Expat Estate Planning in 2026

Using trusts and international wills is a key strategy to safeguard assets and streamline estate planning for expats in 2026. With changing estate, gift, and

Using trusts and international wills is a key strategy to safeguard assets and streamline estate planning for expats in 2026. With changing estate, gift, and

A crypto trust is a legal entity that holds and manages cryptocurrency on behalf of its beneficiaries. It allows you to secure, control, and plan

Putting crypto in a trust allows you to legally transfer, secure, and manage your digital assets through a formal estate planning structure. It also helps

Using offshore companies for crypto is one of the most effective ways to protect digital assets, optimize tax exposure, and operate in clearer regulatory environments.

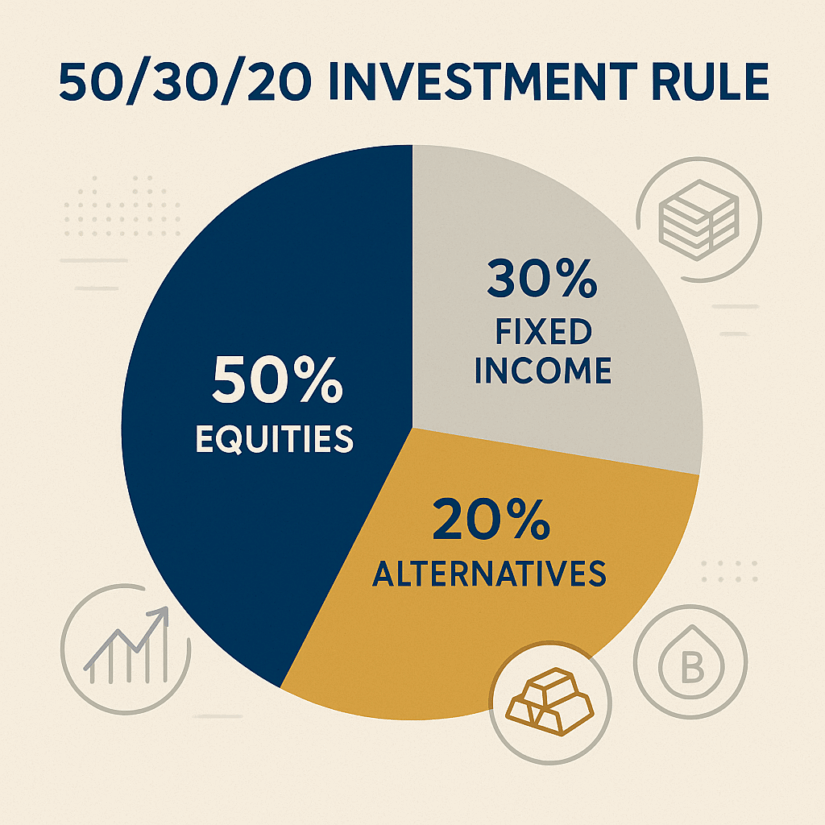

The 50/30/20 rule for allocating assets offers better diversification, downside protection, and risk-adjusted returns than a traditional 60/40 portfolio. By slightly reducing equities, keeping a

Offshore crypto security is critical for high-net-worth investors who want to protect crypto offshore using cold storage, multi-signature wallets, and legal structures. Wealthy investors and

Cold storage remains the best crypto asset protection in 2026 for safeguarding significant digital wealth. High-net-worth investors also rely on multi-signature wallets, institutional custodians, and

Asset protection strategies in 2026 focus on stronger legal structures, offshore diversification, and lawsuit-resistant entities. Rising litigation risk, global tax shifts, and government scrutiny are

Expat wealth management trends in 2026 are increasingly driven by AI-powered investment tools, ESG-focused portfolios, and cross-border tax optimization strategies. Expats are no longer relying

A trust allows you to manage how and when your assets are distributed, even after death or if you become incapacitated. Choosing a trust instead

The best offshore trust jurisdictions in 2026, such as the Cook Islands and Jersey, offer strong legal protections, privacy, and reliable administration for expats and

To set up a Cook Islands trust in 2026, you have to start with appointing a licensed trustee, drafting a trust deed, and transferring your

Many investors wonder if offshore trusts are still effective under CRS — and the answer is yes, but with limitations. While they no longer provide

Resettling a trust means making such major changes to its terms, beneficiaries, or structure that it’s legally treated as a new trust. It effectively ends

Decanting a trust is the process of transferring assets from an existing trust into a new trust, often with modified terms, to better meet the

Setting up a foundation in Liechtenstein means creating a separate legal entity to hold and manage assets according to specific purposes, whether private or charitable.

To set up a Cyprus trust, you must appoint a trustee and create a legally binding trust deed outlining the management of assets for beneficiaries.

To set up an SPV in South Africa, you need to start by choosing the right legal structure, typically a private limited company under the

Alternatives to DIFC foundation, such as ADGM and RAK ICC foundations, offer comparable asset protection and succession planning benefits under different UAE jurisdictions. These structures

The DIFC foundation checklist includes essential requirements such as appointing a registered agent, securing a DIFC-based registered office, naming the foundation in line with DIFC

Downside protection in investing refers to strategies designed to limit potential losses when markets fall. It does not eliminate risk entirely but helps cushion the

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

Gain free access to Adam’s two expat books.

Gain free access to Adam’s two expat books.

Get more strategies every week on how to be more productive with your finances.