Every investor must consider the danger of inflation and must know how to hedge against it through an inflation hedge. But what is an inflation hedge?

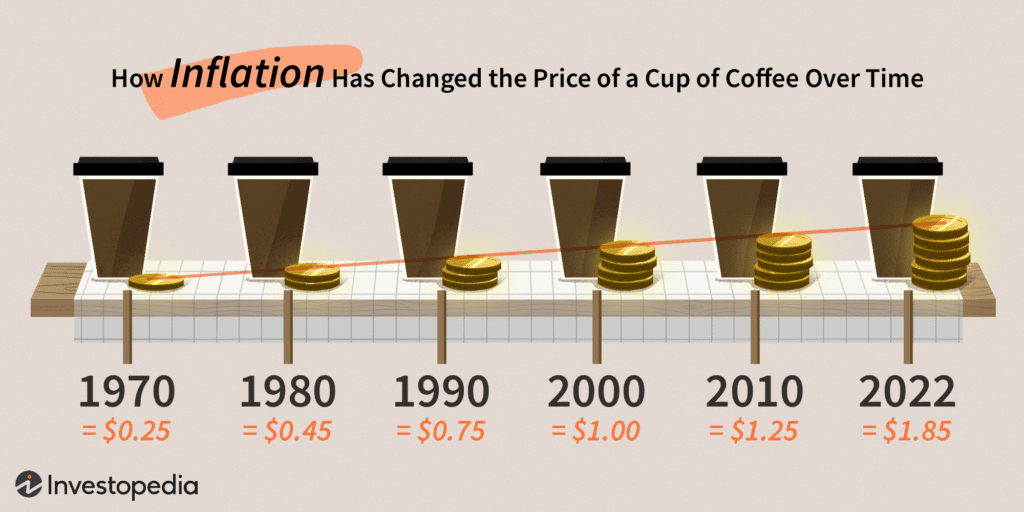

Money tends to depreciate in value over time due to inflation. It’s the reason why, despite the fact that loaves of bread today cost a dollar or two, you might have heard your grandparents mention buying a loaf for a cent.

There are numerous options for investors to protect themselves from inflation, including assets made particularly for this purpose. Find out more about inflation hedge and how it works in this article.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What is an Inflation Hedge?

An inflation hedge is an investment that is thought to preserve a currency’s lower purchasing power as a result of the loss of its value due to rising prices, either macroeconomically or due to inflation.

It usually entails investing in an item that is intended to retain or improve in value over a fixed length of time. Alternatively, the hedging could entail taking a larger position in assets that may lose value more slowly than the currency.

Historically, investments such as gold and real estate have been considered as a solid inflation hedge. Some investors, though, continue to favor investing in stocks in the expectation of countering inflation in the long run.

How Does Inflation Hedging Work?

Hedging against inflation can help preserve an investment’s value. When inflation is taken into account, certain investments that initially appear to offer a respectable return may actually result in a loss when sold.

As an example, if you buy in a company that yields 5% but inflation is 6%, you lose 1% of your money. The value of assets that are regarded as inflation hedges may be self-fulfilling; investors may continue to buy them even if their true value may be much lower.

For instance, gold tends to increase in cost if inflation causes the dollar to lose purchasing power.

Therefore, a gold owner is hedged (or protected) against a declining dollar because when inflation soars and depreciates the value of the dollar, the price of each ounce of gold will increase as a result. In order to make up for this inflation, the investor is given additional money for each ounce of gold.

Reasons Why Businesses Hedge Against Inflation

Some of the explanations why businesses engage in inflation hedging are as follows:

1. To Protect Their Investment’s Value

Companies participate in inflation hedging primarily to safeguard their investments from depreciation during inflationary periods. When inflation is taken into account, certain investment types see a fall in value during inflationary periods but an increase during regular economic cycles.

An investor might, for instance, buy an investment with a 5% yearly return. The inflation rate rises to 6% at the end of the year, when the investor intends to sell the investment. The investor will experience a 1 percent loss, or a reduction in their purchasing power.

Investors choose stable investments that retain or increase in value during periods of inflation in order to avoid fluctuations in the value of their investments.

Real estate is seen as an excellent inflation hedge, for instance, because it typically maintains or increases in market value and rental income during inflationary times.

2. To Maintain Low Operating Expenses

A business may make investments to lower operational expenses if it anticipates that its operating costs will rise during inflationary periods.

Inflation typically raises production costs for products and services, which typically lowers portfolio returns. Companies may be compelled to increase product pricing, reduce operating expenses, or even accept lower profits in order to deal with inflation.

For instance, when there is inflation, oil supply change and prices rise. They might significantly raise airline operational expenses. Oil is a significant expense, and rising oil prices can have a significant impact on these businesses’ profit margins.

In order to lessen the risk of fuel price increases, airlines can engage in inflation hedging by purchasing oil refineries. By doing this, they avoid paying market prices for jet fuel and instead create it for their aircraft and jets.

Inflation Hedging in the Real World

In order to reduce operating costs, businesses will occasionally hedge against inflation. One of the most well-known instances is when, in order to mitigate the risk of rising jet fuel prices, Delta Air Lines bought an oil refinery from ConocoPhillips in 2012.

If airlines attempt to hedge their fuel prices at all, they usually do it on the crude oil market. Delta believed that they could immediately hedge against the inflation of jet fuel prices by producing their own jet fuel at a lower cost than purchasing it from the market. At the time, Delta predicted that it would save $300 million annually on fuel.

Limitations of Inflation Hedging

Hedging against inflation has its limitations and can occasionally be risky. For instance, Delta’s refinery has not consistently generated profits throughout the years after it was acquired, which has reduced the efficiency of its inflation hedge.

The debates over whether to invest or not in commodities as a hedge against inflation typically center on factors like population growth worldwide, technological advancements, production spikes and outages, political unrest in emerging markets, Chinese economic expansion, and global infrastructure spending. The efficiency of inflation hedging is influenced by these changing dynamics.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.