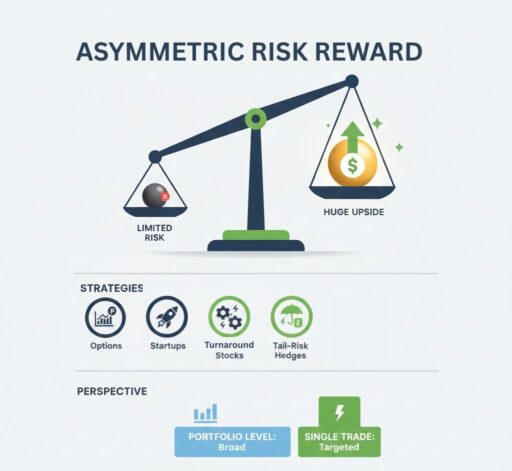

Asymmetric risk reward refers to investment situations where potential gains and losses are uneven, allowing small, controlled risks to produce disproportionately large returns.

It explains why some investments risk little but can gain a lot, while others risk a lot for limited upside.

This article covers:

- What is asymmetrical risk reward?

- What is an example of an asymmetric risk reward?

- What should be considered when assessing risk?

Key Takeaways:

- Asymmetric risk-reward targets investments with limited losses and large potential gains.

- Investors can grow capital over time even if they are wrong more often than not.

- Not all asymmetry helps; hidden risks or correlated exposures can cause losses.

- Applying asymmetry across the portfolio, not single trades, boosts resilience and long-term returns.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What does asymmetric risk reward mean?

Asymmetric risk reward means that the possible outcomes of an investment are uneven. The investor may risk a relatively small, predefined loss while having the potential for a much larger gain, or vice versa.

The asymmetry lies in the payoff structure, not in the probability of success.

For example, risking $1 to potentially make $5 is asymmetric in your favor, even if the chance of success is low.

Conversely, risking $5 to make $1 is asymmetric against you, even if the success rate appears high.

Asymmetric risk reward is about payoff imbalance, not certainty. It focuses on how much you can lose versus how much you can gain.

What are examples of Asymmetric Risk Reward?

Asymmetric risk-reward situations occur in investments like options trading and venture capital, where potential losses are limited but upside gains can be much larger.

- Options trading: Buying a call option limits the loss to the premium paid, while gains can be multiple times that amount.

- Venture capital investing: Most startups fail, but a few outsized winners can return many times the initial investment.

- Turnaround stocks: A distressed company may have limited downside if priced for failure, but large upside if recovery succeeds.

- Insurance-like strategies: Catastrophe bonds or tail-risk hedges risk small, repeated losses in exchange for protection against rare large events.

In each case, the downside is capped or controlled, while the upside remains disproportionate.

Why Asymmetric Risk Reward Matters in Investing

Asymmetric risk reward matters because long-term investment success depends more on payoff structure than on win rate.

Investors who consistently seek favorable asymmetry can be wrong more often and still grow capital.

Key reasons it matters:

- It allows losses to be survivable

- It reduces the need for perfect predictions

- It compounds gains over time

- It protects against ruin

Many professional investors focus less on being right and more on structuring decisions where being right pays far more than being wrong costs.

What is risk management in investing?

Risk management in investing is the process of identifying, measuring, and controlling potential losses.

It ensures that no single decision can cause irreversible damage to a portfolio.

Core risk management tools include:

- Position sizing

- Stop-loss rules

- Diversification

- Hedging strategies

- Maximum drawdown limits

Asymmetric risk reward is a subset of risk management. It complements these tools by shaping how risk and reward are distributed before capital is committed.

What factors do you consider when assessing the risk vs reward in financial opportunities?

Downside risk relative to the capital invested is one of the first factors investors assess when evaluating risk versus reward.

When assessing risk and reward more broadly, investors typically consider the magnitude of potential losses, the size of the upside under realistic scenarios, the time required for the investment thesis to play out, and how easily the position can be exited.

Liquidity constraints, probability-weighted outcomes, and correlation with existing portfolio holdings also play a critical role in determining whether an opportunity improves or weakens overall portfolio risk.

A favorable risk vs. reward profile does not require a high probability of success, but it does require controlled downside and meaningful upside.

Asymmetric Risk Reward in Portfolio Construction

Rather than relying on individual trades to deliver favorable outcomes, investors can design portfolios where downside is structurally limited while upside remains open-ended across multiple sources of return.

In portfolio construction, asymmetric risk reward plays a strategic role rather than a tactical one.

Key approaches include:

- Allocating small capital to high-upside, high-uncertainty assets

Investors deliberately limit position size in opportunities with uncertain outcomes but significant upside potential, such as early-stage ventures, emerging technologies, or distressed situations. Losses are predefined and manageable, while successful outcomes can meaningfully impact overall portfolio returns. - Pairing asymmetric growth positions with defensive, capital-preserving assets

Volatile, high-upside investments are balanced with stable assets such as high-quality bonds, cash equivalents, or low-volatility strategies. This pairing reduces forced selling during drawdowns and allows asymmetric positions time to realize their potential. - Using barbell strategies that combine safety and convexity

Barbell portfolios concentrate exposure at the extremes: very low-risk assets on one end and highly convex, opportunistic investments on the other. This avoids the middle ground where risk is taken without sufficient reward, preserving both resilience and upside optionality. - Limiting exposure to strategies with hidden tail risk

Some strategies generate steady returns but embed rare, catastrophic loss potential. Identifying and constraining these exposures helps prevent a single adverse event from overwhelming the portfolio and destroying accumulated gains.

A portfolio built around asymmetric risk reward prioritizes resilience over precision.

Losses are capped, diversified, and survivable, while gains are allowed to emerge from unexpected places.

This approach is particularly relevant for long-term investors, family offices, and those managing intergenerational wealth, where avoiding permanent capital impairment is as important as achieving growth.

When Asymmetric Risk Reward Fails

Asymmetric risk reward fails when assumptions about downside control are wrong. What appears favorable on the surface can quickly break down when hidden risks materialize.

Common failure points include:

- Hidden leverage or liquidity risk

Leverage can magnify losses beyond expectations, while poor liquidity can prevent timely exits during stress, turning a capped downside into a much larger loss. - Correlated losses during market stress

Assets that appear diversified in normal markets often move together in crises, causing multiple asymmetric positions to fail simultaneously. - Underestimating tail risks

Rare events are frequently dismissed despite driving the largest losses, exposing investors to outcomes far worse than modeled. - Ignoring time decay or opportunity cost

Some asymmetric positions lose value over time, such as options subject to decay or capital trapped in stagnant investments, eroding returns even when losses are limited. - Overpaying for optionality

Paying too much for upside compresses or eliminates asymmetry, as even successful outcomes may not justify the cost.

Asymmetry is not a guarantee of success and must be supported by rigorous analysis, diversification, disciplined sizing, and ongoing monitoring.

Conclusion

Asymmetric risk reward reframes investing around durability rather than prediction.

By prioritizing structures that limit damage while preserving upside, investors reduce their dependence on timing, forecasts, and short-term accuracy.

Over long horizons, this approach rewards patience and discipline, allowing capital to compound through uncertainty instead of being derailed by it.

The advantage comes not from knowing what will happen next, but from being prepared for a wide range of outcomes.

FAQs

How to identify risk reward ratio?

To identify risk reward ratio, estimate the potential loss if the investment thesis fails and compare it to the expected gain if it succeeds.

Divide potential gain by potential loss to calculate the ratio. A risk reward ratio of 3:1 means the potential gain is three times larger than the potential loss.

What is an example of asymmetric information in financial markets?

An example of asymmetric information in financial markets occurs when one party has more or better information than another.

Corporate insiders knowing earnings results before public release is a classic case.

What is the problem of asymmetric information on financial markets?

The problem of asymmetric information is that it can lead to mispricing, adverse selection, and moral hazard.

Markets become less efficient when participants cannot accurately assess risk due to information gaps.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.