Inheritance law in Australia for foreigners allows non-residents to inherit Australian-based assets, including property, bank accounts, and investments, under state and territory succession laws rather than federal rules.

Nationality itself does not limit inheritance rights, but probate requirements, property restrictions, and tax treatment depend on the type of asset, whether a valid will exists, and the beneficiary’s residency status.

This article covers:

- Can a non-citizen inherit?

- What happens if you die intestate in Australia?

- What are the rules for intestacy in Australia?

- Does inheritance tax apply to non-residents in Australia?

Key takeaways

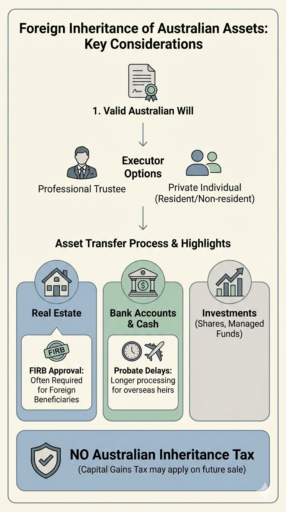

- Foreigners can legally inherit Australian assets, including real estate.

- Australia has no inheritance or estate tax, even for non-residents.

- Property inheritance may trigger FIRB or capital gains tax issues later.

- Having a valid will significantly reduces delays for foreign heirs.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What are the rules of inheritance in Australia?

Australia inheritance rules are governed at the state and territory level, not federally. Each jurisdiction has its own succession legislation, but the underlying principles are similar nationwide.

Assets located in Australia are typically governed by Australian law, regardless of the deceased’s nationality.

If the deceased left a valid will, assets are distributed according to its terms, subject to potential family provision claims.

If there is no will, statutory intestacy rules apply, prioritizing spouses, children, and close relatives.

Foreign beneficiaries are treated the same as Australian beneficiaries under succession law.

What is the property inheritance law in Australia?

Australian property inheritance law allows both residents and non-residents to inherit real estate located in Australia. Ownership can pass through a will, intestacy, or survivorship arrangements such as joint tenancy.

However, inheriting property does not always mean unrestricted ownership.

In some cases, especially involving residential property, foreign beneficiaries may need approval from the Foreign Investment Review Board (FIRB) to retain the property.

If approval is not granted, the property may need to be sold, with proceeds distributed to the heir.

Can a foreign person inherit property in Australia?

Yes, a foreign person can inherit Australian property, as the local law does not prohibit inheritance by non-citizens or non-residents.

The main complications arise after inheritance, particularly if the foreign heir intends to keep the property rather than sell it.

Is there inheritance tax in Australia for non-residents?

Australia does not impose inheritance tax or estate tax, regardless of the beneficiary’s residency or nationality.

This applies equally to residents and non-residents. That said, tax can still arise in other ways.

Capital gains tax may apply when inherited assets are sold, and income generated by inherited Australian assets may be taxable in Australia.

Non-residents may also face tax obligations in their home country, which can create cross-border tax exposure.

Do Wills need to be registered in Australia?

Wills do not need to be registered in Australia to be valid.

A will is legally effective if it meets formal requirements, including being properly executed and witnessed.

After death, the will is typically lodged with the relevant Supreme Court as part of the probate process.

Foreign wills can be recognized in Australia, but practical issues may arise if the document does not clearly address Australian assets or conflicts with local succession laws.

Does an executor need to be an Australian citizen?

Under Australian succession law, an executor does not need to be an Australian citizen or resident.

A foreign executor can apply for probate and administer an Australian estate.

However, courts do not like overseas executors in practice, especially where:

- all executors live overseas,

- beneficiaries are at risk of delay or cost, or

- the estate includes Australian property or business interests.

In those cases, the Supreme Court may:

- require the executor to appoint an Australian attorney or agent under a power of attorney,

- require a security bond,

- or impose procedural conditions before granting probate.

Banks and institutions often refuse to deal efficiently with offshore executors, even if probate is technically granted.

You do not need an Australian executor by law, but having at least one Australian-based executor or professional co-executor significantly reduces friction.

What happens if someone dies intestate in Australia?

If someone dies intestate in Australia, meaning without a valid will, their estate is distributed according to intestacy laws in the relevant state or territory.

These rules prioritize spouses, children, and close relatives in a fixed order.

Foreign heirs can inherit under intestacy laws, but intestacy often creates delays and disputes, particularly for blended families or international estates.

Assets may be frozen until an administrator is appointed by the court, which can be time-consuming for overseas beneficiaries.

Where Foreign Heirs Usually Face Problems in Australia

Foreign heirs are legally allowed to inherit in Australia, but delays and complications most often arise from probate administration, executor location, and asset-specific requirements rather than inheritance rights themselves.

Probate applications involving overseas executors or beneficiaries frequently take longer due to additional court scrutiny, document certification, and identity verification.

Australian banks, land registries, and investment platforms often apply stricter compliance checks when beneficiaries are based offshore, even after probate is granted.

Inheriting Australian property can also create complications if Foreign Investment Review Board approval is required or if the heir wishes to retain the property rather than sell it.

In practice, most difficulties foreign heirs face in Australia are procedural and administrative, but they can significantly delay access to inherited assets if not anticipated in advance.

Conclusion

Australian inheritance law is generally accessible to foreigners, but cross-border estates add layers of procedural and tax complexity that are often underestimated.

While Australian law does not restrict who can inherit, delays commonly arise from probate administration, property approvals, and post-inheritance tax exposure rather than the inheritance itself.

For foreigners with Australian assets or beneficiaries, advance planning and clear documentation are critical to avoiding unnecessary friction for heirs.

FAQs

What is the maximum amount you can inherit without paying tax in Australia?

There is no maximum amount you can inherit without paying tax in Australia because Australia does not levy inheritance tax.

What is the 183-day rule in Australia?

The 183-day rule is used to help determine Australian tax residency.

Spending more than 183 days in Australia during a financial year may make an individual a tax resident, which can affect how inherited income or gains are taxed.

The rule does not restrict inheritance itself but can impact post-inheritance tax obligations.

What is the 6 year rule for non residents?

The six-year rule allows a former main residence to remain exempt from capital gains tax for up to six years per absence if the property is rented out after the owner moves away.

If the property is used to produce income for more than six years in a single absence, capital gains tax applies to the period beyond the six-year limit.

For non-residents, access to this exemption is restricted, meaning inherited Australian property that was rented out for extended periods may face capital gains tax when sold, even if it was previously treated as a main residence.

What voids a will in Australia?

A will can be voided if it was not properly executed, if the testator lacked legal capacity, or if it was created under undue influence or fraud.

Marriage can revoke an existing will in some jurisdictions unless the will was made in contemplation of marriage.

Divorce does not void a will entirely but may cancel provisions relating to a former spouse.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.