Inheritance law in Islam, also known as Mirath, is a well-defined system rooted in the Quran and Hadith. It outlines how a deceased person’s estate should be distributed among their heirs.

The rules are designed to maintain fairness, protect family members, and uphold societal balance.

Understanding these rules is essential for both Muslims and those dealing with Islamic inheritance as part of global estate planning.

This article covers:

- How does inheritance get split in Islam?

- Who is entitled to inheritance in Islam?

- Do sons get more inheritance than daughters in Islam?

- Can inheritance be waived?

Key Takeaways:

- Islamic inheritance law protects family members and prevents disputes.

- Males typically receive larger shares; females get financial protection.

- Inheritance follows fixed shares, residual allocation, and ‘awl adjustments.

- Heirs may voluntarily waive their share without infringing others’ rights.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What is the Rule of Inheritance in Islam?

The rule of inheritance in Islam is based on the Quranic principle that each heir receives a fixed portion of the estate. These shares are determined according to family relationships and the presence of other heirs.

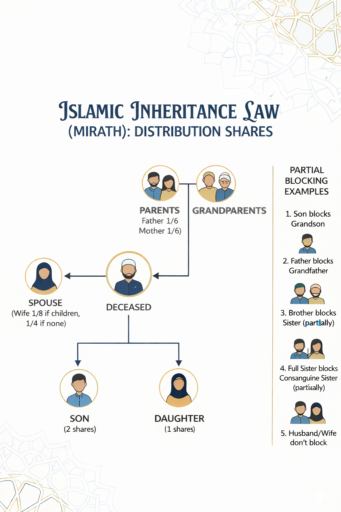

Islamic inheritance is divided mainly among primary heirs (like spouse, children, parents) and secondary heirs (siblings, grandparents, or distant relatives if primary heirs are absent).

Key principles include:

- The estate is distributed fairly and proportionally.

- Male heirs generally receive twice the share of female heirs in certain circumstances.

- A deceased person cannot override the Quranic allocation, though they may make a will for up to one-third of their estate for non-heirs or charitable purposes.

What is the Rule 14 of Inheritance in Islam?

In Islamic inheritance full blocking rules, Rule 14 states that the father of the father (or the father of father of father, how high soever) blocks maternal siblings from inheriting.

Maternal siblings include maternal brothers and maternal sisters.

When a paternal ancestor exists, maternal siblings are completely excluded from the estate.

Rule 14 is one of the sixteen full blocking rules (numbered Rule 0 to Rule 15) used in Sunni Islamic inheritance blocking (ḥajb) tables.

These rules determine when certain heirs are fully excluded due to the presence of closer or priority relatives.

There are also five recognized situations where partial blocking applies, meaning an heir’s share is reduced but not eliminated.

- Husband: His share decreases from 1/2 to 1/4 if the deceased leaves children or grandchildren through the male line, regardless of generational distance.

- Wife: Her share reduces from 1/4 to 1/8 when children or male-line grandchildren exist.

- Mother: Her share falls from 1/3 to 1/6 in the presence of children, grandchildren, or multiple siblings of any category.

- Single son’s daughter: Her entitlement drops from 1/2 to 1/6 when a single daughter of the deceased is present.

- Single paternal sister: Her share reduces from 1/2 to 1/6 if a single full sister exists. This reduction does not apply where a daughter or son’s daughter is present, as the paternal sister then becomes an Asaba, inheriting a variable share rather than a fixed portion.

With respect to the grandmother (maternal or paternal, how high soever), she either inherits her prescribed share or is entirely excluded.

Reductions caused merely by the number of heirs are not classified as partial blocking, and therefore grandmothers are not included within this category.

Why is the Islamic Law of Inheritance Important?

Islamic inheritance law is important because it ensures fair, structured, and enforceable distribution of a deceased person’s estate.

It serves several key purposes:

- Protects family members by guaranteeing parents, spouses, and children their prescribed shares.

- Prevents disputes through clear, predefined rules that limit conflict among heirs.

- Promotes social justice by preventing arbitrary allocation or favoritism.

- Preserves family wealth by supporting orderly succession and asset continuity.

This framework is especially relevant for Muslim families with assets across multiple jurisdictions, where clarity and consistency are essential.

How to Calculate Inheritance in Islam?

Inheritance in Islam is calculated by identifying heirs, applying Quranic shares, adjusting for excess through ‘awl’, and distributing residuary portions.

The process involves several steps:

1. Identify the heirs – determine primary and secondary heirs.

2. Determine fixed shares – consult Quranic allocations for spouses, parents, and children.

3. Apply the principle of ‘awl’ if necessary – adjust shares proportionally if the total exceeds the estate.

4. Allocate residuary shares – distribute remaining assets to male heirs or closest relatives.

Modern calculators and software can assist in accurately calculating shares according to Shariah principles.

Suppose a man passes away leaving:

- Wife

- Mother

- 2 Sons

- 1 Daughter

- Estate worth $120,000

Step 1: Identify heirs

- Primary heirs: wife, mother, sons, daughter

Step 2: Determine fixed shares (Quranic allocations)

- Wife: 1/8 (because children exist) → $15,000

- Mother: 1/6 → $20,000

Step 3: Apply ‘awl’ if necessary

- Remaining estate = $120,000 − ($15,000 + $20,000) = $85,000

- Sons and daughter share the rest, with sons receiving double the share of daughters

- Total shares ratio: 2 sons : 1 daughter = 2 : 2 : 1 = 5 parts

- Value per part = $85,000 ÷ 5 = $17,000

- Each son = 2 × $17,000 = $34,000

- Daughter = $17,000

Step 4: Allocate residuary shares

- Fully distributed:

- Wife: $15,000

- Mother: $20,000

- Son 1: $34,000

- Son 2: $34,000

- Daughter: $17,000

Who Gets the Most Inheritance in Islam?

Typically, sons get the most inheritance in Islam, as they receive double the share of daughters.

This is intended to reflect their financial responsibility within the family.

Surviving husbands may also receive substantial portions if the wife leaves no children, while parents’ shares are fixed but smaller relative to male descendants.

Why Do Daughters Get Less Inheritance in Islam?

Daughters receive less inheritance than sons because Islamic inheritance rules consider financial responsibilities.

Men are expected to provide for the family, including wives, children, and dependent relatives.

Women, while receiving a smaller share, gain financial protection and independence without direct family obligations, which balances the distribution in practice.

Can You Give Up Your Inheritance in Islam?

Yes, an heir can voluntarily renounce or give up their inheritance, either fully or partially.

This waiver may be done for charitable purposes or to resolve family disputes, but it must be made freely and in writing.

Importantly, the waiver cannot violate the fixed rights of other heirs, as Islamic law protects their prescribed shares.

Do You Have to Follow Islamic Inheritance?

Yes, Muslims are required to follow Islamic inheritance rules, though enforcement may vary depending on local civil law.

Muslims are legally and religiously expected to follow Islamic inheritance rules, especially regarding fixed shares outlined in the Quran.

However, in countries where civil law governs inheritance, the applicability depends on local legislation.

Non-Muslims are not required to follow these rules.

Islamic Inheritance Law vs Civil Inheritance Systems

Islamic inheritance law differs fundamentally from most Western civil law systems in how much freedom a person has to distribute their estate.

Under Islamic law, inheritance is largely mandatory and formula-based, with fixed shares prescribed by the Quran for specific heirs.

A Muslim may only allocate up to one-third of their estate through a will, and even then, it generally cannot benefit existing heirs.

This sharply limits discretion but ensures predictable outcomes and family protection.

By contrast, many civil law and common law systems allow broad testamentary freedom.

Individuals can often leave assets to anyone they choose, subject only to limited forced-heirship rules (such as those in parts of Europe).

This flexibility can increase planning options but also raises the risk of disputes, disinheritance, and unequal outcomes.

For Muslims living in non-Islamic jurisdictions, this creates a practical tension.

Civil courts may default to local succession law unless Islamic inheritance is clearly documented and legally recognized through a valid will, Shariah-compliant trust, or applicable choice-of-law rules.

Without proper planning, estates may be distributed in ways that conflict with religious obligations.

Aligning Islamic inheritance principles with local legal frameworks often requires proactive structuring to ensure both religious compliance and legal enforceability, especially when assets span multiple countries.

Conclusion

Islamic inheritance law is more than a set of rules. It is a system designed to promote fairness, responsibility, and harmony within families.

By clearly defining shares, prioritizing heirs, and allowing adjustments through mechanisms like ‘awl, it balances equity with practical financial obligations.

Understanding these principles helps families navigate inheritance smoothly, prevent disputes, and ensure that wealth is preserved responsibly for future generations.

FAQs

What are the impediments of inheritance in Islam?

An heir is barred from inheriting in Islam in specific circumstances, including: intentionally murdering the deceased, leaving Islam (apostasy), simultaneous death with uncertain order, li‘an (denying paternity via Quranic oath), and slavery.

In rare cases, inheritance may also be restricted in an emergency marriage if death occurs from illness before full recovery.

What was the pre-Islamic law of inheritance?

In pre-Islamic Arabia, inheritance was governed by tribal customs, favoring paternal male relatives, adopted heirs, and tribal allies, while excluding women and minors.

Islam reformed this system by establishing fixed shares for women and children and protecting widows’ rights.

What is the concept of ‘awl in Islamic inheritance?

‘Awl is a corrective adjustment applied when the total fixed shares exceed the estate.

In such cases, shares are reduced proportionally to fit the available estate without violating the principles of fairness.

What is the Sunni inheritance law?

Sunni inheritance law applies Quranic rules of fixed shares and residual distribution, interpreted through the four Sunni schools: Hanafi, Shafi’i, Maliki, and Hanbali.

While sons typically receive double the share of daughters, and spouses and parents have fixed portions, each school differs slightly in calculating shares, handling distant relatives, and applying adjustments like ‘awl when the estate is insufficient.

Sunni law ensures heirs receive their rightful portions with fairness and clarity under Shariah.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.