A family office refers to a privately held company that handles investment management and wealth management for a wealthy family.

According to Deloitte’s Family Offices Insights Series, there are an estimated 8,030 single-family offices worldwide as of 2024 representing a 31% increase from 6,130 in 2019.

This number is projected to grow by 12% to 9,030 family offices by the end of 2025 and by 33% to 10,720 family offices by 2030, marking a 75% increase over this decade.

The total estimated wealth managed by these family offices currently stands at approximately USD 5.5 trillion, thus, reflecting a 67% increase within five years from USD 3.3 trillion in 2019.

Given these statistics, we can understand that the world of family offices has seen remarkable growth in recent years, with an increasing number of ultra-high-net-worth individuals seeking dedicated structures to manage their wealth across generations.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (hello@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for a second opinion or alternative investments.

Some facts might change from the time of writing. Nothing written here is financial, legal, tax, or any kind of individual advice or a solicitation to invest.

This guide explores the typical family office minimum net worth, along with various types of family office, who invest in them, their operational costs, and other considerations.

What Are the Different Types of Family Offices?

Family offices generally fall into two primary categories: single-family offices (SFOs) and multi-family offices (MFOs).

However, variations and hybrid models exist based on specific family preferences and circumstances.

Other notable models of family offices include, but are not limited to:

- Embedded Family Office

- Virtual Family Office

- Outsourced Family Office

- Virtual Family Office

- Philanthropy Office

Each of the models has different types of functions and is structured based on the specific needs and requirements.

Single Family Offices (SFOs)

Single-family offices are private entities established by a single wealthy family to exclusively manage their financial affairs.

These structures offer highly personalized and tailored services that align precisely with the specific needs and objectives of the family.

SFOs provide an elevated level of control, allowing the family to maintain direct oversight and influence over their wealth management strategies.

The structure of an SFO typically includes a core team of professionals such as investment managers, financial planners, tax experts, legal advisors, and administrative staff.

This dedicated team works closely with the family to develop and implement customized strategies across various aspects of wealth management.

SFOs are particularly suitable for families with substantial assets and complex financial situations seeking comprehensive attention to their affairs.

According to Wharton Magazine, approximately 1,000 SFOs operate around the world catering to families with at least USD 100 million in assets.

Within these, more than half are known for managing family wealth exceeding $1 billion.

Multi-Family Offices (MFOs)

Multi-family offices serve multiple families, functioning as a shared platform that offers cost efficiencies through economies of scale.

By pooling together resources and expertise from several families, MFOs can access a broader range of services while distributing the associated expenses.

These offices typically employ teams of professionals with diverse skill sets to address the various needs of the participating families.

MFOs offer services similar to SFOs but may lack the same level of customization since their offerings are shared among families with varying needs and priorities.

They represent a popular choice for families with significant wealth who may not require the exclusivity or extensive customization provided by SFOs.

Some families initially establish an SFO and later transition to an MFO to leverage shared resources.

On the other hand, some multi-family offices offer certain families additional customization options that resemble elements of a single-family office.

Family Office Investors

Family offices typically serve ultra-high-net-worth individuals (UHNWIs) and their families who possess substantial wealth requiring sophisticated management approaches.

The following are deemed general investors in family offices:

- UHNWIs

- Family members of family offices

- Family entities like trusts, foundations, etc.

- External investors (in the case of some family offices)

- Investment advisors

These clients often have complex financial situations involving diverse asset classes, international holdings, and multigenerational wealth transfer considerations.

Family offices manage investments across various asset classes.

They commonly allocate capital to private equity, venture capital opportunities, hedge funds, and commercial real estate.

Many family offices turn to hedge funds for alignment of interest based on risk and return assessment goals.

Some family offices remain passive and simply allocate funds to outside managers, while others take more active roles in investment management.

The geographic distribution of family offices reflects global wealth patterns.

By region, it is estimated that there are approximately:

- 3,180 single-family offices in North America

- 2,290 in Asia Pacific

- 2,020 in Europe

- 290 in the Middle East

- 190 in South America

- 60 in Africa

This distribution highlights the global nature of the family office phenomenon.

Significant concentrations are observed in developed financial markets but a growing presence is seen in emerging economies as wealth accumulation accelerates worldwide.

How Much Does a Family Office Cost?

Operating a family office involves substantial costs that vary based on several factors including size, location, service offerings, and management structure.

According to multiple sources, a family office can cost over $1 million annually to operate.

This significant expense makes it essential for families to carefully consider whether the benefits justify the costs.

Annual Budget

J.P. Morgan Private Bank estimated that a single-family office is expected to cost around USD 3.2 million per annum.

This budget comprises the expenses related to staffing, technology, infrastructure, legal matters, compliance, and so on.

Personnel costs can vary substantially depending on the expertise required and geographic location of the office.

Cost as a Percentage of the Assets Under Management

When measured as a percentage of assets, the average cost of running a family office typically ranges from 0.1% to 0.5% of AUM according to Forbes’ Global Family Office Compensation Benchmarking Report 2023.

However, costs can vary significantly by geography.

In more mature markets like the United Kingdom, for instance, the average cost rises to between 0.6% and 1% of AUM.

A clear relationship exists between the size of a family office and its cost efficiency.

Larger family offices benefit from economies of scale, making them more cost-effective relative to their AUM.

Research from the Forge Community found that family offices managing approximately $200 million in assets operate at an average cost of 0.55% of AUM.

On the other hand, those managing an estimated average of $12.5 billion operate at just 0.17% of their AUM.

Interestingly, budget levels remain virtually identical across family offices falling within the $625 million to $875 million AUM range.

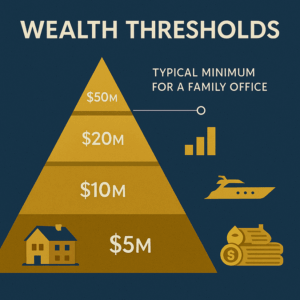

What Is the Minimum Net Worth for a Family Office?

To be precise, there is no regulatory minimum net worth requirement to establish a family office.

Anyhow, practical considerations typically place certain thresholds on when such structures become financially viable.

Generally, family offices serve families with at least USD 50 – 100 million in investable assets.

This informal threshold exists primarily because of the substantial costs associated with operating a family office, which can exceed USD 1 million annually.

According to industry research, the majority of family offices globally manage assets of USD 500 million or more.

Nonetheless, approximately 45% of the family offices manage assets between USD 50 million and USD 500 million.

This suggests that the USD 50 million mark often serves as a practical entry point for families considering a dedicated family office structure.

Once again, it’s important to note that there is no absolute minimum asset value required for establishing a family office.

In many aspects, it depends on the intended utilization of the family office.

Families must weigh their specific needs against the energy required to oversee the office and the overhead incurred through running it.

The minimum net worth threshold can also vary based on the type of family office being considered.

Single-family offices usually require a minimum of USD 100 – 250 million considering the overhead costs.

Overhead costs are usually indirect costs that are not associated with the respective services of the business.

Single-family offices, due to their exclusive nature and comprehensive service offerings, typically require higher minimum wealth levels than participation in multi-family offices.

MFOs allow families to access professional family office services at a lower wealth threshold by sharing costs among multiple families.

For families whose wealth falls below the practical threshold for maintaining a single-family office, a multi-family office can represent an attractive alternative.

This option provides many of the benefits of a dedicated family office but at a lower cost point due to the shared expense structure.

Alternatively, families with USD 10 – 30 million may prefer outsourced or virtual family office solutions via private banks or wealth managers.

Conclusion

As of April 2025, the global family office landscape continues its rapid expansion.

The concept of family offices continues to evolve globally as wealth creation accelerates and the needs of ultra-high-net-worth families become increasingly complex.

While conventional wisdom suggests a minimum net worth of $50-100 million for establishing a single-family office, no hard and fast rule exists.

The decision ultimately depends on each family’s unique circumstances, objectives, and willingness to bear the associated costs.

The family office landscape is projected to continue its robust growth trajectory, with the total wealth managed by family offices to increase from USD 5.5 trillion today to USD 9.5 trillion by 2030.

This represents a remarkable rise between 2019 and 2030, highlighting the growing significance of family offices in the global wealth management ecosystem.

For families contemplating the establishment of a family office, careful consideration should be given to:

- Specific needs

- Intended utilization of the office

- Complexity of their financial affairs

- Desired level of control

- Cost considerations

While significant wealth is certainly a prerequisite, the structure and approach can be tailored to match the family’s particular circumstances and objectives.

Soon, innovations in technology and service delivery models may potentially lower the effective minimum net worth threshold for accessing family office services.

Thus, making these sophisticated wealth management approaches accessible to a broader segment of high-net-worth families around the world.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.