Italian Lump-Sum Tax Regime: What It Is & How It Works

Italy’s lump-sum tax regime represents a unique approach to taxation for wealthy individuals seeking residency. This comprehensive taxation framework differs significantly from progressive tax systems used in most countries. Italy recently increased its lump-sum tax. The regime offers substantial benefits for those with substantial international income streams, especially global businesses. In this article, we are […]

Can ETFs be Transferred Abroad?

Yes, ETFs can be transferred abroad through various mechanisms and settlement systems. Exchange-traded funds (ETFs) have revolutionized global investing by providing access to diverse markets and asset classes. However, the transfer process depends on regulatory frameworks, broker capabilities, and specific cross-border arrangements. As investors seek greater flexibility in managing their portfolios across borders, understanding ETF […]

Do Non-Residents Pay Property Tax in Spain?

Yes, non-residents who own property in Spain are required to pay property taxes. This obligation applies regardless of whether the property generates rental income or remains vacant. The Spanish tax system imposes specific levies on foreign property owners through various mechanisms designed to ensure fair taxation. Non-resident property taxation in Spain has become increasingly complex […]

Best investments in Portugal for Foreign Investors

Portugal offers diverse investment opportunities ranging from real estate and renewable energy to technology startups and traditional agriculture. The best investments in Portugal include property in major cities like Lisbon and Porto, renewable energy projects, and business ventures in growing sectors. Portugal’s strategic location, stable economy, and favorable investment programs make it attractive for global […]

Investing in Canada as a Non-Resident

Canada has emerged as one of the world’s most attractive investment destinations for non-residents. The country offers political stability, robust regulatory frameworks, and diverse investment opportunities. According to recent data, Canada attracted USD 50.3 billion in foreign direct investment in 2023. This represents a 9% increase year-on-year, making Canada the sixth-largest FDI recipient globally. Non-residents […]

What is an international portfolio bond and how does it work?

An international portfolio bond is an insurance-based investment wrapper set up in a low-tax jurisdiction. These structures are not right for everyone. But when used correctly, they can offer real advantages, especially for expats, HNWIs, and long-term planners. This post will cover various points, including: If you are looking to invest as an expat or […]

Estate Equalization Using Life Insurance: Meaning, Strategies

Estate equalization using life insurance is a strategy used in inheritance planning to ensure a fair distribution of assets among heirs, especially when a business or other substantial assets make equal division challenging. By providing liquidity, life insurance helps balance inheritances, trim potential conflicts, and preserve family accord. This approach is used when some heirs […]

US stocks will underperform: Why is that, and what can you do about it?

Why will US stocks underperform? Nobody can predict what will happen with the US stock market this year or next year. But what we have to remember is the long-term patterns of stock markets. What are those patterns? 1.Pretty much all developed stock markets go up over time. Even the Japanese stock market hit a […]

Investment Outlook 2025: Q3 & Q4 Review of Key Trends & Market Insights

The second half of 2025 is marked by the aftershocks of Q2 volatility, with global markets seeking stability while still facing elevated risk premiums. Central banks are cautious, inflation trends are moderating, and earnings revisions are increasingly sector-specific. While Q3 reflects measured stabilization, Q4 is likely to bring increased dispersion across asset classes as monetary […]

Why do billionaires have family offices?

At a certain level of wealth, traditional private banking simply isn’t enough. Billionaires often face a different kind of financial complexity: multi-generational wealth planning, global tax exposure, illiquid private assets, philanthropy, direct investments, as well as governance across families, entities, and jurisdictions. Family offices are built to handle exactly that. If you are looking to […]

How to Set Up a Family Office in Malaysia

In recent years, Malaysia has emerged as a strategic location for high-net-worth individuals seeking to manage their wealth efficiently. The increasing complexity of global financial landscapes has made centralized wealth management solutions like family offices increasingly valuable. For high-net-worth families in Malaysia, establishing a family office represents a strategic approach to preserving, growing, and transmitting […]

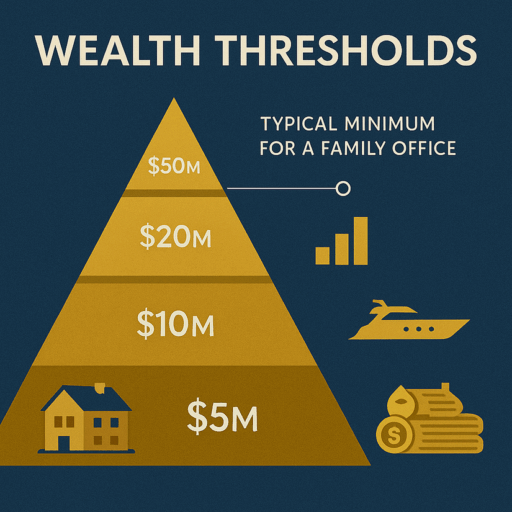

Family Office Minimum Net Worth: A Global Perspective

A family office refers to a privately held company that handles investment management and wealth management for a wealthy family. According to Deloitte’s Family Offices Insights Series, there are an estimated 8,030 single-family offices worldwide as of 2024 representing a 31% increase from 6,130 in 2019. This number is projected to grow by 12% to […]

CitizenX Citizenship Review

CitizenX is a Swiss platform that provides services and tools to help people secure residency, add more passports, and effectively handle second citizenship-related procedures. In this CitizenX citizenship review, we’ll talk about how the platform works, costs, list of supported countries for citizenship by investment, and pros and cons of the product. We have discount codes […]

Peninsula Global Bonds Review

The Peninsula Global Bonds offering is an investment vehicle with fixed income. It is intended to provide dependable revenue, flexible terms, and an alluring yearly return to investors. We’ll assess the product’s features and pros and cons in this review. If you are looking to invest as an expat or high-net-worth individual, which is what […]

Peninsula Capital Trust Loan Notes Review

The goal of Peninsula Capital Trust is to offer investors options outside of the usual asset classes of stocks and bonds. That’s why the firm provides short-term notes that allow investors to tap and diversify into the private credit market. This developing alternative sector generally yields greater returns and has less association with conventional market […]

9Mountains Bonds Review

Bonds known as converter bonds have the option to be converted, at a predefined conversion ratio, into shares of the issuing company. In this review, we take a closer look at the 9Mountains bonds and see what the converter bonds offering is all about. It can be a way to diversify your portfolio, but it’s […]

Balqis Bond Review

The Balqis bond is a fixed-income investment that provides access to the litigation finance market. Due to the increasing number and value of class action lawsuits, particularly in the UK, this sector has grown significantly in recent years. The United Kingdom has emerged as a major force in the litigation finance industry. From 2018 to […]

Setting Up a Foundation in Canada: A Comprehensive Guide

Canada’s charitable sector plays a vital role in supporting communities and addressing social needs across the country. Foundations form a crucial component of this ecosystem, enabling the flow of private wealth toward public causes. If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email […]

Setting up a Foundation in the UK: A Comprehensive Guide

In the United Kingdom, foundations play a vital role in providing funding and support for various charitable causes. They represent a significant portion of the charitable sector, with large foundations contributing billions of pounds in grants annually. This article is mainly for people living outside the UK. If you are looking to invest as an […]

Setting Up a Foundation in Nigeria

Nigeria has seen a significant rise in philanthropic initiatives aimed at addressing various social challenges across the country. Setting up a foundation provides a structured approach to achieving charitable goals while ensuring legal compliance and operational sustainability. If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, […]

Redbridge Insurance Review

Barbados-based Redbridge Insurance Company Ltd. is a global insurance and reinsurance firm rolled out in 2010. The company provides various international health insurance and associated products intended to give quality healthcare coverage as well as financial security to individuals, families, and expats. In this Redbridge Insurance review, we’ll discuss: If you are looking to invest as an expat […]