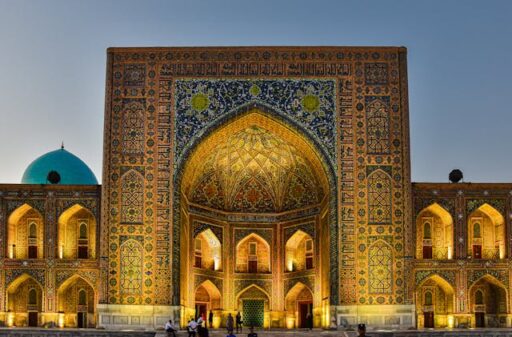

Uzbekistan Golden Visa: Residency from $250K Without Buying Property

Uzbekistan has joined the global race for investment migration with the launch of its own Golden Visa program in June 2025. This new initiative offers foreign nationals a streamlined path to long-term residency through a significant financial contribution, without the need to purchase property or establish a business. The standard package grants a five-year residence […]

Golden Visa Countries List: Where Investors Can Buy Residency or Citizenship

Golden visas are residency or citizenship programs granted in exchange for qualifying investments, such as real estate, government bonds, business creation, or direct contributions. They have become popular among high-net-worth individuals seeking global mobility, tax benefits, or a secure base abroad. This article provides a comprehensive overview of all countries currently offering golden visas or […]

Maldives Investor Visa: New Residency by Investment Scheme

The Maldives, long recognized as a high-end tourism destination, will introduce its first formal residency-by-investment program. Announced in early July 2025, the Maldives investor visa is part of President Mohamed Muizzu’s Vision 2040 agenda, which seeks to reduce reliance on tourism and attract foreign capital into the economy. Unlike the earlier Corporate Resident Visa—built around […]

Expat Investment Advice in El Salvador: Emerging Investment Hub in Central America

El Salvador has rapidly evolved from one of Central America’s most turbulent nations into an emerging investment hub with unique opportunities for expats. Its dollarized economy, sweeping security reforms, and pioneering digital-asset framework have drawn international attention. This article explores expat investment advice in El Salvador in 2025, covering the latest changes to the Bitcoin […]

Expat Investment Advice in Liechtenstein: Understanding One of the Most Sophisticated Financial Markets in the World

Liechtenstein is one of Europe’s smallest countries, but it offers one of the most sophisticated and stable environments for cross-border investment. Nestled between Switzerland and Austria, it shares the Swiss franc (CHF) and a customs and monetary union with Switzerland, while also being a member of the European Economic Area (EEA). This rare combination gives […]

Expat Investment Advice in Venezuela: Understanding Investor Visa, Tax and Crypto for Investors

Venezuela’s economy has partially dollarized, creating openings in real estate, small business ventures, and select local securities. However, these prospects exist alongside serious challenges: complex currency controls, recurring inflation, shifting regulations, and ongoing international sanctions. For most foreign investors, compliance, liquidity management, and legal clarity matter far more than speculation. This article aggregates expat investment […]

Vietnam’s New Residency Options: Investor, Talent, and Golden Visas

Vietnam does not currently offer citizenship or permanent residency through investment alone. Yet, it does have a proposed Golden Visa program, offering 5- to 10-year residency permits to investors, skilled professionals, and long-term visitors. While not yet in effect, the proposal represents a significant shift in Vietnam’s traditionally conservative immigration policies and signals the country’s […]

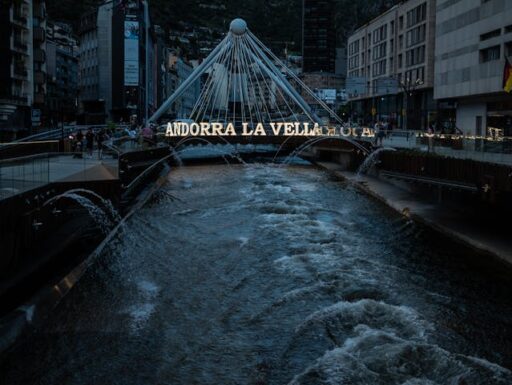

Expat Investment Advice in Andorra: Residency, Taxation and Real Estate

Andorra has evolved from a secluded mountain tax haven into a transparent, low-tax, and highly livable hub for international investors. For expats, Andorra offers the opportunity to establish residency, safeguard wealth, and manage global investments under clear and predictable rules. The country combines political stability, access to European markets, and a simple tax structure, offering […]

The Best International Financial Advisors: What They Do and How to Find Them

Managing money across countries is complex. For expats and international investors, wealth moves between currencies, tax regimes, and legal frameworks. A mistake in one jurisdiction can have financial or legal consequences in another. That’s why international financial advisors exist: to bridge these gaps, protect global assets, and ensure compliance across borders. This article explains exactly […]

Expat Investment Advice for Passive Income: How to Build Wealth Abroad

Unlike earned income from employment, passive income streams can continue regardless of location, making them particularly valuable for those who relocate often or plan to retire overseas. At the same time, expats face additional challenges, such as navigating double taxation, complying with cross-border regulations, and managing currency risks. This article explores the most reliable passive […]

Expat Investment Advice in Jordan: Banking, Taxes, and Opportunities

Jordan is a relatively stable, dollar-pegged economy in the Middle East. In 2025, two major changes impact expats and foreign investors. First, the country formally joined the Common Reporting Standard (CRS) in April 2025, meaning banks now automatically exchange account information with tax authorities abroad. Second, Jordan’s investment migration framework was reworked in July 2025, […]

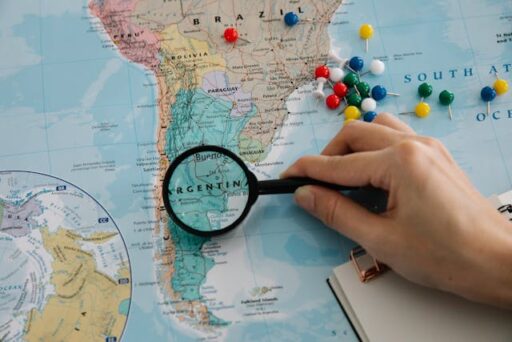

Expat Investment Advice in Argentina: A Practical Guide for Foreign Investors in 2025

Following years of currency restrictions and economic turbulence, recent policy reforms in Argentina have begun easing capital controls and improving access to foreign exchange. Combined with comparatively low property prices, a skilled workforce, and abundant natural resources, Argentina now offers opportunities across real estate, agriculture, and financial markets for those willing to navigate its complexities. […]

Expat Investment Advice in Cyprus: Residency, Non-Dom Tax, and Property Guide

Cyprus has become one of the most attractive European destinations for foreign investors and professionals seeking a combination of low taxation, strategic EU access, and Mediterranean living. This guide provides comprehensive expat investment advice in Cyprus covering residency by investment, non-dom tax incentives, property acquisition rules, banking procedures, and retirement planning. My contact details are […]

Expat Investment Advice for International Tax Planning: A Guide to Tax-Efficient Global Investing

Unlike domestic investors, expats face issues such as double taxation, varying tax residency rules, mandatory reporting requirements, and cross-border estate implications. Without proper planning, tax liabilities can quickly erode investment returns and expose individuals to penalties. This article explains the essentials of international tax planning for expat investors. It covers what tax planning involves, why […]

Expat Investment Advice for Offshore Banking: What Expats Need to Know

Offshore banking refers to holding accounts in financial institutions located outside an individual’s country of residence. For expats, it is a strategic tool for managing wealth across borders. Offshore banks allow expats to maintain financial stability when moving between countries, access multi-currency services, and diversify assets beyond their host nation. Offshore accounts can also provide […]

Expat Investment Advice for High Net Worth Individuals: Best Strategies for Global Wealth

High net worth expatriates face more complex financial challenges than the average investor. Moving across borders exposes wealth to different tax systems, regulatory environments, and market risks. The best expat investment advice for high net worth individuals must therefore cover three priorities: protecting assets across multiple jurisdictions, achieving tax efficiency, and building a globally diversified […]

The Best Expat Investment Advice for Retirement Planning: 7 Key Questions to Financial Freedom Abroad

The best expat investment advice for retirement planning is twofold: build a resilient, diversified financial plan, and reinforce it with expert guidance. Without careful planning, expats can lose a significant share of their wealth to double taxation, poor investment structures, or unexpected costs of living abroad. Answering these key questions in the article will provide […]

Expat Investment Advice in Lebanon: A Guide to Navigating Risks in 2025

Lebanon presents a complex environment for investors living abroad. The country has faced a prolonged financial crisis since 2019, marked by sovereign default, strict capital controls, and multiple exchange rates. While reforms are underway, foreign investors continue to face significant risks related to banking access, taxation, and compliance. This article provides a structured guide for […]

Choosing Where to Set Up an Offshore Business: Questions and Considerations for Foreign Investors

Deciding where to set up an offshore business starts with defining your goals and then matching them with the right jurisdiction. The process typically involves clarifying what you want to achieve such as tax efficiency, asset protection, or market access then comparing jurisdictions based on their legal frameworks, tax regimes, banking systems, and global reputation. […]

How to Start a Business in the Maldives: Step-by-Step Guide for Foreign Investors and Entrepreneurs

To open a business in the Maldives, you must first decide on the business structure, usually a private limited company, reserve a company name with the Ministry of Economic Development, and draft your Memorandum and Articles of Association. You’ll also need at least two directors (one resident in the Maldives), a local company secretary, and […]

How to Start a Business in Samoa: Step-by-Step Guide for Foreigners

Setting up a business in Samoa typically involves choosing the right company structure, reserving a name, preparing governing documents, and submitting your application through the Samoa Companies Registry. For foreign investors, an additional step is required: obtaining a Foreign Investment Certificate from the Ministry of Commerce, Industry & Labour. Once approved, the company receives a […]