This article will tell you how to invest in the UK stock markets, the FTSE100 and FTSE250.

It can be especially difficult for British expats to invest from overseas, in certain specific locations at least.

So, if you are looking to invest, you can use the WhatsApp function below, or email me (advice@adamfayed.com).

Introduction

You may have heard about index fund from a friend, on TV, or on a podcast. But what it is exactly?

An index fund is a type of mutual fund or exchange-traded fund (ETF). It consists of stocks or bonds that are trying to make the same profit as a certain index.

Thousands of indexes track the movements of various sectors, markets and investment strategies every day and are used to determine the health and performance of that market.

For example, the Dow Jones Industrial Average is a broad market index of 30 blue-chip stocks, while the US Global Jets Index tracks the global airline industry as an industry index. The index can also act as a market benchmark or a way to measure performance.

You cannot directly invest in the index as it is a purely mathematical construct.

However, you can invest in an index fund either through an index mutual fund or an ETF. Most index funds faithfully copy the index, holding all the securities of the index, but sometimes the fund will approximate the index to a sample of securities or additional derivatives such as options and futures.

And today, in this article we will discuss another popular index fund trading platform called FTSE and its two composite companies; FTSE 100 & 250. Also here you can find all the answers such as how to invest, what you need to invest, etc.

What is the Financial Times Stock Exchange (FTSE)?

The Financial Times Stock Exchange Group (FTSE), also known by the nickname “Footsie”, is an independent organization.

It is similar to Standard & Poor’s (S&P 500), which specializes in creating index offerings for the global financial markets.

The index will represent a market segment and a hypothetical portfolio of equity holdings. The most famous index among many on the FTSE is the FTSE 100, which consists of blue-chip stocks listed on the London Stock Exchange.

The London Stock Exchange Group (LSEG) owns the FTSE Group. LSEG is the parent organization headquartered in London, which also owns Russell Indexes, Borsa Italiana, MilenniumIT and other financial institutions.

More about FTSE 100 Index

The FTSE 100 is an index of the 100 largest companies by market capitalization on the London Stock Exchange (LSE). The price of the index is determined by the price movement of these constituent stocks.

To be listed on the FTSE 100, a company must be listed on the LSE, denominated in pounds, and must meet minimum placement and liquidity requirements for shares.

The FTSE 100 is a market capitalization weighted index. Market cap weighting means that individual stocks with a higher market cap have a correspondingly higher weight in the index.

The FTSE Group manages the FTSE 100 Index, which calculates its value in real time. The index is updated and published every 15 seconds.

Adjustments to the components of the index or the companies that make up the FTSE 100 occur every quarter, usually on the Wednesday following the first Friday of March, June, September and December.

Any changes in the constituents of the underlying index and their weights are based on the company value obtained at the close of business the night before the audit.

As of February 2019, the four largest holdings by market capitalization were:

- (RDSB.L) ROYAL DUTCH SHELL PLC B

- (RDSA.L) ROYAL DUTCH SHELL PLC-A

- (HSBA.L) HSBC HOLDINGS PLC

- (BP.L) BP PLC

The FTSE 100 is often considered a leading indicator of the health of companies in the United Kingdom (UK) and the UK economy as a whole.

Thus, it usually attracts investors looking for opportunities to participate in large UK companies. While some of his listings do include companies with homes outside of the UK, he is mostly comprised of UK companies influenced by day-to-day UK events.

As mentioned, many indices are tied to the FTSE group and the FTSE Russell brand. The most popular indices of the FTSE group in addition to the FTSE 100 are the FTSE 250, FTSE 350 and FTSE All-Share. We’ll talk about the FTSE 250 index fund later.

Some of the other popular FTSE Russell indices include;

- FTSE Nasdaq 500

- FTSE AIM 100

- FTSE4Good

- FTSE Dividend Growth

- Russell Top 200

- Russell 2000

- Russell Equal Weight

- Russell Geographic Exposure

How to invest in FTSE 100?

There are several ways to invest in the American FTSE 100 Index:

- Stocks

- Exchange traded funds (ETF)

- American Depositary Receipts (ADR)

To trade stocks and ETFs, you will need a brokerage account that will allow you to buy and sell international securities.

If you want to stick with an internal trading platform, your FTSE 100 investment options are limited to ADRs: large UK stocks traded on the New York Stock Exchange, American Stock Exchange and NASDAQ. ADRs belong to US banks, their price and dividends are paid in US dollars.

While you cannot directly invest in the FTSE 100, you can invest in the companies it tracks by buying individual stocks or ETFs that track the index.

If you want to choose which companies you support, look into stock investing opportunities. If you’d rather have access to everything the FTSE 100 tracks, invest in an exchange-traded fund.

Before you can start investing, you need a brokerage account. Here’s a quick snapshot of the process:

- Open a brokerage account. If you are planning to invest in global index fund platform like the FTSE 100, you will need an international trading account. Sign up with a broker that offers access to global exchanges.

- Fund your account. Before you can start buying securities, you will need to fund your brokerage account by external transfer.

- Look for securities. In-platform research and analytics tools can help you narrow down your trading opportunities by industry, sector, market, and more.

- Make an order. Once you’ve narrowed down your options, specify how many stocks or ETFs you want to buy and submit your order.

- Keep track of your investments. Log into your brokerage account to track your investments.

How do FTSE 100 ETFs work?

When you buy an FTSE 100 ETF, you are not investing directly in the companies included in the index. Most FTSE 100 ETFs will own stocks of the companies in the index, but you will not have a stake by simply buying the ETF.

However, the performance of the ETF will be closely related to the performance of the stocks in the index. For example, if the FTSE 100 increases in value by 2%, your ETF should also rise by almost 2%.

To invest in ETFs, you usually need to pay a commission of 0.07% to 2.5% annually, as well as any trading fees charged by the broker.

What are the risks of investing in the FTSE 100?

No index is immune to risk or volatility. If the companies tracked by the FTSE 100 succeed, your investments will prosper. But if the market goes downhill, so does your investment.

Since the stocks and ETFs that track the FTSE 100 are not traded in the US markets, investors have to deal with market conversions and foreign exchange transactions, which can be confusing for newbies.

Some investment experts also argue that the FTSE 100 is only a fraction of the UK economy and is dominated by international oil and mining companies. Investors looking to get their hands on British securities may be disappointed to learn that some of the companies tracked by the FTSE 100 are not predominantly British.

What drives the price of the FTSE 100?

The following factors affect the price of the FTSE 100:

- Economic Events – Events like Brexit can have a significant impact on the price of an index. After the 2016 referendum, the FTSE 100 tended to move inversely with the pound.

- Profit and loss statements. Changes in the valuation of FTSE members can significantly affect the price of the index, depending on the weight of the stock.

- Exchange rates – Fluctuations in exchange rates can affect the price of the FTSE 100 because its constituents receive a significant portion of their income in other countries.

- Press Releases – Some press releases are usually followed by a period of volatility in the market. If the news concerns any of the industries or constituents of the FTSE 100, it could affect its price.

More about FTSE 250 Index

There are hundreds of mid-cap companies in the UK that are listed on the London Stock Exchange. You can trade or invest in a basket of these stocks with the FTSE 250 Index. Let’s learn more about the FTSE 250 and find out how it works and how you can invest in it.

As already mentioned, FTSE 250 is a part of a big brand named FTSE Russel, which is a capitalization-weighted index of the 101-350 largest companies listed on the London Stock Exchange.

The ups and downs in the index and vice versa occur quarterly in March, June, September and December. The index is calculated in real time and published every minute.

How is FTSE 250 calculated?

The FTSE 250 is calculated by weighting all stocks traded on the London Stock Exchange by market capitalization. Companies ranked 101–350 by market capitalization are included in the index. As with other capitalization-weighted indices, companies with higher market caps have more weight in the index and have a greater impact on price movements.

Which companies are listed on the FTSE 250?

Top contributors to the FTSE 250 include Aston Martin, Marks & Spencer Group, Royal Mail and Virgin Money UK. FTSE 250 companies are reviewed every three months. If the market capitalization of one company overtakes another, the composition of the index may change.

How to invest in the FTSE 250?

How you trade or invest in the FTSE 250 will depend on your personal preference, your risk appetite, and when you want to trade. While you cannot directly invest in the FTSE 250, you can use stock trades to access ETFs or index members.

While you cannot directly invest in the FTSE 250, you can buy stocks in its constituents or buy stocks in ETFs that track the price of the index.

When you invest, you get direct ownership of the underlying asset, and you can only make a profit if prices rise. If you decide to invest, you will need to deposit the full value of the position up front. You can access the FTSE 250 by investing in ETFs and physical stocks;

- ETFs – they are investment vehicles that track the movement of a basket of assets. Investing in ETFs is a good way to distribute your capital among all the companies listed on the FTSE 250. There are various forms of ETF, the most popular of which is the Vanguard FTSE 250 UCITS ETF, which mimics the composition of the FTSE 250.

- Promotions – Investing in stocks listed on the FTSE 250 means that you will own the underlying stock of the companies in the index. You can choose this option if you want to subsequently profit from the sale of the shares at a higher price. In addition, investing offers other benefits such as dividend payments (if issued by the company) and certain shareholder rights.

What drives the price of the FTSE 250?

- Economic News and Events: News about the FTSE 250 index sectors, as well as planned or unexpected events affecting the economy, could affect the price of the FTSE 250.

- Company Profit: When FTSE 250 members post their earnings, company estimates may change. Any adjustment in the company’s value can affect the price of the FTSE 250 – even more so if the component has a significant weight in the index.

- Financial sector performance: Over 42% of the FTSE 250 is financial stocks. Consequently, fluctuations in this sector can affect the price of the index. Other industries that account for a significant portion of the index include manufacturing and consumer services.

FTSE 100 & 250 Trading Strategies & Tips

In addition to having a good trading plan and risk management strategy, the following tips will help you make the most of your FTSE 250 trading experience;

- Explore FTSE 100 & 250 Charts: Price charts can help you gauge market sentiment and think about whether the index might move up or down.

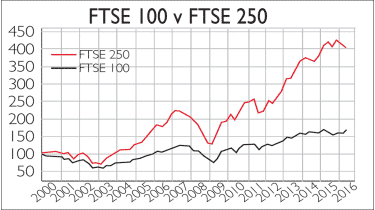

- It is far better to buy and hold both rather than to market time. The FTSE 250 has outperformed the FTSE100 recently, but the FTSE100 has a superior yield:

- It also makes sense to hold a bonds index, and an international index, as a British investor. This allows for broader diversification.

FTSE 100 vs. FTSE 250: Top differences

As already mentioned, the FTSE 100 represents the 100 largest companies listed on the London Stock Exchange by market capitalization, while the FTSE 250 includes the next 250 companies (101st to 350th). But what other key differences between the two indices could influence trading decisions?

When looking at the FTSE 100 and FTSE 250, there are a number of key differences to keep in mind. These include global coverage, the impact of certain industries on the price of indices and how fluctuations are interpreted, as well as factors in particular related to trading these assets, such as levels of volatility and liquidity.

Market capitalization

The biggest difference between FTSE 100 and FTSE 250 is market capitalization. Naturally, given the size of the companies in each index, the capitalization of the FTSE 100 is significantly larger than the FTSE 250, and the market capitalization of several of the top companies disproportionately affects the broader index. The FTSE 250, meanwhile, has a smaller market capitalization and a wider range of companies drive price movements.

Industry and weight targeting

The FTSE 100 is heavily focused on blue-chip or large-cap stocks in selected sectors such as Shell and BP in the oil industry, GlaxoSmithKline and AstraZeneca in the pharmaceuticals, BHP Billiton and Rio Tinto in the mining industry, and HSBC and Barclays in the banking sphere.

These are the companies that have more weight in the index; for example, HSBC weighs 9.22% and Shell weighs 8.39%. This means that any fluctuations in the price of these larger constituent stocks are more likely to affect the broader index than the stock in the lighter weight company.

Meanwhile, the FTSE 250 has a wider range of industries and a lower weighting, with a more proportionate representation of sectors such as consumer services and industry than the FTSE 100.

Source of income

About 70% of the FTSE 100’s revenues come from international sources. This fact is important because it has serious implications for the impact of the pound’s value on the index. Since so much of the revenue of the FTSE 100 companies is generated in US dollars, the weakening of the British pound means that revenue will be worth more when converted back to sterling.

This factor often overcomes the other side of the coin – imports become more expensive when the pound sterling weakens. Consequently, when the pound sterling falls, the FTSE 100 has historically rallied frequently.

However, since the FTSE 250 is more domestically oriented, there is a less pronounced history of pound fluctuations affecting the index than in the case of the FTSE 100, although history shows that the mid-cap index may tend to benefit from the stronger pound sterling.

Returns

The return on the FTSE 250 has, as a percentage, been higher than the FTSE 100 over long periods of its history. From January 1, 2015 to January 1, 2020, the price of the FTSE 250 increased by 37%, compared to 16% of the FTSE 100 in the same period.

It goes without saying that smaller mid-cap stocks may have higher upside potential than large blue-chip issues, which means that the FTSE 250 can perform proportionally better than the FTSE 100 during periods of “risky” markets. Conversely, during periods of more bearish sentiment, money can spill over into larger, more defensive stocks, which can be viewed as carrying less risk overall, given their net size and capital resources.

However, it is important to be wary of the fundamental events that trigger the market crash, as sectors can be hit in different ways depending on the nature of the shock. In the case of the coronavirus outbreak in 2020, there have been few attractive UK stocks due to weak global oil demand, low interest rates on bank stocks and a general slowdown in economic activity that has plunged many other sectors.

So which index is generally more stable for investors?

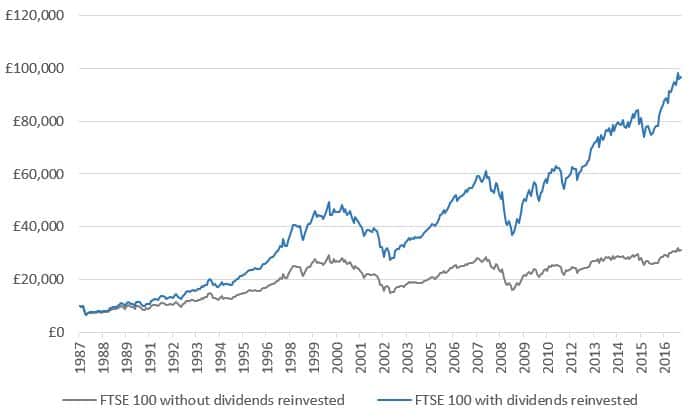

Historically, the FTSE 100 has generally been more stable than the FTSE 250 because it is more reliable in paying dividends.

If the global economy is doing well, investors will invest their money in the FTSE 100 as the global markets will be where they will do more business.

But when it goes bad, both indexes will feel bad. During the downturns that have occurred in the past two decades, 2001, 2008 and 2020, stock market indices showed similar declines. During these three periods, the FTSE 100 lost 53%, 49% and is 39% so far, while the corresponding falls in the FTSE 250 were 47%, 54% and 44%.

Thus, while the FTSE 100 blue-chip index may inspire more confidence, this does not mean investment success is guaranteed.

So here it is all the information about two most popular trading platforms of FTSE Group, now you know about all ups and downs of each platform and you can make your choice based on this article. But as mentioned above, it is more recommended to invest in FTSE 100, as it is a more stable and reliable platform.

Conclusion

It does make sense to invest in the FTSE if you are a British investor. What is important is to hold the FTSE100 and 250, alongside an international and bonds index for diversification.