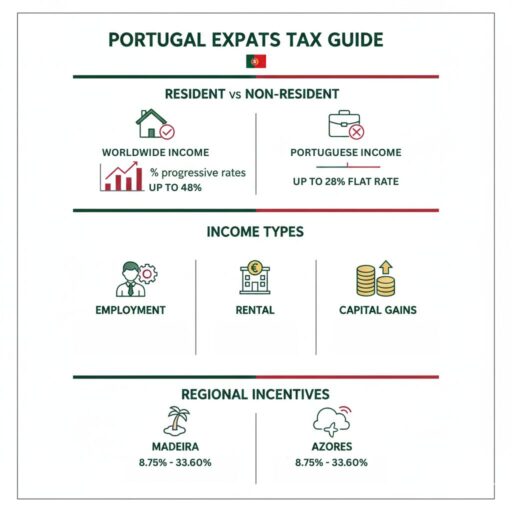

In Portugal, non-residents pay flat tax rates of 25–28%, while residents face progressive rates from 12.50% up to 48%, based on income.

Tax in Portugal for expats applies to income, deductions, and regional incentives, with Madeira and the Azores offering opportunities to reduce overall liability.

This article covers:

- What taxes do expats pay in Portugal?

- What is the non resident tax in Portugal?

- What is the tax rate for residents in Portugal?

- Is there a way to avoid double taxation?

- What deductions can I take to reduce my taxes?

Key Takeaways:

- Residents pay progressive rates on worldwide income; non-residents pay flat rates on Portuguese-source income.

- Regional incentives in Madeira and the Azores can reduce overall tax liability for residents.

- Deductible expenses include health, education, housing, and charitable donations.

- Planning and proper registration are essential to avoid double taxation and maximize savings.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is not tax advice and may have changed since the time of writing. I can connect you with expert tax support for your specific situation.

Who has to pay taxes in Portugal?

Everyone earning or receiving income in Portugal must pay taxes, either as a resident or non-resident.

- Residents are taxed on their worldwide income. You are considered a resident if you spend more than 183 days in Portugal in a 12-month period or have a permanent home there. Portugal applies progressive tax rates for residents on worldwide income. As of 2026, the main rates are:

- Up to € 8,342: 12.50%

- €8,342 – €12,587: 15.70%

- €12,587 – €17,838: 21.2%

- €17,838– €23,089: 24.10%

- €23,089– €29,397: 31.1%

- €29,397 – €43,090: 34.9%

- €43,090– €46,566: 43.1%

- €46,566– €86,634: 44.6%

- Over €86,634: 48%

Additionally, there is a solidarity surcharge for high-income earners.

- Non-residents only pay taxes on Portuguese-source income, such as rental income, capital gains from Portuguese assets, or work done in Portugal. Non-residents are subject to a flat tax rate of 25% on employment income and 28% on investment and rental income from Portuguese sources. Certain pensions are also taxed at this rate unless treaty exemptions apply.

Expats can benefit from transitional provisions if they were registered under the old Non-Habitual Resident (NHR) regime before it ended in 2024, but this is no longer available to new applicants.

Portugal also offers targeted tax incentives for certain scientific, research, or innovation roles.

What are the taxes for expats in Portugal?

Expats in Portugal are subject to personal income tax (IRS) on employment income, self-employment income, rental income, capital gains, and certain pensions.

They may also encounter social security contributions if employed or self-employed, as well as municipal taxes like property tax (IMI) and stamp duties on specific transactions.

Value-added tax (VAT/IVA) applies to most goods and services, and there are also taxes on dividends, interest, and inheritance in some cases.

Understanding the types of taxes and which apply to your income is essential for accurate planning and compliance.

What is the best way to reduce my taxes?

The best way to reduce your taxes in Portugal is through legal tax planning, income structuring, and maximizing available deductions.

Expats and residents can reduce taxes in Portugal by:

- Investing in tax-efficient retirement or pension plans.

Contributions to approved Portuguese pension plans (PPRs) may qualify for tax deductions and can provide favorable taxation on withdrawals, depending on holding periods and conditions. - Structuring income efficiently.

Different types of income are taxed differently. For example, certain capital gains and dividends may be taxed at flat rates, while employment income is taxed progressively. Choosing the right structure (employment, self-employment, or corporate setup) can significantly impact your effective tax rate. - Optimizing capital gains timing.

Selling assets strategically across tax years or offsetting gains with losses can reduce the overall tax burden. - Claiming all eligible deductible expenses.

Residents can deduct qualifying expenses such as health costs, education fees, rent, mortgage interest (where applicable), childcare, and approved charitable donations. Proper invoicing through Portugal’s e-fatura system is essential to secure these deductions. - Using double taxation agreements effectively.

Expats with foreign income can reduce taxes by applying treaty reliefs and claiming foreign tax credits where applicable.

Planning with a financial advisor who is well versed in tax and reporting rules can help ensure compliance while legally minimizing tax liability.

How can I avoid double taxation in Portugal?

You avoid double taxation in Portugal by using tax treaties and claiming foreign tax credits.

Portugal has double taxation agreements (DTAs) with many countries, including the US, UK, France, and Germany.

To prevent being taxed twice:

- Claim foreign tax credits for taxes paid abroad.

- Apply treaty exemptions or reduced withholding rates where available.

- File the correct tax forms with both Portuguese and your home country tax authorities.

For US expats, the Foreign Tax Credit (FTC) can offset US tax liabilities on Portuguese income.

What expenses are tax deductible in Portugal?

Residents in Portugal can deduct approved health, education, housing, family, and charitable expenses.

These deductions mainly apply to tax residents, as non-residents are generally taxed at flat rates and do not have access to most personal deductions.

Portugal allows residents to deduct certain expenses, including:

- Health expenses (medical consultations, health insurance premiums, prescriptions, and hospital bills), typically deductible up to an annual cap.

- Education expenses (tuition fees for children and eligible self-education costs), subject to deduction limits.

- Housing expenses (rent for a primary residence and certain legacy mortgage interest cases), within defined thresholds.

- General family expenses (dependents, childcare, and household-related costs properly registered through the e-fatura system).

- Donations to approved charities, which may qualify for partial tax credits depending on the institution and amount.

Is it better to file as a resident or nonresident?

For most expats earning Portuguese-source income, filing as a resident is better because it allows access to personal deductions and credits, which can significantly lower overall tax liability.

Residents pay progressive rates on worldwide income, but deductions for health, education, housing, and charitable contributions help offset taxes.

Non-residents are taxed at flat rates of 25–28% and cannot claim most deductions, which can result in higher effective taxes for those with deductible expenses.

However, non-resident status can be advantageous for individuals with minimal Portuguese-source income, no deductible expenses, or those who primarily earn income abroad.

In such cases, paying the flat rate may simplify taxation and reduce administrative burdens, making non-resident status a better option.

How to stop being a tax resident in Portugal?

You stop being a tax resident in Portugal by officially de-registering and proving you no longer live there.

1. Deregister as a tax resident with the Portuguese tax authorities.

2. Close your permanent home or prove you do not live in Portugal for more than 183 days per year.

3. Declare your global income in your new country of residence to avoid double taxation.

Timing and documentation are critical, so consulting a tax advisor is recommended.

Regional Variations and Incentives in Portugal

Portugal’s national tax system sets standard progressive and flat rates, but residents in the autonomous regions of Madeira and the Azores benefit from lower personal income tax rates compared with the mainland.

- Madeira: Regional IRS rates reduce the effective tax burden. The lowest rate starts around 8.75%, while the highest is 33.60%, compared with 12.5%–48% on the mainland.

- Azores: Similarly, residents benefit from a top IRS rate of 33.60%, with the minimum rate also around 8.75%, reinforcing the regional tax advantage.

Residents in Madeira and the Azores can pay significantly less income tax over time compared with those living on the mainland, particularly at higher income levels.

Non-residents, who are taxed at flat rates of 25–28%, do not benefit from these regional reductions.

Although the differences are relatively modest at lower income levels, they accumulate for higher earners, making the choice of residency region a key factor in long-term tax planning.

Conclusion

Portugal’s tax system is not inherently high or low; your total tax bill varies significantly based on your residency status and income structure.

The difference between being classified as a resident, non-resident, or incorrectly registered can mean a gap of 20% or more in effective taxation.

The real risk for expats is not the headline rate, but misalignment. That is, misunderstanding residency rules, failing to apply treaty relief correctly, or structuring income inefficiently.

Those small technical details often matter more than the published tax brackets.

For most internationally mobile individuals, the smartest move is proactive planning before income is earned or assets are sold, not after.

In cross-border taxation, timing and structure typically determine the outcome far more than the country itself.

FAQs

How are US expats taxed in Portugal?

US expats pay Portuguese taxes on income sourced in Portugal and, if resident, on worldwide income.

They must still file US taxes, but the Foreign Tax Credit and the US–Portugal tax treaty help prevent double taxation.

Is 3000 euros a good salary in Portugal?

A gross salary of €3,000/month is considered above average in Portugal.

After taxes, net income typically falls around €2,000–€2,300, influenced by residency status and eligible deductions.

Is Portugal a tax-friendly country?

Portugal can be tax-friendly for expats who plan carefully and structure their income efficiently.

Regional incentives in Madeira and the Azores can reduce taxes, but new residents no longer have access to the NHR program.

What is the downside to moving to Portugal?

New residents face relatively higher taxes on Portuguese-source income, bureaucratic registration processes, and limited social security benefits.

Even so, Portugal remains attractive for lifestyle and strategic long-term tax planning

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.