Why will US stocks underperform?

Nobody can predict what will happen with the US stock market this year or next year.

But what we have to remember is the long-term patterns of stock markets.

What are those patterns?

1.Pretty much all developed stock markets go up over time.

Even the Japanese stock market hit a new all-time record a year or so ago. However, it is normal for stock markets, including the US S&P500 and Nasdaq, to be stagnant over relatively long periods of time.

From 1965 to 1982, the S&P 500 experienced a massive underperformance compared to inflation. Whilst historically the US stock market has beaten inflation by 6%-7% annually, US inflation outpaced the S&P 500 by an average of 3% per year during that period.

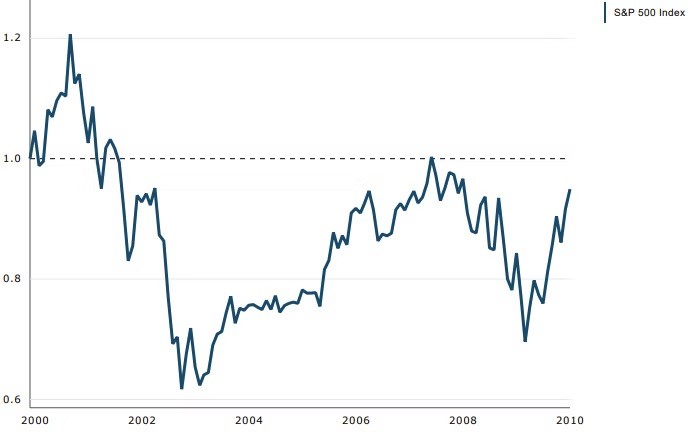

The S&P500 had another lost decade from 2000 until 2010.

In comparison, the US markets outperformed from 1982 until 2000, and 2009 until now.

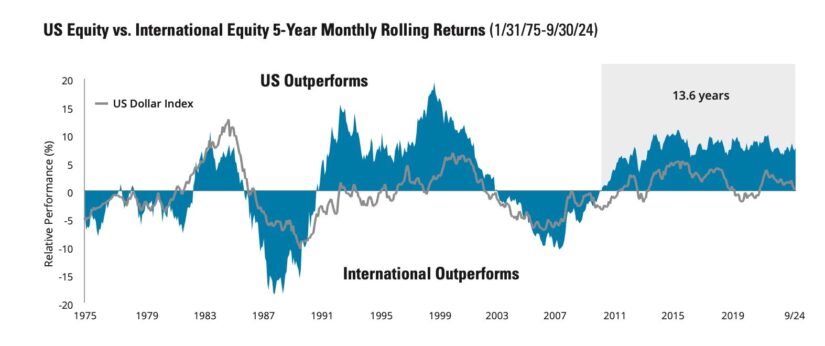

The US markets will have another period of outperformance in the future, but it appears that international stocks are due their time in the sun.

2. Non-US stocks often outperform

Recency bias means that people think that a ten or fifteen year period is the long-term.

It isn’t. If we look much further back, US stocks have often been beaten by international ones.

The US Dollar and stock market has had a good run, but that doesn’t mean this will carry on forever.

International stocks are looking much cheaper than US assets.

What can you do about it?

Obviously, everybody’s situation is different, but the main thing you can do are:

- Gain exposure to international assets, and not just stocks

- Invest into US assets with some downside protection/insurance

- Diversify your portfolio to gain exposure to growing sectors like private credit

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.