Whisky casks can be a good investment, especially for those seeking long-term, alternative assets.

Whisky cask investment has reportedly delivered average returns of 8–12% annually, making it an increasingly popular alternative for high-net-worth individuals and expats seeking portfolio diversification.

Unlike traditional spirits collecting, this strategy involves owning entire barrels of maturing whisky, which can appreciate in value over time as the spirit ages and supply tightens.

In this guide, we’ll explore:

- How to buy whisky as an investment?

- Is investing in whisky casks a good idea?

- How much is it to invest in a cask of whisky?

- What are the returns on whisky cask investment?

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

How Does Whisky Cask Investment Work?

Whisky cask investment involves purchasing a full cask of maturing whisky directly from a distillery or through a licensed broker.

Unlike buying collectible bottles, you’re acquiring the liquid in its aging stage before it’s bottled and sold to the public.

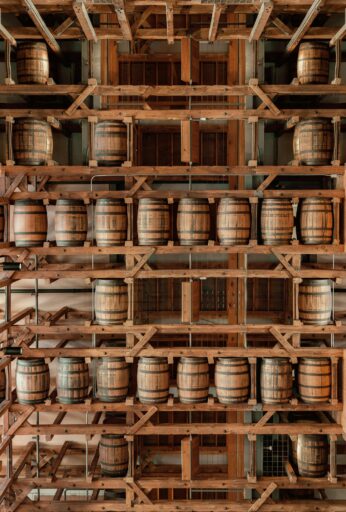

Once purchased, the cask is typically stored in a bonded warehouse, often located in Scotland, Ireland, or Japan, depending on the origin of the whisky.

The investor does not take physical possession of the cask but instead holds legal title while paying annual storage and insurance fees.

The whisky continues to mature, increasing in both quality and market value over time.

Exit strategies include:

- Selling the cask to another investor

- Bottling and branding for private sale

- Selling to independent bottlers or whisky brands

The process is relatively hands-off but requires choosing trustworthy partners and having a long-term horizon.

How to Invest in Whisky Casks

Here are several avenues to enter the whisky cask market, each offering varying levels of control, risk, and involvement:

- Direct from Distilleries

Some distilleries, especially smaller or newer ones, sell casks directly to private individuals. This method gives investors direct access at source pricing but is less common among established brands. Direct purchases may also come with limitations, such as a minimum holding period or restrictions on resale. It’s important to verify whether the distillery provides full title ownership, not just participation rights. - Through Licensed Brokers or Cask Investment Firms

This is the most common route for individual investors. Licensed brokers act as intermediaries, sourcing casks from a range of distilleries and managing logistics like bonded warehouse storage, insurance, and resale facilitation. Top-tier firms provide detailed provenance data, distillery reputation, and market projections. Working with brokers is ideal for those who want exposure without managing every detail themselves, but it also requires vetting the firm’s credentials carefully. - Whisky Investment Funds or Digital Platforms

For those who prefer a hands-off approach, pooled investment structures and digital platforms offer indirect exposure to whisky casks. These may include fractional ownership models or collective cask portfolios. While these platforms lower the entry barrier, they can also lack transparency around fees, ownership rights, or how returns are calculated. They’re typically unregulated, so investor protection varies significantly by provider.

Before committing capital, due diligence is essential.

Here are some key checks to make:

- Licensing and regulation: Confirm that the broker or platform is registered and operates under appropriate regulatory frameworks, especially if offering financial products.

- Warehouse verification: Ensure the cask is stored in a bonded or licensed facility appropriate to the local jurisdiction with proper insurance, security protocols, and regular third-party audits..

- Title documentation: Insist on receiving full legal ownership paperwork, including cask number, fill date, spirit type, and distillery of origin.

- Exit strategy clarity: Ask how resale is handled, what fees apply, and whether you’ll have input into bottling or holding decisions.

Many reputable brokers also provide value assessments, projections based on maturation periods, and guidance on when to hold or sell for maximum return.

For global investors, tax implications and import duties should also be factored in, especially if bottling or exporting is part of the exit strategy.

Whisky Cask Investment Cost

- Young Scotch casks can start at around GBP 2,000–5,000.

- Mid-aged or branded casks may range from GBP 10,000–30,000.

- Rare or aged casks can exceed GBP 50,000–100,000 or more.

The cost of investing in whisky casks varies significantly depending on the age, distillery, and country of origin.

Additional costs include:

- Annual warehouse storage fees: Typically GBP 50–100 per cask.

- Insurance: Usually a small percentage of the cask’s value.

- Bottling and labeling fees (if you choose to bottle): These can run several thousand pounds.

- Broker fees or platform commissions: Depending on the firm.

For expats or offshore investors, consider currency exchange costs and potential VAT or excise tax depending on your jurisdiction.

Whisky Casks Investment Taxation

- In the UK, whisky casks may be classified as a Wasting Asset (with a lifespan under 50 years), which can be exempt from Capital Gains Tax (CGT) if stored in bonded warehouses.

- For US investors, capital gains may apply upon sale; gains should be declared to the IRS.

- Expats and offshore investors should seek local advice. In some jurisdictions, such as UAE or Monaco, there may be no CGT, while others might tax foreign investment gains.

- VAT may be charged upon purchase or bottling, depending on your location and the warehouse jurisdiction.

Professional tax advice is essential before investing.

Why Invest in Whisky Casks?

- Tangible asset: Whisky casks are physical, insurable assets stored in bonded warehouses. Unlike digital investments or paper assets, they provide a sense of security and ownership that appeals to traditional investors.

- Hedge against inflation: Historically, tangible goods like gold, real estate, and aged spirits have preserved or increased in value during inflationary periods. Whisky, with rising global demand and limited supply, fits this profile.

- Low correlation to stock markets: Whisky cask prices don’t typically move in tandem with equities or bonds, making them a diversification tool within an investment portfolio, especially during market downturns.

- Growing global demand: Demand for aged Scotch and other premium whiskies is growing significantly in Asia (especially China, Taiwan, and India), as well as in the US and parts of Europe. This rising global appreciation for fine whisky supports upward price trends for well-aged stock.

- Limited supply: Unlike mass-produced commodities, aged whisky is finite by nature. Each year, as casks mature, the remaining inventory from the same vintage becomes rarer, potentially driving up its market value.

- Prestige and passion: For many investors, whisky casks combine financial opportunity with lifestyle appeal. They offer a way to engage with the world of spirits and luxury collecting, similar to fine wine, classic cars, or art.

Is It Profitable to Invest in Whisky Cask?

Yes, whisky cask investment can be profitable, especially when approached with a long-term strategy and careful cask selection.

While past performance doesn’t guarantee future returns, historical data from the broader whisky market shows strong growth.

The Rare Whisky 101 Apex 1000 Index, which tracks collectible bottles, delivered an average annual return of around 16.7% over the last decade, significantly outperforming traditional markets.

Although casks differ from bottles, many brokers report similar annualized returns of 8% to 15% for quality casks held over 5 to 10 years.

For example, a notable case reported by Whisky 1901 highlights a 19% return in just 18 months, although such performance is not typical and often depends on timing and distillery reputation.

However, actual profitability depends on several factors:

- Quality and age of the cask

- Reputation of the distillery

- Length of maturation

- Supply and demand trends

Short-term profits are uncommon.

Whisky casks are best viewed as 5- to 10-year investments with the potential for strong, tax-efficient returns when managed correctly.

What Is the Average Return on Whisky Cask Investment?

- Conservative estimates: 6%–8% annually

- Optimistic projections: 10%–15% annually for high-quality casks held 8–10 years

Returns may come from selling the cask to collectors, independent bottlers, or through private label bottling.

Investors should always factor in costs (storage, insurance, fees) when calculating net returns.

Whisky casks, unlike public stocks, do not provide dividends or interim income.

All profits are realized upon exit.

What Are the Risks of Whisky Cask Investment?

- Illiquidity: Whisky casks are not traded on open markets, and reselling one typically involves private brokers or auctions. This means it can take weeks or even months to exit your position, especially for younger or less desirable casks.

- Market transparency: Unlike publicly traded assets, whisky cask prices lack a universal benchmark. Most valuations come from brokers or index estimates (like Rare Whisky 101 for bottles), which can vary and be hard to verify independently.

- Counterfeit or fraudulent brokers: The growth in whisky cask investments has attracted bad actors. Some brokers may misrepresent cask ownership, exaggerate returns, or charge inflated premiums. Conduct due diligence, and ensure you receive ownership certificates and warehouse documentation.

- Evaporation loss: Known as the Angel’s Share, casks lose about 2% of their volume annually through evaporation. This reduces the eventual bottle yield and may affect resale value over time.

- Storage dependency: Casks are typically stored in bonded warehouses in Scotland or Ireland. Investors must trust third-party operators for proper aging, maintenance, and access. Improper storage can impact quality and valuation.

- Tax or regulatory changes: As whisky cask investment becomes more global, changes in alcohol taxation, customs duties, or investment classification could impact future returns, especially for international investors.

Whisky Cask Investment vs Other Passion Investments

| Asset Class | Liquidity | Storage Needs | Historical Returns | Enjoyment Factor |

| Whisky Casks | Low | Moderate | Moderate-High | Medium |

| Fine Wine | Medium | High | Moderate | High |

| Rare Art | Very Low | High | Variable | High |

| Classic Cars | Low | Very High | Variable | Very High |

| Vintage Watches | Medium | Low | High | High |

Whisky casks offer a balance between exclusivity and performance, but they’re best suited to investors comfortable with illiquidity and long holding periods.

Bottom Line

So, are whisky casks a good investment? For investors looking to diversify their portfolios with tangible, inflation-resistant assets, the answer can be yes—provided they do the research and partner with legitimate brokers.

It’s not a short-term play.

Success in whisky cask investment requires patience, a long-term view, and a willingness to accept some illiquidity.

But with careful selection and professional support, it can be a rewarding asset, both financially and personally.

Whether you’re an expat in a low-tax jurisdiction or a high-net-worth investor looking for alternatives to traditional markets, whisky casks can be a compelling addition to your investment toolkit.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.