Green finance is the practice of funding projects and investments that have a positive environmental impact.

It specifically supports initiatives that reduce carbon emissions, promote renewable energy, and protect natural resources.

This article covers:

- What is the meaning of green finance?

- What is the purpose of green finance?

- What is an example of a green investment?

- What is the difference between green finance and sustainable finance?

Key Takeaways:

- Green finance directs capital toward environmentally beneficial projects.

- Its focus is narrower than ESG or sustainable finance, emphasizing the environment.

- Investors can access green finance through bonds, funds, and sustainable loans.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What is meant by green finance?

Green finance refers to financial investments that support environmentally sustainable projects and initiatives.

Its primary goal is to promote activities that reduce carbon emissions, conserve natural resources, and foster renewable energy solutions.

Green finance encompasses loans, bonds, equity investments, and insurance products that fund environmentally friendly projects.

Another name for green finance is environmental finance.

It is sometimes also referred to as eco-finance, especially in contexts that focus on funding projects with a measurable environmental benefit.

What are examples of green finance?

Examples of green finance include instruments like green bonds that fund renewable energy projects, as well as loans and funds supporting eco-friendly initiatives.

- Green bonds: Debt instruments issued to raise money for projects such as solar or wind farms, energy-efficient buildings, and other renewable energy initiatives.

- Sustainable loans: Loans provided to businesses that adopt environmentally responsible practices, including waste reduction, clean manufacturing, or water conservation.

- Climate funds: Investment funds that specifically target projects addressing climate change, such as reforestation programs, carbon reduction initiatives, or climate-resilient infrastructure.

- Green insurance: Insurance products designed to cover environmental risks or encourage sustainable practices, such as lower premiums for companies with eco-friendly operations.

Is green finance profitable?

Yes, green finance can be profitable, and many green financial products have delivered competitive returns compared with traditional investments.

For example, average yields on green bonds have been rising, with projected yields increasing from about 3.2 % in 2024 to around 3.8 % in 2026 as demand grows and markets mature.

Meanwhile, many climate and sustainable equity funds have generated average returns of around 6.5 %–7.5 %, with expectations of further improvement as more capital flows into sustainable sectors.

Data also show that different types of climate‑focused investments can offer diverse but competitive returns.

Equity climate funds delivered an average annualized return of about 9.2 % in 2025, while green bond funds returned roughly 5.1 %, slightly above some traditional bond benchmarks.

Returns vary by asset class, geography, and market conditions, and can be influenced by factors like policy incentives or cost structures.

However, the expanding volume of green bonds, climate funds, and renewable energy investments reflects growing investor confidence in the profitability of green finance.

How can I invest in green finance?

You can invest in green finance by putting money into bonds, funds, or companies that support environmentally sustainable projects.

–Purchasing green bonds or sustainable ETFs: Invest in debt instruments or exchange-traded funds that fund renewable energy, energy efficiency, or other eco-friendly initiatives.

–Participating in renewable energy funds: Contribute to funds that focus on solar, wind, or other clean energy projects.

–Supporting companies with strong environmental performance through equity investments: Buy shares in businesses that prioritize sustainability and environmentally responsible operations.

–Using banks or financial institutions that offer green loans or sustainable investment accounts: Access banking products specifically designed to finance eco-friendly initiatives.

Step-by-step guide to start investing in green finance:

1. Set your goals: Decide if you want short-term returns, long-term growth, or environmental impact.

2. Research options: Look into green bonds, ETFs, funds, or sustainable companies that match your goals.

3. Verify legitimacy: Check that the bonds, funds, or institutions are certified and credible to avoid greenwashing.

4. Invest gradually: Start with a small allocation and monitor performance and impact.

5. Review and adjust: Periodically check returns and sustainability outcomes to optimize your portfolio.

What are the risks of green financing?

The main risks of green financing include regulatory changes, market underperformance, greenwashing, and operational challenges in implementing sustainable projects.

- Regulatory risk: Changes in environmental laws, subsidies, or government incentives can affect project profitability and investment returns.

- Market risk: Renewable energy or sustainable projects may underperform financially due to fluctuating energy prices, technology adoption, or competition.

- Greenwashing risk: Some projects may be marketed as environmentally friendly without delivering real environmental benefits, misleading investors.

- Operational risk: Implementing large-scale green projects, such as wind farms or solar plants, can face technical, logistical, or maintenance challenges that affect performance.

Are green finance investments riskier than traditional investments?

Green finance investments can carry unique risks, but they are not inherently riskier than traditional investments when assessed properly.

Unlike conventional assets, green investments are exposed to regulatory, technological, and greenwashing risks, as well as market volatility in emerging sectors like renewable energy.

Policy changes, shifting subsidies, or delays in project implementation can affect returns, making due diligence essential.

At the same time, green finance offers risk-mitigation advantages.

Companies and projects that prioritize sustainability are often better prepared for environmental regulations, resource scarcity, and long-term market shifts.

Additionally, global trends toward carbon neutrality and ESG integration are driving demand for green financial products, potentially creating more stable, resilient investment opportunities over time.

For investors, the key is to balance potential rewards with specific risk factors, diversify across green bonds, climate funds, and sustainable equities, and verify that projects meet recognized environmental standards.

When approached thoughtfully, green finance can combine competitive returns with long-term resilience, offering a strategic edge over traditional investments that may ignore environmental exposures.

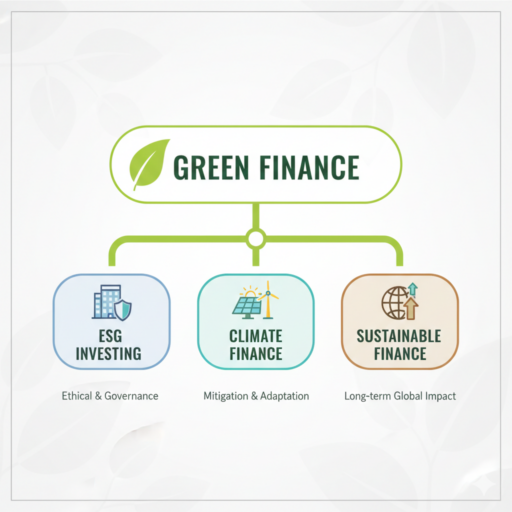

What is the main focus difference between green finance and ESG investing?

The main difference is that green finance targets only environmental projects, while ESG investing evaluates companies on environmental, social, and governance factors.

- Green finance: Focuses specifically on funding projects with a positive environmental impact, such as renewable energy, energy efficiency, or conservation initiatives.

- ESG investing: Considers environmental, social, and governance factors in investment decisions, evaluating companies more broadly on sustainability, ethical practices, and corporate governance.

Green Finance vs Sustainable Finance

The main difference is that green finance focuses solely on environmental benefits, while sustainable finance considers environmental, social, and economic sustainability together.

Green finance channels money specifically into projects like renewable energy, energy efficiency, and conservation.

In contrast, sustainable finance takes a broader approach, funding initiatives that also address social equity, economic development, and long-term resilience alongside environmental goals.

Green Finance vs Climate Finance

Climate finance is a subset of green finance that specifically funds projects aimed at mitigating or adapting to climate change.

While green finance encompasses a wide range of environmentally sustainable investments, climate finance focuses narrowly on initiatives such as carbon reduction programs, renewable energy for climate mitigation, and climate-resilient infrastructure.

Which countries are leading the way in green finance?

Countries like France and China are among the global leaders in green finance, with major contributions also coming from the UK, Germany, and other advanced markets.

France ranks at the top of global green finance indices, excelling in policy frameworks, market depth, and international cooperation that support sustainable financial products and green investment flows.

The UK, Germany, China, the Netherlands, Japan, Sweden, Denmark, Spain, and the United States also rank highly for their developed green finance markets and extensive issuance of green bonds and related instruments.

Beyond these, emerging leaders are strengthening their roles: Malaysia and Singapore are key hubs in Asia with growing sustainable finance markets and frameworks.

Meanwhile, the UAE and Saudi Arabia have rapidly expanded green and sustainable bond issuances in the Middle East.

Overall, leadership in green finance tends to come from a mix of advanced economies with mature financial systems and proactive policies, as well as fast‑growing markets that are scaling up green debt and investment instruments.

Conclusion

Green finance is reshaping how capital is allocated, showing that profitability and environmental responsibility can coexist.

Its value goes beyond funding renewable energy or conservation projects. It’s aligning financial systems with long-term planetary and economic health, turning sustainability into a core metric for growth and risk management.

The future of green finance will be defined by transparency, rigorous standards, and innovation.

Countries and institutions that embrace these principles are likely to lead global investment flows, unlocking opportunities across technology, infrastructure, and emerging markets.

FAQs

What are the four types of finance?

The four main types of finance are:

Personal finance – managing individual or household money.

Corporate finance – financial activities of businesses.

Public finance – government revenue and expenditure.

International finance – cross-border financial activities.

What are the 4 types of sustainability?

The four types of sustainability are:

Environmental sustainability – protecting natural resources.

Social sustainability – ensuring social equity and well-being.

Economic sustainability – maintaining financial stability over time.

Cultural sustainability – preserving cultural heritage and diversity.

How do I know if a company is truly committed to sustainability?

You can assess a company’s sustainability commitment by checking for recognized certifications, transparent reporting, and measurable environmental goals.

– Look for third-party verification such as ISO 14001, B Corp, or CDP scores

– review their sustainability reports for clear targets and progress

– ensure they have policies that integrate environmental responsibility into operations and decision-making rather than just marketing claims.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.