French inheritance tax ranges from 0% for spouses to as high as 60% for unrelated heirs, with rates determined by family relationship, residency status, and how assets are held.

Close relatives benefit from substantial tax-free allowances, while distant relatives and non-family heirs face significantly higher exposure, making early awareness of the rules essential for anyone connected to France.

This article covers:

- What are the inheritance tax laws in France?

- What is the tax allowance in France?

- Who pays French inheritance taxes?

- Who are exempted from paying taxes in France?

- How to reduce French inheritance tax?

Key Takeaways:

- Spouses and civil partners are fully exempt from inheritance tax in France.

- Children benefit from up to €100,000 tax-free inheritance per parent.

- Non-residents may owe tax on French assets, including real estate.

- Unrelated heirs face the highest tax rate of 60%.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What are the inheritance tax rules in France?

Under the French Civil Code (Code civil) and the French Tax Code (Code général des impôts), inheritance tax is based on the heir’s relationship to the deceased and the value of the assets, with specific rules for who must inherit and how much tax is due.

France applies forced heirship rules, meaning a portion of the estate must pass to protected heirs, usually children.

This applies regardless of nationality and can affect expats who assume they can freely distribute assets under a foreign will.

From a tax perspective, France uses a relationship-based system: the closer the family connection, the lower the tax rate and the higher the tax-free allowance.

Unrelated heirs face significantly higher taxation.

What is the inheritance tax rate in France?

Inheritance tax in France ranges from 0% to 60%, based on the relationship between the deceased and the beneficiary.

Spouses and PACS partners are fully exempt from inheritance tax.

Children and parents benefit from generous allowances and progressive rates, while distant relatives and unrelated beneficiaries face steep taxation.

For direct descendants, tax rates increase progressively once allowances are exceeded.

For unrelated heirs, the tax rate is a flat 60%, making estate planning particularly important for unmarried partners, stepchildren, or friends.

How much tax do you pay on foreign inheritance?

Foreign inheritance can be taxed in France at the same inheritance tax rates of up to 60% if the beneficiary is a French tax resident or the assets are considered French-situs.

If the beneficiary is a French tax resident and meets the six-out-of-ten-year rule, France may tax worldwide inherited assets, even if the estate and assets are located abroad.

If both the deceased and the beneficiary are non-residents, only French-situs assets are taxable.

In these cases, foreign inheritance may fall outside the French tax net but could still be taxed in another jurisdiction.

Tax treaties can reduce double taxation, but France often retains taxing rights over French property, regardless of treaty protection.

What is the inheritance tax limit in France?

In France, the inheritance tax limit refers to the tax-free allowance each heir can receive before tax applies.

Children can inherit up to €100,000 per parent tax-free, while parents inheriting from a child benefit from the same €100,000 allowance.

Spouses and PACS partners are fully exempt from inheritance tax, regardless of the estate’s size.

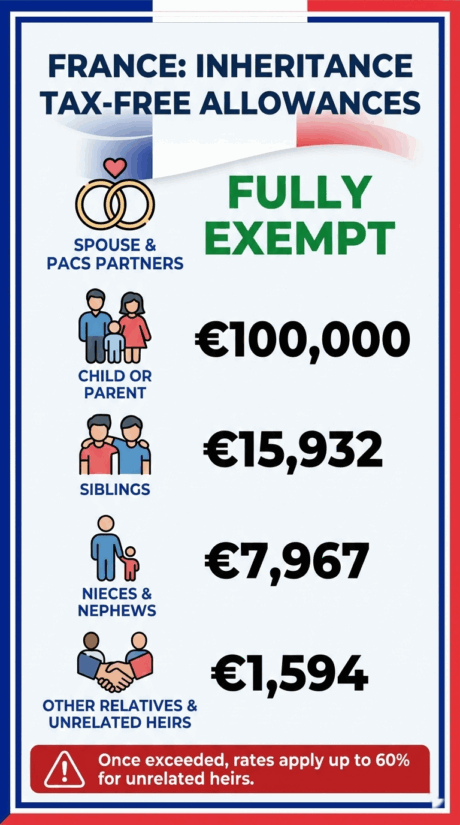

Siblings have a much smaller allowance of €15,932, nieces and nephews can receive up to €7,967, and other relatives or unrelated heirs only get a minimal exemption of €1,594 before the standard rates apply.

There is no overall cap on the total tax that can be charged.

Once these allowances are exceeded, inheritance tax is applied progressively according to the relationship and taxable amount, with unrelated heirs facing rates up to 60%.

Who is responsible for paying the inheritance tax bill?

In France, the beneficiary is responsible for paying the inheritance tax, not the estate itself.

Each heir must individually declare their share of the inheritance and pay any tax due to the French tax authorities.

The deadline is six months from the date of death if the death occurred in France, or 12 months if the death occurred abroad.

Late payment triggers interest and penalties, which can be especially problematic for foreign heirs who are unfamiliar with French inheritance procedures or face delays accessing assets.

Do non-residents pay inheritance tax?

Yes, non-residents can be liable for inheritance tax in France.

If the deceased owned French-situs assets, such as real estate, shares in French companies, or certain financial accounts, those assets are taxable in France regardless of where the deceased or heir resides.

Additionally, if the beneficiary has been tax resident in France for at least six out of the previous ten years, France may tax worldwide inherited assets, even if the deceased lived abroad.

Double taxation treaties may offer relief, but they do not always eliminate French IHT exposure entirely.

Who is exempt from inheritance tax?

Spouses and registered civil partners (PACS) are fully exempt from IHT in France.

Certain transfers to disabled beneficiaries may also qualify for additional allowances.

Charities and recognized public-interest organizations are generally exempt as well.

It is important to note that cohabiting partners who are not married or in a PACS are not exempt, even if they lived together for decades.

These beneficiaries are treated as unrelated heirs and taxed at the highest rate.

What Is the Difference Between Inheritance Tax in the UK and France?

The main difference between inheritance tax in the UK and France is who is taxed and how the tax is calculated.

In the UK, inheritance tax is charged on the estate as a whole before distribution. If the total estate value exceeds the nil-rate band, tax is generally applied at a flat rate, regardless of how many beneficiaries there are.

In France, inheritance tax is charged per beneficiary, not on the estate.

Each heir is taxed separately based on their relationship to the deceased, with different allowances and progressive tax rates.

Key distinctions include:

- Tax basis

- UK: Tax is calculated on the entire estate.

- France: Tax is calculated individually for each heir.

- Tax rates

- UK: A standard inheritance tax rate applies once thresholds are exceeded.

- France: Rates are progressive and can range from 0% for spouses to up to 60% for unrelated heirs.

- Allowances

- UK: One main nil-rate band applies to the estate.

- France: Each beneficiary receives their own tax-free allowance based on family relationship.

- Planning approach

- UK: Planning focuses on estate size and reliefs.

- France: Planning focuses on beneficiary structure, gifting, and life insurance.

How to avoid inheritance tax in France for residents?

French inheritance tax can only be reduced by using lifetime gifting allowances, marital and ownership planning, and life insurance structures, rather than being fully eliminated.

1. Use Lifetime Gifting Allowances

Residents may transfer assets during their lifetime using tax-free allowances that reset every 15 years.

For example, parents can gift up to €100,000 per child per cycle without triggering inheritance tax.

2. Plan Marital Regimes and Ownership Structures

Spouses are fully exempt from French inheritance tax.

Selecting the appropriate matrimonial regime and structuring ownership correctly can significantly reduce tax exposure, particularly for mixed-nationality couples.

3. Leverage Life Insurance (Assurance-Vie)

Life insurance is one of the most effective inheritance planning tools in France.

Qualifying policies benefit from separate tax allowances and preferential rates, often allowing substantial sums to pass outside the standard inheritance tax scale.

4. Account for Timing and Forced Heirship Rules

Although allowances renew every 15 years, forced heirship rules apply in many cases, limiting the ability to exclude protected heirs.

Timing mistakes can reduce the effectiveness of otherwise valid strategies.

5. Avoid Poorly Structured or Aggressive Planning

Inheritance planning must comply with French succession and tax law.

Poor structures can trigger disputes or negate expected tax benefits, making professional advice essential.

Conclusion

Inheritance tax in France is highly technical and can apply even when neither the deceased nor the heir lives in France.

For expats and internationally mobile families, exposure often arises unexpectedly through property ownership, residency history, or family structure rather than deliberate planning choices.

Because French inheritance rules interact with forced heirship, residency tests, and international tax treaties, outcomes can differ significantly from other countries.

Early planning and clear structuring are often the only way to avoid unnecessary tax leakage or legal disputes across borders.

FAQs

Does France have a high tax rate?

France is widely considered a high inheritance tax country, particularly for non-family heirs.

While direct descendants benefit from allowances and progressive rates, unrelated beneficiaries face a flat 60% tax, which is among the highest globally.

Is property tax in France high?

Property tax in France is generally moderate, with annual taxes varying by municipality and property size rather than a single national rate.

Most owners pay local property tax each year, and inheritance tax only applies when the property is transferred on death, not during ownership.

What country has the highest inheritance tax?

Japan is generally considered to have the highest inheritance tax overall, with a top marginal rate of 55% that applies even to close family members once allowances are exceeded.

France has the highest statutory rate at 60%, but this applies only to unrelated heirs rather than immediate family.

Is it cheaper to live in the UK or France?

France is generally cheaper for healthcare and everyday living costs, while the UK often offers lower inheritance tax exposure for families.

Overall costs depend on location and lifestyle, but France’s tax system is typically more complex for expats with international assets.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.