This article was updated on March 11, 2020

E-Trade is an investment platform. Started in the US, in New York, it is focused on the online DIY investing space.

It is mainly a US focused option, but has expanded to Singapore, Hong Kong, the UK and beyond, with clients globally. That part of the operation is called E*trade Global.

This article will review the option, alongside speaking about the issues with DIY investing more generally.

If you are looking to invest or have questions more broadly, you can email me at advice@adamfayed.com, or connect with me on the chat function below.

Table of Contents

What are the different options within this platform?

The platform has three options: E*TRADE Web, Power E*TRADE and E*TRADE Pro .

Essentially though, the main difference is about the technology. For example, E*TRADE Pro, which is compatible with the company’s desktop platform, has features like the strategy scanner.

That isn’t a completely positive thing, as we will discuss below.

What does their trading platform look like?

The trading platform looks like the picture at the top of this article, although they are always making changes to it.

What are the negatives associated with this option?

The main negatives are:

- It is best for non-Americans to avoid US brokerages, as there is a risk of US estate and withholding taxes applying. This point doesn’t just apply to this option. It applies to any US domiciled firm. Remember, it is possible to invest in US indexes, such as the S&P500, without the money physically being held in America.

- Even dividends can be charged at 30% withholding US tax.

- They are an “off the peg” solution. Even though they have expanded their service offering, they aren’t specialised in expat advice, or high net wealth advice as an example. So this option might suit the basic needs of beginner investors, but often isn’t the best option for somebody that has more specialised needs.

- Some of the features encourage active trading. The evidence is clear; the more you trade the more you lose and most “professional traders” don’t beat the market long-term. Therefore, is it really an advantage to have all these analysis tools, when it won’t help you?

- As Vanguard’s founder says below, 24/7 valuations and being able to “trade in real time” isn’t always an advantage:

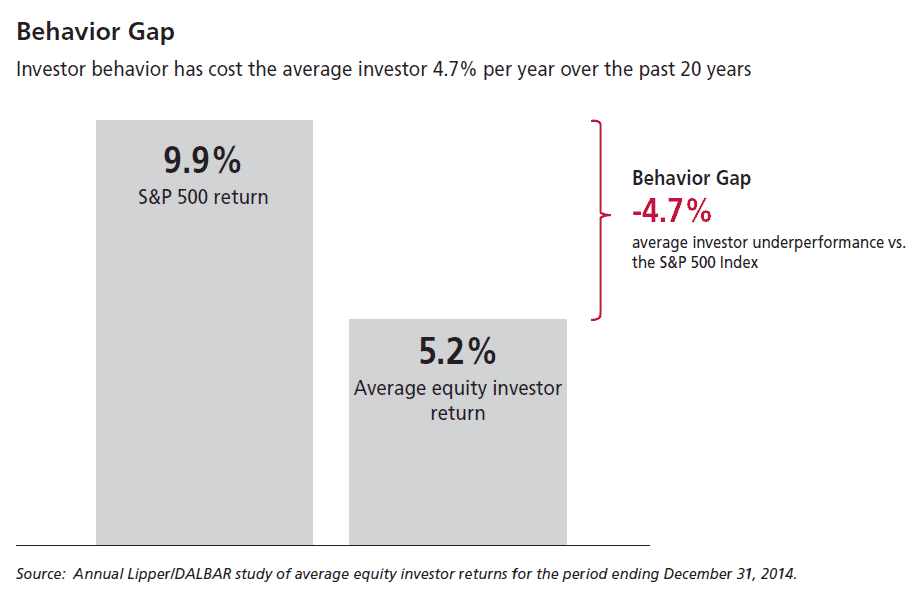

- As the last week has shown, with plunging market values, many investors, including many who consider themselves “professionals”, panic when the stock market is down. They buy high and sell low and try to trade the market. That also happened in 1999 and during the financial crisis of 2008-2009. This help explains the results like the ones below:

- If we look at things from this perspective, being given incentive to trade more (active traders pay less commissions on DIY platforms and so on), is almost like trying to encourage drug addition to alcoholism. The less you trade and react to the news, the better. The more you trade, the worse your situation will be.

- People shouldn’t be reassured by big familiar sounding names. Many people who are new to investing are reassured by size. In reality, many big firms, simply rely on trading on their corporate brand name.

- Countless customers have claimed online that E*trade have called in short positions against their will and other such actions. It is difficult to substantiate whether such claims are true, but it does seem like the computer is slow at reacting to customer requests, even if the customer service is generally good.

What are the positives about the platform?

The major positives about this option are:

- For people based in the United States, this isn’t a bad option at all provided you buy and hold and don’t buy and trade.

- They have added significant features in the last few years, which strengthens their US business.

- Low fees are charged in general.

- No minimum investments for smaller investors.

- Easy to use with good customer service.

- The research functions aren’t bad, although again, it is generally better to just buy and hold, and not try to “research the market”.

- The technology, such as mobile app, is very good.

What have been some of the best performing funds connected to this platform?

The major US indexes and technology stocks have been some of the best options in recent years.

Today’s winners aren’t always tomorrow’s victors though.

Conclusion

This isn’t a bad offering for people based in the US, especially with beginner investors, that have the self-discipline to buy and hold.

For people based overseas, especially for non-Americans, it doesn’t make sense to hold money in a US brokerage.

These kinds of options are also not ideal for people with very specialised financial planning and tax needs.

Further reading

How much money do you need to invest to become wealthy slowly from investing?

The answer might surprise you.

How to become rich by investing: Rational Investing Based on Evidence vs Speculation