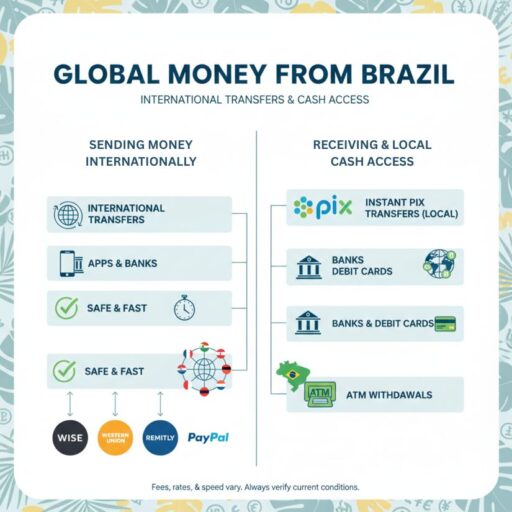

You can get money out of Brazil through banks, digital apps, and international transfer services like PayPal, Western Union, and Wise.

Residents can move money internationally safely and efficiently while managing fees and transfer speed.

This article covers:

- How can someone send you money from Brazil?

- Is Brazil using the PayPal or Cash App?

- Does Brazil use PayPal or Zelle?

- Which payment method is available in Brazil?

- Which bank has the best private banking?

Key Takeaways:

- Brazilians can send money internationally through banks, PayPal, Western Union, Wise, and Remitly.

- Cash App, Venmo, and Zelle are not available in Brazil.

- Verifying recipient details and using trusted platforms reduces fraud and errors.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

How can I send money out of Brazil?

To send money out of Brazil, residents rely on banks, transfer services, or digital apps to move funds internationally.

Popular methods include:

- Bank transfers: Brazilian banks offer international wire transfers through SWIFT.

- Money transfer services: Companies like Western Union or MoneyGram allow cash pickups or direct transfers to foreign accounts.

- Online apps: Digital services like PayPal, Wise, and Remitly allow transfers directly to international bank accounts.

Senders typically need the recipient’s full name, bank account number, and sometimes a SWIFT/IBAN code. Transfers can be sent in USD, EUR, or other major currencies.

What money transfer apps work in Brazil?

The most reliable money transfer apps in Brazil for sending money internationally are PayPal, Wise, Remitly, and Xoom.

- PayPal: Widely used for cross-border payments.

Pros: Supports multiple currencies, easy to use, trusted platform.

Cons: Higher fees for currency conversion, slower for large transfers. - Wise (TransferWise): Low-cost international transfers using real exchange rates.

Pros: Transparent fees, fast bank-to-bank transfers.

Cons: Only works with bank accounts (no cash pickups). - Remitly: Offers fast delivery with bank deposits or cash pickups.

Pros: Quick transfers, convenient for smaller amounts.

Cons: Higher fees for instant delivery, exchange rates slightly marked up. - Xoom (by PayPal): Sends funds from Brazil to international bank accounts or cash pickup locations.

Pros: Fast, multiple payout options, integrates with PayPal.

Cons: Fees and exchange rates can be higher than Wise.

Does Brazil use Cash App or PayPal?

Cash App is not supported in Brazil, while PayPal is widely used for both domestic and international transfers.

Key points:

- PayPal supports bank-linked transfers, international payments, and online purchases.

- Cash App is unavailable, so residents cannot send or receive funds using this app.

- For small personal transfers, PayPal is convenient, though fees and currency conversion costs may be higher than fintech alternatives like Wise.

What is the Brazilian Cash App?

Brazil does not have an official equivalent to Cash App, but residents rely on domestic solutions such as PicPay, Mercado Pago, and PIX for app-based transactions.

These platforms may be excellent for local payments, QR code transfers, and peer-to-peer payments but have limited international capabilities.

For international transfers, combining a domestic app with a service like PayPal or Wise is often necessary.

PIX is Brazil’s instant payment system, increasingly popular for domestic transfers, but cross-border integrations are still limited.

Does Brazil use Venmo?

Venmo is a US-only service and is not available to Brazilian residents. Attempting to use Venmo requires a US bank account and may involve complex workarounds that are not officially supported.

Residents should avoid relying on Venmo for personal or business transfers from Brazil.

Instead, consider PayPal, Wise, Remitly, or traditional bank transfers, which are regulated and secure.

Is Zelle available in Brazil?

Like Venmo, Zelle is not officially supported in Brazil.

Residents cannot receive funds directly through Zelle, although some may attempt workarounds with US bank accounts, which are not standard or reliable.

Brazilian residents seeking bank-to-bank transfers should opt for SWIFT-enabled banks or fintech platforms.

For cash pickup or non-bank recipients, services like Western Union or Remitly provide safer alternatives.

Does Western Union operate in Brazil?

Yes, Western Union is widely available in Brazil. It allows cash pickups or transfers directly to bank accounts.

Pros:

- Fast delivery, sometimes within minutes

- Works for recipients without bank accounts

- Accessible through many agent locations

Cons:

- Higher fees than online-only services

- Exchange rates may be less favorable

- Not ideal for large or repeated transfers

Is it possible to transfer money to an international bank account?

Yes, Brazilian residents can transfer money to international bank accounts using SWIFT transfers.

Local banks or digital platforms like Wise or PayPal can be utilized.

Accurate recipient information is required to avoid delays or lost funds.

What are the safest ways to transfer money?

The safest way to transfer money from Brazil is to use licensed banks or well-established international money transfer services while carefully verifying all recipient details.

- Use licensed banks or reputable transfer services: Choose regulated institutions with strong security, fraud protection, and compliance standards.

- Verify recipient information: Double-check names, bank account numbers, and any required codes before confirming the transfer.

- Avoid unverified apps or informal cash drops: These methods carry higher risks of fraud, delays, or irreversible loss of funds.

- Use tracking and confirmation features: Rely on services that provide transaction tracking and proof of delivery.

Which banks are used for international money transfers in Brazil?

Several large Brazilian banks facilitate international money transfers, including Itaú, Bradesco, Santander, and Banco do Brasil.

These institutions provide cross-border transfers primarily through SWIFT and online banking platforms, and many also offer private banking services for high-net-worth clients.

However, traditional banks are not the only option. In many cases, digital banks and international payment platforms may offer lower transfer fees or more competitive exchange rates.

The most suitable option varies based on transfer size, urgency, currency pair, and the level of advisory support required.

- Itaú

Pros: Large domestic and international network; reliable SWIFT transfers; private banking offers personalized wealth planning and global asset access.

Cons: Fees can be higher than digital-only alternatives. - Bradesco

Pros: Good international reach and multi-currency support; private banking provides tailored investment portfolios and dedicated advisors.

Cons: Some transfers require additional paperwork. - Santander

Pros: Efficient online international transfers with competitive fees; private banking includes global investment advice and multi-currency strategies.

Cons: Transfer limits may apply for larger amounts. - Banco do Brasil

Pros: Trusted institution with strong international links; private banking delivers customized financial solutions and wealth preservation services.

Cons: Processing can be slower for urgent transfers compared with digital-only platforms.

Digital platforms and certain international banks may offer lower-cost structures, particularly for smaller or more frequent transfers.

We also have access to lower-cost international transfer options.

What online payment method does Brazil use?

The main online payment methods in Brazil are PayPal, Mercado Pago, PicPay, and PIX, which allow residents to send money domestically and, in some cases, internationally.

- PayPal: Used for both domestic and international transfers.

- Mercado Pago: Popular for app-based payments within Brazil.

- PicPay: Facilitates domestic transfers and QR code payments.

- PIX: Brazil’s instant payment system; primarily domestic but increasingly connected with some international platforms for cross-border payments.

Banks vs Fintech Apps vs Money Transfer

Banks are the most secure but slower and costlier, fintech apps are faster and cheaper but require linked accounts, and money transfer services are convenient for cash pickups but have higher fees.

Banks: Offer reliable SWIFT transfers and strong regulatory protections. Pros include security and direct bank-to-bank transactions, but fees can be higher and processing slower.

Fintech Apps (Digital Wallets): Platforms like PayPal, Wise, Remitly, and Xoom provide fast transfers with lower fees and transparent exchange rates. Ideal for smaller amounts or frequent transfers, but they usually require linked bank accounts.

Money Transfer Services: Companies such as Western Union or MoneyGram allow cash pickups or transfers without a bank account, convenient for recipients without banking services. Fees can be higher, and exchange rates less competitive than digital wallets.

Choosing a method is like selecting a transportation mode—banks are like long-distance trains: safe but slower and costlier; fintech apps are express buses: fast and flexible; transfer services are taxis: convenient but expensive.

Conclusion

Brazil’s evolving financial landscape, with innovations like PIX alongside established banks, gives residents unprecedented options for moving money domestically and abroad.

Understanding which services are fully supported locally versus internationally is crucial to avoid blocked transfers or hidden fees.

By strategically combining Brazil’s robust banking networks, private banking offerings, and trusted digital platforms, residents can send money efficiently and maintain greater control over their funds in a market known for complex regulations and currency volatility.

FAQs

How much are PayPal fees on $1,000?

PayPal fees for sending $1,000 from Brazil internationally are approximately 4–5% of the amount, plus currency conversion fees.

Which apps are banned in Brazil?

Cash App, Venmo, and Zelle are not supported for use in Brazil. These apps cannot be used for sending or receiving money by Brazilian residents.

Some other apps, like Telegram or X (formerly Twitter), have faced temporary blocks due to legal or compliance issues, but most financial apps like PayPal and PIX remain fully operational.

Can I use my US phone in Brazil?

Yes, US phones can work in Brazil if they are unlocked and compatible with local GSM networks.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.