Countries with inheritance tax include the United Kingdom, Japan, France, Germany, and South Korea, where heirs may owe taxes when receiving assets after death.

Inheritance tax rules vary widely by country, with major differences in tax rates, exemptions, and who is required to pay.

This article covers:

- Which European countries have inheritance taxes?

- Where has the highest inheritance tax?

- What are some countries with no inheritance tax?

- Are estate tax and inheritance tax the same?

- How do I reduce inheritance tax?

Key Takeaways:

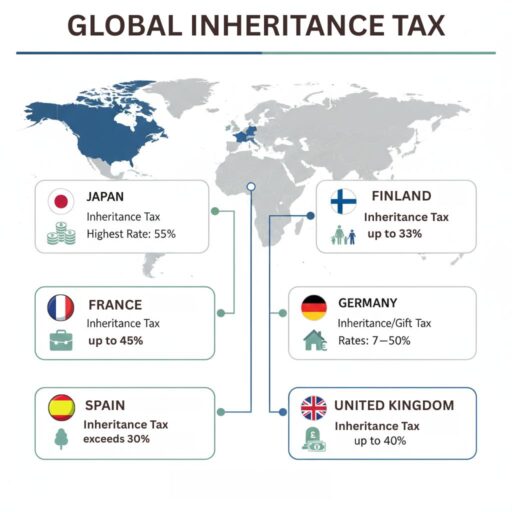

- Japan currently has the highest inheritance tax rates worldwide.

- Some countries, like the UK and Germany, impose inheritance tax on heirs, while others, such as the US and Philippines, tax the estate itself.

- Several countries have abolished inheritance tax entirely, including Australia, New Zealand, and Norway.

- Residency and asset location strongly affect tax liability.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What is the meaning of Inheritance Tax?

Inheritance tax is a tax imposed on beneficiaries who receive assets from a deceased person.

It is usually calculated based on the value of the inherited assets, the beneficiary’s relationship to the deceased, and the specific tax laws of the country involved.

The purpose of inheritance tax is to generate government revenue, limit the concentration of wealth across generations, and promote a more equitable distribution of assets within society.

In many systems, close relatives such as spouses or children benefit from exemptions or reduced rates, while distant relatives or unrelated beneficiaries are subject to higher inheritance tax rates.

Which countries have inheritance tax?

Countries with inheritance tax include the United Kingdom and Japan, along with many European and Asian nations that tax inherited assets at varying rates.

These taxes differ widely by region, with some countries taxing worldwide assets of residents and others taxing only assets located within their borders.

Europe

- United Kingdom

The UK’s inheritance tax is 40% on estates above the £325,000 nil-rate band, with full spouse exemptions and an additional residence nil-rate band that can raise the total allowance for family homes. - France

France applies progressive inheritance tax rates of up to 45% for close relatives and up to 60% for distant or unrelated heirs, with tax-free allowances starting at €100,000 per child and much lower thresholds for non-family beneficiaries. - Germany

Germany’s inheritance tax ranges from 7% to 50%, with generous exemptions such as €500,000 for spouses, €400,000 for children, and smaller allowances for distant relatives. - Spain

Spain levies inheritance tax with rates that can exceed 30%, but exemptions and thresholds vary significantly by autonomous region, with some regions offering near-total relief for close family members. - Belgium

Belgium has progressive inheritance tax rates that can reach up to 80% for distant heirs, while spouses and children benefit from lower rates and regional tax-free thresholds. - Italy

Italy applies inheritance tax rates of 4% to 8%, with high exemptions including €1 million per heir for spouses and children before tax applies. - Netherlands

The Netherlands imposes inheritance tax at rates of up to 40%, with tax-free thresholds such as over €700,000 for spouses and lower allowances for children and other heirs. - Ireland

Ireland charges inheritance tax, known as Capital Acquisitions Tax, at a flat rate of 33% above lifetime tax-free thresholds, including €400,000 for children and lower thresholds for other beneficiaries. - Switzerland

Switzerland inheritance tax is applied at the cantonal level, so rates and thresholds vary widely. Spouses and children are often fully exempt, while distant heirs may face progressive rates of up to around 50% in some cantons. - Finland

Finland levies inheritance tax at progressive rates of up to 33%, with tax-free allowances starting at €20,000, depending on the heir’s relationship and inheritance value. - Denmark

Denmark applies inheritance tax of up to 36.25% for non-immediate family members, while close relatives benefit from lower rates and partial exemptions. - Luxembourg

Luxembourg imposes inheritance tax mainly on non-direct heirs, with spouses and direct descendants largely exempt and rates for others reaching up to 48%.

Asia

- Japan

Japan has the highest inheritance tax rates globally, with progressive rates reaching up to 55%, applying after a basic exemption calculated as ¥30 million plus ¥6 million per statutory heir. - South Korea

South Korea levies inheritance tax at rates of up to 50%, with exemptions including approximately ₩500 million for spouses, though large estates may face additional surcharges. - Taiwan

Taiwan applies inheritance tax at rates of up to 20%, with a relatively generous tax-free threshold exceeding NT$12 million before tax applies. - Philippines

The Philippines imposes inheritance tax, known as estate tax, at a flat rate of 6%, applied only to the net estate after allowable deductions and exemptions. - Thailand

Thailand inheritance tax is levied at rates of 5% to 10%, applying only to inheritances exceeding THB 100 million, effectively exempting most smaller estates.

Americas

- Brazil

Brazil applies inheritance tax at the state level, with rates typically ranging from 2% to 8%, and exemptions varying depending on the state and asset type. - Chile

Chile imposes inheritance tax with progressive rates that can reach up to 25%, with tax-free allowances that depend on the heir’s relationship to the deceased. - Colombia

Colombia taxes inheritances through income and capital transfer rules, with limited exemptions and effective rates that can exceed 30% for large inheritances.

Key differences across countries

- Some countries tax worldwide inheritances of residents (e.g., Japan, UK)

- Others tax only domestic assets or apply taxes regionally (e.g., Spain, Switzerland, Brazil)

- Family relationship remains a major factor in determining tax rates

- Inheritance tax rules are subject to frequent political and legislative change

Which country pays the most inheritance tax?

Japan is widely regarded as the country with the highest inheritance tax rates in the world, with top marginal rates reaching 55% for large inheritances.

Other countries with high inheritance tax rates include:

- South Korea (up to 50%)

- France (up to 45% for non-direct heirs)

- United Kingdom (40% above thresholds)

However, effective tax rates depend heavily on exemptions, family relationships, and planning strategies.

Is there a country with no inheritance tax?

Australia and New Zealand are examples of countries with no inheritance tax, making them attractive for estate planning.

Other countries with no inheritance tax include:

- Canada (no inheritance tax, but capital gains may apply)

- Singapore

- Malaysia

- United Arab Emirates

In these countries, beneficiaries generally receive inherited assets tax-free, although other taxes may apply depending on the type of asset.

Countries reducing or repealing inheritance tax

South Korea and Denmark are among countries currently reforming or reducing inheritance tax, reflecting political pressure, concerns about economic competitiveness, and efforts to ease the tax burden on families and businesses.

- South Korea – Lawmakers and political parties are reportedly debating reforms to overhaul the current inheritance tax system in South Korea, including proposals to abolish spouse inheritance tax and shift to a system where heirs are taxed only on what they actually inherit.

- Denmark – Recent policy reforms have continued to reduce inheritance tax rates, particularly on family-owned businesses, easing the transfer burden and supporting business continuity.

- Balearic Islands (Spain) – The regional government has reportedly passed legislation to abolish inheritance tax in the Balearic Islands, eliminating the levy on transfers and inheritances subject to validation by Parliament.

Several other countries have abolished inheritance or estate taxes in recent decades, setting precedents for reform:

- Slovak Republic, Austria, Sweden, Cyprus, Norway – These countries repealed their wealth transfer taxes or inheritance taxes between the early 2000s and 2010s, reflecting a broader trend toward tax simplification.

This trend reflects growing competition among jurisdictions to attract wealthy residents and reduce the economic drag of high transfer taxes on families and businesses.

How do you avoid inheritance tax?

You can legally reduce or avoid inheritance tax through careful estate planning and use of exemptions.

Common strategies include:

- Gifting assets during one’s lifetime

- Establishing trusts or foundations

- Relocating tax residency

- Using spousal exemptions

- Purchasing life insurance to cover tax liabilities

Professional estate planning is essential, especially for international families with assets in multiple jurisdictions.

Do beneficiaries pay tax on their inheritance?

In countries with inheritance tax systems, beneficiaries usually pay the tax, not the estate. Examples include the UK, Japan, and Germany, where heirs calculate tax based on value and relationship.

In contrast, in estate tax systems, the estate itself pays the tax before distribution, so heirs receive net assets. Examples include the United States, Philippines, and Canada.

The amount owed depends on:

- The value of the inheritance

- The beneficiary’s relationship to the deceased

- Applicable exemptions and thresholds

Inheritance Tax vs Estate Tax

The difference between inheritance tax and estate tax is who is legally responsible for paying: beneficiaries or the estate itself.

Inheritance tax is paid by beneficiaries after they receive assets, with amounts based on the inheritance value, relationship to the deceased, and exemptions.

Estate tax, by contrast, is paid by the estate before distribution, so heirs receive assets net of tax.

This distinction has significant implications for estate planning: inheritance tax may encourage early gifting, trusts, or use of exemptions, while estate tax planning focuses on reducing the taxable value of the estate through deductions, charitable contributions, or insurance.

Countries like the United Kingdom and Japan use inheritance tax systems, while the United States, Philippines, and Canada rely on estate tax.

Understanding which system applies is crucial for timing transfers, minimizing liability, and ensuring heirs receive the intended inheritance.

Conclusion

Inheritance tax shapes decisions around wealth transfer, family planning, and cross-border asset management.

While rates and systems vary widely, the underlying trend is clear: countries are balancing revenue generation with competitiveness and fairness, leading some to reform or abolish these taxes entirely.

Strategic planning, awareness of residency rules, and an understanding of exemptions are increasingly essential for minimizing liability and preserving wealth for future generations.

FAQs

What is the most taxed country in the world?

Japan is widely regarded as the most heavily taxed country for inheritance, with top marginal rates reaching 55%.

For broader taxation, Finland has the highest personal income tax at 57.65%, Denmark follows with 55.9%, Bhutan leads in sales tax at 50%, and Puerto Rico has one of the highest corporate tax rates at 37.5%.

Is an inheritance from a foreign country taxable?

Yes, an inheritance from a foreign country can be taxable. Factors that determine taxation include:

-Your tax residency

-The location of the inherited assets

-Applicable tax treaties

Some countries tax worldwide inheritances of residents, while others tax only assets located within their borders.

Do I pay inheritance tax if I live abroad?

Yes, living abroad does not automatically exempt you from inheritance tax.

Many countries tax based on residency, domicile, or citizenship, so expats may still owe inheritance tax in their home country or where the assets are located.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.