Discover what happens if you retire 1 day after a Lehman collapse and how offshore investments can further enhance financial security.

One of the biggest misconceptions and fears people have is that “markets might collapse 1 day after I retire”.

These worries seem to imply:

- We invest from our 20s until 65 and then the money is just left in cash. Meaning that a crash a few weeks before retirement would cut our retirement savings in half. In reality, people at 65 should drawdown their assets, until retirement.

- Even if we ignore the last fact, this worry assumes that a crash is likely to be so big that it would wipe out your entire capital gains from a lifetime investing

I answered a question yesterday, which asked about this very issue. I will share part of my response here:

“It is sensible for people to start off with 100% in stock indexes. Then 90%-10%. Then 80%-20%, 70%-30% and finally 60%-40% in retirement.

That has never failed people historically. If it fails people in future, it will be the first time.

Let’s also not forget, that even if you were so unlucky that markets collapsed 1 day after you retire, you will be invested for 20 years +, given the current life expectancies.

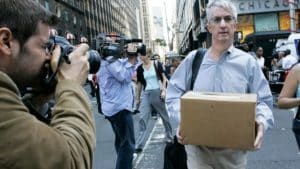

Let’s say somebody retired in 2008–2009, 1 day before Lehman collapsed.

They were 60% in markets and 40% in bonds. The 40% bonds would have increased, and 60% would have reduced.

By 2011, however, markets were up. Markets are now up 200% since 2007–2008.

So having this buy, hold and rebalance strategy between bonds and stocks, allows you to take advantage of any falls in the markets, by buying stock indexes at a cheaper price.

Simple example:

- You have $1m in retirement. 600k in stocks and 400k in bonds. Let’s say the unit prices of stocks are 100 and bonds 50 to keep this simple. So now you have 6,000 units of stock indexes and 8,000 units of bonds

- There is a stock market crash! Now the unit price of bonds is worth 55 (they have increased by 10% as people are panicking, selling stocks to buy bonds). So your bonds are now worth $440,000 – 55x 8,000. Your stocks are now worth 80 (a 20% fall) so $480,000 (80×6,000)

- So now, you have a $920,000 portfolio. Down from $1m. So already your portfolio hasn’t fallen as much as you might have expected, as the 40% in bonds has protected the falls.

- Now to maintain the 60% stocks/40% bonds portfolio, you need to get the bonds down to $368,000 (40% of $920,000). So you sell $72,000 worth of bonds, and buy stocks at 80 per unit – so 900 units extra units ($72,000 divided by 80).

- So now you have 6,900 of stock units (the original 6,000 + 690 purchased after the collapse of the markets). In 10 years, let’s say markets have doubled from before the crash (like they did from 2007–2017). The units are now worth 200 per unit. So now if we do 200×6,900 we have $1,380,000m.

I worked this out quickly, so if I made a mistake, I made a mistake, but you get my point. Falling markets can be good.

So you see, with this simple buy, hold and rebalance strategy, you can see how a rational investor can benefit from falling markets”

So there you go. No need to worry about market crashes if you are young and/or have proper asset allocation between bonds and markets.