The best wealth managers for expats in 2026 are firms and advisors with proven experience in international investing, cross-jurisdiction tax planning, regulatory compliance, and serving clients living overseas.

This list highlights expat-relevant wealth managers and advisory firms selected based on:

- Cross-border and multi-jurisdiction expertise

- Regulatory and licensing awareness

- Expat-specific financial planning capability

- Demonstrated track record with international clients

For transparency, our list includes Adam Fayed, who works in conjunction with fully licensed partners and regulated advisors to deliver compliant, international wealth management solutions.

Expats and internationally mobile investors typically want clear, actionable answers upfront—who to consider, what they do, and why they are relevant.

This list represents alternative options for expats seeking global wealth management, rather than a definitive ranking.

This article covers:

- Best wealth managers for expats

- Top wealth managers in the world (as per Forbes)

- Cost of wealth management

- Financial advisors vs wealth managers

- Choosing a wealth manager

Key Takeaways:

- Top expat wealth managers excel in international planning and compliance.

- Large banks charge lower AUM percentages but require high minimums.

- Wealth managers handle holistic finances; advisors focus on specific planning.

- Choose managers based on experience, licensing, fees, and multi-country service.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

Expat-Friendly Wealth Managers

For practical reasons, this section focuses primarily on independent and specialist firms, like Creative Planning, rather than large global banks.

Many large institutions prioritize clients with substantial assets and may offer limited flexibility or accessibility for internationally mobile investors with more complex needs abroad.

1. Creative Planning International

A US-based wealth management firm with a dedicated international division serving American expats in 90+ countries. They provide:

- Cross-border investment planning

- Tax-aware portfolio design

- Estate planning tailored to living abroad

Creative Planning International typically has a minimum investable asset requirement of 500,000 USD.

Charges: Tiered AUM (assets under management) fee structure for wealth management services:

- ~1.20% on the first ~$500,000

- ~1.00% on the next $500,001–$2M

- ~0.85% on $2M–$5M

- ~0.80% on $5M–$10M

2. Brooks Macdonald

A UK-based wealth management group with international reach, providing:

- Discretionary investment management

- Financial planning

- Bespoke advisory solutions for high-net-worth individuals worldwide

They are a major player in the UK and the Channel Islands. They are best suited for high-net-worth individuals who prefer Discretionary Fund Management (DFM).

However, they often work through intermediary financial advisors rather than directly with retail clients, so you may need a separate advisor to access their portfolios.

To use Brooks Macdonald’s bespoke discretionary portfolio service, the minimum initial investment is typically £250,000.

There’s around £100,000 minimum for certain advisor‑linked portfolio services.

Fees: Typically asset-based when accessed through their Managed Portfolio Services (MPS) or discretionary mandates.

Annual management charges around 0.20% to 0.25%. Total underlying costs can range roughly 0.35% to 1.12%, depending on risk profile and portfolio composition.

3. Synergy Singapore

Synergy Singapore is an independent wealth management firm, with a strong focus on expatriates and overseas professionals across Asia and beyond.

The firm specializes in long-term, goals-based financial planning rather than short-term trading.

Services typically include:

- Overseas financial and retirement planning

- International investment portfolio construction

- Structuring for future relocation and multi-currency needs

Synergy offers a Singapore-based advisory hub with a planning-first approach, rather than a discretionary, bank-style portfolio mandate.

Minimum investment requirements are typically determined by the underlying platform or solution used, rather than a single firm-wide threshold.

Fees: Advisory and wealth management fees are usually asset-based and vary by mandate, platform, and complexity.

In practice, costs are generally competitive for expat-focused advisory services in Singapore.

4. Adam Fayed

Adam Fayed operates on a brokerage model, connecting expats and high-net-worth clients to various platforms and licensed partners and advisors to provide custom solutions.

His services include:

- Offshore and cross-border investment strategies

- Tax-efficient wealth management

- Estate planning and asset protection

Clients benefit from expertise combined with fully licensed partners to ensure compliance across jurisdictions.

This is a more modern/fintech approach compared to the institutional feel of Creative Planning or Brooks Macdonald.

No firm‑wide minimum assets under custody — depends on the partner platform and product chosen.

Annual fees: Usually, 0.5% to 2.5% per year depending on the solution and complexity of the investment strategy.

Consultation/Advisory engagement: At least USD 1,500 for portfolio review and structuring advice if not using partner investment platforms.

World’s Leading Wealth Managers: Forbes-Ranked

Forbes’ lists include advisors from firms like Morgan Stanley and J.P. Morgan.

For context, Forbes publishes several widely recognized rankings—such as Top Wealth Management Teams (High Net Worth) and Best-in-State Wealth Management Teams.

These highlight advisors and teams from large global institutions based on client impact, experience, and assets under management.

We picked out a few names to provide brand and industry context, rather than as direct recommendations for all expats.

Many primarily serve ultra-high-net-worth clients and may have higher minimums or less flexibility for multi-jurisdictional exposure.

- Morgan Stanley Wealth Management – Global investment management, financial planning, and retirement solutions.

- Goldman Sachs Private Wealth Management – Bespoke advisory services, portfolio management, and wealth planning for ultra-high-net-worth clients.

- UBS Wealth Management – Investment management, estate planning, and international advisory services.

- HSBC Private Banking – Global wealth advisory, investment solutions, and estate planning for international clients.

Clients can generally expect annual advisory fees on AUM in the broad range of about 0.7% to 2.5% per year, though exact fees vary by program, relationship size, and services provided.

Additional Forbes-Recognized Wealth Management Teams include advisory teams from major global firms such as Morgan Stanley, UBS, Merrill, Ameriprise, and Raymond James.

These have been independently ranked by Forbes for high-net-worth advisory excellence.

These examples illustrate the breadth of reputable advisors recognized across the industry, particularly within large institutions that dominate Forbes’ team-based rankings:

- AllTides Wealth Group (Ameriprise Financial Services) — Recommended team with robust client service.

- AlphaBridge Group (Morgan Stanley Wealth Management) — Morgan Stanley team with significant assets and Forbes recognition.

- Laurella, Roundy & Associates (Merrill Wealth Management) — Recognized Merrill team with deep advisory experience.

- Seventy2 Capital Wealth Management — Independent top-tier team on the High Net Worth list.

- The Wise Investor Group (Raymond James) — One of Forbes’ Top 100 High Net Worth teams.

- UBS Advisor Teams (e.g., The Murray Group, Trillium Partners) — UBS teams recognized for high-net-worth advisory excellence.

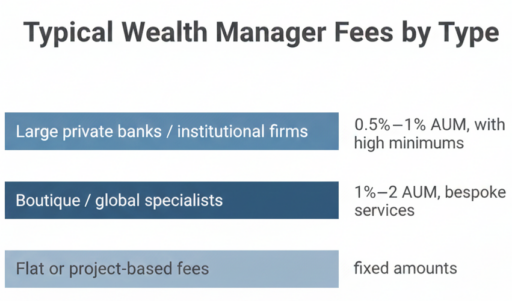

What is the typical fee for a wealth manager?

A wealth manager typically charges 0.5% to 2.0% per year of assets under management (AUM), with higher fees often applying to complex or cross-border portfolios.

In practice, large private banks and institutional firms tend to sit toward the lower end of the percentage range but impose high minimums (often $1 million to $5 million+).

Boutique or global specialists may charge higher percentages to reflect bespoke structuring, multi-jurisdiction tax planning, and ongoing coordination with external professionals.

Some advisors also offer flat-fee or project-based pricing, particularly for second opinions, portfolio reviews, or structuring advice.

What is the difference between a financial advisor and a wealth manager?

A financial advisor usually focuses on specific planning or investment needs, while a wealth manager provides holistic, ongoing management of a client’s entire financial picture.

- Wealth management usually combines investments, tax planning, estate planning, asset protection, and long-term strategy under one advisory relationship.

- Financial advisors may specialize in one or two areas—such as retirement planning or investments.

- Wealth managers are more commonly engaged by higher-net-worth or internationally mobile clients with complex needs.

Do I need a wealth manager or financial advisor?

You generally need a financial advisor for focused planning or investing, and a wealth manager if you have complex, multi-layered financial needs.

In practice, many high-net-worth and expat clients work with both: a financial advisor for day-to-day investment management and a wealth manager to oversee broader strategy, structuring, tax coordination, and long-term planning across jurisdictions.

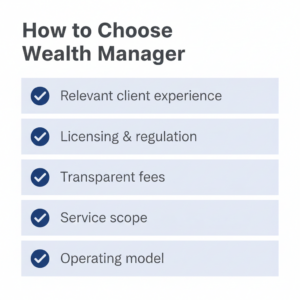

How to choose a wealth manager

Choose a wealth manager whose experience, regulatory status, fee structure, and service model align with your financial complexity, jurisdictional exposure, and long-term targets.

When assessing a wealth manager, focus on the following:

1. Relevant client experience, e.g., expats, business owners, retirees, multi-jurisdiction families.

2. Regulatory and licensing coverage, especially if assets or income span multiple countries.

3. Transparent fees and incentives, with a clear explanation of how the advisor is compensated.

4. Service scope, including investment management, tax coordination, estate planning, and structuring.

5. Operating model, whether independent, fee-only, discretionary, or platform-based.

For expats and international mobile clients, regulatory competence and multi-country coordination often matter more than firm size or brand recognition.

Bottom Line

For expats, effective wealth management is less about rankings and more about execution.

The right wealth manager can coordinate investments, tax strategy, and structuring across jurisdictions, while the wrong one can add cost and complexity.

Regulatory competence and real-world international experience ultimately matter more than brand names.

Beyond technical expertise, the most effective wealth manager for an expat is one you can trust and work with long term.

Alignment on communication style, transparency, and decision-making approach is just as important as cross-border capability.

Sustainable outcomes come from advisors who understand both your financial structure and your personal context.

FAQs

Which country is best for wealth management?

Popular hubs include Switzerland, Singapore, the UK, the US, and Luxembourg, which offer strong regulation, private banking, and estate or trust planning options.

Overall, the best country for wealth management is determined by your residency, tax situation, and asset location.

What is considered high net worth for wealth managers?

High-net-worth individuals generally have $1 million or more in investable assets.

Ultra-high-net-worth clients typically exceed $30 million, requiring more complex planning and personalized services.

At what income do you need a wealth manager?

There’s no strict income cutoff. Individuals with $500,000+ in investable assets or $250,000+ annual income often benefit from comprehensive wealth planning.

This is especially true when multiple accounts, investments, or tax considerations are involved.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.