How Much Money Do You Need to Live Off Investments?

Living off investments means reaching a point where your passive income typically from dividends, interest, and capital gains is enough to cover all your living expenses without relying on employment or business income. For many, this is the ultimate goal of financial independence: the freedom to choose how to spend your time without the pressure […]

What are the Best Short Term Investments?

Short-term investments are financial instruments or strategies meant to hold capital for a limited duration typically under three years. The best short term investments preserve principal, ensure liquidity, and earn modest, predictable returns. These investments are essential for anyone planning for near-term financial goals such as building an emergency fund, saving for a major purchase, […]

What Are the Best Long Term Investments?

Long-term investments are financial assets intended to be held for five years or more, often aligned with major life goals such as retirement, legacy building, wealth preservation, or funding a child’s education. The best long term investments are designed to weather economic cycles, benefit from compounding returns, and outperform inflation over time. If you are […]

Is a 10% Return Realistic?

Many investors, especially those familiar with long-term stock market trends, use a 10% annual return as a benchmark for successful investing. This expectation stems largely from the historical average performance of U.S. equities, particularly the S&P 500 which has delivered approximately similar annualized returns over the last century when accounting for dividends and reinvestment. The […]

What Makes Up Wealth—and Why It’s More Than Just Money

Wealth is often misunderstood as being synonymous with high income or a large bank balance, but in reality it encompasses a far broader and more nuanced set of assets, resources, and capabilities. At its core, what makes up wealth is the total value of what a person or household owns, minus what they owe, a […]

What is the optimal investment frequency?

Investment frequency refers to how often an individual contributes funds to their investment portfolio. This could be daily, weekly, monthly, quarterly, or in one or more lump sums. While the concept may seem secondary to selecting the right assets, how often one invests can significantly affect long-term returns, risk exposure, and psychological resilience. Is there […]

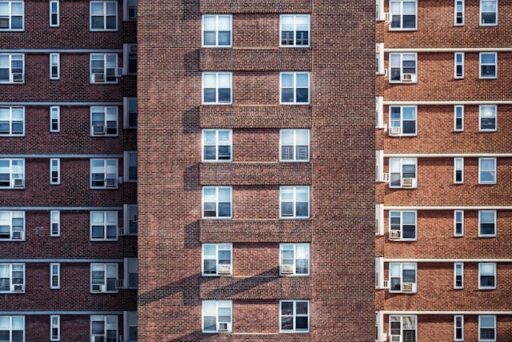

Types of Investment Properties: Pros and Cons

Real estate is one of the most widely used vehicles for building wealth. Unlike stocks or bonds, property offers tangible value, the potential for both income and appreciation, and a broad range of options to suit different investor goals. But not all properties are the same. Investment property comes in many forms and each category—residential, […]

How much do you need to invest per month to become a millionaire in 10 years?

If you consistently earn a 7% annual return, you’ll need to invest around $5,846 per month to reach $1,000,000 in a decade. At a 10% return, that drops to $5,003 per month, while a 5% return requires closer to $6,478 monthly. Your exact number depends on your expected returns, risk tolerance, and whether you’re starting […]

How do the rich avoid inheritance tax?

Inheritance tax (IHT), also referred to as estate or death duties is a levy applied to the transfer of wealth following a person’s death. It typically affects high-value estates and can significantly reduce the amount passed on to heirs. In countries where inheritance tax is imposed, it can range from modest percentages to rates exceeding […]

What are double taxation treaties and how to avoid paying tax twice

Double taxation occurs when two countries impose tax on the same income, asset, or financial transaction. This often affects individuals and businesses who earn income across borders, such as expats, digital nomads, multinational employees, and investors with international holdings. What are double taxation treaties then? They are designed to allocate taxing rights between countries, prevent […]

What is the best type of investment income?

The question “What is the best investment?” is a deceptively simple question with no single correct answer. For some investors, “best” means highest yield. For others, it means consistent, low-risk cash flow. For high-net-worth individuals and expats, considerations like taxation, currency exposure, and regulatory complexity can significantly influence the answer. The reality is what is […]

Income Investing vs Growth Investing: Which is better?

When it comes to building long-term wealth, investors often face a key strategic choice: income investing or growth investing. These two approaches serve different financial goals, offer distinct risk-reward profiles, and carry unique tax and liquidity implications. Understanding the differences between income investing vs growth investing strategies is essential not only for achieving financial independence […]

Income vs Investment: Which is better for expats?

In wealth management, distinguishing between income and investment is more than just an academic exercise, it’s fundamental to building, preserving, and transferring wealth effectively. While both play critical roles in a long-term financial plan, they serve very different functions and are governed by different tax rules, liquidity dynamics, and risk considerations. If you are looking […]

What is a safe haven asset — and why it should matter to investors

Periods of market volatility, economic crisis, and geopolitical instability often drive investors to seek safety. In these moments, certain assets tend to perform better than others not necessarily by generating high returns, but by preserving capital and limiting losses. These are known as safe haven assets. Safe haven assets are a core component of risk […]

Investment Property vs REITs: Which real estate strategy is right for you?

For investors evaluating how to gain exposure to real estate, the decision often comes down to investment property vs REITs. Real estate is a foundational element in many long-term investment strategies. It offers the potential for reliable income, protection against inflation, and tangible asset value. But real estate investing today goes far beyond owning and […]

How to Choose an Investment Property: A Guide

Real estate has long been considered one of the most reliable ways to build long-term wealth. Unlike stocks or bonds, property offers the potential for both steady income and capital appreciation while also serving as a tangible, inflation-resistant asset. But not all properties are created equal, and knowing how to choose an investment property is […]

Does Switzerland have inheritance tax?

Many expats and investors ask: Does Switzerland have inheritance tax? The answer is both yes and no. Switzerland does not impose inheritance tax, at least not at the federal level. Switzerland presents a unique case: while it is known for financial stability, tax efficiency, and investor-friendly policies, its inheritance tax system is not governed by […]

Does Singapore have inheritance tax?

The short and definitive answer is no. Singapore does not currently impose an inheritance tax. Inheritance tax, also known in some jurisdictions as estate duty, death tax, or succession tax, is a common feature of tax regimes in many countries. It typically applies to the estate or beneficiaries of a deceased person, based on the […]

Does Cyprus have inheritance tax?

Cyprus does not impose inheritance tax. The tax was officially abolished on January 1, 2000, and as of 2025, this policy remains unchanged. Inheritance tax plays a central role in estate planning, particularly for individuals with cross-border assets or beneficiaries residing abroad. In some countries, the transfer of wealth after death is subject to significant […]

How to Choose the Best Wealth Management Firms for Expats

Managing wealth as an expat is challenging because whether you’re relocating for work, retiring abroad, or simply living a globally mobile lifestyle, the complexity of your financial landscape increases significantly as you cross borders. In this context, a well-qualified financial advisor or wealth management firm can help you navigate complexities like international tax exposure and […]

Should You Buy a Second Home? Costs, Loans, and Tax Facts

The idea of owning a second home is appealing to many people for a variety of reasons. For some, it’s about having a weekend escape; for others, it’s part of a retirement plan, a legacy for family, or even a way to earn extra income. But a second home is not a purchase to be […]