Capital.com is a multinational CFD broker, which also offers commission-free stock trades in some countries.

This broker is headquartered in Cyprus and has clients in numerous countries.

Today, we will have a detailed overview of this CFD broker, which would include all the information an investor needs.

This article is here for informational purposes only. Nobody should invest, or not invest in capital.com, based on this article alone, and you should you your own research.

Some of the information might also be outdated, even though we will sometimes update the article.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837)

Capital.com Account Opening

The process of opening an account at Capital.com is straightforward. The process happens to be relatively easier compared to most other brokers.

Except for a few countries, which include the United States, most countries can access the services offered by Capital.com.

In general, new members would have to fill out the registration form, which will be verified as quickly as possible (mostly 1 day).

Following that, you can make your first deposit, which typically starts from $20, and start trading.

So, given below are the main account types being offered to the clients at Capital.com.

The Standard Account

This is the account type being offered for beginners at Capital.com. This account type comes with a maximum leverage of up to 1:30 and spreads beginning at 0.6 pips.

There is no specific requirement for any minimum deposit, yet it has been suggested to keep at least $20 in the account.

The Plus Account

This is a popular account type at Capital.com and it has a minimum deposit requirement of $3,000.

The maximum leverage and spreads of the plus account are pretty much the same as the standard account.

The Premiere Account

This account type is for experienced traders and the minimum deposit requirement is set at $3,000.

The maximum leverage and spreads of this account are the same as the standard account and plus account.

The Invest Account

This account is generally targeted toward investors and offers different types of features such as:

— Fee-free stock investment service

— Tight spreads

— No commission

— No transaction fees

— No mark-ups

This account also allows European traders to trade with stocks and shares with the help of market data obtained from exchanges.

These accounts are offered by Capital.com under two categories, i.e., “Retail” and “Professional”.

Retail Clients

For a retail account, the minimum deposit is low, forex CFD fees are low, and accessibility toward commission-free stocks is provided.

In layman’s terms, beginner-level traders should try to opt for Retail type accounts, especially the Standard (retail) Account.

Professional Clients

To become a professional client of Capital.com, the criteria is as follows.

— The client must have had 10 trades, which should be of a significant amount (must be in the previous quarter).

— The portfolio of the client should exceed €500,000.

— The client should have worked in the financial sector for at least one year.

Those who become professional clients at Capital.com, get access to higher leverage. There is also a negative balance protection up to 1:50 with professional accounts at Capital.com.

Corporate Account

However, there is also the availability of a corporate account, which is aimed at corporate clients.

To apply for a corporate account, one must get in contact with the customer support team of Capital.com.

Demo Account

For the convenience of beginners, Capital.com does offer a demo account so that the trader can practice.

Using the virtual funds provided within a demo account, beginner-level traders can improve their skills.

Individuals who wish to compare this trading platform with other brokers may also find the demo account useful.

Experienced traders who intend to try out their trading strategies in a live environment can also benefit from this.

Islamic Account

There is no dedicated Islamic account offered by Capital.com.

Clients can convert their live trading account into an Islamic account or apply for a standalone account with a separate application procedure.

This account exempts the traders from overnight fees or interests. But the features of an Islamic account such as minimum deposit, spread, etc., may differ compared to other individual account types.

Kindly get in contact with the support team of Capital.com to know about the exact information related to an Islamic account.

Capital.com Base Currency

Unless you have a trade in the same currency as the account’s base currency, you might be subject to a conversion fee.

This issue can be easily resolved by getting a multi-currency bank account at a digital banking service provider.

That being said, the base currencies at Capital.com are USD, GBP, EUR, PLN, and AUD.

Capital.com Deposits and Withdrawals

Deposits

At Capital.com, the minimum deposit amount is $20, which is mandatory for you to start trading.

However, Capital.com does offer the flexibility of withdrawing your funds any time you want.

The payment methods available for making a deposit at Capital.com are Bank transfers, credit cards, debit cards, Apple Pay, and PayPal.

You should note that the minimum deposit for bank transfers is set as $250. Deposits do not require any additional charges, but you can only deposit from accounts in your name.

Withdrawals

The methods available for withdrawals at Capital.com are the same as those available for deposits.

The withdrawals are also free but can only be made into accounts under your name.

Capital.com Fees

Fees charged by Capital.com are considered to be below average compared to the competitors.

Forex fees

To know the trading fees at Capital.com, let us start by knowing about the forex fees, which are known to be low. Let us see some examples.

Note – Forex trading at Capital.com can only be done with the help of CFDs.

For EUR/USD, the fees are built into the spread and the average is 0.6 pips during peak hours.

For GBP/USD, the fees are built into the spread and the average is 1.3 pips during peak hours.

For a $20,000 trade with a leverage of 30:1, the forex fees are as follows.

EUR/USD benchmark fee – $13.1

GBP/USD benchmark fee – $7.8

AUD/USD benchmark fee – $9.4

EUR/CHF benchmark fee – $3.2

EUR/GBP benchmark fee – $12.4

CFD fees

The CFD fees are also low at Capital.com. Let us see some brief details on commissions and spreads for different assets. Let us see some examples.

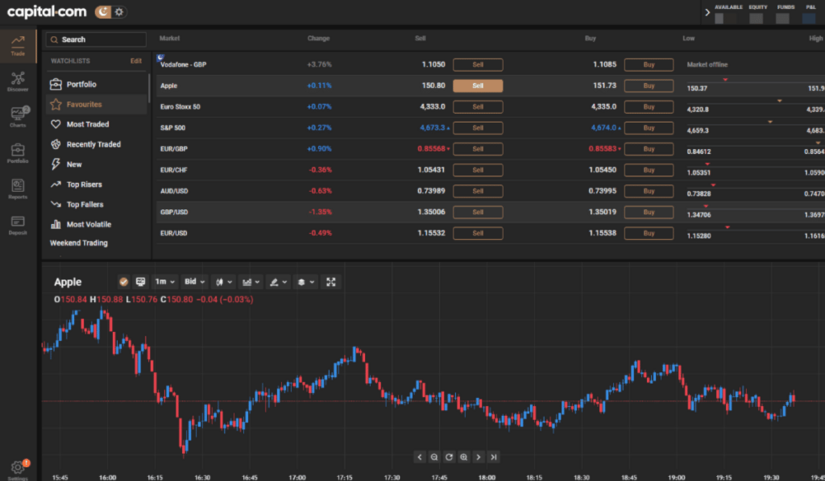

Considering the stock index CFDs, the spreads and commissions at Capital.com are as follows.

For the S&P 500 CFD, the fees are built into the spread with an average of 1.1 points during peak hours.

For Europe 50 CFD, the fees are built into the spread with an average of 2.2 points during peak hours.

Considering the stock CFD, the spreads and commissions at Capital.com are as follows.

For the Apple CFD, the fees are built into the spread with an average spread cost of 0.1 during peak hours.

For the Vodafone CFD, the fees are built into the spread with an average spread cost of 0.3 during peak hours.

Based on a $2,000 trade using 20:1 leverage for stock index CFD, the CFD fees are as follows.

S&P 500 index CFD – $2.5

Europe 50 index CFD – $4.3

Apple CFD – $0.7

Vodafone CFD – $0.1

Financing rates

The financing rates at Capital.com are average and can sum up to a significant part of the trading costs when the position is held for a long time.

The general financing rates at Capital.com are provided below for reference. These rates are determined as daily overnight rates and are charged only for the leveraged amount.

EUR/USD financing rate – 3.1%

GBP/USD financing rate – 1.4%

S&P 500 CFD financing rate – 5.1%

Europe 50 CFD financing rate – 4.4%

Apple CFD financing rate – 2.3%

Vodafone CFD financing rate – 10.2%

Non-trading fees

At Capital.com, there are no deposit fees, withdrawal fees, account fees, or inactivity fees.

Capital.com Trading Platforms

There are three types of trading platforms available for trading with Capital.com, which are:

— Mobile Application

— Web Trading Platform

— Desktop Trading Platform

The mobile platform is the broker’s very own smartphone application, which is said to possess a great interface.

For those looking for a web-based alternative, there are three options available with Capital.com. The first one is the broker’s proprietary web-based trading platform, the second one is MetaTrader4, and finally, there is TradingView.

For UK clients, the MetaTrader4 platform is not available with Capital.com.

Desktop trading is also done through MetaTrader4 while trading with Capital.com.

Most of the details and information in this post are relevant to the broker’s web trading platform. This is because most traders usually opt for a web platform rather than the other two platforms available.

Capital.com Products and Markets

You should know that Capital.com is a dedicated CFD broker, and it may not be ideal if you want to trade other assets.

Even though you get access to assets such as forex, it can only be done through CFD trading.

Depending on the country, you may get access to trade with real stocks and real ETFs with no commissions. This is mostly for the clients of Capital.com who are from Europe and the UK.

Those who qualify for stock trading can access the markets of the US, the UK, France, Germany, Spain, Italy, and the Netherlands.

UK investors do get access to spread betting, but they can’t invest in crypto CFDs.

The number of products available for trading at Captal.com have been mentioned below.

Currency pairs – 138

Stock index CFDs – 26

Stock CFDs – 5,430

ETF CFDs – 150

Commodity CFDs – 48

Cryptocurrencies – 490

Research

This broker is known to offer some extensive charting tools on the web-based version. The tools are simple and easy to use while having accessibility to several technical indicators.

The news fees offered by Capital.com is also said to be great, which can be accessed through the “Discover” feature available.

Information related to most traded assets, most volatile assets, and other trading statistics are also made available.

This broker does not offer any fundamental data, which would have been great if provided.

Trading ideas, which are the recommendations from analysts are also available. These recommendations include the data such as the buying, selling, and holding of an asset.

Capital.com TV offers information related to market events and assets, which is also available in the “News and Features” area.

Education

Capital.com offers various educational resources to its clients such as articles, videos, lesson program, and a demo account.

The comprehensive lesson program consists of 28 lessons with five different courses. There will be a final test in this program in order to determine the client’s progress and level of financial knowledge.

The Investmate application is a fun way of learning at your own pace while tracking progress. This mobile application offers a simple interface and a great user experience.

There is no need to get a trading account to access the educational videos offered by Capital.com as they are available on YouTube.

Some of these videos are embedded in the web trading platform of Capital.com.

There are 10 written guides available, which have been deemed informative and in-depth. Several important topics such as CFD trading and trading psychology have been included in these guides.

Some of the important educational features provided by Capital.com have been listed below.

— Forex/CFD education

— Client webinars

— Beginner trading videos

— Advanced trading videos

— Investor dictionary

Concluding what I have said now, Capital.com can be considered effective in terms of its educational resources.

Capital.com Customer Service

Unlike most conventional brokers who have limited options for contacting customer support, Capital.com offers various options.

The methods available for getting in touch with the support team at Capital.com are as follows.

— Live Chat

— Email

— Phone

— WhatsApp

— Telegram

— Facebook Messenger

— Viber

The customer service team is known to provide a quick response with relevant solutions to the client’s issues.

However, Capital.com doesn’t have the availability of 24/7 support, which would have been great if provided.

Safety

Capital.com is regulated by reputable authorities all over the world, which makes it a safe broker.

Depending on the country of your residence, you may even get investor protection, which is as follows.

UK – up to £85,000.

EU (excluding Belgium, Cyprus, and Norway) – up to €20,000.

The authorities that regulate Capital.com are listed below.

— Financial Conduct Authority (FCA)

— Australian Securities and Investments Commission (ASIC)

— Cypris Securities and Exchange Commission (CySEC)

— Financial Services Authority of Seychelles (FSA)

All the clients of Capital.com are offered negative balance protection.

Out of 8,556 reviews it has received on Trustpilot.com, it was able to get a 4.3-star rating out of 5.

Some reliable internet sources have provided the following ratings for Capital.com.

— TradersUnion – 7.2 out of 10

— BrokerChooser – 4.6 out of 5

— Trustpilot – 4.3 out of 5

— ForexBrokers – 4.5 out 5

— Investing.com – 5 out of 5

Based on these ratings, we can safely come to a positive conclusion about the broker.

Capital.com Pros and Cons

Pros

— Fast account opening process.

— Minimum deposit starts from $20.

— Accessibility to a wide range of trading assets (mostly CFDs).

— Lack of non-trading fees.

— Trading fees are minimal.

— Excellent educational resources.

— Safe and reliable.

— Investor protection.

— Great charting tools.

— Excellent resources for market analysis.

— Availability of a demo account.

— Tight spreads.

— Fast order execution.

— Regular live updates and price alerts.

— Multiple deposit and withdrawal options.

— The clients’ funds are held by Capital.com in segregated accounts.

— Multilingual support.

Cons

— Does not accept U.S. clients.

— Charges overnight fees.

— MetaTrader5 is not available.

— Apart from FCA and ASIC, it lacks additional licenses in Tier-1 regulatory jurisdictions.

— Higher minimum deposit when you opt for deposit through bank transfer, i.e., $250.

— Lack of certain investment programs such as copy trades.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.