Japan’s debt has long been massive yet manageable—until 2026. Recent shifts in interest rates, political policy, and global capital flows are exposing vulnerabilities that could ripple worldwide.

Japan carries one of the world’s highest debt levels, yet continues to avoid default. How did it get here, and what does the future hold?

Prefer listening over reading? This audio breaks down the key risks, market transmission channels, and the portfolio implications investors should monitor.

Key Takeaways:

- Japan’s debt is massive, politically sensitive, and increasingly costly to service.

- Rising rates and fiscal expansion could trigger market stress domestically and globally.

- Carry trade unwinds connect Japan’s debt to US tech, emerging markets, & global bonds.

- Focus on liquidity, defensive positioning, and strategic rebalancing, not short-term market predictions.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

Why is Japan so heavily in debt?

Japan borrows more than twice the size of its economy, and demographic pressures make repayment increasingly difficult.

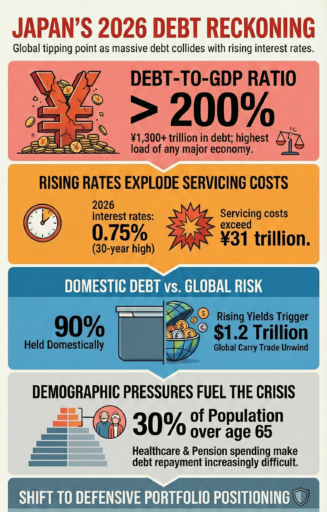

Japan’s debt-to-GDP ratio sits at more than 200%, the highest among major economies.

While the government could rely on ultra-low borrowing costs for decades, the underlying drivers of debt remain unchanged:

- Demographics and social spending – With roughly 30% of the population over 65, pensions and healthcare consume a growing share of government expenditure.

- Chronic low growth and deflation – Economic stagnation since the 1990s prompted repeated fiscal stimulus programs, funded by debt.

- Reliance on domestic financing – Japanese banks, insurers, and pension funds have historically absorbed government debt, allowing authorities to avoid foreign funding pressures.

- Ultra-low interest rates – Negative or near-zero rates for decades made borrowing cheap, but recent policy normalization is beginning to strain this model.

The debt itself was not immediately dangerous when rates were near zero, but even modest interest rate increases now dramatically raise the cost of servicing debt.

This scenario forces difficult trade-offs between fiscal support and sustainability.

What will happen to Japan’s debt?

Rising rates and political spending threaten to make Japan’s debt unsustainable in a way that could ripple through global markets.

Recent developments highlight the fragility:

- Interest rates rising – The Bank of Japan kept rates at 0.75% in early 2026, the highest in 30 years. With national debt reportedly exceeding ¥1,300 trillion, servicing costs have already surpassed ¥31 trillion.

- Political pressures – Prime Minister Takaichi’s election promises to cut consumption taxes and expand fiscal stimulus have triggered market jitters, as bond investors demand higher yields for increased risk.

- Global contagion risk – The unwinding of Japan’s low-yield carry trades (estimated at $1.2 trillion in global assets) could pressure US tech stocks, emerging markets, and global credit markets.

As noted in J.P. Morgan’s Fiscal Fireworks report, markets are already repricing fiscal risk in advanced economies like Japan, where soaring debt levels and political spending plans are creating volatility in government bonds and exchange rates.

Japan’s debt isn’t just a domestic problem anymore. Rising yields, political spending, and global financial linkages mean that every change in Japan’s fiscal trajectory could reverberate across the world.

Why Japan’s Financial Crisis Matters Globally

Japan’s debt crisis is a global stress test for bond markets, currency stability, and technology stocks.

According to Al Jazeera’s analysis of Japan’s 2026 fiscal announcements, bond yields spiked after planned tax cuts and stimulus measures raised doubts about long‑term debt sustainability.

This was a move that also sent ripples through US Treasury yields and overseas markets. US Treasuries may face selling pressure as Japanese institutions adjust holdings.

- Emerging markets could see rapid capital outflows triggered by liquidity-driven moves, not fundamentals.

- Central banks globally face impossible choices: support fiscal expansion, stabilize markets, or risk undermining confidence.

Japan’s situation is a lens through which to understand broader fiscal sustainability issues in aging, high-debt economies worldwide.

Past warnings were ignored because debt was mostly domestic and rates near zero. Now, yields are rising, debt service costs explode, and market confidence is fragile.

Central banks face impossible choices:

- Raise rates → stabilize currency but increase debt costs

- Hold rates → risk yen weakness and inflation

- Cut rates → risk hyperinflation and credibility loss

Japan’s crisis is a wake-up call for all high-debt economies. US, Europe, and other aging nations may face similar fiscal pressures if investor confidence falters.

What Investors Should Watch

Investors need to track Japanese interest rates, carry trades, and political developments to protect portfolios from cascading risks.

- Interest rate trajectory – Further rate hikes could sharply increase domestic and global debt costs.

- Carry trade unwinds – Japanese investors’ cheap yen loans fund trillions globally; a reversal forces forced selling in tech, emerging markets, and bonds.

- Government policy – Election outcomes and fiscal spending plans directly affect bond yields and risk premiums.

- Portfolio exposure – Overweight positions in long-duration bonds, leveraged equities, or assets indirectly financed by cheap yen are vulnerable.

Preparation is more critical than prediction. Defensive allocations, liquidity, systematic rebalancing, and safe-haven assets may protect investors against volatile market adjustments.

Bottom Line

Japan’s debt bubble in 2026 may redefine global investment assumptions, especially the belief that central banks can suppress volatility indefinitely.

For investors, risk and opportunity coexist—preparation, discipline, and strategic positioning are essential.

FAQs

Why is Japan’s public debt so high?

Key reasons why Japan’s public debt is the highest among developed countries include:

• Aging population: Rising social security and healthcare costs.

• Economic stimulus: Government spending to fight deflation and stimulate growth since the 1990s.

• Low inflation and low interest rates: Allowing Japan to borrow cheaply for decades.

How can Japan survive its debt?

Long-term sustainability will depend on gradual deficit reduction, productivity-enhancing reforms, and careful fiscal-monetary coordination.

Expanding labor participation and private investment would further strengthen the tax base and improve debt stability.

Japan has managed its debt largely because about 90% of government bonds are held domestically, limiting exposure to foreign capital flight.

Historically low borrowing costs, combined with strong exports and substantial foreign reserves, have helped maintain confidence and keep servicing manageable.

Why did Japan’s bubble burst in the 90s?

Japan’s bubble of the late 1980s collapsed due to:

• Asset price inflation: Real estate and stock prices soared far beyond fundamentals.

• Tight monetary policy: The Bank of Japan raised interest rates to cool speculation.

• Speculative lending: Banks had overextended loans, leading to a banking crisis when asset values fell.

Which country has the highest national debt?

By debt-to-GDP ratio, Japan is the highest among major economies (~230-250%).

By absolute amount, the United States’ total national debt is the largest at roughly $39 trillion as of late 2025.

Are the USA richer than Japan?

The answer hinges on how you measure wealth. The US has a much larger economy by total GDP (~$32 trillion vs. ~$4 trillion for Japan) and higher GDP per capita (~$93,000 vs. ~$36,000).

Japan, however, has high household savings and lower income inequality.

Who owns most US debt?

Most US debt is held domestically by institutions and individuals (around two-thirds).

Foreign governments also hold large amounts, with Japan and China as the top foreign creditors.

Who owns most of Japan’s debt?

About 90% of Japan’s government debt is held domestically by banks, insurance companies, and the Bank of Japan.

Foreign ownership is minimal, which helps reduce vulnerability to external shocks.

Why hasn’t Japan’s economy collapsed?

Despite massive debt, Japan remains stable because:

• Domestic debt ownership: Limits the risk of sudden capital flight.

• Low borrowing costs: Interest rates near zero prevent a debt spiral.

• Economic resilience: High-tech exports, strong infrastructure, and disciplined savings support the economy.

• Deflationary environment: Keeps debt manageable relative to income.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.