Countries with no death tax such as Singapore, Australia, and the United Arab Emirates allow wealth to be transferred after death without inheritance tax, estate tax, or similar levies.

In these jurisdictions, heirs can receive assets with little to no tax erosion, making them especially attractive for estate planning and cross-border wealth preservation.

This article covers:

- What are the tax implications of death?

- Is there a country with no inheritance tax?

- What is the difference between inheritance tax and estate tax?

- Which countries don’t take estate taxes?

- What are the most common methods used to reduce federal and state death taxes?

Key Takeaways:

- There are three main types of death taxes: estate taxes, inheritance taxes, and succession taxes.

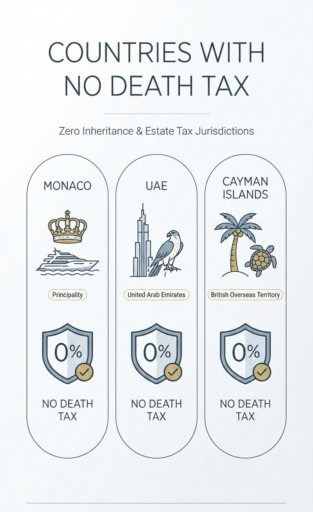

- Countries with no death taxes include the UAE, Monaco, and the Cayman Islands.

- Strategies to reduce death taxes include using trusts and gifting during lifetime.

- Legal complexities in estate planning involve succession laws, inheritance rights, and anti-avoidance rules.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What is the meaning of death taxes?

Death taxes refer to taxes imposed when a person dies and their assets are transferred to heirs or beneficiaries.

These taxes can apply to the estate itself or to the individuals who receive the inheritance.

Depending on the country, death taxes may be charged before assets are distributed or after heirs receive them.

The primary goal of death taxes is revenue generation and wealth redistribution, but they can substantially reduce the value of an estate if not planned for properly.

What are the different types of death taxes?

The different types of death taxes are estate tax, inheritance tax, income tax on inherited assets, and capital gains tax on inherited assets.

- Estate tax – A tax imposed on the total value of a deceased person’s estate before assets are distributed to heirs.

- Inheritance tax – A tax paid by beneficiaries based on the value of the assets they receive from an estate.

- Income tax on inherited assets – Applies when inherited assets generate income, such as rental income, interest, or dividends.

- Capital gains tax on inherited assets – Triggered when heirs sell inherited property or investments and realize a gain.

Countries with no death taxes

Countries like United Arab Emirates, Monaco, and the Cayman Islands impose no death-related taxes, meaning heirs pay no inheritance, estate, income, or capital gains tax.

Countries with no death taxes:

- United Arab Emirates

- Monaco

- Cayman Islands

- Bahamas

- Bermuda

- Qatar

- Saudi Arabia

- Bahrain

These jurisdictions are considered tax-friendly or tax-neutral, making them highly attractive for comprehensive estate planning and long-term wealth preservation.

Countries with no inheritance taxes

Countries with no inheritance taxes such as Australia, Canada, and Singapore do not tax beneficiaries simply for receiving inherited assets.

- Australia – Abolished inheritance tax in 1979; beneficiaries receive assets without inheritance tax.

- Canada – Abolished inheritance tax in 1972; no tax on beneficiaries (capital gains rules may apply separately).

- New Zealand – Abolished inheritance tax by 1992; heirs receive assets without inheritance tax.

- Sweden – Abolished inheritance tax in 2005; beneficiaries pay nothing on inheritance.

- Norway – Abolished inheritance tax in 2014; transfers to heirs are not taxed.

- Austria – Abolished inheritance tax around 2008; no inheritance tax today.

- Czech Republic – Repealed inheritance tax effective 2014; beneficiaries do not pay inheritance tax.

- Hong Kong – Abolished inheritance tax in 2006; beneficiaries receive assets tax‑free.

- Singapore – Abolished inheritance tax in 2008; no tax on beneficiaries.

- Mexico – Inheritance tax was phased out before 1980; beneficiaries receive estates without inheritance tax.

- Estonia & Latvia – Have never imposed inheritance tax.

- Cyprus, Malta, Romania, Slovakia – Do not levy inheritance tax (abolished or never imposed).

- Israel – Abolished inheritance tax in 1981; heirs typically do not pay inheritance tax today.

- Russia – Repealed inheritance tax in 2006 (though minor transfer fees exist).

- Philippines – No inheritance tax per se (estate tax instead, which is separate from inheritance tax).

Countries with no estate taxes

Countries with no estate taxes such as New Zealand, Austria, and Mexico do not tax the estate itself before distributing assets to heirs.

- Australia – Estate tax abolished at the federal and state levels between 1979 and 1982; estates are not taxed before distribution.

- Canada – Estate taxes were eliminated in 1972; only the estate-level capital gains triggered at death may apply.

- New Zealand – Estate taxes abolished in 1992; estates are distributed tax-free.

- Singapore – Estate tax fully abolished in 2008; estate-level tax does not apply.

- Austria – No federal estate tax; some low-rate inheritance tax may apply at state level (reformed in 2008).

- Czech Republic – Estate tax abolished in 2014; estate itself is not taxed.

- Mexico – No federal estate tax; estates generally transfer without estate-level taxation.

Countries Where Income Tax Applies to Earnings From Inherited Assets

In countries like Canada, Australia, and Singapore, inherited assets are not treated as taxable income, so heirs do not pay income tax simply for receiving an inheritance.

- Canada – Inheritances themselves are not taxable; only income generated from inherited assets (like rent or dividends) is taxed.

- Australia – Inherited assets are not considered taxable income; subsequent earnings are subject to standard income tax.

- Singapore – No inheritance is treated as income for tax purposes.

- Malaysia – Inheritances are not income-taxable; income earned from these assets later is taxed normally.

- Philippines – Inheritances are excluded from income tax; separate estate tax applies instead.

- Norway – Beneficiaries do not pay income tax on received inheritance; only future income from assets is taxed.

- Oman, Pakistan, Panama, Paraguay, Papua New Guinea – Inherited assets are not counted as income for income tax purposes.

While heirs do not pay income tax at the time of inheritance, any income generated after receipt (rent, interest, dividends, or capital gains) is subject to normal income tax rules.

Countries with no capital gains tax

In countries like Singapore, Malaysia, and the United Arab Emirates, inherited assets are not subject to capital gains tax when sold.

- Singapore – Capital gains are generally not taxed, including on inherited assets.

- Malaysia – No capital gains tax on inherited assets; only certain real property sales are taxed.

- New Zealand – Generally no capital gains tax, but some exceptions exist (e.g., property sold within certain time frames).

- United Arab Emirates – No capital gains tax on inherited assets; popular for investment holdings.

- Cayman Islands – No capital gains tax; inherited investments can be sold tax-free.

- Monaco – No capital gains tax on inherited assets; often chosen for wealth preservation.

- Bermuda – No capital gains tax; favored for high-net-worth individuals.

- Bahamas – No capital gains tax; inherited assets can be sold without taxation.

- Qatar – No capital gains tax on inherited property or investments.

- Saudi Arabia – No capital gains tax for individuals, including inherited assets.

- Isle of Man – No capital gains tax; inherited assets are exempt.

- Jersey & Guernsey (Channel Islands) – No capital gains tax on inherited assets.

These jurisdictions are often selected for investment holdings, family offices, and long-term wealth preservation due to their favorable capital gains tax treatment.

Estate Planning in Countries With and Without Death Taxes

In countries that impose estate or inheritance taxes, residents often adopt specific strategies to minimize their tax burden and ensure their assets are passed on according to their wishes.

These strategies typically include establishing trusts, gifting assets during their lifetime, and leveraging tax exemptions and deductions.

For example, in jurisdictions like France or Japan, careful estate planning is essential to reduce the impact of high death taxes and preserve wealth for heirs.

Conversely, in countries with no or very low death taxes such as the United Arab Emirates, Monaco, or several states in the US, residents might focus less on tax mitigation and more on estate clarity and asset protection.

Without the immediate pressure of hefty death taxes, individuals often prioritize simplicity in estate planning, such as creating wills or powers of attorney, to ensure their assets are distributed smoothly and according to their wishes.

This contrast highlights how the tax environment influences estate planning approaches.

In high-tax countries, proactive planning can save significant amounts of money, while in no-tax jurisdictions, the emphasis shifts toward clarity and asset management rather than tax reduction.

Understanding these differences helps individuals tailor their estate plans to their country’s legal and fiscal landscape.

How to reduce taxes after death

Strategies like forming trusts, gifting assets, or changing tax residency can significantly reduce taxes after death.

1. Establishing trusts or foundations – Allows assets to be managed and transferred in a tax-efficient way, often protecting wealth from inheritance and estate taxes.

2. Gifting assets during one’s lifetime – Reduces the taxable estate while enabling beneficiaries to receive wealth early, sometimes with lower or no taxes.

3. Changing tax residency – Moving to a jurisdiction with lower or no death-related taxes can minimize the overall tax burden on heirs.

4. Holding assets in tax-efficient jurisdictions – Keeping investments or property in countries with favorable tax laws can reduce estate, inheritance, or capital gains taxes.

5. Using life insurance for liquidity – Life insurance proceeds can provide cash to pay taxes or pass wealth directly to heirs without additional taxation.

6. Structuring investments to minimize capital gains exposure – Organizing assets to defer or reduce capital gains tax on inherited property or investments.

Professional estate and tax advice is essential, especially when dealing with multiple countries, to ensure strategies comply with all applicable laws and maximize tax efficiency.

Legal and Regulatory Considerations in Cross-Border Estate Planning

While jurisdictional differences in death taxes create opportunities for wealth preservation, navigating the legal landscape of international estate planning presents unique challenges.

Here are key legal and regulatory considerations that can impact your estate plans:

1. Jurisdictional Conflicts and Overlaps

Different countries have varying inheritance, estate, income, and capital gains tax laws. Conflicts may arise when assets are spread across multiple jurisdictions, leading to double taxation or legal ambiguities. Understanding treaties and agreements between countries can mitigate these issues.

2. Anti-Avoidance and Tax Evasion Laws

Many nations have introduced anti-avoidance measures to prevent aggressive tax planning. These include rules on controlled foreign corporations (CFCs), transfer pricing, and substance requirements for offshore entities. Being aware of these regulations ensures compliance and avoids penalties.

3. Legal Recognition of Offshore Structures

Establishing trusts, foundations, or holding companies offshore requires adherence to local laws and recognition standards. Not all structures are equally protected or recognized, and some jurisdictions may have specific reporting or registration requirements.

4. Succession Laws and Inheritance Rights

Local inheritance laws (intestate succession, forced heirship rules) can override estate planning documents, especially in jurisdictions with strict inheritance laws. Ensuring legal validity across borders requires careful drafting and possibly local legal counsel.

5. Reporting and Disclosure Obligations

Global initiatives like FATCA, CRS, and AML regulations mandate reporting of offshore assets to tax authorities. Transparency requirements are increasing, and failure to comply can lead to legal issues and fines.

6. Ethical and Reputation Considerations

While planning to minimize taxes is legal, aggressive or opaque strategies can attract scrutiny or damage reputation. Ethical considerations and transparency are vital in maintaining compliance and peace of mind.

Conclusion

Ultimately, the landscape of death taxes underscores the importance of proactive and strategic estate planning.

While some jurisdictions offer tax-neutral or tax-free environments that preserve wealth across generations, navigating the complexities of international laws requires tailored solutions.

Leveraging legal structures, residency strategies, and timely gifting can unlock significant tax efficiencies.

In an era where wealth preservation is increasingly global, informed planning becomes not just advantageous but essential for safeguarding assets and ensuring a smooth transfer of wealth.

FAQs

When to file a deceased tax return?

A deceased tax return is usually filed for the year of death. Deadlines vary by country, but it often follows the standard annual tax filing deadline or a few months after death.

Who pays taxes after death?

The estate typically pays any outstanding taxes before assets are distributed. In some cases, beneficiaries may be responsible for taxes related to what they receive.

Who is the highest taxed country in the world?

Finland, Denmark, and Sweden are often ranked among those countries with the highest tax burdens overall, considering income, sales, and corporate taxes.

However, tax burdens vary depending on the specific metric used (e.g., total tax revenue as a percentage of GDP, highest marginal tax rates, or overall tax pressure on individuals and corporations).

Is there a death benefit on taxes?

Some countries offer tax reliefs, exemptions, or deductions upon death, such as spousal exemptions or thresholds below which no tax is due. These benefits vary widely by jurisdiction.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.