-friendly environment.

Bahamas

The Bahamas offers a zero corporate tax rate, and it has long been a sought-after location for companies in industries like tourism, finance, and real estate.

With no corporate tax, capital gains tax, or inheritance tax, the Bahamas is a prime tax haven for both individuals and corporations seeking to reduce their tax liabilities.

The country’s transparent legal system and favorable regulatory environment continue to attract foreign investment.

These jurisdictions have become established financial hubs by offering an attractive combination of no corporate tax, regulatory stability, and ease of doing business.

However, businesses must ensure they comply with international regulations and tax laws to avoid any legal complications.

Always seek professional advice before setting up operations in these tax havens.

Countries with Zero Corporate Tax (Under Certain Conditions)

These countries have corporate tax exemptions or significantly reduced tax rates.

The zero rate typically applies only under specific conditions, such as for certain types of businesses, income, or industries.

Let’s explore some of these jurisdictions with conditional or partial corporate tax exemptions:

Guernsey

Guernsey, a British Crown Dependency, is known for its attractive tax environment, offering a low corporate tax rate with exemptions for specific sectors.

The island does not charge corporate tax on most businesses, making it appealing for international companies looking to reduce their tax liabilities.

- Current Corporate Tax Rate: 0% for most businesses, but certain sectors, such as financial services, are subject to a 10% or 20% tax.

- Key Features: No capital gains tax, inheritance tax, or VAT, making Guernsey a favorable jurisdiction for holding companies, investment funds, and trusts.

- Conditional Factors: Financial services companies are taxed at a 10% rate, while most other businesses can benefit from a 0% rate.

- Companies engaged in certain activities like banking, insurance, and investment management must comply with specific regulations to maintain their tax-exempt status.

Jersey

Jersey offers a highly favorable tax regime, with a standard 0% corporate tax rate for most businesses.

However, Jersey differentiates its tax structure by applying higher tax rates to specific sectors like financial services, making it a balanced tax haven for international business activities.

- Current Corporate Tax Rate: 0% for most businesses, 10% for financial services, and up to 20% for larger retailers and utilities.

- Key Features: Known for its strong financial services industry, Jersey also offers no capital gains tax and no inheritance tax, alongside its competitive corporate tax structure.

- Conditional Factors: Businesses operating in sectors such as financial services are taxed at 10%, while larger corporate retailers and utilities may face a 20% tax rate. Companies in these sectors must meet certain regulatory requirements to benefit from Jersey’s favorable tax rates.

Isle of Man

The Isle of Man is an attractive option for businesses due to its low corporate tax environment.

Like Guernsey, the Isle of Man offers a 0% corporate tax rate for most businesses but applies higher rates to specific industries.

It’s popular among digital businesses, holding companies, and international investors.

- Current Corporate Tax Rate: 0% for most businesses, 10% or 15%* (see their corporate income rates page) for banking businesses, and 20% for income from land and property.

- Key Features: The Isle of Man does not impose capital gains tax, inheritance tax, or VAT, making it highly attractive for international corporations, especially in the tech, online gaming, and financial sectors.

- Conditional Factors: The 10% corporate tax rate applies to banking businesses, while businesses that derive income from land and property are taxed at 20%. Companies operating in other sectors can benefit from the 0% corporate tax rate, provided they meet the island’s economic substance requirements.

Bermuda

Bermuda is a well-known tax haven, offering a 0% corporate tax rate for most businesses.

However, the government has announced plans to introduce a 15% corporate income tax rate for multinational enterprises with revenues reportedly exceeding €750 million starting in January 2025.

This will apply to large corporations that were previously exempt, signaling a shift toward more regulated tax structures for big enterprises.

Nonetheless, Bermuda’s tax-friendly status remains largely intact for smaller and specialized industries, such as insurance and investment funds.

- Current Corporate Tax Rate: 0% for most businesses and firms under specific conditions, with exceptions for large multinationals starting in 2025.

- Key Features: No capital gains tax, VAT, or sales tax, making it a tax-friendly environment for international firms, particularly in the financial sector.

- Conditional Factors: Companies must adhere to economic substance rules if involved in certain sectors.

United Arab Emirates (UAE)

The UAE introduced a corporate tax of 9% on profits exceeding AED 375,000 in 2022.

Before this, the UAE was known for its tax-free corporate environment, particularly in free zones.

Many businesses operating in designated free zones can still benefit from exemptions or reduced tax rates, providing an attractive tax structure for new businesses.

The UAE aims to align its tax system with international standards while still offering significant advantages for companies operating in its free zones.

- Current Corporate Tax Rate: 9% on profits over AED 375,000, with exemptions for free zone businesses.

- Key Features: No corporate tax on Qualifying Income for businesses in free zones, attracting global investors in various sectors.

- Conditional Factors: Businesses that operate outside free zones or exceed the revenue threshold are subject to the new tax rate, while companies in free zones may still benefit from tax exemptions.

Low Corporate Tax Countries (Not Zero)

While these countries do not offer a completely zero corporate tax rate, they feature significantly lower tax rates compared to global standards.

Businesses in these jurisdictions can benefit from competitive tax rates, tax exemptions, and favorable conditions, making them attractive for multinational corporations and entrepreneurs.

Switzerland

Switzerland is a popular choice for international businesses, offering low corporate tax rates and a highly stable economy.

It is particularly attractive for holding companies, financial institutions, and multinational corporations.

- Current Corporate Tax Rate: The corporate income tax consists of federal tax (8.5%) and cantonal tax, with the overall rate ranging from 11.9% to 20.5%, depending on the region.

- Key Features: Switzerland has a highly skilled workforce, a strong banking sector, and political stability, making it an ideal location for holding companies and financial services.

- Conditional Factors: The corporate tax rate varies depending on the canton in which a business is registered. Companies with substantial economic activity in Switzerland may benefit from reduced tax rates or tax holidays through special agreements with cantonal governments.

Singapore

Singapore is renowned for its low corporate tax regime, ease of doing business, and pro-business environment, attracting international corporations and startups alike.

- Current Corporate Tax Rate: 17%, with partial tax exemptions for small and medium-sized enterprises (SMEs) and start-ups.

- Key Features: Singapore offers numerous tax incentives for businesses in the tech, finance, and innovation sectors. It has no capital gains tax and benefits from a robust legal and financial framework.

- Conditional Factors: SMEs may benefit from 75% tax exemptions on the first SGD 10,000 of chargeable income and then 50% exemption on the next SGD 190,000. There are also tax exemptions for start-ups (75% for the first SGD 100,000 and then 50% for the next SGD 100,000) and investment incentives for businesses involved in research and development or innovation.

Hong Kong

Hong Kong offers a competitive corporate tax rate that makes it one of the most attractive places for international businesses to establish a presence in Asia.

- Current Corporate Tax Rate: 16.5% on assessable profits above HKD 2 million; 8.25% on the first HKD 2 million of assessable profits. If the two-tiered rates do not apply, the rate is 16.5%.

- Key Features: Hong Kong has a straightforward tax system, with no VAT or sales tax, making it a hub for multinational corporations and small businesses. It is also an ideal jurisdiction for holding companies due to its network of double tax treaties.

- Conditional Factors: Profits derived from activities carried out outside of Hong Kong may be exempt from tax. Hong Kong also offers a two-tiered profits tax rate, where the first HKD 2 million of profits are taxed at 8.25% for eligible corporations.

Ireland

Ireland has one of the most competitive corporate tax rates in Europe, making it a top choice for multinational companies, particularly in the tech and pharmaceutical sectors.

- Current Corporate Tax Rate: 12.5% on trading income, with a 25% rate for non-trading income.

- Key Features: Ireland offers a stable business environment, a skilled workforce, and access to the European Union market. It is particularly attractive to multinational companies due to its low tax rates and strong network of double tax treaties.

- Conditional Factors: Certain companies may qualify for a lower rate under specific incentive programs, such as the Knowledge Development Box, which provides tax relief for income derived from intellectual property.

Malta

Malta offers a favorable tax regime for international businesses, particularly for those in the financial services, gaming, and technology sectors.

The country also boasts a robust legal and regulatory framework.

- Current Corporate Tax Rate: 35%, but companies can benefit from a full tax refund scheme that effectively reduces the rate to around 5% for foreign investors.

- Key Features: Malta has a favorable tax refund system, which allows companies to reduce their effective tax rate. It also has a wide network of double tax treaties, making it attractive for international trade and holding companies.

- Conditional Factors: To benefit from Malta’s tax refund scheme, companies must meet certain criteria, including the requirement to conduct business activities in Malta. The effective tax rate can vary based on the nature of the business and the structure of the investment.

Luxembourg

Luxembourg offers one of the lowest tax rates in Europe, along with several tax exemptions for international companies involved in cross-border activities.

- Current Corporate Tax Rate: 16% for income exceeding €200,000; 14% for companies with taxable income up to €175,000

- Key Features: Luxembourg offers a favorable environment for holding companies, investment funds, and international corporations, particularly those in the financial services and technology sectors.

- Conditional Factors: Luxembourg offers preferential tax treatment to companies that engage in international business activities and have substantial substance in the country. It also offers tax incentives for research and development activities.

Cyprus

Cyprus has established itself as a low-tax jurisdiction, making it an attractive location for holding companies and international businesses looking for a strategic base in Europe.

- Current Corporate Tax Rate: 12.5%, one of the lowest rates in the European Union.

- Key Features: Cyprus has a strong financial sector and offers a network of double tax treaties with numerous countries. The island is also popular for international companies engaged in shipping, intellectual property, and real estate investment.

- Conditional Factors: Cyprus offers various tax exemptions, including exemptions for dividend income and capital gains from the sale of securities, provided certain conditions are met.

Netherlands

While often used in tax planning structures, the Netherlands does not offer a 0% corporate tax regime. Its incentives are primarily designed to support innovation and R&D.

- Corporate Tax Rate: 19% (up to €200,000), 25.8% above that

- Key Features: “Innovation box” regime allows qualifying IP income to be taxed at an effective rate of 9%

- Conditional Factors: No corporate entity or industry enjoys a 0% tax rate

Mauritius

Mauritius is attractive due to its partial exemptions, but a full corporate tax exemption isn’t available. Most companies can, however, benefit from very low effective tax rates.

- Corporate Tax Rate: 15% standard

- Key Features: Partial exemption of 80% for global business companies, bringing effective tax down to 3%

- Conditional Factors: Requires licensing and global business activity to benefit from reduced rates

China

China offers reduced tax rates to encourage specific sectors, but a true 0% rate is not available.

The country’s incentives are focused on innovation and strategic industries.

- Corporate Tax Rate: 25% standard

- Key Features: 15% rate available for qualified technology-advanced service enterprises

- Conditional Factors: Businesses must meet strict criteria to qualify for reduced rates

United Kingdom

The UK has a competitive corporate tax structure for small businesses and R&D-intensive companies, but no exemption to zero.

- Corporate Tax Rate: 25% (19% for small profits below £50,000)

- Key Features: R&D tax credits and patent box can reduce effective tax rate

- Conditional Factors: Reductions apply only under strict R&D or IP-related conditions; no full exemption

France

France is not considered tax-friendly from a corporate perspective.

Still, small companies may qualify for lower rates on a limited portion of their income.

- Corporate Tax Rate: 25% standard

- Key Features: 15% on first €42,500 of profits for qualifying SMEs

- Conditional Factors: Strict eligibility requirements; no 0% regime exists

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.