Updated January 2, 2021

This article will discuss options for people that are looking to invest in the Asia-Pacific region.

We will look at investing directly through real estate and land, in addition to indirect investments through funds and indexes.

We will also look at business investments, although we will assume that is only good for people with experience in those specific industries mentioned.

If you want to contact me, you can do so using this page or via email – advice@adamfayed.com.

Introduction

In recent years, housing in Asia has been of interest to many investors. Some investors businessmen prefer Thailand, Indonesia, Malaysia, Vietnam and China. T

These countries have fast developing and are considered to have stable economies by many.

Mass relocation of residents of small towns to megalopolises dictates the development of infrastructure and a greater demand for real estate, so prices on the market are growing rapidly.

After the 2008 crisis, there were big inflows into many Asian real estate markets. According to the American company Jones Lang LaSalle, the inflow of investments in Asian real estate is growing steadily every year, and by 2030 will amount to $ 1 trillion.

Investors are attracted only by high-quality properties, so developers take good materials, hire high-quality designers and architects.

Due to the tourist attraction of many Asian countries, renting has become a side income. This seems like a daunting task if you don’t know the law, but a developer usually helps the landlord at all stages: from preparing papers to finding and checking clients, monitoring their integrity.

Let us in this article get to know better those countries that can really be interesting and attractive for an investor to make a big investment in 2020-2021.

Investing in Japan

When we think about Japan we assume stagnation. I have previously stated why people shouldn’t invest in Japanese real estate.

However, there are profitable ways people can invest in Japan. Whilst real estate prices might have stagnated, land can be a profitable investment if done correctly.

Japan is located on islands with a small territory, so Japan’s land resources are very limited.

Accordingly, the demand for land is growing, which determines the increase in the price of the land, which sometimes reaches the cost of a residential building.

Whilst capital values aren’t rising long-term in Japan, rental yields aren’t bad.

One reason for that is population. At the moment, the population density of Japan reaches 330 people per area of one square kilometer, and land resources are so small that it has become nowhere to build new houses and neighborhoods and is very expensive.

When renting an apartment, the client must pay for the rental of the apartment itself, plus the so-called “key money”. “Money for the key” is a one-time non-refundable gift to the lessor, the amount of which is the amount of the rent for several months.

Japan is considered a highly developed country due to its developed and successful production of various goods.

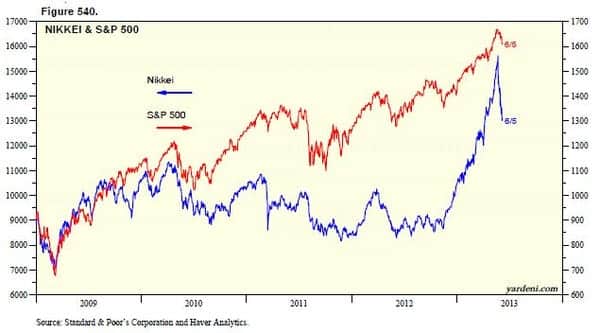

Therefore, despite weak capital market performance in recent decades, some investors are becoming more interested in the Japanese Nikkei again.

One reason for that is its relative underperformance in recent decades.

This has started to change in the last decade or so, with the Japanese Stock Market slowly improving again:

After hitting a low of 7,000 in 2009, the Nikkei has recovered to 22,000-24,000.

In Japan, the securities market is represented by a wide range of developed and developing enterprises and firms engaged in various industrial sectors.

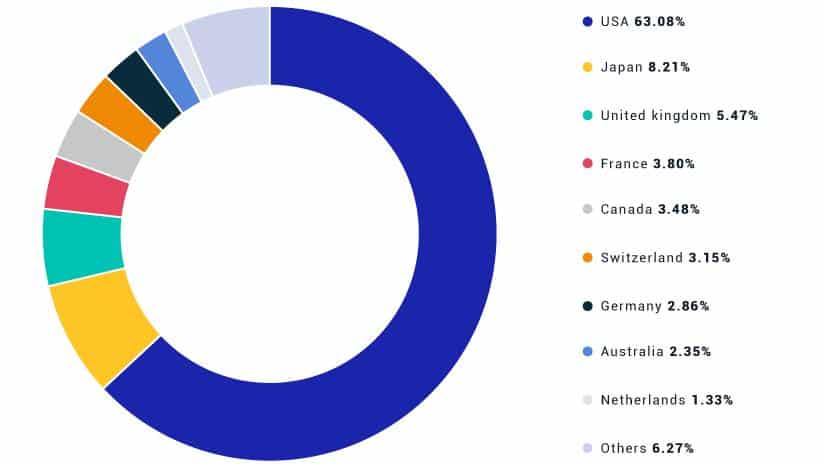

Investing part of your portfolio in Japanese stock indexes isn’t a bad idea, and you do get access to Japan through MSCI World.

Investing in Korea

Currently, buying property in Korea is a highly cost-effective method of preserving and increasing the capital of an investor.

Property prices in Korea are high, but despite this, the value of Korean property is constantly increasing, at least until the 2008-2009 financial crisis.

The high real estate values creates a problem though. As renting is much cheaper than buying, rental yields in Seoul can be as little as 1%-2% per year.

In human terms, that means that renting is much cheaper than buying if you live in Korea, even if the property goes up a bit in value.

The real estate market in the Republic of Korea is represented by a wide range of diverse residential and commercial real estate.

The investment company you contact will monitor the real estate market in Korea and select for your consideration only the most advantageous offers for buying real estate, in accordance with your wishes and material capabilities.

Also, the introduction of capital into the land of the Republic of Korea looks attractive.

Given that only 30% of the plains fall on the entire territory of Korea and the remaining 79% are mountains, the cost of land in Korea is high.

Some Koreans consider the most profitable way to invest is the purchase of a land plot for construction, since with an obvious deficit of land suitable for construction, you can not only save, but also multiply your capital by many times.

Analysts of your chosen investment company will provide you with complete information about the state of the land market in Korea.

Also, they will develop for you an individual scheme for the introduction of your funds into the land of the Republic of Korea.

Korea is currently a strong country with a stable economic and political situation.

Like Japan, Korea is a democratic country which guarantees non-Koreans certain rights over property, land and other assets.

Despite this, it isn’t easy for non-Koreans to do certain types of investments, such as business, land and property acquisitions, without a lot of knowledge of Korean culture and language.

Therefore, investing in Korea through the equities markets can be a more convenient way to invest.

The Korean Kospi index has done better than the Japanese Nikkei in recent decades, but has had its ups and downs like all markets:

Investing in Vietnam

Many onlookers expect Vietnam to become the next China, with some seeing parallels in Ho Chi Minh City and Shanghai’s growth.

Due to the trade war between China and the US, Vietnam was also benefiting from factories moving.

The current trend of localisation after coronavirus, where some countries are looking to move operations back home for risk and environments reasons, might harm this development though.

Vietnam’s economy is at the stage of effective development and needs additional foreign investment, and it will be interesting to see if coronavirus will affect this.

In addition to manufacturing other industries are developing too, such as tourism, construction, chemical production of goods and the extraction of certain types of natural resources are actively developing.

If you are interested in Vietnam as a country for investment, it will be good if you get acquainted with the peculiarities of the legislation of Vietnam and the nuances in concluding sales and investment transactions.

Like China, Vietnam isn’t a democracy, and this adds legal risks for investors.

The area for investment in Vietnam is striking in its diversity. The most popular areas for investment are land and real estate, the construction of public facilities, the purchase of securities from manufacturing enterprises in Vietnam, and the extraction of natural resources such as phosphates, bauxite, chromite, coal, manganese, and subsea oil and gas.

While Vietnam’s natural resources are not particularly diverse, the area is nevertheless in high demand among investors.

Buying securities of enterprises, companies, factories in Vietnam is one of the most profitable options for increasing your capital.

The industry of manufacturing and exporting goods is the most important component of the Vietnamese economy.

Vietnam produces and supplies seafood, rice, coffee, rubber, clothing, footwear, and a host of other consumer goods. Almost all countries of the world use Vietnamese-made products.

From this it follows that the enterprises of Vietnam for the production of industrial goods bring very high profits to the state and their owners.

In addition, Vietnamese legislation provides for many benefits and privileges for foreign investors, which provokes a very high interest among investors in this country.

Another popular area for investing in Vietnam is the purchase of real estate, land and construction in Vietnam.

You can choose an excellent option for residential or commercial premises in various locations and can purchase a wonderful apartment, house, hotel or villa in the resort areas.

A number of hotels and houses in the coastal area will open for you wonderful places and magnificent views of the bays of the South China Sea, which are very popular among tourists.

Like much of Asia, the price of land and property is very expensive now in Vietnam. So it might be profitable but the risks are high.

The Vietnamese Stock Market is relatively new and more risky than many.

Investing in Thailand

Thailand, like China, is now a mid-income country as opposed to a pure developing market like it was in the 1990s.

Along with the developed tourism sector, Thailand has a steadily developing economy.

The economically stable situation in the country attracts a large percentage of investments from other countries.

In recent years, its real estate market has suffered, and tourism has been hit by the coronavirus pandemic.

There could therefore be a lot of bargains to be had in 1-2 years time.

There are other ways to invest in Thailand. Buying securities/shares of Thai companies can be a profitable way to increase your capital, but does come with significant risks compared to investing in US Stock Markets.

You can purchase securities of both heavy industry enterprises (extraction and processing of natural resources) and light industry enterprises.

Both areas of industry are quite developed and consistently generating income and dividends.

In terms of real estate, there is a big difference between the capital Bangkok, which these days looks similar to any other main capital with its skyscrapers, and smaller towns and beach resorts.

Investing in China

China has had one of the world’s fastest growing economies in the last few decades.

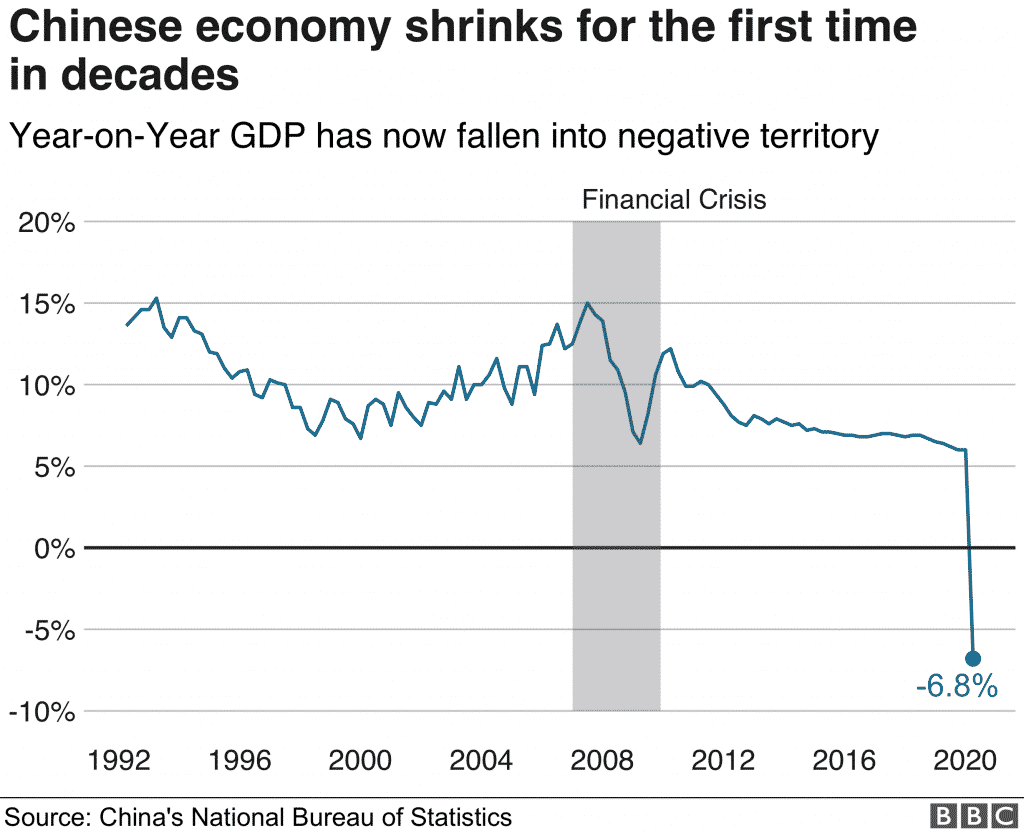

China was slowing down in the last ten years, and recorded its first drop in GDP in decades:

China’s economy is expected to keep slowing down in the coming ten years.

The question is, does this mean that investing in China is now a bad idea?

Nobody knows is the short answer. What we do know is that opportunities and threats persist.

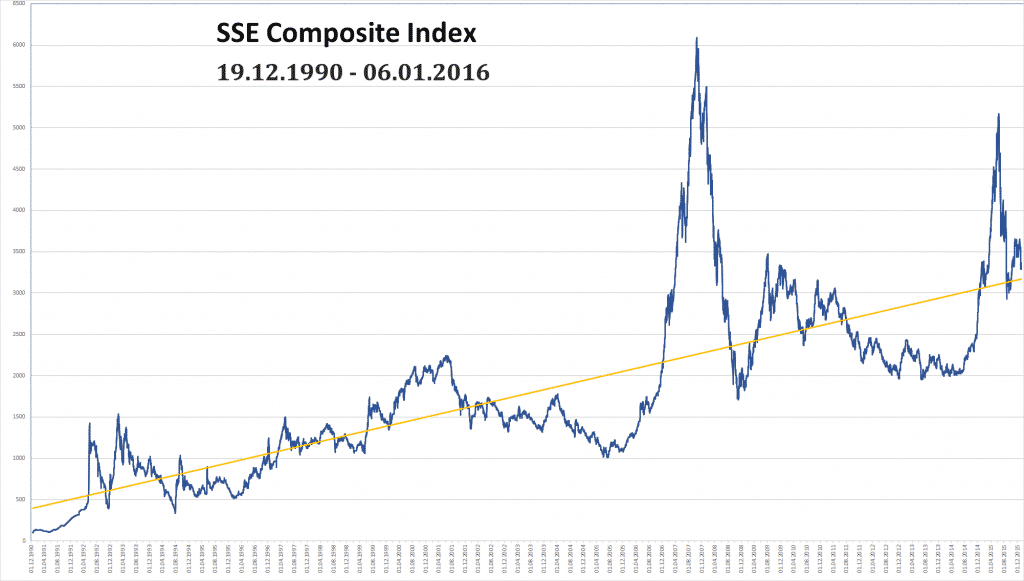

On the opportunities side, Mainland Chinese equities have been the worst performing major stock market since 2006.

This means that Mainland stocks are relatively undervalued compared to most other markets:

However, stock markets might not always be efficient, but they aren’t stupid either.

Investors, including institutional ones such as banks and hedge funds, are factoring in the risks (political and economic) of investing in China.

When we come to real estate, Chinese residential and commercial real estate saw huge rises after the 2008-2009, due to the Chinese Government’s stimulus packages.

Like South Korea, this means that rental yields are as low as 1% these days.

Unlike South Korea, China also restricts what types of property non-Chinese can purchase.

It is in business investments that many foreigners have made money in China.

The extraction and export of iron, manganese, vanadium, titanium, tungsten, tin, antimony, zinc, lead, mercury and rare earth metals have made China one of the world’s leading exporters of natural resources and minerals.

Investments in this area, alongside consumer goods servicing the middle-classes, has benefitted some foreign investors in the past.

Right now though the big threat is political. Due to the trade war and coronavirus situation, countries are increasingly picking between the US and China.

This has resulted in more restrictions on Chinese firms like Huawei and others.

It wouldn’t be surprising if China retaliates by imposing their own restrictions on foreign investors.

In general then, China is a much riskier investment these days compared to the 1990s and 2000s, when real estate was much cheaper and the business environment more open to foreign investors.

Investing in Myanmar/Burma

Myanmar only opened up relatively recently to foreign investors.

Located in Southeast Asia and bordering Thailand, Myanmar has a climate and landscape similar to it.

Despite the low standard of living in the country, in recent years there has been an active growth in the economy and industry of Myanmar.

In addition, Myanmar’s tourism industry is also actively developing, with strong growth before the global health pandemic struck.

At the stage of economic development, Myanmar is in dire need of attracting foreign investment.

Therefore, it isn’t surprising that the country is more open to foreign investment compared to China.

Myanmar’s laws allow foreigners to freely purchase real estate and land in the country, and also provide various benefits when buying.

Investments in Myanmar are aimed at the long term, but the good thing is that investment objects do not require significant investments.

Property and land prices in Myanmar have gone up a lot in the capital, but some bargains can be found in rural areas.

Therefore, investing in Myanmar can be suitable for people with small initial capital, and who are also open to taking risks.

Business investments can be profitable in the country, including investing money in mining.

In Myanmar, precious and semiprecious metals and stones are actively mined: gold, silver, rubies, sapphires, topaz, jade.

Investing in the mining of Myanmar consists not only in investing in the development of mining and processing enterprises, but also in the purchase of securities of these enterprises.

The state of Myanmar is actively developing the forest industry, the agricultural sector and the export of natural resources. Myanmar is teeming with forests in which rare species of trees such as teak are found in large quantities.

Myanmar is the leading exporter of teak, with over 75% of the world’s teak reserves located in this country. The agricultural industry is the main component of the economy of the state of Myanmar. Agriculture generates high GDP and employs over 70% of the population of Myanmar.

Myanmar supplies rice and bean crops, seafood and fish, timber, semi-precious stones and minerals to the world market. The country’s light industry includes clothing, footwear, home textiles, plastic and rubber products.

The Yangon Stock Exchange was only founded in 2015. Investing in stocks in Myanmar is significantly more risky than in most countries around the world.

Final opinion about investing in Asian countries

We need to separate real estate, land, stock and business investments.

In most countries in the Asia-Pacific, real estate and land prices have been going higher for decades.

This has led to a situation where valuations are too high. So high, in fact, that renting can be much cheaper than buying.

So buying real estate is a high-risk game in the region, especially as a foreigner, and often you aren’t given a discount on that risk.

There are exceptions to that generalisation. Some bargains can still be found in Cambodia even though the condo market has been in a bubble.

Business investments can be profitable in the region, as can stock market plays.

Probably the safest play is via long-term buy and hold stock market investments into the indexes of the region.

Japanese equities have lagged for decades, which gives investors an opportunity.

As you can get access to the region through MSCI World, and indeed the US Stock Markets give you access to emerging market growth, you don’t always need to invest money locally.

There is no correlation between GDP growth and the stock market, as China’s recent past shows.

This illustrates why it is important not to assume that the Vietnamese and other fast-growing economies will see their stock markets skyrocket.

Further Reading

I am one of the most read Quora writers in the world, with over 210 million answer views.

In the following answers I spoke about:

- What habits and mindsets are needed to become a successful business owner or investor?

- What are some of the things that the average person gets wrong about investing? I look at the 1990s to explain an important concept.

- Why do many people hate successful people? What does it show about them?

- Everybody makes mistakes – poor and rich people. Yet what mistakes are poorer people more likely to make, and make specific mistakes are richer people more inclined to make? Also, is it possible that some people that have relatively poor salaries are actually quite wealthy?

Here is a snippet of one of my answers about the mistakes people make investing:

In the 1990s, there were plenty of people who made a lot of money from picking individual stocks.

I remember I met an American guy when I was on holiday in Cambodia.

He was siting next to me on the bus back from the capital, Phnom Penh.

He admitted to me that he made a lot of money trading stocks in the 1990s, but it was probably luck, as shown by the 5 years after that (2000–2005).

So, he now admits it was luck, but back then, he saw things differently – it was all his knowledge and foresight you see.

We see similar trends in 2020:

Markets have had a pretty good 2020, despite the craziness in the middle.

The Dax in Germany is at records, as is MSCI World and all three major US Markets indexes.

The S&P500 is up over 10%, with the Nasdaq rising about 40%, from just over 9,000 on January 1, to close to 13,000 today.

What’s more, it has almost doubled since the worst of the crisis in March, and some individual stocks have risen by incredible amounts.

Tesla is up by 7-fold, with some tech stocks up more than 10-fold.

All of this has resulted in some market timers and stock pickers having an even better year than the average buy and hold investor.

I put some in bold because many market timers simply panic sold when markets crashed earlier this year, yet again.

The point is though, short-term performance is no indication of a longer-term trend.

Stock pickers have a 20% chance of beating the S&P500 over 5 years, and well over 30% in any given year.

If you stock pick for decades, you will beat the S&P500 very easily some years, and probably even manage to do it for 5–10 years.

Yet if you continue for an investing career, your chances fall to about 2%-5%.

Beating the S&P500 or even MSCI World over a 40-50 year career if you start investing from your 20s, is very difficult indeed.

Yet few have the foresight to see this. The thinking is that the recent past will replicate itself (recency bias).

You see the same pattern when it comes to things like gold and unfashionable markets like Japan.

People become interested in gold once a decade or so, when it is in a bull market.

They have only recently become interested in Japan and emerging markets, after both have started to perform well in the last year.

Every dog has its day in investing, which is why putting 100% in a “hot” sector seldom makes sense.

Many people have also recently put 100% in US Markets, even non-Americans, because of the recent performance.

Whilst this isn’t a big issue as the US markets are global in nature, international markets also regularly outperform US ones, as they did from 2000 until 2008.

To read more click below.