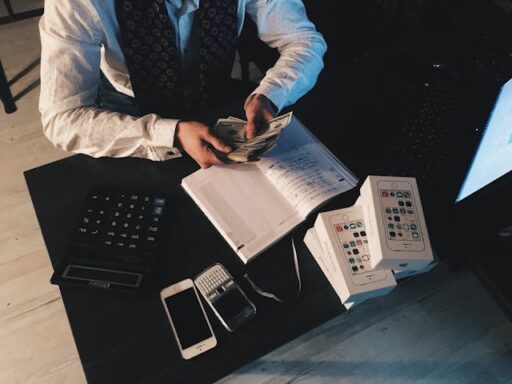

Basic Financial Terms Glossary: Banking and Personal Finance, Investing, and Taxes

Basic financial terms related to banking, personal finance, investing and taxes.

How to Move a Company to Another Country: A Guide

To move a company to another country is a significant decision that can offer substantial benefits—if executed strategically. Businesses typically consider international relocation to access new markets, reduce operational costs, optimize their tax exposure, or take advantage of favorable regulatory frameworks. Others may be driven by political or economic instability at home, or by the […]

Financial Management: All You Need to Know

Financial management is the strategic process of planning, organizing, directing, and controlling financial resources to achieve personal, business, or government financial goals. If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837). This includes if you are looking for […]

Is Moving Abroad with a Family Worth It?

Relocating to another country for work can be a life-changing opportunity, offering the chance to earn higher salaries, experience a new culture, and build a better future. However, when is moving abroad with a family worth it? The answer suddenly becomes much more complex. If you are looking to invest as an expat or high-net-worth […]

Qatar Golden Visa 2025: What is the Mustaqel Visa?

Qatar golden visa requires a minimum USD200,000 investment in real estate, whereas Mustaqel Visa provides a residency for entrepreneurs with less than USD70,000 or for talented individuals.

Is Working Abroad a Good Idea?

For many professionals, the idea of working abroad is an exciting one—higher salaries, new career opportunities, and the chance to live in a different culture. But from a financial perspective, is working abroad a good idea in reality? If you are looking to invest as an expat or high-net-worth individual, which is what I specialize […]

Can You Retire Early as an Expat? Tips and Strategies

To retire early as an expat requires meticulous financial planning, balancing income generation, cost management, taxation, and economic stability. Unlike traditional retirees who rely on government pensions or employer-based retirement plans, early retirees must ensure their investments and passive income sources are sustainable for decades. If you are looking to invest as an expat or […]

How to Invest in the US Stock Market as a Foreigner

The US stock market is the largest and most influential financial market in the world, attracting investors from across the globe. Knowing how to invest in the US stock market as a foreigner not only allows you to invest in some of the biggest companies in the world, but also gives you access to its […]

Australian Expat Trusts: A Guide

Trusts play a crucial role in wealth management, estate planning, and tax efficiency for Australian expats. Many people use trusts to protect assets, distribute income efficiently, and ensure long-term financial security. However, for Australian expat trusts, taxes and management can change significantly. If you are looking to invest as an expat or high-net-worth individual, which […]

Australian Expat Wills and Estate Planning: A Guide

For Australian expats, wills and estate planning is essential to ensure that assets are distributed according to their wishes while complying with both Australian and foreign legal systems. Without a proper estate planning, assets may be subject to intestate succession laws, leading to unintended outcomes and potential disputes. If you are looking to invest as […]

How to Retire Early: Different Types of FIRE Retirement

The Financial Independence, Retire Early (FIRE) movement is a financial strategy and lifestyle choice designed to help individuals achieve financial freedom long before the traditional retirement age of 65. We have talked about it before. FIRE focuses on aggressive saving, disciplined investing, and mindful spending to build a large enough financial portfolio that can support […]

Canada Wills and Estates for Expats: A Guide

Managing Canada wills and estates is a challenge for expats, as cross-border estate planning and asset management presents unique problems. Many expats assume that their Canadian will is automatically valid worldwide, but this is not always the case. Different countries have varying inheritance laws, tax implications, and legal frameworks that could impact how an estate […]

When Should You Buy the Dip?

Buying the dip is a popular investment strategy where investors purchase an asset after its price has dropped, expecting a future rebound. But exactly when should you buy the dip?

What Is Sovereign Risk and How to Mitigate it as Expat Investors?

Sovereign risk is a critical factor that expat investors must consider when investing in foreign countries. For expat investors, knowing what is sovereign risk can influence how they should invest in stocks, bonds, real estate, and business ventures in foreign countries. If you are looking to invest as an expat or high-net-worth individual, which is […]

Canadian Expat Trusts: A Guide

Canadian expat trusts are an essential financial and estate planning tool for those who want to protect and manage their assets while living abroad. However, Canadian expats must navigate complex tax regulations, trust residency rules, and reporting obligations to ensure compliance with Canadian law. If you are looking to invest as an expat or high-net-worth […]

Best Investment Platforms for Expats in 2025

Expats face unique financial challenges when investing, including cross-border taxation, currency fluctuations, regulatory restrictions, and limited access to certain investment products. Choosing what investment platform to use is essential for maximizing returns, ensuring tax efficiency, and maintaining financial flexibility while living abroad. The best investment platforms for expats provide global accessibility, multi-currency support, low fees, […]

What are the Easiest Countries to Buy a Home In?

Choosing which are the easiest countries to buy a home in is not easy. Buying an investment property abroad can be a complex process, but some nations make it easier than others by offering clear legal frameworks, minimal restrictions on foreign buyers, and straightforward property registration systems. However, there is no single easiest country to […]

Best Passive Income Investments for Expats

Living as an expat comes with unique financial challenges and opportunities. Unlike traditional employment, which often depends on location and work visas, passive income provides financial freedom by allowing expats to earn money regardless of where they live. Choosing the best passive income investments for expats needs to consider all the factors unique to the […]

Is Real Estate a Good Investment for Expats?

Real estate has long been considered one of the most reliable investments for building long-term wealth. But is real estate a good investment for expats specifically? For many expats, owning property abroad offers the promise of passive income, financial security, and potential residency benefits. However, investing in foreign real estate is far more complex than […]

What are the Safest Investments for Expats?

Unlike local investors, expats face additional challenges such as currency fluctuations, foreign taxation, economic instability, and political risks in different jurisdictions. This makes safety a top priority when choosing investment options. What are the safest investments for expats? Those that provide stable returns, liquidity, and capital protection, while being accessible across borders. If you are […]

Should you invest internationally or in your home country as an expat?

As an expat, should you invest internationally? or Should you invest in your country?