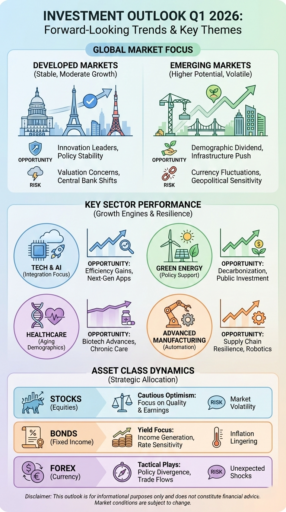

Investment outlook for Q1 2026 kicks off a turbulent but opportunity-filled investment landscape, where strategic choices could make the difference between strong gains and missed potential.

Investors face a mix of growth opportunities, market volatility, and shifting global trends.

This article covers:

- What is the market outlook for Q1 2026 across stocks, bonds, and forex?

- What to invest in in 2026 Q1?

- What is the EM outlook for 2026?

Key Takeaways:

- Emerging markets offer higher upside, developed markets offer policy-backed stability.

- Bonds deliver steady income; tech, AI, green energy, and healthcare lead growth.

- Macro trends, rates, and geopolitics will shape opportunities and risks.

- Diversify across developed and emerging markets to balance growth and stability.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What is the Outlook for Investments in 2026?

The investment outlook for 2026 suggests strong growth potential in some sectors like technology and renewable energy, while traditional safe havens like bonds are expected to deliver more conservative returns.

Investors are facing a year of contrasts in 2026.

Market volatility remains a reality, making diversification more critical than ever.

What is the Outlook for Emerging Markets in 2026?

The forecast for emerging markets in 2026 is positive but highly differentiated, with some economies positioned to outperform significantly while others face structural headwinds.

This market is forecast to deliver solid GDP expansion around 3.9% in 2026, outpacing developed markets and reflecting stronger consumer and investment activity in key regions.

India, in particular, remain a standout, with sustained growth above 6% thanks to manufacturing expansion, digital services, and rising exports.

China’s growth is moderating but still contributes meaningfully to regional performance.

Equity markets in emerging economies are also gaining traction: analysts at Goldman Sachs expect the MSCI Emerging Markets Index to offer further upside, supported by earnings growth that outpaces many developed peers.

Earnings in major EM economies are projected to grow in the mid‑teens, underlining the earnings momentum behind EM equities.

Structural growth drivers include:

- Higher earnings growth across technology, consumer discretionary, and financial sectors.

- Monetary easing prospects as inflation stabilizes and central banks in some countries consider rate cuts.

- Improving credit quality and attractive carry yields in fixed income and FX markets.

- Trade and supply‑chain diversification boosting exports beyond traditional markets.

That said, risks remain important for 2026 outcomes: inflation differentials, idiosyncratic currency volatility, and geopolitical pressures could slow investment flows.

Additionally, regions with weaker institutions or export dependence are more sensitive to global headwinds.

Overall, emerging markets are expected to grow faster than most advanced economies, driven by robust domestic demand, earnings growth, and supportive policy trends.

What this means for investors:

Emerging markets offer potential higher growth and diversification benefits, but success will be tied to careful country and sector selection, with emphasis on economies exhibiting stable policy frameworks, strong domestic demand, and consistent reforms.

Investment Outlook for Developed Markets

The outlook for developed markets in Q1 2026 is steady but uneven, with growth generally slower than in emerging economies and returns shaped by interest rate levels, inflation dynamics, and sector leadership.

Global investors are closely watching the US, Europe, and Japan, where fiscal stability and mature capital markets provide defensive anchors, but economic expansion is more measured.

Key points for Q1 2026:

- United States: GDP growth is projected at 2.4% in 2026, outpacing other developed economies, though the strength is concentrated in a few sectors like technology and services, making broad-based gains uneven.

- Europe: Growth in developed European economies is expected around 1.4% in 2026, supported by stabilizing domestic demand and labor markets, while geopolitical risks and energy costs may create selective opportunities.

- Japan: Real GDP growth is forecast at 0.7% in 2026, reflecting modest domestic demand and weak external trade, though certain sectors such as technology and exports offer pockets of potential.

Market positioning:

Developed markets are seeing moderate equity gains, with sectors tied to AI, industrial automation, and health care likely to outperform, while defensive areas like consumer staples and utilities provide income stability.

Bond markets in these regions continue to offer higher yields than in prior years, supporting balanced portfolio construction.

What this means for investors:

While emerging markets may offer higher growth, developed markets provide stability, liquidity, and policy predictability.

Q1 2026 favors selective allocation, combining equities in structurally strong sectors with income-oriented bonds, to manage risk without sacrificing returns.

What Are the Recent Trends in Financial Markets?

Recent trends in financial markets in early 2026 are defined by AI-led equity concentration, structurally higher interest rates, more disciplined sustainable investing, and heightened geopolitical influence on capital flows.

These shifts are reshaping how investors allocate capital across stocks, bonds, and alternative assets.

Key trends shaping financial markets in early 2026 include:

- Technology and AI-driven concentration: Artificial intelligence, automation, and cloud infrastructure continue to drive earnings growth, but gains are concentrated in a narrower group of companies and sectors, increasing market dispersion.

- Interest rate recalibration, not easing cycles: Central banks are holding rates at higher structural levels, resetting expectations across bonds and equities and elevating the importance of income and balance-sheet strength.

- Shift from ESG hype to ESG fundamentals: Sustainable investing is moving away from broad ESG labeling toward projects with clear regulation support, profitability, and measurable cash flows.

- Geopolitical fragmentation and trade realignment: Trade policy shifts, energy security concerns, and regional supply-chain restructuring are influencing sector performance and market stability.

What is the Current State of the Stock Market?

In early 2026, global equity markets show moderate gains with uneven sector performance, reflecting a transition from broad rallies to concentrated leadership and selective strength.

Analysts expect the S&P 500 to post low-to-mid double-digit returns this year, driven by persistent earnings growth and ongoing capital investment in key themes like artificial intelligence.

Market Outlook:

The S&P 500’s outlook for 2026 projects around ~10% gains, as earnings growth estimated at 13–15% helps underpin valuations despite macro uncertainties.

Which stocks are gaining traction in early 2026?

Investor interest is clustering around companies with durable earnings, AI-linked scale advantages, and structural positioning rather than short-term technical moves.

Current leadership trends include:

- AI and data infrastructure names, where hyperscale computing demand underpins margins and capital spending.

- Technology sector leaders whose robust earnings are being reinforced by accelerated AI adoption across industries.

- Healthcare and biotech innovators, driven by clinical breakthroughs and renewed M&A interest.

- Utilities and clean energy infrastructure stocks that benefit from energy transition demand and interest rate environments supportive of yield-oriented equities.

What this means for investors:

The stock market in Q1 2026 is not experiencing a blanket rally but rather tentative gains anchored in earnings growth and thematic leadership.

This environment rewards investors who emphasize sector positioning and fundamentals over broad index exposure, particularly as markets digest macro risk signals and evolving policy expectations.

Should I Take My Money Out of the Stock Market Right Now?

For most long-term investors, pulling money out of the stock market in early 2026 is generally not advisable.

Short-term market fluctuations are normal, and exiting entirely increases the risk of missing long-term gains driven by earnings growth and compounding.

The more effective approach is to align decisions with your investment horizon and risk tolerance.

Rather than reacting to volatility, many investors benefit from maintaining exposure while diversifying across sectors and asset classes, which helps manage risk without sacrificing long-term return potential.

What is the Bond Market Doing Now?

In early Q1 2026, the bond market is in a period of recalibration and elevated yields, with government and corporate debt reflecting a higher-for-longer interest rate environment that’s shaping returns and investor positioning.

Yields and valuations:

Benchmark US government bond yields have risen through late 2025 into early 2026, with the **10-year Treasury around the 4.2% range, one of the higher levels seen since 2025.

This signals that long-dated yields have repriced amid persistent inflation expectations and monetary policy uncertainty.

Long-term yield forecasts suggest that 10-year US Treasuries could average above 4% through 2026, while other developed market sovereigns such as German Bunds, are anticipated to hold elevated yields relative to recent years.

Government bonds:

Government bonds remain a core defensive asset, offering higher absolute yields than in earlier parts of the decade and attractive income for long-term investors while central banks calibrate policy.

However, prices are sensitive to shifts in rate expectations and macro data.

Corporate bonds:

Corporate debt is drawing investor interest.

Tight credit spreads and strong investor demand have kept yields attractive, with US investment-grade credit spreads recently at historically low levels (about 0.73 percentage points over Treasuries).

It’s the lowest since the late 1990s, reflecting confidence in corporate credit even amid volatility.

While spreads may widen modestly as the credit cycle evolves, many fixed-income strategists expect corporate bonds to deliver positive excess returns in 2026, particularly in the intermediate maturities (3–7 years), where income and duration risk balance favorably.

What this means for investors:

The bond market in Q1 2026 is best viewed through the lens of income and diversification, not price appreciation alone.

Higher yields make nominal returns more attractive than in recent low-rate years, but sensitivity to interest rate expectations and macro data means positioning, in quality government bonds for defense and corporate bonds for yield, remains key.

Is It Smart to Invest in Bonds Right Now?

Yes, for income-focused and risk-conscious investors, bonds are a smart allocation in early 2026.

With yields at multiyear highs, high-quality government and corporate bonds offer more attractive income and diversification benefits than in much of the past decade.

Bonds can help stabilize portfolios amid equity volatility, particularly for investors prioritizing predictable cash flow and capital preservation.

That said, interest rate uncertainty remains a near-term risk, and further policy adjustments could still pressure bond prices.

As a result, many investors are favoring short- to intermediate-duration bonds and higher-quality credit to balance income potential with rate sensitivity.

What is the GDP Growth Rate in 2026?

Global GDP growth is projected to be around 3.0–3.3% in 2026, reflecting a resilient world economy that continues to expand moderately despite inflationary pressures, trade tensions, and policy uncertainties.

According to the International Monetary Fund’s latest World Economic Outlook, the global economy is expected to grow about 3.3% in 2026, supported by technological investment and adaptive supply chains.

Advanced economies are forecast to expand at a slower pace, while emerging markets are anticipated to maintain higher growth rates.

This contributes disproportionately to global output and offers potential opportunities for investors seeking growth exposure.

What is the Best Economy Right Now?

In early 2026, the strongest economies are the United States and India, supported by innovation-driven growth, resilient domestic demand, and structural advantages.

These economies are outperforming peers in a slower global environment by combining productivity gains with policy stability.

The United States continues to lead through technology, AI, and deep capital markets, while India stands out as a high-growth economy benefiting from demographics, manufacturing expansion, and digital infrastructure.

Select European economies also remain competitive due to fiscal discipline and industrial strength.

Which Sector is the Best to Invest in Right Now?

In early 2026, technology and AI remain the strongest investment sector, with healthcare, green energy, and fintech also offering compelling opportunities.

These sectors benefit from long-term structural drivers rather than short-term economic cycles.

- Technology and AI: Driven by continued innovation, automation, and productivity gains across industries.

- Green energy and ESG initiatives: Accelerated by sustainability mandates, infrastructure spending, and energy transition policies.

- Healthcare and biotech: Supported by aging populations, innovation pipelines, and demand for medical services.

- Financial technology: Benefiting from digital transformation, payments innovation, and fintech adoption.

That said, sector performance can vary significantly by geography, valuation, and individual risk tolerance, and no single sector is suitable for all investors.

Top Risks to Watch in Q1 2026 and How to Prepare

Q1 2026 presents several key risks that could impact returns across investments like equities and bonds. Investors should monitor these factors closely to position portfolios effectively.

1. Geopolitical tensions

- Trade disputes, regional conflicts, and sanctions could disrupt supply chains, particularly in energy, technology, and manufacturing sectors.

- Impact: Selective sector volatility; emerging markets may face sharper swings.

- Preparation: Consider diversifying globally, maintaining exposure to politically stable economies, and limiting concentration in high-risk regions.

2. Currency and FX risks

- The US dollar may weaken modestly, while some emerging market currencies could outperform due to capital flows and growth fundamentals.

- Impact: FX volatility can affect returns for investors with overseas exposure.

- Preparation: Hedge foreign currency exposure selectively, and monitor interest rate differentials that drive currency movements.

3. Interest rate and inflation pressures

- Higher-for-longer rates remain a central theme, affecting bond prices, dividend-paying stocks, and rate-sensitive sectors.

- Inflation may persist unevenly across regions, influencing real yields and purchasing power.

- Preparation: Tilt portfolios toward short- to intermediate-duration bonds, diversify across sectors, and focus on assets with pricing power or inflation resilience.

4. Market concentration and sector-specific volatility

- Tech and AI sectors continue to lead but are concentrated in fewer companies, increasing sensitivity to earnings surprises or regulatory shifts.

- Preparation: Balance high-growth positions with defensive sectors like utilities, healthcare, or high-quality fixed income to mitigate drawdowns.

Conclusion

As we move through Q1 2026, the market landscape is being shaped not by broad rallies but by selective strength and differentiated performance.

Higher yields, sector leadership in technology and AI, and diverging currency dynamics underscore a shift from easy gains to disciplined allocation.

In this environment, the traditional playbook of market timing has less utility; the real edge is in understanding where fundamentals are strongest, which economies are structurally advantaged, and which segments offer durable growth backed by earnings and policy support.

For investors, this means prioritizing quality over breadth.

High-growth sectors with clear demand drivers, selective emerging market exposures, and income-oriented fixed income can coexist in a thoughtful portfolio designed to navigate volatility without sacrificing long-term potential.

In essence, Q1 2026 rewards precision over momentum, and the most successful strategies will be those that integrate macro insight with disciplined, forward-looking positioning rather than reactionary moves.

FAQs

What is the investment outlook for HSBC Q1 2026?

HSBC’s Q1 2026 Investment Outlook sees continued support for equities underpinned by strong earnings, especially from AI‑linked innovation, a diversified multi‑asset approach including quality bonds and alternatives, and compelling diversification opportunities across both US and Asian markets.

The bank emphasizes balancing equity exposure with income strategies and broadening beyond mega tech into other sectors and geographies.

What was the stock market performance in Q1 2025?

In Q1 2025, major US equity indices ended lower — the S&P 500 fell about −4.6% and the Nasdaq declined around −10.4% — amid macro uncertainty and sector rotation.

Energy and defensive sectors such as health care and consumer staples posted gains, while technology and consumer discretionary were among the weakest performers.

What are 5 current assets?

Stocks, bonds, real estate, commodities, and forex are commonly considered current assets for investors.

What are the two main types of markets?

The two main types of markets are the primary market, where new securities are issued and investors provide capital directly to issuers, and the secondary market, where existing securities are traded between investors without involving the issuing company.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.