Wealth tax countries such as Spain, Switzerland, and Norway impose taxes on an individual’s net worth rather than only on income or spending.

These taxes primarily target high-net-worth individuals and differ widely in rates, exemptions, and asset coverage.

This article explains:

- How does wealth tax work?

- What are the countries with wealth tax?

- What are the pros of taxing the rich?

- What are the arguments against taxing the rich?

Key Takeaways:

- Only a small number of countries actively enforce wealth taxes today.

- Europe has the highest concentration of wealth tax systems.

- Many low-tax countries attract wealthy residents by avoiding wealth taxes entirely.

- Wealth tax debates center on fairness versus economic impact.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What is global wealth tax?

A wealth tax refers to taxes levied on an individual’s net worth rather than income or consumption.

It typically applies to assets such as real estate, shares, bonds, business ownership, luxury goods, and cash holdings, after deducting liabilities.

While there is no single worldwide system, the concept is debated globally as governments look for ways to address inequality and raise public revenue.

Which EU countries have a wealth tax?

Only one European Union country currently has a true wealth tax: Spain.

Spain levies a net wealth tax on residents and certain non-residents, with progressive rates applied to total net assets above set thresholds.

No other EU member state applies a comprehensive wealth tax.

Countries such as France, Italy, Belgium, and the Netherlands have replaced wealth taxes with narrower levies, such as real-estate-only taxes, financial asset taxes, or deemed-return systems, rather than taxing total net worth.

Norway and Switzerland are often cited in wealth tax discussions, but neither is a member of the European Union.

Both countries impose wealth taxes—Norway at the national level and Switzerland at the cantonal level—placing them outside EU-specific classifications.

Do other countries have wealth tax?

Yes, several non-EU countries have experimented with or continue to apply wealth taxes, often targeting individuals with very high net worth rather than the general population.

These taxes are usually structured with high exemption thresholds and progressive rates, limiting their impact to a small segment of taxpayers.

In many cases, wealth taxes outside the EU are introduced as temporary or extraordinary measures, frequently during periods of fiscal stress or economic crisis.

Some Latin American countries, including Argentina, have adopted such approaches, framing wealth taxes as one-time or time-limited tools to raise revenue from the wealthiest households.

Which countries have wealth tax?

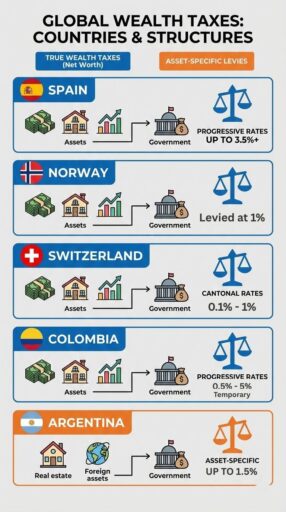

Only a few countries in the world currently levy a true net wealth tax: Spain, Norway, and Switzerland.

These taxes are applied to residents’ total net assets above defined thresholds, with progressive rates that increase for higher wealth levels.

- Spain: Maintains a progressive net wealth tax (Impuesto sobre el Patrimonio) on residents’ worldwide assets and certain non-residents’ Spanish assets. Rates vary by region, generally ranging from 0.16 % to around 3.5 % for very high net worth individuals. Exemptions apply for assets below €700,000 (residents), and the thresholds and rates increase progressively for higher net assets.

- Norway: For the 2026 tax year, Norway’s wealth tax is levied at 1 % on net assets above NOK 1.9 million. This threshold was increased from NOK 1.76 million in 2025. The tax applies to residents’ worldwide assets, with certain domestic exemptions.

- Switzerland: Wealth tax is levied at the cantonal and municipal level on residents’ worldwide net assets. There is no federal wealth tax. Each canton sets its own thresholds and rates, typically from 0.1 % to 1 %, with exemptions for lower net worth individuals (often below CHF 100,000). Taxable wealth includes real estate, financial assets, and other holdings.

Other countries with wealth‑related or asset‑specific taxes:

- Colombia: Following the declaration of a state of economic emergency in December 2025, Colombia imposed a wealth tax on assets held on or after January 1, 2026 under Decree 1474 of 2025. The tax applies to net assets exceeding 40,000 UVT (approximately COP 2 billion), with progressive marginal rates starting at 0.5 % and rising to 5 % on assets above 2 million UVT (approximately COP 104.7 billion). The measure significantly expands the tax base and is currently framed as an extraordinary, emergency-driven wealth tax.

- Argentina: The solidarity wealth tax targets high‑value assets above a minimum non‑taxable amount (recent reforms raised the threshold—e.g., from ARS 27 million to ARS 100 million), with progressive rates on assets held in Argentina that have included brackets from 0.5 % up to 1.5 % and historically higher rates on broad measures.

- Bolivia (repealed): Bolivia previously applied a Tax on Large Fortunes to individuals with substantial net worth, with progressive rates ranging from approximately 1.4 % to 2.4 %. The tax was repealed in late 2025 as part of broader fiscal reforms aimed at improving the investment climate.

Countries with asset-specific levies (not true net wealth taxes):

- France — After abolishing its broad wealth tax in 2018, France now imposes a real estate wealth tax (Impôt sur la Fortune Immobilière, IFI) on individuals whose net taxable real estate assets exceed €1.3 million, with progressive rates from 0 % up to 1.5 % on the portion above the threshold.

- Italy — Italy taxes financial assets held abroad by resident taxpayers without Italian intermediaries at 0.2 % (with 0.4 % for certain countries) and foreign real estate (IVIE) at about 1.06 %, but it does not impose a comprehensive net wealth tax on total assets.

- Belgium — Belgium has a solidarity tax (tax on securities accounts) of 0.15 % annually on securities accounts whose average value reaches or exceeds €1 million; this applies to the entire account value, but it is not a general wealth tax on net worth.

- Netherlands — The Dutch system taxes returns on wealth rather than net wealth itself. Under the temporary regime (through 2027), wealth above a personal exemption (about €57,684) is taxed on a deemed return basis at a flat 36 % income tax rate on that deemed benefit — an indirect form of wealth-related taxation rather than a standard annual net wealth tax.

Which country has the highest wealth taxes?

Spain has the highest wealth tax rates among countries with a permanent, recurring net wealth tax.

Its progressive system applies to residents’ worldwide assets and certain non-residents’ Spanish assets, with top marginal rates reaching around 3.5 %, though regional variations and exemptions can significantly affect the effective burden.

While Colombia currently applies higher headline rates of up to 5 % under an emergency wealth tax, these measures are temporary, extraordinary, and not part of a stable long-term system.

Overall, the actual wealth tax burden in any country depends on thresholds, asset valuations, regional rules, and deductions, meaning the highest rate can differ from the practical impact on taxpayers.

What country has the lowest taxes for the wealthy?

Countries with some of the lowest overall tax burdens for wealthy individuals include Monaco, the United Arab Emirates, and select Caribbean jurisdictions.

These countries generally do not levy a wealth tax, and many also have low or zero personal income tax, making them particularly attractive for high-net-worth individuals seeking tax efficiency.

However, the overall burden can still vary depending on other factors such as inheritance taxes, corporate taxation, and residency requirements.

What is the difference between income tax and wealth tax?

The main difference between income tax and wealth tax is that income tax is charged on money earned during a year, while wealth tax is levied on the total value of assets owned, regardless of income.

Income tax applies to earnings such as salaries, dividends, or business profits, targeting cash flow, whereas wealth tax targets accumulated capital like real estate, investments, and savings.

In short, income tax measures what you earn, while wealth tax measures what you own.

Why wealth tax is good

A wealth tax is considered beneficial because it helps ensure the richest individuals contribute fairly to society.

Supporters highlight several advantages:

- Reduces economic inequality by taxing accumulated wealth rather than just income.

- Generates revenue for public services such as healthcare, education, and infrastructure.

- Prevents excessive concentration of wealth across generations, promoting social mobility.

- Encourages fairer distribution of resources and can complement other progressive tax policies.

Why wealth tax is a bad idea

A wealth tax is considered problematic because it can create economic and administrative challenges.

Critics point to several disadvantages:

- Difficult to administer due to the need for accurate annual valuation of diverse assets.

- Encourages capital flight or tax avoidance as wealthy individuals move assets or residency to lower-tax jurisdictions.

- May discourage investment and entrepreneurship, reducing incentives for business creation and economic growth.

- Can negatively affect long-term savings and asset accumulation, potentially impacting overall wealth generation.

Are Wealth Taxes Effective at Reducing Inequality?

Yes, wealth taxes have been shown to reduce economic inequality by directly taxing the accumulated assets of the wealthiest individuals.

Their effectiveness, however, is determined by factors such as tax design, enforcement, and integration with other fiscal policies.

For example, Switzerland demonstrates that reductions in canton-level wealth tax rates were associated with increases in wealth concentration at the top, suggesting that sustained or stronger wealth taxes help contain extreme inequality.

In Colombia, the 2026 emergency wealth tax illustrates both potential and limitations: while some high-net-worth individuals adjusted reported assets to avoid higher rates, the tax temporarily expanded the revenue base and influenced reported wealth distribution patterns.

The OECD further notes that wealth taxes are most effective when integrated with broader fiscal measures, such as progressive income taxes, inheritance taxes, and social spending, rather than applied in isolation.

Key factors for effectiveness include:

- Design and thresholds: Properly structured taxes capture meaningful wealth without leaving loopholes.

- Enforcement and compliance: Accurate valuation of assets is critical; poor enforcement limits both revenue and fairness.

- Behavioral responses: Relocation, asset restructuring, or tax planning by wealthy individuals can reduce the redistributive impact.

- Integration with broader fiscal policy: Wealth taxes work best as part of a wider, progressive tax framework.

Conclusion

Wealth taxes remain a contentious tool in modern fiscal policy, balancing questions of fairness, social equity, and economic efficiency.

While they can provide meaningful revenue and help reduce extreme inequality, their practical implementation is complex and often politically fraught.

The global landscape shows that permanent wealth taxes are rare, and countries continuously experiment with asset-specific or temporary measures to achieve similar goals.

For policymakers and investors alike, the key insight is that how a tax is structured, enforced, and perceived can be as important as its headline rate, shaping both economic behavior and long-term social outcomes.

FAQs

When was wealth tax removed in India?

India abolished its wealth tax in 2015, replacing it with a higher surcharge on high-income earners.

The change aimed to simplify tax administration and improve compliance.

What country in Asia has the highest tax?

In Asia, Japan has the highest top marginal personal income tax rates, at around 45 % plus a 2.1 % surtax for high earners.

Other countries, such as the Philippines, China, and South Korea, have high rates as well, while formal wealth taxes are generally rare across the region.

What country has the best tax structure?

Countries like Singapore and Switzerland are often praised for combining competitive rates, efficient administration, and clear, predictable rules while still funding essential public services.

Does Japan have a wealth tax?

No, Japan does not levy a formal wealth tax. The country relies on high personal income taxes, inheritance taxes, and property taxes to collect revenue from high-net-worth individuals.

Is there a wealth tax in China?

No, China does not currently impose a general wealth tax. Taxes are primarily collected through personal income tax, property-related levies, and corporate taxes rather than on total net assets.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.