How to Set Up a Family Office in India

Setting up a family office in India means choosing the right structure, building a professional team, and meeting the scale to manage wealth, tax, and

Setting up a family office in India means choosing the right structure, building a professional team, and meeting the scale to manage wealth, tax, and

Over the years, the term “offshore” has also become unfortunately associated with tax evasion and financial scandals. As a result, many people ask a deceptively

Yes, offshore accounts are legal in almost all jurisdictions—provided they are used transparently and reported in accordance with applicable tax and financial disclosure laws. An

To be straightforward: No, trust funds are not only for the rich. While often associated with wealthy families and elite estate planning, trust funds are

A trust fund is a financial and legal arrangement that allows a person (the settlor) to transfer assets into a formal structure, where they are

Trusts can be classified based on when they take effect, how much control the grantor retains, and the purpose they serve. The main types include

A family trust is a legal arrangement in which assets are transferred by a settlor to a trustee, who manages and holds them for the

A family trust is a legal structure designed to hold and manage assets on behalf of members of a family. It is widely used as

Trusts are powerful tools for managing, protecting, and transferring wealth. Used by individuals, families, and institutions worldwide, they offer flexibility for estate planning, tax structuring,

The 72 rule in wealth management is a simple yet powerful formula to estimate how long it takes for an investment to double, based on

It’s never too late to build wealth. To do so, you need more than just a high income. It’s about making smart financial decisions that

Can you borrow against assets? Yes, and it’s a strategy used by many expats, investors, and business owners to unlock liquidity without selling. Borrowing against

Yes — it’s possible to legally avoid probate on bank accounts, especially with the right estate planning strategies. For expats and high-net-worth individuals, failing to

Probate is the legal process of administering a deceased person’s estate, and when property is involved, it can become especially time-consuming and costly. Many property

Avoid probate in the UK to save your loved ones time, money, and stress after your passing. This legal process can be lengthy, costly, and

Probate is the legal process of validating a will and distributing a person’s assets after death. In Thailand, while probate may not be as formalized

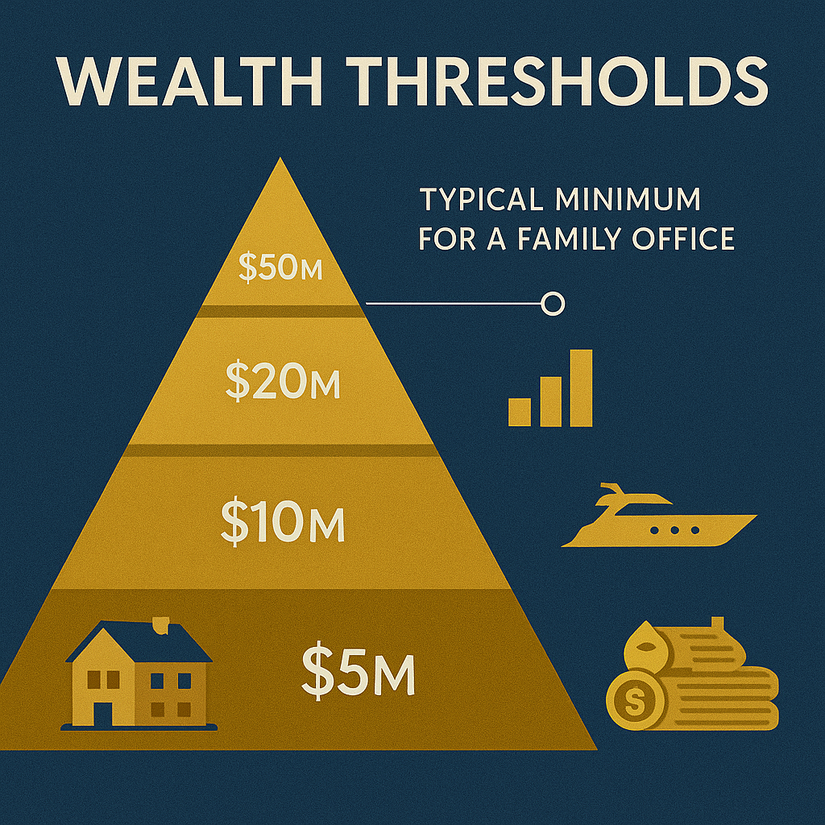

At a certain level of wealth, traditional private banking simply isn’t enough. Billionaires often face a different kind of financial complexity: multi-generational wealth planning, global

In recent years, Malaysia has emerged as a strategic location for high-net-worth individuals seeking to manage their wealth efficiently. The increasing complexity of global financial

A family office refers to a privately held company that handles investment management and wealth management for a wealthy family. According to Deloitte’s Family Offices

A trust is a legal arrangement where a settlor transfers assets to a trustee to manage for beneficiaries. The trust structure provides asset protection and

Hong Kong has emerged as one of Asia’s premier destinations for establishing family offices. It is known for offering a robust financial infrastructure and a

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

Gain free access to Adam’s two expat books.

Gain free access to Adam’s two expat books.

Get more strategies every week on how to be more productive with your finances.