Annuities provide guaranteed income while 401ks grow through market investments and offer the potential for higher returns.

Your choice in annuities vs 401k depends on your age, risk tolerance, and retirement income goals.

This article covers:

- How is an annuity different from a 401k?

- Is a 401k better than an annuity?

- Who is best suited for an annuity or 401k?

- Is it best to combine retirement accounts?

Key Takeaways:

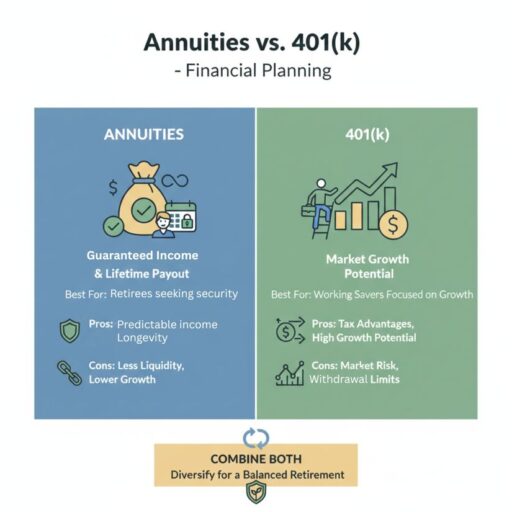

- Annuities offer guaranteed income; 401ks grow with the market.

- 401ks suit long-term growth and younger savers; annuities suit retirees.

- Combining both balances growth and income security.

- Rolling over a 401k into an annuity reduces risk but limits liquidity.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What is the difference between an annuity and a 401k?

The difference between annuities vs 401k is that a 401k is a US-specific, market-based retirement savings plan, while an annuity is an insurance product designed to provide guaranteed income.

- A 401k is an employer-sponsored retirement plan available only in the United States, allowing employees to contribute pre-tax income and grow it tax-deferred.

- Investments are typically held in mutual funds, stocks, or bonds, so the account value fluctuates with market performance.

- An annuity is a contract with an insurance company that provides predictable income, often for life, in exchange for a lump sum or a series of payments.

- Unlike a 401k, annuities are available in many countries and focus on income stability rather than investment growth.

Is it better to have a 401k or an annuity?

A 401k is better for building retirement savings, while an annuity is better for turning savings into reliable income.

- A 401k offers flexibility, long-term growth potential, and employer matching contributions, but the income it ultimately provides is tied to market performance.

- An annuity provides stability and predictable income, which can reduce uncertainty in retirement, though it may involve higher fees and reduced liquidity.

Many financial experts recommend using both to combine growth during working years with income security in retirement.

Who is best suited for an annuity or 401k?

A 401k is best suited for individuals focused on long-term savings growth, while an annuity is best suited for those seeking guaranteed retirement income.

- 401k: Ideal for workers who want to build retirement savings, benefit from employer matching contributions, and participate in market-based growth.

- Annuity: Best for retirees or those nearing retirement who prioritize predictable income and protection against outliving their savings.

Is an annuity safer than a 401k?

Generally, yes. Annuities are considered safer than 401ks in terms of income stability because they provide guaranteed payments that are not affected by market fluctuations.

For retirees, this can mean predictable cash flow for essential expenses, protecting against the risk of outliving savings.

However, the safety of an annuity depends on the issuing insurance company, as guarantees are backed by the insurer’s financial strength.

Fixed annuities offer steady payments, while variable annuities may still fluctuate with market performance, albeit with optional income riders for protection.

In contrast, a 401k is fully exposed to market risk: investment losses can reduce the account balance, and income is not guaranteed.

The advantage of a 401k is the potential for higher long-term growth and employer contributions, making it ideal for accumulation before retirement.

Can I have both an annuity and a 401k?

Yes, many retirees and pre-retirees choose to hold both a 401k and an annuity as part of a diversified retirement plan.

Using both allows you to balance the benefits of market growth with the stability of guaranteed income.

- A 401k continues to offer tax-deferred growth, potential employer contributions (if still working), and access to investment options.

- An annuity provides a reliable income stream that can cover fixed expenses, such as housing, healthcare, and utilities.

- For example, some retirees allocate a portion of their savings into a fixed or indexed annuity to secure a baseline of guaranteed income, while leaving the remainder in a 401k invested in equities and bonds for long-term growth.

- This combination can reduce the risk of running out of money while still allowing for potential portfolio growth.

The key is timing and allocation: younger retirees may rely more on 401ks for growth, while older retirees may increase annuity income to protect against market volatility.

Professional guidance is recommended to ensure the mix aligns with your retirement goals.

Can I transfer my 401k to an annuity?

Yes, you can transfer or roll over your 401k into an annuity, often via a rollover IRA annuity.

This allows you to convert accumulated savings into a predictable income stream, which can be particularly useful as retirement approaches or begins.

When considering a transfer, it’s important to understand the implications:

- a rollover annuity can provide lifetime income,

- protect against market declines,

- and simplify budgeting.

However, it may also involve:

- higher fees,

- surrender charges,

- and reduced liquidity compared to leaving funds in a 401k.

For example, a retiree with a 401k balance of $300,000 could use a portion to purchase a fixed annuity providing $1,500 per month for life, while leaving the rest invested in the 401k for growth and potential legacy planning.

This hybrid approach balances security with flexibility.

Before making a transfer, review the annuity’s terms, compare options for fixed vs. variable annuities, and consider tax implications.

Is it a good idea to convert 401k to annuity?

Converting a 401k to an annuity is a good idea when the priority shifts from growing savings to securing guaranteed retirement income.

This approach can help create predictable cash flow and reduce exposure to market volatility, especially as retirement approaches or begins.

However, converting also means accepting higher fees, possible surrender charges, and limited access to your money, along with reduced opportunity for future investment growth.

What are some advantages and disadvantages of a 401k and an annuity?

A 401k offers growth and flexibility but carries market risk, while an annuity provides income certainty at the cost of higher fees and reduced liquidity.

- A 401k’s main advantages include employer matching contributions, long-term investment growth, and tax-deferred savings.

- Its disadvantages are exposure to market volatility, required minimum distributions after age 73, and penalties for early withdrawals.

- An annuity’s primary advantage is guaranteed income for life, along with protection from market fluctuations and optional features such as inflation or death benefit riders.

- The main drawbacks are higher fees, limited access to funds, and complex contract terms.

Conclusion

Choosing between annuities and 401ks is less about picking a winner and more about designing a retirement structure that matches how you want your money to behave later in life.

Growth-focused strategies work best when time is on your side, while income-focused solutions matter most once regular paychecks stop.

Understanding when to shift from accumulation to income can make a meaningful difference in long-term financial confidence.

FAQs

Is a 401k considered a pension or annuity?

No, a 401k is a retirement savings account, not a pension or annuity.

Pensions and annuities provide guaranteed income, whereas 401ks depend on investment performance.

Why do rich people use annuities?

Wealthy individuals use annuities to secure guaranteed income that cannot be outlived, even when other investments are available.

Unlike stocks or funds, annuities can lock in reliable cash flow, reduce exposure to market downturns, and simplify income planning while supporting estate and tax strategies.

Are annuities better for older people?

Yes, annuities are generally more suitable for older individuals who prioritize predictable income over growth potential.

How much do I need in my 401k to get $1000 a month?

You generally need around $300,000 in your 401k to generate $1,000 per month.

This estimate assumes a 4% safe withdrawal rate and can vary depending on investment growth and other factors.

What are the pros and cons of 401k withdrawal?

Withdrawing from a 401k gives you access to your retirement savings, allows tax-deferred growth to continue, and offers flexibility in how you take funds.

The drawbacks include early withdrawal penalties, potential taxes, and the risk of depleting your account too quickly.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.