An external asset manager is a professional or firm that manages investment portfolios independently of banks, offering tailored wealth management solutions.

This independence enables a more objective approach to portfolio construction and strategic decision-making.

This article covers:

- What is the meaning of external assets?

- Who uses external asset managers?

- What are the responsibilities of an external asset manager?

- What are the risks in asset management?

Key Takeaways:

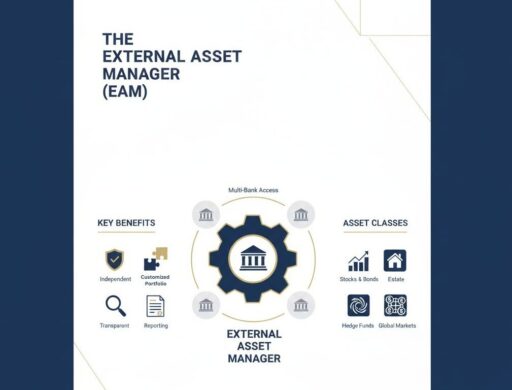

- EAMs offer independent, personalized investment management.

- Clients gain access to diverse global assets beyond traditional banking products.

- The main benefits include customization, transparency, and professional guidance.

- Risks include market volatility, regulatory issues, and operational dependency.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions. We also offer bespoke structuring solutions tailored to your situation.

The information in this article is for general guidance only, does not constitute financial, legal, or tax advice, and may have changed since the time of writing.

What does an external asset manager do?

An external asset manager (EAM) is an independent professional or firm that oversees and grows clients’ investment portfolios outside of traditional banking institutions.

Unlike in-house bank managers, EAMs provide a fully tailored approach to wealth management, selecting investment products across various institutions to suit the client’s objectives, risk tolerance, and financial goals.

Key responsibilities include:

- Developing personalized investment strategies

- Monitoring and rebalancing portfolios

- Advising on risk management and diversification

- Ensuring compliance with financial regulations

- Coordinating with other financial professionals like tax advisors or estate planners

What is an example of an external asset?

An external asset refers to financial instruments or holdings that are managed outside a client’s primary banking institution like ETFs and hedge funds.

Examples include:

- Stocks, bonds, and ETFs held in a third-party brokerage account

- Private equity investments

- Real estate portfolios managed through specialized trusts

- Hedge funds or alternative investment vehicles handled independently

By managing these assets externally, clients gain flexibility, transparency, and access to a broader range of investment opportunities.

Who are the clients of asset managers?

The clients of asset managers typically include high-net-worth individuals, family offices, and institutional investors who require sophisticated wealth oversight and long-term capital management.

- Entrepreneurs and business owners after a liquidity event

- Multi-generational family offices preserving legacy wealth

- Senior executives with complex compensation structures

- Institutional entities such as foundations, pension funds, and endowments

These clients usually have substantial investable assets, cross-border financial exposure, or complex financial structures that require dedicated oversight.

They prioritize capital preservation, disciplined growth, governance, and long-term strategic alignment over short-term speculation.

What are the benefits of EAM?

External asset managers provide greater independence and unbiased investment selection compared to traditional banking relationships, along with highly personalized portfolio management.

- Independence: EAMs are not tied to a specific bank’s products, allowing for objective investment decisions.

- Customization: Strategies are fully tailored to each client’s needs and goals.

- Global Access: Clients can invest in a wide range of international markets.

- Comprehensive Advice: EAMs can coordinate with tax, legal, and estate planning professionals for holistic wealth management.

- Transparency: Clear reporting and accountability are standard in external asset management relationships.

What are the top risks of external asset managers?

Despite their independence and flexibility, external asset managers carry operational, regulatory, and structural risks that investors must carefully evaluate.

- Operational Risk: Errors in trade execution, reporting inaccuracies, or compliance failures may negatively affect portfolio performance.

- Market Risk: Portfolios remain exposed to market volatility, geopolitical shifts, and economic downturns.

- Regulatory Risk: Cross-border structures and multi-jurisdictional accounts can create tax and compliance complexities.

- Manager Dependency Risk: Heavy reliance on a single manager increases exposure if performance declines or the firm restructures or dissolves.

- Fee Structure Risk: Complex or layered fee arrangements may reduce net returns if not clearly understood.

Comprehensive due diligence, including reviewing track records, custody arrangements, and fee disclosures, is essential before appointing an EAM.

External Asset Manager Vs Family Office

An external asset manager focuses primarily on managing investment portfolios, while a family office oversees the full spectrum of a family’s financial and administrative affairs.

External Asset Manager (EAM)

An EAM concentrates on portfolio construction, asset allocation, manager selection, and ongoing performance monitoring.

The manager operates independently and typically works with client assets held at one or multiple custodian banks.

The relationship is centered on investment strategy and capital growth.

Family Office

A family office delivers a comprehensive wealth management structure that goes beyond investments.

Services may include tax coordination, estate planning, philanthropy, succession planning, governance, accounting, and sometimes lifestyle management.

Family offices are commonly structured as:

- Single-Family Office (SFO): Serving one ultra-high-net-worth family

- Multi-Family Office (MFO): Serving multiple affluent families

Key Differences

- Scope: EAMs specialize in investment management; family offices manage broader wealth affairs.

- Cost Structure: EAMs are typically more cost-efficient; family offices require substantial wealth to justify their infrastructure.

- Complexity Level: Family offices are designed for ultra-high-net-worth families with multi-generational and cross-border complexity.

- Operational Depth: Family offices may maintain in-house legal, tax, and accounting teams, whereas EAMs focus strictly on portfolio oversight.

In some cases, an external asset manager may work alongside a family office, acting as the dedicated investment specialist within a larger governance framework.

External Asset Manager Vs Private Bank

Private banks combine investment management with traditional banking services, often offering products primarily from their own portfolio, while external asset managers provide independent, unbiased investment advice across multiple institutions.

Private Bank:

- Provides integrated banking and wealth management services, including lending, credit, and deposit facilities.

- Investment offerings are often proprietary, which can limit independent product selection.

- Suited for clients who prefer centralized management of both banking and investments.

- May have less transparent fee structures, as costs are sometimes embedded in banking products.

Key Differences Compared to External Asset Managers:

- Independence: Private banks may promote their own products; EAMs operate independently.

- Customization: Private banks typically use standard investment solutions; EAMs tailor strategies more extensively.

- Focus: Private banks offer broad financial services beyond investments; EAMs focus primarily on portfolio management.

Many clients also use both: a private bank for day-to-day banking needs and an independent manager for portfolio oversight.

How to choose an external asset manager?

The first and most crucial step in choosing an asset manager is evaluating whether their investment philosophy, risk discipline, and incentives align with your long-term financial objectives.

1. Assess Independence and Conflicts of Interest

Determine whether the manager is independent or tied to specific financial products.

Independent managers typically offer broader investment selection and fewer product-driven incentives.

2. Review Track Record and Performance Consistency

Look beyond headline returns. Examine performance across different market cycles, downside protection during volatility, and consistency relative to benchmarks.

3. Understand the Investment Philosophy

A clear, disciplined investment process is essential. Ask:

-How are assets allocated?

-How is risk managed?

-What is the approach during market downturns?

-Is the strategy active, passive, or hybrid?

4. Evaluate Risk Management Framework

Strong asset managers prioritize capital preservation. Understand how they diversify portfolios, monitor liquidity, and manage concentration risk.

5. Scrutinize Fees and Transparency

Ensure the fee structure is clear and fully disclosed.

Review management fees, performance fees (if any), custody fees, and potential commissions.

6. Verify Regulatory Status and Custody Arrangements

Confirm the manager is properly licensed and regulated in their jurisdiction. Assets should be held with reputable custodian banks, not directly with the manager.

7. Assess Communication and Reporting

Clear, regular reporting and proactive communication are essential.

You should understand portfolio positioning and strategic adjustments at all times.

How Technology Is Reshaping External Asset Management

Given the increasing digitalization and modernization in the world, external asset managers are leveraging advanced technology to enhance portfolio management, transparency, and client engagement.

Modern EAMs use portfolio management software, data analytics, and automated reporting tools to monitor investments in real time, assess risk exposure, and optimize asset allocation.

Digital dashboards allow clients to track portfolio performance, view holdings, and receive alerts on market movements or rebalancing actions, providing a level of insight previously only available through in-person meetings.

Technology also facilitates integration with tax, legal, and family office systems, ensuring seamless coordination across complex financial structures.

By adopting these tools, EAMs can deliver faster, more precise, and more transparent advice, helping clients make informed decisions while maintaining oversight and control over their wealth in a highly connected, rapidly changing financial environment.

Conclusion

Wealth management is no longer just about choosing investments; it’s about building a structure that can adapt, protect, and grow over time.

The choice between an external asset manager, a family office, or a private bank should be guided by your long-term goals, complexity of your financial situation, and the level of independence you desire.

Strategic oversight, disciplined risk management, and transparent guidance are what differentiate successful wealth stewardship from short-term gains.

Ultimately, the most effective approach is one that balances growth, security, and flexibility, ensuring your wealth serves both present ambitions and future generations.

FAQs

What are the 5 P’s of asset management?

The 5 P’s of asset management are Portfolio, Plan, People, Process, and Performance, guiding managers in aligning strategy, resources, and results with client objectives.

What are the challenges in asset management?

Key challenges in asset management include market volatility, regulatory compliance, client expectations, technological advancements, and risk management complexities.

What are the types of asset managers?

The main types of asset managers are External Asset Managers (independent, personalized), Institutional Asset Managers (large-scale funds), Private Bank Asset Managers (in-house banking), and Robo-Advisors (automated portfolios).

What is another name for asset manager?

An asset manager is also commonly referred to as a portfolio manager or investment manager.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.