How to Set Up a Company in Uganda: Registration Process, Taxation, and Advantages

Opening a company in Uganda requires four core steps: reserving your company name with the Uganda Registration Services Bureau (URSB), submitting your incorporation documents through URSB’s online or in-person system. Once registered, you must obtain a Tax Identification Number (TIN) and a local trading license before you can operate. The country allows full foreign ownership […]

UK Visa Fees in 2026: Visitor, Student, Work, and Spouse Visa Costs

Standard visitor visas in the UK cost a minimum of £127, while long-term visit visas and student visas start at £475 and £524, respectively. Work visas start higher depending on category, and settlement or partner visas exceed £1,900 before the Immigration Health Surcharge (IHS). Based on the latest published Home Office fee schedules, applicants who […]

How to Transfer Money From Uganda: Steps and Cheapest Options

Sending money from Uganda is possible through multiple channels: mobile money services like MTN MoMo, international remittance apps such as WorldRemit or (in some corridors) Wise, cash-transfer operators like Western Union, or a traditional bank wire. The best method depends on the destination country, the recipient’s preferred way of receiving funds, and the costs involved, […]

Portugal Golden Visa Fund for US Citizens: €500,000 Investor Visa Option

The Portugal Golden Visa Fund lets US citizens pursue residency via LXL Ventures, a CMVM-regulated private equity fund for Americans under Portugal’s post-2023 rules. Instead of real estate, the newly launched investment pathway now centers on a €500,000 investment into an approved fund, and LXL Ventures is currently the only fund explicitly structured to meet […]

Retirement in Uganda: Everything Foreigners Need to Know

Foreigners can retire in Uganda, and the country offers a dedicated Retirement Permit (Class H) for those aged 60 and above who can show at least USD 36,000 in annual assured income. Uganda is affordable by Western standards, especially in Kampala and Entebbe, but retirees must be prepared with a retirement plan suited for uneven […]

Investment Advice for Expats in Czech Republic: Tax, Real Estate & Residency Options in Central Europe

With a resilient economy, an independent central bank, and a strong rule-of-law framework anchored in the European Union, the Czech Republic offers expats a secure environment for long-term financial growth. But unlike many of its EU peers, Czechia maintains a moderate cost of living, a stable national currency (the koruna), and clear, predictable tax rules […]

Downside Protection Explained: Meaning, Strategies, & Importance

Downside protection in investing refers to strategies designed to limit potential losses when markets fall. It does not eliminate risk entirely but helps cushion the impact of downturns, allowing investors to preserve more of their capital and recover faster when markets rebound. In essence, downside protection is about managing the damage rather than avoiding it, […]

Investment Advice in Gabon for Expats: Navigating a Complex Market in Central Africa

Investing as an expat in Gabon combines strong natural-resource opportunities with strict regulatory and currency controls. Gabon offers access to hydrocarbons, mining, and timber, a euro-pegged CFA franc, and investor-friendly special economic zones. At the same time, expats must manage foreign-currency restrictions, shifting regulations, land-title complexities, and compliance requirements in sensitive sectors like forestry and […]

Investment Advice in Cape Verde for Expats: Investment Opportunities in West Africa

Cape Verde, or officially Cabo Verde, has quietly become one of the Atlantic’s most promising investment destinations for expats, offering political stability, a euro-pegged currency, and open property ownership for foreigners. The country stands out for low investment risk, simple business regulations, and fast-growing sectors such as tourism, real estate, and renewable energy.. This article […]

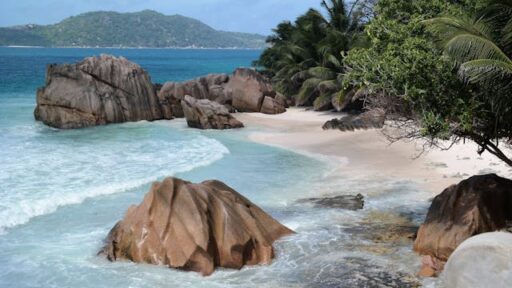

Investment Advice in Seychelles for Expats: From Tax Haven to New Investment Potential

Seychelles maintains a liberal foreign-exchange regime, no restrictions on repatriation of profits, and a maturing legal framework designed to balance transparency with ease of doing business. Over the past decade, Seychelles has moved from being perceived as a traditional offshore tax haven toward a fully compliant, OECD-aligned investment jurisdiction. For expat investors, Seychelles presents opportunities […]

Investment Advice in Poland for Expats: Understanding Residency, Property and the Belka Tax

Poland has become one of Europe’s most dynamic investment destinations, drawing expatriates with its mix of affordability, economic resilience, and access to the EU market. For foreign professionals and investors, Poland offers a balance of opportunity and structure, from accessible property ownership to a new proposed tax-sheltered investment accounts. This article covers: Key Takeaways: My […]

Expat Investment Advice in the Maldives: Business, Residency & Property Ownership

The Maldives is best known as a luxury tourist destination, but beyond its image as a holiday paradise, the country has quietly positioned itself as a niche investment environment. With sustained tourism income, a stable currency pegged to the US dollar, and new investor-residency reforms, it is drawing interest from foreign entrepreneurs and high-net-worth individuals […]

UK Spouse or Partner Visa Guide: 2.5-Year Stay, 5-Year Path to Settlement

Applying for a UK spouse or partner visa allows foreign nationals to live in the United Kingdom with their British, Irish, or settled partner. The process is done online through the UK government website, followed by biometric submission at a visa application centre and the upload of supporting documents proving your relationship, finances, and accommodation. […]

Airbnb Investment: Are Short-Term Rentals Worth It?

Investing in Airbnb properties can still be profitable, as it still is one of the most popular ways to generate income from real estate. This approach can yield higher returns than traditional rentals, often double or more in high-demand locations, but also comes with higher costs, tighter regulations, and more active management. This article covers: […]

Expat Investment Advice in South Korea: Banking, Investing and Residency

South Korea has become one of Asia’s most attractive destinations for foreign investors. It combines world-class infrastructure and a mature financial system with strong government incentives for innovation and foreign direct investment. This article gathers common expat investment advice in South Korea: everything an expat investor needs to know about South Korea’s investment landscape. It […]

Global Financial Advisors: FAQs About Managing Wealth Across Borders

Global financial advisors specialize in helping individuals and businesses navigate complex international markets, cross-border taxation, and offshore investment structures. For expatriates, entrepreneurs, and globally mobile professionals, they serve as trusted partners in protecting and growing wealth on a worldwide scale. My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions. The information […]

Expat Investment Advice in Hungary: Residency-by-Investment and Tax Guide

Hungary has become one of Central Europe’s most practical and cost-efficient destinations for expat investors. It offers a competitive tax system: a 9% corporate income tax, the lowest in the European Union, and a flat 15% personal income tax. Recent reforms have made Hungary even more appealing. A new residency-by-investment program launched in 2024 offers […]

Expat Investment Advice in Guyana: Investment Opportunities in an Emerging Economy

Since ExxonMobil’s discovery of vast offshore oil reserves in 2015, Guyana has transformed from an overlooked agricultural economy into one of the fastest-growing nations globally, with GDP expanding by double digits each year. For expats, this boom has opened a once-closed market to one now brimming with investment opportunities in oil services, construction, logistics, real […]

Expat Investment Advice in Suriname: Residency, Taxes, and Opportunities

Suriname, a small South American country bordered by Brazil, Guyana, and French Guiana, is drawing renewed attention from foreign investors in 2025. Its growing offshore oil discoveries, gold and bauxite industries, and expanding trade ties through the Caribbean Community or CARICOM make it a compelling, if underexplored, frontier for expat investors. This guide provides clear, […]

Expat Investment Advice in Luxembourg: A Premier Hub for Global Expats and Investors

Luxembourg has long been one of Europe’s most attractive destinations for expats seeking financial stability, legal predictability, and sophisticated investment options. As one of the world’s leading financial centers home to more than 130 banks and the largest investment fund industry in Europe, Luxembourg offers an unusually balanced environment for both professionals and investors. Its […]

Expat Investment Advice in Monaco: Navigating a Global Hotbed of Wealth and Investment

Monaco is one of the world’s most exclusive destinations for wealthy expats seeking tax efficiency, political stability, and a luxurious lifestyle. While the Principality is often described as a tax haven, it is in fact a fully regulated European financial center with strong transparency and compliance standards. This article covers some of the most important […]