Outlook in Uganda 2026: Opportunities and Risks

Uganda outlook for 2026 shows the country is poised for growth driven by oil production, expanding agriculture, and a rising services sector, though investors must

Uganda outlook for 2026 shows the country is poised for growth driven by oil production, expanding agriculture, and a rising services sector, though investors must

The UAE Golden Visa offers long-term residency for expats and international investors, granting the ability to live, work, and invest in the UAE without a

UN pensions are generally considered strong and reliable, providing staff with predictable lifetime income, survivor benefits, and disability coverage. They are fully funded, professionally managed,

Foreign residents can open a NISA in Japan to invest tax-free in stocks, ETFs, and mutual funds. NISA allows capital gains and dividends to grow

NISA contributions are not tax deductible in Japan. While NISA allows your investments to grow tax-free, it does not reduce your taxable income. This article

NISA allows tax-free investing with anytime withdrawals, while iDeCo locks your money until retirement but offers tax-deductible contributions. Choosing between them depends on whether you

iDeCo Japan is a private retirement savings account in Japan designed to help residents build long-term wealth for retirement. Contributions are tax-deductible, investments grow tax-deferred,

DIFC vs IFZA boils down to a choice between a globally regulated financial hub (DIFC) and a low-cost, flexible, all-sector free zone (IFZA). DIFC appeals

In comparing DIFC vs DMCC, DIFC is better suited for financial institutions, investment firms, and wealth management businesses, while DMCC is ideal for trading, property,

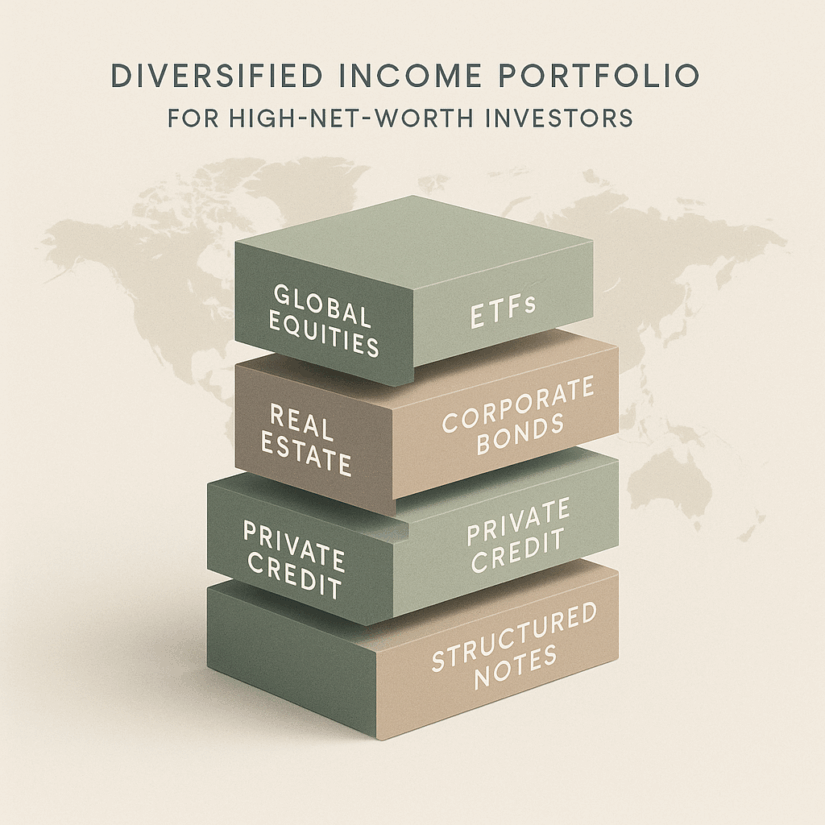

Expats and high-net-worth individuals have several income options than just cash and government bonds. Modern portfolios mix dividend-paying global stocks, income-focused funds and ETFs, and

DIFC suits businesses that want a mature, globally connected financial center, while ADGM is better for those seeking competitive costs, easier regulation, and strong fintech

The temporary non-residence rule in the UK determines how certain UK taxes, especially Capital Gains Tax, apply to gains made while living outside the UK.

The top ten livable cities for expats in 2026 are led by global hubs like Switzerland, Denmark, and Austria, which offer the strongest mix of

Top places to invest in 2026 include jurisdictions like Singapore and Switzerland, offering political stability, robust financial infrastructure, and access to global markets. Expats and

The best investment in the UAE in 2026 combines strong returns, stable growth, and exposure to emerging sectors like real estate, technology, and renewable energy.

The cheapest passports to buy in 2026 are Sao Tome and Principe, Nauru, and Vanuatu. For expats seeking a more structured residency pathway, Paraguay offers

Offshoring assets will become more attractive. Rachel Reeves announced tax increases in her recent budget. Perhaps unsurprising when she wrote a book titled The Women Who

Offshore bonds offer tax-deferral, flexible withdrawal options, and estate planning benefits. They are investment wrappers issued outside an investor’s home country, typically via life-insurance style

A crypto trust is a legal entity that holds and manages cryptocurrency on behalf of its beneficiaries. It allows you to secure, control, and plan

Putting crypto in a trust allows you to legally transfer, secure, and manage your digital assets through a formal estate planning structure. It also helps

Spain has officially ended its Golden Visa program, leaving non-EU nationals seeking residency and citizenship to explore alternative pathways. These Spain Golden Visa alternatives include

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

Gain free access to Adam’s two expat books.

Gain free access to Adam’s two expat books.

Get more strategies every week on how to be more productive with your finances.