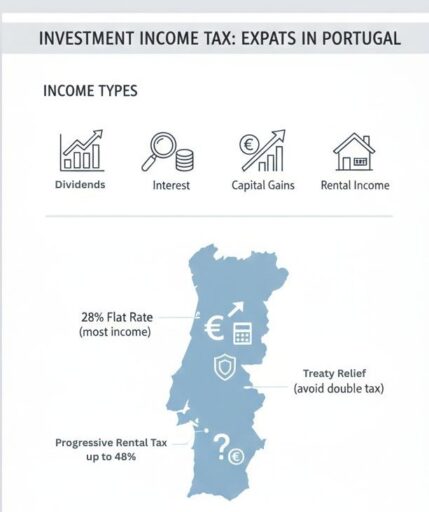

Most investment income in Portugal is taxed at a flat 28% rate, with relief available through double taxation treaties and specific statutory exemptions.

Investment income tax in Portugal is charged on dividends, interest, capital gains, and other passive income earned by residents and non-residents.

This article covers:

- Does Portugal charge tax on foreign income?

- What counts as investment income for tax purposes?

- How much do I get taxed on investment income in Portugal?

- What is the threshold for investment income tax?

- How can I avoid double taxation in Portugal?

- How to minimize taxes on investment income

Key Takeaways:

- Portugal applies a standard 28% tax rate to most investment income.

- Dividends, interest, and capital gains are fully taxable unless exempt.

- Double taxation treaties reduce or eliminate overlapping taxes.

- Exemptions, thresholds, and treaty relief can lower effective tax for expats.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What is Classed as Investment Income?

Investment income in Portugal refers to income generated from capital, financial assets, or property rather than active employment or business activity.

This income is taxed separately from salaries and may be subject to flat or progressive rates depending on how it is reported.

Common examples of investment income in Portugal include:

- Dividends from shares, ETFs, mutual funds, and other equity investments

- Interest from savings accounts, fixed-term deposits, government or corporate bonds, and similar instruments

- Capital gains from the sale of financial assets such as shares, funds, cryptocurrencies, or real estate

- Rental income from residential or commercial property, whether located in Portugal or abroad (for tax residents)

- Royalties and licensing income from intellectual property, patents, or copyrighted works

- Other passive income, including distributions from trusts or investment vehicles

Correctly classifying income as investment income is essential, as different rules, tax rates, and reporting obligations apply depending on the income category and source.

What Taxes Do Expats Pay in Portugal?

Expats in Portugal pay personal income tax (IRS), capital gains tax, and, when applicable, social security and property-related taxes.

Residents are subject to worldwide taxation, while non-residents are liable only on Portugal-sourced income.

Key taxes expats may pay include:

- Personal income tax (IRS) on employment, business, and investment income

- Social security contributions for employed or self-employed individuals

- Capital gains tax on the sale of property and certain financial assets

- Property-related taxes, such as IMI and IMT, on Portuguese real estate

An individual is considered a tax resident if they spend more than 183 days per year in Portugal or maintain a habitual residence in the country.

How is Investment Income Taxed in Portugal?

Portugal taxes investment income under its Personal Income Tax (IRS) code by assigning income to specific IRS income categories, each with its own tax treatment and reporting rules.

Portuguese law recognizes investment and capital income as distinct categories (e.g., investment income, rental income, and capital gains) within the IRS system.

- Under the IRS rules, investment income such as dividends, interest, and royalties is governed by the investment income category (Category E), which defines how passive returns from financial assets are treated for tax purposes.

- Capital gains from the disposal of assets fall under capital gains (Category G) and have defined computation and reporting guidelines under the PIT code.

- Rental income is treated as property income (Category F), subject to specific taxation methods and deductible expense rules.

- Investment income may be taxed by withholding at source when paid or made available, or declared in the annual PIT return filed with the Portuguese tax authorities.

Residents are required to report both Portuguese‑sourced and foreign‑sourced investment income, while non‑residents report only Portugal‑sourced investment income.

This system of categories and reporting ensures that each type of investment income is taxed according to the rules set out in the IRS code and related regulations.

This provides a structured framework for how dividends, interest, capital gains, and rental returns are treated under Portuguese tax law.

How Much Tax Do I Pay on Investment Income?

Investment income in Portugal is generally taxed at a flat 28% rate for dividends, interest, and most capital gains, while rental income is taxed progressively, with rates ranging from 14.5% to 48%.

For non-residents, dividends and interest are usually withheld at source, and only Portugal-sourced capital gains are taxable.

Effective tax rates can range from 0% to 48%, depending on exemptions, income thresholds (such as the €8,500–€83,696 progressive IRS bands), and eligible deductions.

Certain capital gains may be partially exempt if reinvested in property or held long-term, while gains from specific instruments, like Portuguese government bonds, may be fully exempt.

Some passive income can also benefit from reduced rates or exemptions under Portugal’s double taxation treaties.

Expats are advised to consult a tax advisor to maximize exemptions, apply treaty relief correctly, and ensure compliance with Portuguese tax law.

Investment Income Tax Planning for Expats in Portugal

Expats in Portugal can reduce their investment tax liability by diversifying investments and timing asset sales strategically while staying fully compliant with Portuguese law.

- Diversify investments to balance assets that are fully taxable, partially exempt, or eligible for preferential tax treatment.

- Time asset sales strategically, especially capital gains or high-yield investments, to benefit from exemptions, deductions, or lower-income years.

- Leverage double taxation treaties to avoid being taxed twice on foreign income.

- Plan your residency carefully if you spend time in multiple countries, as tax residency status affects which income is taxable and how treaties apply.

By applying these strategies proactively, expats can legally minimize tax exposure while taking full advantage of Portugal’s investment income rules.

How Do Tax Treaties Avoid Double Taxation?

Portugal has double taxation treaties with many countries to prevent expats from being taxed twice on the same income.

Relief is usually provided either by crediting taxes already paid abroad or exempting certain foreign-sourced income.

Expats should carefully review treaty provisions when planning their investments to minimize overall tax liability.

Working with a tax advisor or consulting treaty tables can help identify which types of foreign income qualify for exemptions or credits.

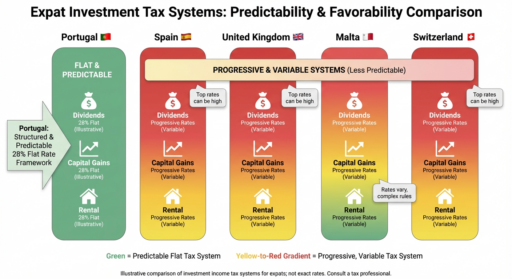

Portugal vs. Other Expat Hotspots: Investment Income Tax Overview

Portugal is often cited as a favorable destination for expats, but how does its investment income taxation compare to other popular countries?

Most investment income in Portugal is taxed at a flat 28%, while rental income is taxed progressively from 14.5% to 48%.

Non-residents pay tax only on Portugal-sourced income, and exemptions, reinvestment relief, and double taxation treaties can further reduce the effective rate.

Country comparisons for investment income tax:

- Portugal:

- Dividends, interest, and capital gains: flat 28%

- Rental income: progressive 14.5%–48%

- Non-residents taxed only on Portugal-sourced income

- Exemptions and double taxation treaties reduce effective tax

- Spain:

- Dividends and interest: progressive 19%–26%

- Capital gains: up to 23%

- Limited exemptions for reinvestment

- United Kingdom:

- Dividends: 8.75%–39.35% depending on income

- Interest: taxed at ordinary income rates (20%–45%)

- Capital gains: 10%–28% with annual allowances

- Malta:

- Dividends and capital gains: 15%–35%

- Fewer deductions for foreign-sourced income

- Switzerland:

- Dividends: subject to 35% federal withholding tax at source; can usually be credited or refunded when declared

- Dividend and other investment income: added to ordinary income and taxed at progressive federal, cantonal, and communal rates, which vary by location

- Capital gains on private movable assets like shares are generally tax-exempt

- Rental income: taxed at combined federal and cantonal rates, typically 10%–30%

This is an illustrative 2026 tax overview. Rates and rules vary by residency status, personal income level, and local legislation. Always verify current laws before making financial decisions.

For expats, the comparison highlights structural differences in how countries tax investment income.

Portugal applies flat taxation to most financial income, while other jurisdictions rely more heavily on progressive systems or income-band-based structures.

While other countries may offer lower nominal rates in certain categories, Portugal’s predictable framework and exemptions could often produce a lower effective tax burden, especially for diversified and cross-border investment portfolios.

Conclusion

Navigating investment income tax in Portugal offers expats both challenges and opportunities.

Understanding how different income types are classified, and how thresholds, exemptions, and double taxation treaties apply, allows investors to plan strategically rather than reactively.

Thoughtful timing of asset sales, diversification, and careful residency planning can turn tax obligations into tools for optimizing returns.

By approaching investment decisions with foresight, expats can protect wealth, reduce unnecessary taxation, and build a sustainable financial foundation while enjoying life in Portugal.

FAQs

Is Passive Income Taxable in Portugal?

Yes, passive income including dividends, interest, and rental income is generally taxable in Portugal.

Some income may be exempt or benefit from reduced rates if it qualifies under Portuguese tax law or a double taxation treaty with the source country.

How to Avoid Portugal Capital Gains Tax for Non-Residents?

Non-residents can avoid Portugal capital gains tax by ensuring they sell only non-Portuguese assets or invest in exempt instruments.

Strategies include using jurisdictions with favorable tax treaties, investing in Portuguese government bonds, or applying reinvestment exemptions for gains on a primary residence.

What are the Incentives for Expats in Portugal?

Portugal offers several incentives for expats, including no wealth tax on most assets, favorable capital gains rules for certain property and financial assets, and access to double taxation treaties that reduce the overall tax burden.

These features make Portugal attractive for managing and optimizing investment income while living abroad.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.