Expat financial advisors in Bermuda – that will be the topic of today’s article.

I will compare some of the options available locally, alongside more portable, online, and international options like what we offer.

It makes sense to have a portable option as an expat, as opposed to a localized one, and that is something we specialize in.

If you want to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Table of Contents

Introduction

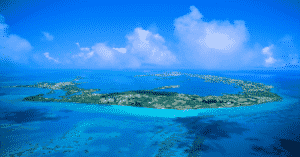

Bermuda is a British overseas territory located on a group of coral islands in the northwestern Atlantic Ocean, 900 km from North America.

Bermuda consists of 181 islands and reefs, of which about 20 are inhabited, and 10 of them are connected by bridges and overpasses and form the main island – Main Island. The islands are located at the crossroads of sea routes.

The area is 54 km². Population – 64,000 people (in 2020). The majority of the population is black (53.8%) and mulatto (7.5%), descendants of African slaves, 31% are from Europe and North America, 7.7% are Asians and Indians.

Administrative-territorial division: nine districts and two municipalities. The capital and main port is the city of Hamilton. The British governor is in charge of foreign policy, defense, police. The local bicameral parliament regulates internal life. The head of the executive branch is the Prime Minister.

How to become a resident in Bermuda? How to get a residence permit in Bermuda?

Bermuda offers a mixture of privacy, comfort, privacy and good infrastructure. It is no wonder that wealthy people from all over the world have been coming here for decades. In 2014, Bermuda was recognized as the most popular island jurisdiction where ultra-wealthy investors come.

To become a part of this world, you first need to get a visa and come to look around. In any case, you will need a visa – either a special one for Bermuda, or a multiple visa that allows you to visit the UK, Canada or the USA. A residence permit in these countries is also suitable.

At the same time, at the border they are required to show a valid passport (even if there is a residence permit), which must be valid for at least 45 days from the date of departure, a visa (if necessary), and round-trip tickets. If a person came to work, then they will take $ 208 bail in case of repatriation. If the person leaves on their own, the money will be returned.

You can stay in Bermuda for up to 90 days, but this period can be doubled if the purpose of your visit satisfies the local authorities.

How to get a temporary residence permit in Bermuda?

In fact, there are two ways to get a temporary residence permit in Bermuda: work – more precisely, a work permit and family migration. Moreover, if you are going to Bermuda for the first time, then only work remains a real chance.

However, if you are not going to work because you have your own stable sources of income, do not be in a hurry to get upset – you need to wait for the section “Permanent Residence in Bermuda”.

For those who decide to move to Bermuda, there are 6 types of work permits. Regardless of them, there are general requirements: a request to hire a foreigner is put forward by a local company, which is obliged to make sure that it has not found a suitable specialist locally; the permit is issued while the foreigner is abroad (on a tourist visa it is impossible to get a job and request a permit); and it is allowed to work only for one company – which registered a foreigner at home.

A standard work permit is available to all Bermuda companies, in case there are no suitable workers among citizens, their spouses and permanent residents. Issued for terms of 1, 2.3, 4 or 5 years. It will cost $874 for a year and $5,624 for 5 years.

A temporary work permit is when a company needs a foreign specialist who will come to the country several times over a given period and each visit will not be longer than 30 days. A distinctive feature is that this position does not have to be advertised. The price is $874 for a year and $5,624 for 5 years.

A short-term work permit allows you to hire a foreigner for up to 6 months. From $608 for 3 months to $920 for six months.

The New Business Work Permit allows you to automatically receive approvals for work permits for a selected type of new companies, within 6 months after receiving the first New Business Work Permit. Price from $1,690 per year to $6,441 for 5 years.

A work permit for international entrepreneurs (Global Entrepreneur Work Permit (GE Permit)) is issued for a year within the framework of dedicated companies and start-ups. In this case, work is considered to be business planning, obtaining state and other permits, seeking funding, etc. The cost of a visa for a year is $1,690.

The Global Work Permit is suitable for international companies that are relocating employees from a foreign office to Bermuda, no job advertisement is required. The term of the visa is from 1 to 5 years. The cost is from $1,690 to $6,441.

Family migration involves a partner moving in with a Bermudian citizen, permanent resident or work permit holder. Moreover, both ordinary and same-sex relationships / marriages are considered partners. The main thing in both cases is to prove your sincerity and the reality of the relationship.

In both cases, the partner must be of legal age (18+) and in a relationship before coming to Bermuda. For an ordinary marriage, a minimum of 2 years is required, for same-sex partners the period is not indicated, but the requirements are a little more vague – much is left to the discretion of the inspector.

What criteria are considered proof of a real and long-term relationship?

On average, the following are considered proof of true relationships:

• Partners live together and can prove it (by accounts, joint investments, etc.);

• Partners have common children (biological, step, adopted);

• Partners share financial responsibility;

• Partners visit each other’s relatives in another “native” country and can prove it;

• The partners have plans for a joint future in Bermuda.

For same-sex couples, strong evidence will be the provision of union documents issued by countries that recognize same-sex marriages and proof that the partner is not in another relationship.

That in the case of work, that in the case of family migration, the applicant must be clean before the law, both local and foreign (this also applies to the case of extending the status), have foreign medical insurance on hand, not have tuberculosis and have means of subsistence (from partner or alone).

It is possible for family migrants to obtain a work permit, but this requires additional efforts.

How to get a permanent residence permit in Bermuda?

It is here that the wealthy get a significant advantage, which, by the way, was less available before. Starting December 15, 2015, the rules for obtaining a permanent residence have been eased, unnecessary requirements have disappeared, and now it will be easier to become a permanent resident.

On the other hand, it is important to understand the following: you will receive a certificate of residence, which proves your right to live without restrictions in Bermuda. However, it does not give you the right to work – its essence is that you must support yourself without attracting the resources of the island.

This is one of the reasons why so many wealthy people have chosen Bermuda – it is difficult for others to get here.

A resident certificate is issued if the following conditions are met:

• Adulthood (18+);

• Not condemned in Bermuda and other countries;

• Good feature;

• Valid health insurance (not state Bermuda);

• Do not have tuberculosis, especially if you have stayed in the territory dangerous with this disease for more than 3 months;

• In the presence of a constant source of funds or income, which is enough to ensure life without a job.

Previously, it required the purchase of real estate or work for 5 years. Now on the official website of Bermuda (in the useful links section) there is no other way to get a permanent residence.

Together with the main applicant, his dependent persons – spouse / partners and children can also apply for the status. For them, all the same requirements, except for age (for children) and the availability of income – this is provided by the main applicant.

Children can be brought along if they are under 25 years old or have not yet completed their education (whichever happens first). However, they do not have the right to attend local public schools, and parents are required to provide documents confirming admission to a private school. The cost of an adult residency certificate is $2,000.

A person already clearly understands what tasks he is striving for. He only needs a specialist who will help him choose the right strategy to achieve his goal. And will offer the best tools for solving important problems. In both cases, a personal financial advisor is helpful.

Who is a financial advisor?

This is a specialist who advises on financial policy issues at various levels. It can operate both as an individual and as a legal entity. It does not change its function.

He advises clients on the issues of saving or increasing funds, assesses their financial condition, develops an investment policy, a scheme for working with banking institutions, and makes management decisions.

This category includes the following specialties:

• brokers;

• investment consultants;

• accountants;

• financial lawyers;

• insurance agents;

• financial analysts.

A consultant can be well versed in a particular area of finance, but can also be a multidisciplinary specialist.

What should a financial advisor know?

First, he must have all the necessary skills in the profession. Secondly, it is excellent to know the provisions and laws of legislation in the field of finance and economics. Further, he must understand the market economy, the trends of cash investments.

He must also be able to value financial assets and their instruments. Understand the procedures for buying and selling securities in the stock markets. In addition, he must be familiar with modern systems of lending and investment, control and taxation.

In other words, a financial advisor is a consultant with excellent knowledge in any financial, legal and accounting field.

Requirements for a financial advisor

As a rule, financial advisors are required to:

• higher specialized education;

• at least 1 year experience in finance;

• knowledge of financial management and accounting;

• knowledge of the stock market and the securities market;

• experience in analysis and evaluation of financial risks;

• PC knowledge;

• English proficiency;

• sales skills.

Types of Financial Advisors

There are several categories of financial advisors:

• Investment consultants, sellers, employees of financial companies. They will help in cases where the client has medium-term savings and investment projects. They have certain plans that they are ready to share. This category includes bank employees, insurance agents, realtors, pension and investment fund consultants.

• Motivational financial consultants. This is a different category. Such specialists help draw attention to a specific problem, recognize it, and then decide to close it in the chosen ways. In other words, the client receives instructions for action, taking into account his financial characteristics. Such specialists are approached for short-term cooperation, when the client already has a certain action plan, but he cannot decide on its implementation.

• Independent financial advisors. Their functions include finding out the capabilities of the client, choosing a number of solutions, as well as identifying the most suitable for implementation in a certain time frame. As a rule, they develop plans for the long term. For example, 10 years. During this time, the client’s well-being should improve.

But in this article, we will mainly focus on the two most popular types of financial advisors: local and online.

Local Financial Advisors

There are many misconceptions about the role of a financial advisor and the differences between financial market professionals. The reality is that having an expert to help you navigate the financial market and select nutritional investments based on your individual needs can be extremely rewarding in the long run. Especially local fiduciary consultants who are required by law and ethics to always put you first.

Many people prefer a local financial advisor because of the convenience, interaction, and more. Here are the main reasons and benefits of choosing a local consultant:

One-on-one communication

Yes, some only trust personally, especially when it comes to money. If you are not comfortable doing business online, a local financial advisor may be a good fit for you.

Many people prefer a personal, human touch, especially the older generation who grew up on bricks and mortar, rather than doing business online, which is why a local financial advisor is the advisor of choice.

In addition to managing your investment portfolio, the benefits of being a traditional local financial advisor include being able to discuss your questions and concerns as often as you like, from anywhere.

Face-to-face meetings can help you clarify your expenses and goals by scheduling an assessment meeting and scheduling regular reviews. All consultants are individuals, so it’s important to shop around and ask questions to find the one that fits your individual needs.

Local experience

Bermuda is a foreign country and for many expats the laws may be different, investment options, savings accounts and more may require different skills.

The key solution is a local financial advisor. They are usually educated and focused on the laws and regulations they follow in the country. As such, they are an excellent resource if you are looking to invest locally to spur growth in your area, city, or state.

Keep in mind that local investments can bring you two rates of return: one directly to your portfolio and the other through your community. There is growing evidence that, compared to their non-local counterparts, local businesses have two to four times the impact on local economic development for every dollar spent on them.

So if you have an investment portfolio that includes local businesses, your dollars will continue to circulate and improve the well-being of your entire community by creating new jobs, increasing income, and ultimately supporting funding for schools, parks, police. and fire services; and safe and prosperous areas.

An expert, local financial advisor can help you with due diligence to make sure your local investment makes sense.

Online Financial Advisors

Online financial advisors have been steadily gaining popularity over the years and for a variety of reasons.

One of the first reasons people started working with virtual financial advisors was to buy time in the old days as they didn’t have to get in a car or be stuck in traffic to meet their financial advisor when the phone rang or Zoom meetings were unavailable. simply. also.

For people who travel frequently or plan to move to another part of the country (or live abroad), working with an online financial advisor also ensures that your relationship doesn’t end, no matter where you are.

Perhaps the most significant advance accelerating the trend towards virtual financial advice is the ability of financial advisers to specialize in serving a niche that would be impractical if they were limited to working with clients in their home city.

Thus, you have the opportunity to hire a financial advisor who truly understands your individual needs based on their education, experience, and commitment to helping people like you.

Location is the first advantage

Investors looking to hire a consultant in high cost of living cities often struggle to find a consultant that is affordable or accepts them as a client if they do not meet the requirements based on their minimum assets.

Virtual relationships allow investors in, say, San Francisco or New York to hire a Delaware or Mississippi advisor who is likely to be more affordable and have a lower stated minimum asset, even if they have the same experience and level. service offers.

Everything must be in its time

Those professionals who work long hours earn good salaries but often cannot find a consultant who is available when they are available – after hours. An online consultant is usually not limited to “office” time and can contact you when you need it!

In times of great financial stress, simply revising your annual plan is often not enough. As an investor, you will likely prefer to have your financial planners or advisors available throughout the year.

The client/consultant relationship is not a set-and-forget relationship, but rather an ongoing dialogue. This includes ongoing text or email conversations, which are much more convenient than scheduled face-to-face meetings once a year.

Increasing your chances of finding the right consultant

Often, due to location restrictions, people choose financial advisors that are not right for them. Instead of focusing on finding a trusted consultant who cares about your interests and has experience with your specific needs, physical limitations may encourage you to hire a low-skilled consultant who lives nearby. The opportunity to find a working consultant practically expands the pool of potential candidates, so you can find the most suitable one for you!

Financial advisors come from a variety of backgrounds and the value they add can vary greatly. Even if a consultant is paid, it does not mean that he has the same level of knowledge, offers the same services, or serves the same types of clients. Zoe will help you find the top 5% independent paid consultants in the country so you can find a highly qualified consultant wherever you are.

Once you can be sure that your potential online financial advisor has the right experience, you will need to evaluate whether his or her experience fits your needs and your investment. The value consumers expect from a consultant has changed dramatically over the past few decades.

In the past, advisors were valued for their ability to beat the market by picking stocks, bonds, or mutual funds on your behalf. Technology and innovative products have commodified many of these tasks with more passive and cost-effective investment vehicles such as index funds or ETFs. A financial advisor’s online practice can provide an interactive service that has already been redesigned to work virtually with their clients.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.