Annuities vs IRA is a choice defined by one main difference — annuities provide guaranteed income while IRAs focus on investment growth.

An annuity protects against outliving your savings, whereas an IRA allows your money to grow through stocks, bonds, and mutual funds, offering tax advantages but no guaranteed payouts.

This article covers:

- What is the difference between an IRA and an annuity?

- What are the pros of annuities vs IRAs?

- What are the risks associated with annuities?

- What are the risks of IRAs?

- Why choose an annuity over an IRA?

Key Takeaways:

- An annuity focuses on lifetime retirement payouts and longevity protection.

- An IRA emphasizes tax-advantaged growth with investment flexibility.

- Annuities favor stability over liquidity and cost efficiency, while IRAs favor growth over certainty.

- Converting IRA assets into an annuity can combine tax benefits with structured retirement income.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

Does an annuity count as an IRA?

No, an annuity is not the same as an IRA. An annuity is an insurance product that provides a guaranteed income stream, usually in retirement.

An IRA (Individual Retirement Account) is a US-specific, tax-advantaged retirement account for investing in stocks, bonds, or funds.

However, you can hold certain annuities inside an IRA, combining the IRA’s tax benefits with the annuity’s guaranteed income.

Readers outside the US should note that while annuities exist worldwide, the IRA itself is unique to the United States.

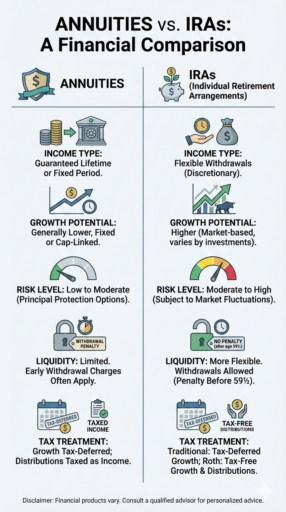

What is the difference between an annuity and an IRA?

An annuity focuses on providing guaranteed income, while an IRA focuses on growing your savings through investments.

The key difference is in how they manage your retirement savings.

- Annuities deliver predictable income, which can be fixed, variable, or indexed. They are designed to give retirees financial security for life.

- IRAs allow investments in stocks, bonds, ETFs, or mutual funds, offering tax advantages and growth potential but no guaranteed payouts.

In short, annuities prioritize income stability, while IRAs prioritize investment growth.

What is a major advantage of annuities vs IRA?

A major advantage of annuities compared to IRAs is the reliable income they provide. Unlike an IRA, which depends on market performance, annuities can help retirees manage longevity risk and ensure they do not outlive their savings.

Other advantages include:

- Protection from market volatility: Annuities shield your income from stock market swings, providing peace of mind.

- Flexible payout options: Many annuities allow for lifetime income or a set period, adjustable to retirement needs.

In comparison, IRAs offer advantages focused on growth and flexibility:

- Higher growth potential: IRAs allow investment in stocks, bonds, and mutual funds, which can yield greater returns over time.

- Tax benefits: Traditional IRAs offer tax-deferred growth, and Roth IRAs offer tax-free withdrawals in retirement.

- More liquidity and control: IRAs let you adjust your investments and access funds (with some restrictions) more easily than many annuities.

What is the biggest disadvantage of an annuity vs IRA?

The biggest disadvantages of an annuity vs IRA are limited liquidity and higher fees.

Many annuities charge surrender fees for early withdrawals, and insurance and administrative costs can reduce overall returns compared to an IRA invested in stocks, bonds, or mutual funds.

Other disadvantages of annuities include:

- Lower growth potential: Fixed annuities may offer smaller returns than market-based investments.

- Complexity: Some annuities have complicated terms that can make it hard to understand fees and payout structures.

By contrast, IRAs provide greater flexibility and potential growth:

- More investment choices: IRAs allow investments in a wide range of assets like stocks, ETFs, and bonds.

- Easier access to funds: While early withdrawals may have penalties, IRAs generally offer more liquidity than annuities.

- Lower fees: IRAs typically have lower administrative costs, especially when self-managed.

Is an annuity safer than an IRA?

In terms of principal protection, yes, an annuity is often safer than an IRA.

Fixed annuities guarantee a minimum return regardless of market performance, whereas an IRA’s value fluctuates with investments in stocks, bonds, and other securities.

However, safer comes with trade-offs like lower growth potential and higher costs.

Why would you roll an IRA into an annuity?

Rolling an IRA into an annuity can be a smart strategy for retirees who want to convert their savings into a steady retirement payout.

This move allows you to maintain the tax benefits of your IRA while gaining the stability of regular distributions from the annuity.

It can be particularly useful for:

- Managing longevity risk: Ensures your savings last throughout retirement.

- Reducing exposure to market swings: Converts fluctuating investments into a consistent cash flow.

- Customizing retirement funds: Many annuities offer fixed, variable, or indexed payment options to match your needs.

Why would you put an annuity in an IRA?

Putting an annuity inside an IRA is typically done to simplify tax reporting and maintain tax-deferred treatment while adding structured retirement payouts.

Because IRAs already provide tax deferral, holding an annuity within the account avoids layering unnecessary tax features while keeping all retirement assets under one umbrella.

This approach may appeal to investors who want to organize retirement savings in a single account, align annuity payouts with required minimum distributions, or integrate income-focused products into an existing IRA strategy without changing the account’s tax status.

When an annuity may make more sense than an IRA

An annuity may be the better choice for retirees who prioritize predictable, guaranteed income over market-driven growth.

Unlike an IRA, whose value fluctuates with investments, an annuity can provide a steady monthly payout, helping cover essential living expenses such as housing, healthcare, and daily costs.

This predictability can be especially valuable for those who worry about outliving their savings or navigating periods of market volatility.

Certain types of annuities, like fixed or immediate annuities, offer built-in protection against market swings, making them a form of retirement insurance.

For retirees who prefer peace of mind and financial stability, these guarantees can outweigh the potentially higher returns of an IRA.

Annuities may also suit individuals with lower risk tolerance or those approaching retirement age without sufficient guaranteed income sources.

They can be combined strategically with an IRA or 401(k), allowing part of your portfolio to continue growing while the annuity covers your baseline expenses.

Ultimately, choosing an annuity over an IRA isn’t about one being better than the other.

For many, the security of an annuity is a valuable complement to the growth potential of tax-advantaged accounts like IRAs.

Conclusion

When deciding between annuities and IRAs, consider not just income and growth, but how each fits your lifestyle, risk tolerance, and retirement timeline.

Annuities can provide peace of mind by stabilizing your retirement plan, while IRAs offer flexibility to adapt your investments as your goals evolve.

Ultimately, the best approach may involve blending both tools strategically, using each where it plays to its strengths to create a retirement plan that is both resilient and adaptable.

FAQs

What is the main purpose of an annuity?

The main purpose of an annuity is to protect against outliving your retirement savings, providing a guaranteed income stream for life.

What is better than an annuity?

Investment-focused options such as IRAs, Roth IRAs, 401(k)s, and taxable brokerage accounts can be better than an annuity for those seeking higher growth and greater flexibility.

These options allow direct exposure to stocks, bonds, and funds, offering stronger long-term return potential, though without built-in lifetime income features.

Which is better, IRA or Roth IRA?

A Roth IRA may be better if you expect your tax rate to be higher in retirement because contributions grow tax-free.

A traditional IRA can be advantageous if you want tax-deductible contributions now.

What are the three types of retirement accounts?

The three main types of retirement accounts are Traditional IRAs, Roth IRAs, and annuities.

Traditional IRAs offer tax-deferred growth, Roth IRAs provide tax-free growth and withdrawals, and annuities are insurance-based products designed to turn savings into long-term retirement income.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.