Future Focus is a unit-linked insurance policy with no set contribution schedule and accepts lump sum payments.

It is a financial product from Hansard Worldwide Limited, a unit of financial services firm Hansard Global.

In this Hansard Future Focus review, we’ll delve into the offering’s features, fees, and advantages and disadvantages, among other things.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (hello@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for a second opinion or alternative investments.

Some facts might change from the time of writing. Nothing written here is financial, legal, tax, or any kind of individual advice or a solicitation to invest. So, potential investors shouldn’t base any investment decision on this Hansard product review alone.

What is Hansard Future Focus?

The product provides flexible investment choices, with no minimum fund allocations, multi-currency access, and bid-to-bid switches.

You can withdraw your money anytime with no penalties and manage your contract easily online.

Every contribution has a term of five years.

A 0.5% annual loyalty bonus is credited every five years, commencing on the fifth anniversary of each payment.

Who can invest in Hansard Worldwide Future Focus?

Those seeking a straightforward, adaptable, and safe online option with internationally diversified options for medium- to long-term saving and investing can access the product.

Prospective clients must be at least 18 years old.

How to Invest

You can open the contract with just USD/GBP/EUR 1,000, and top up whenever you like with a minimum USD/GBP/EUR 1,000.

The product comes in three currency options and may be issued as life assurance or capital redemption, depending on local regulations.

For life assurance contracts, the policyholder is generally the same person as the life assured, unless it’s set up under a trust.

Future Focus Investment Options

The product puts you in control, allowing you to:

- Build a custom investment plan with Hansard Unit-linked Funds

- Use the Hansard Deposit Fund to safeguard your portfolio during uncertain markets

- Align your investments with retirement or estate goals through Trusts or Pension Schemes

Hansard Future Focus Charges

Future Focus fees include:

- An establishment charge of 1.5% per year of each contribution (initial and additional) is applied, charged quarterly over 5 years.

- A tiered annual management charge of 0.90%–0.50% per year is assessed monthly based on the contract’s aggregate value, with lower rates for higher amounts.

- No additional charges for investing in Hansard Deposit or Unit-linked Funds.

- External fund charges vary depending on the external fund manager.

- Currency conversion fees apply when trading across different currencies.

- Bank transfer charges may be incurred when making contributions or withdrawals.

- There’s also an optional fee of up to 1.5% per annum, agreed with your financial advisor for continued service.

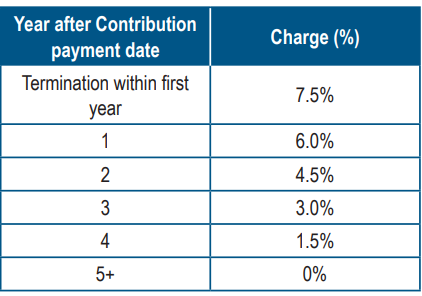

- A termination charge starts at 7.5% and diminishes over the term.

Each top-up or premium’s terms and charges are evaluated independently over a five-year period from the date of purchase.

Pros and Cons of Hansard Worldwide Future Focus

Future Focus Hansard Investment Benefits

- Offers a loyalty bonus.

- The Hansard online account allows easy monitoring.

- There is no penalty for withdrawals made at any time.

- There is no set timetable for payments, so contributions are flexible.

- There are no minimums for asset options, so you can invest any sum in any of the funds available.

- Can be held within a Trust or Personal Pension Plan.

Future Focus Investment Risks

- Changes in exchange rates can raise or trim the value of your investment.

- There’s no protection on your capital, so losses are possible.

- Hansard Worldwide isn’t backed by any investor compensation program.

- Higher rewards often mean taking on more investment risk.

Making the wrong investment decision could be the result of incomplete information or misguided advice.

The product has its merits, but there are more competitive alternatives available.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.