Succession planning in France is governed by a rigid civil law framework that prioritizes family protection, tax collection, and administrative certainty.

Unlike common law systems, French law restricts how wealth can be transferred at death through mandatory inheritance rules and progressive taxation.

French succession operates under the authority of the French Civil Code, enforced through a compulsory notaire-led process.

Children benefit from legally protected inheritance rights, while testamentary freedom applies only to a limited portion of the estate.

Despite these constraints, France offers well-defined and legally robust planning mechanisms.

This article covers:

- What is the succession planning process in France?

- What is succession planning for business owners in France?

- What are the advantages and disadvantages of succession planning in France?

- Tips for Succession Planning in France

Key Takeaways:

- France enforces forced heirship: children receive 50-75% of the estate.

- Inheritance tax rates reach 45% for children and 60% for non-relatives.

- Estate settlement typically takes 6–12 months.

- Foreign residents have limited testamentary freedom since 2021.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What is Succession Planning in France?

Succession planning is the legal process of organizing asset distribution, minimizing taxes, and ensuring business continuity according to French law and personal wishes within forced heirship constraints.

The process applies equally to individuals, investors, and business owners, whether French or foreign, whenever French law asserts jurisdiction.

French law divides an estate into two distinct portions.

- The first is the reserved portion, which must pass to protected heirs, primarily children.

- The second is the freely disposable portion, which can be allocated according to personal wishes through wills, beneficiary designations, or contractual arrangements.

Effective planning focuses on optimizing the freely disposable portion while reducing the taxable base of the reserved portion.

Succession planning is essential for anyone with French assets.

Real estate, businesses, and financial accounts automatically trigger French inheritance rules and taxation.

Without planning, heirs face high taxes, liquidity pressure, and long administrative delays.

Succession Planning Framework in France

France’s succession framework relies on forced heirship, progressive taxation, and mandatory notaire oversight, ensuring orderly transfer of assets and family protection.

The succession law in France is governed by the French Civil Code, primarily Articles 870–1099, and applies at both national and international levels.

EU rules allow some foreign nationals to elect their home inheritance law instead of French law.

However, a 2021 reform limits this option when the deceased or their children are EU residents, restoring French forced heirship protections.

The system rests on three core pillars: forced heirship, progressive inheritance taxation based on kinship, and mandatory estate administration by a notaire.

Forced Heirship (Réserve Héréditaire)

French law guarantees children a protected share of the estate that cannot be reduced by will or donation:

- One child: 50%

- Two children: approximately 66.6% shared equally

- Three or more children: 75% shared equally

The balance (quotité disponible) may be freely allocated to any beneficiary. If no children survive, the spouse inherits either 25% (where parents or siblings exist) or the entire estate.

All children are equal heirs regardless of marital status, ensuring that disinheritance below the reserved share is not legally possible.

Succession Taxes: Rates and Allowances

Inheritance tax is levied per beneficiary, with relationship-based allowances:

- Children: €100,000 per parent

- Spouse or PACS partner: fully exempt

- Siblings: €15,932

- Nephews/nieces: €7,967

- Unrelated beneficiaries: €1,594

Amounts above allowances are taxed progressively.

For children, rates range from 5% to 45%, while unrelated beneficiaries face a flat 60% rate.

Spouses and civil partners pay no inheritance tax, making marital regimes a key planning consideration.

European and International Succession Rules

EU Regulation 650/2012 applies to cross-border successions within the EU, excluding Ireland and Denmark.

Succession is generally governed by the law of habitual residence, with limited scope to elect nationality law following the 2021 restrictions under Article 913.

The regulation is enforced by French courts.

Foreign wills executed under the Hague Convention (1961) are generally recognized, subject to notaire verification and compliance with French public policy, particularly forced heirship protections for children.

Succession Planning Process in France

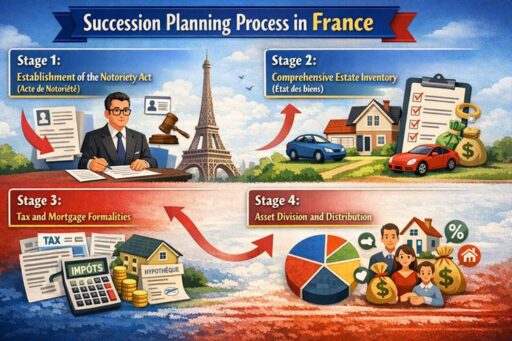

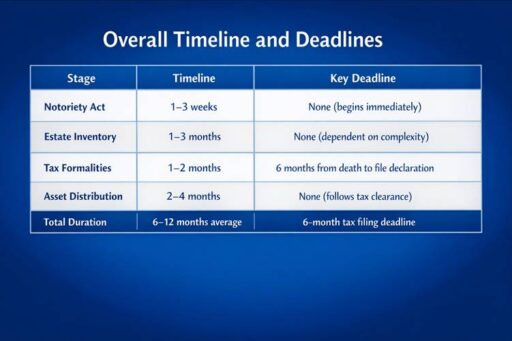

The French succession process is a four-stage, notaire-supervised procedure: heir identification, estate inventory, tax filings, and final asset distribution.

Stage 1: Establishment of the Notoriety Act (Acte de Notoriété)

The notaire first identifies all legal heirs and prepares the official notoriety act (acte de notoriété).

Heirs must provide civil records, wills, and family documents.

Simple estates move quickly, but missing heirs can delay this stage for months.

Stage 2: Comprehensive Estate Inventory (État des biens)

The notaire creates a full inventory of assets and debts, including property, accounts, businesses, and loans.

Heirs must submit financial and ownership records. Businesses and real estate require professional valuation.

This stage usually takes 1–3 months.

Stage 3: Tax and Mortgage Formalities

The notaire files inheritance tax declarations within six months (12 months if death occurred abroad).

Late filing triggers interest and penalties. Property and business registries are updated to prevent ownership disputes.

Stage 4: Asset Division and Distribution

After taxes are calculated, assets are distributed according to forced heirship and any valid will.

Heirs receive official ownership deeds from the notaire. Disputes may require court involvement.

Most successions take 6–12 months; complex estates take longer.

Succession Planning for Business Owners in France

Business owners can leverage the Dutreil Pact and posthumous mandates to secure tax-efficient, orderly family business succession.

Key Steps for Business Owners:

- Dutreil Pact: Reduces inheritance tax on family businesses by up to 75%. Requires family ownership, minimum shares, and management continuity.

- Start Early: Establish the pact 5–7 years before succession; gradually gift shares and train successors in the years leading up to transition.

- Posthumous Mandate: Appoints a trusted manager to run the business for 2–5 years after death, preventing disruption. Must be notarized.

Quick Tax Impact Example:

A €10M family business could save ~€117,000 in inheritance taxes by using the Dutreil Pact and allowances.

Ownership Strategy Tips:

- Phase share transfers to heirs using allowances.

- Align governance and training with family or company rules.

- Ensure all filings and notaire registrations are completed on time.

Succession Planning for Family Businesses

Family business succession requires governance structures, successor training, and careful tax planning to prevent disputes and preserve wealth.

Governance and Succession Frameworks

- Family constitution/charter: Defines roles, decision-making, and succession rules.

- Shareholder agreements: Regulate voting, transfers, and dispute resolution.

- Successor training: Start 5–7 years before transition.

- Legal structure review: Ensure your company structure—SARL (Société à Responsabilité Limitée), SAS (Société par Actions Simplifiée), or SA (Société Anonyme)—aligns with succession and Dutreil eligibility.

Multi-Generational Planning

Balance control and fairness between active and passive heirs:

- Differential gifting to favor active heirs.

- Buy-sell agreements funded by insurance or profits.

- Assurance vie to compensate passive heirs.

- Gradual management buyouts from earnings.

Preventing Family Disputes

- Documented succession plan with roles and timelines.

- Annual family discussions.

- Mediation for sensitive issues.

- Notarization and registration of agreements.

- Fairness framework distinguishing equality vs equity.

Succession Planning for Foreign Companies in France

French succession law applies to assets located in France, regardless of nationality; branch closures and cross-border planning require strict compliance.

Regulatory Framework

- Residency: French residents are subject to French succession law on worldwide assets; non-residents only on French situs assets.

- Asset-based taxation: French real estate and business interests are always taxable in France.

- Treaty relief: France maintains inheritance tax treaties with select countries to prevent double taxation.

International Estate Structuring

- Separate wills for French and non-French assets.

- Careful evaluation of nationality law elections under EU Regulation 650/2012, noting post-2021 restrictions where EU-domiciled children exist.

- Use of French subsidiaries or holding structures to recharacterize property as business assets.

- Ownership splitting (usufruct and bare ownership) to optimize tax outcomes.

Branch Closure and Dissolution

- Foreign companies closing French branches must file Form M4 within 15 days of closure

- Publish a legal notice where required

- Failure to complete formal closure exposes the company and heirs to ongoing French tax liabilities and penalties.

Pros and Cons of Succession Planning in France

Proper succession planning reduces taxes, prevents disputes, and ensures business continuity, while poor planning incurs high taxes, family conflict, and administrative delays.

Advantages

- Tax efficiency and wealth preservation

Tools such as the Dutreil Pact, assurance vie, and renewable lifetime gift allowances can reduce inheritance tax exposure by 50–75%, preserving family and business assets. - Family harmony and dispute reduction

Written succession plans and governance rules reduce ambiguity and lower the risk of inheritance conflicts. - Business continuity

Posthumous mandates allow a trusted manager to run the business for 2–5 years after death, preventing operational disruption. - Flexible planning within legal limits

Despite forced heirship rules, careful structuring of the disposable portion and life insurance allows tailored asset allocation. - Protection for non-traditional beneficiaries

Assurance vie and structured gifting enable tax-efficient transfers to unmarried partners, step-children, and non-relatives.

Disadvantages

- Residual tax exposure remains high

Even with planning, inheritance tax can reach 20–45% for children and up to 60% for unrelated heirs. - Restrictions on testamentary freedom

Forced heirship laws limit the ability to disinherit children or freely allocate assets. - Administrative delays

Mandatory notaire involvement and legal formalities often extend estate settlement to 6–12 months or longer. - Professional costs

Notaire, legal, and accounting fees typically range from 0.5–1.5% of estate value. - Reduced flexibility after recent reforms

Post-2021 restrictions make cross-border planning adjustments more difficult and increase legal exposure.

Succession Planning Best Practices in France

For best practices, establish formal wills through notaires, use Dutreil Pacts and assurance vie, communicate with heirs, review plans every 5-10 years, and engage expert advisors.

Execute a Valid Will

A French will must comply with local inheritance law. The safest option is a notarized will (testament authentique), executed before a notaire and witnesses, securely stored and difficult to challenge (typical cost €115–€200).

Handwritten wills are valid but easier to challenge. Some foreign wills are recognized under international conventions.

Every will must respect forced heirship while allocating the freely disposable portion.

Use Tax-Efficient Planning Tools

Dutreil Pact: Execute at least two years before business succession.

Assurance vie: Up to €152,500 per beneficiary tax-free if funded before age 70.

Lifetime gifts: €100,000 per child per parent every 15 years to reduce estate size.

Communicate Succession Plans

Regular, documented discussions with heirs clarify roles, expectations, and distributions, significantly reducing disputes, especially in family businesses.

Engage Professional Advisors Early

Effective succession planning requires a notaire, tax advisor, and accountant working together.

Starting 5–7 years early allows better structuring and tax efficiency.

Review Plans Periodically

Succession arrangements should be reviewed every 5–10 years or after major life or asset changes.

Pre-death amendments to wills, insurance beneficiaries, and Dutreil agreements are simpler and more effective.

Centralize Documentation

Maintain an updated succession file covering wills, insurance contracts, Dutreil documentation, governance agreements, asset lists, and explanatory letters.

Clear records speed administration and reduce disputes.

Plan for Specific Situations

- Blended families: Use assurance vie to benefit step-children or younger spouses.

- Unmarried partners: Marriage or PACS grants full tax exemption; otherwise, 60% tax applies.

- International residents: Maintain separate French and foreign wills and account for treaty relief.

- Large estates (€2M+): Combine holding structures, assurance vie, and lifetime gifts to manage tax exposure.

Conclusion

French succession rules create a tightly regulated framework that rewards early planning and penalizes delay.

After death, flexibility vanishes and families must navigate fixed inheritance shares, strict tax deadlines, and mandatory administrative procedures.

Without preparation, estates face forced liquidity, compressed timelines, and limited strategic options.

Effective planning transforms succession from a legal burden into a structured transfer of control.

Dutreil structures, insurance vehicles, and phased gifting are not simply tax tools — they are mechanisms for preserving enterprise value and intergenerational control.

Families that approach succession with the same rigor as portfolio management protect both financial capital and family stability.

FAQs

How does estate planning work in France?

Estate planning organizes asset distribution according to French law, balancing forced heirship (reserved portion for children) and the freely disposable portion.

Tools include notarized wills, Dutreil Pacts, lifetime gifts, and assurance vie to optimize inheritance taxes and ensure orderly transfers.

What is the declaration of succession in France?

The déclaration de succession is a mandatory tax declaration filed with French tax authorities within six months of death (12 months if abroad).

It lists all heirs, assets, and liabilities to calculate inheritance taxes.

Who are the legal heirs in succession?

Legal heirs include children (primary reserved heirs), the surviving spouse or PACS partner, and, if no descendants, parents or siblings.

French law guarantees children a protected share called the réserve héréditaire.

What is the order of inheritance in France?

1. Children (share of reserved portion)

2. Surviving spouse/PACS partner (exempt)

3. Parents or siblings (if no children)

4. Other relatives or non-relatives (subject to high tax rates)

How to avoid French inheritance tax from parents?

Options include:

• Lifetime gifts (€100k per child every 15 years)

• Assurance vie policies

• Dutreil Pact for family businesses

• Careful structuring of ownership (usufruct and bare ownership splits)

• Marital contracts (PACS/marriage) to benefit from spouse exemptions

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.