Can I invest in ISA UK if living abroad?

Can I invest in ISA UK if I live abroad? Definitely. We’ll discuss that here and other relevant matters, including: This article is mainly for

Can I invest in ISA UK if I live abroad? Definitely. We’ll discuss that here and other relevant matters, including: This article is mainly for

The type of business being formed and the services offered can affect the cost of opening a company in Panama. Interested in starting a business in

A person’s legal status and tax responsibilities are largely determined by their place of residence. Individuals are permitted by UK domicile of choice to shift

There are several advantages to opening an offshore USD account, particularly for people and companies who want to handle their money abroad. Documentation must be

There are many deliberations that come into play for retiring abroad: affordability, quality of life, environment, healthcare options and accessibility, among other things. So, where

This post will give an overview of what is CARF, its scope, reporting rules, and effectivity. I will mainly focus on three talking points: Because

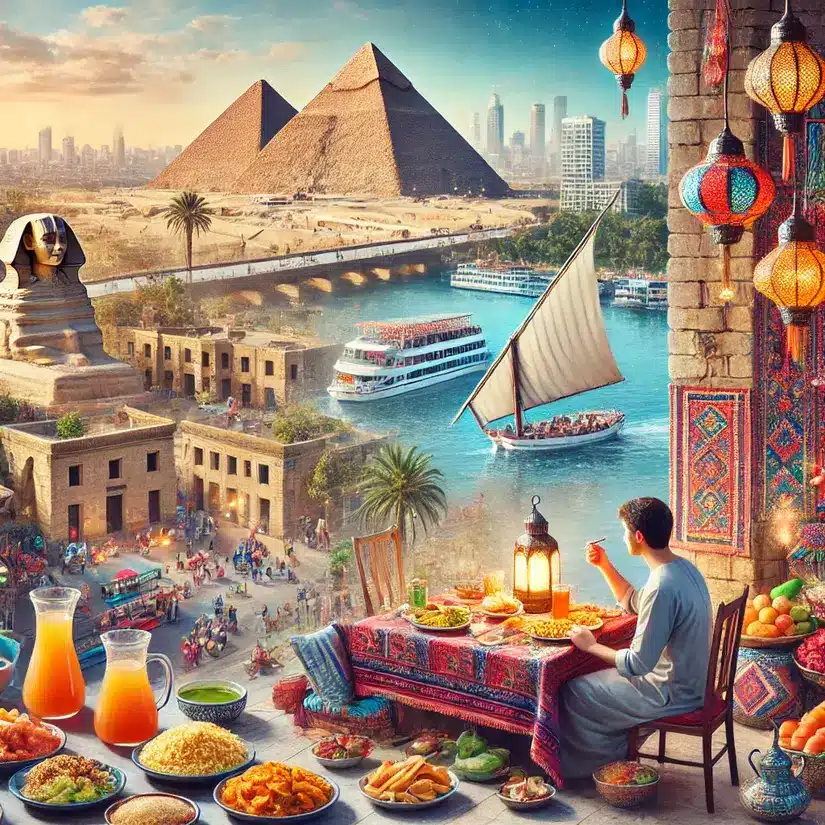

Egypt’s famous sites and reasonably priced lifestyle draw in a lot of foreign nationals. They might, however, have difficulties adjusting to cultural differences, negotiating governmental

First, can foreigners work in Taiwan? Of course. In fact, Taiwan was home to more than 850,000 foreign nationals in 2023 as per Statista. The

Let’s get familiar with MM2H Malaysia new rules issued in 2024. In an attempt to attract high net worth individuals, the Malaysia My Second Home

Can a non UK resident open a savings account overseas? This post will explain offshore savings accounts for non-UK residents and how they can be

While it’s eventually up to you to decide what the best places to live in Italy are based on your preferences, we’ll list some options

Perhaps you’ve heard of the more well-known and well-adopted NHR program in Portugal. This post will focus on the NHR regime in Cape Verde or

“Can I withdraw money from SRS account?” is not an unusual concern among expats looking to access their funds. Withdrawing funds from this account might have

Expat Banking in the UK 2024: Updates, Outlook

What Happens to My US Investments if I Move Abroad?

Can Canadian expats still make RRSP contributions?

Can I keep my savings account if I move abroad?

In this post, we’ll answer: do expats pay tax on UK pensions? Expats may have to pay taxes on their UK pensions. Tax implications vary

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

Gain free access to Adam’s two expat books.

Gain free access to Adam’s two expat books.

Get more strategies every week on how to be more productive with your finances.