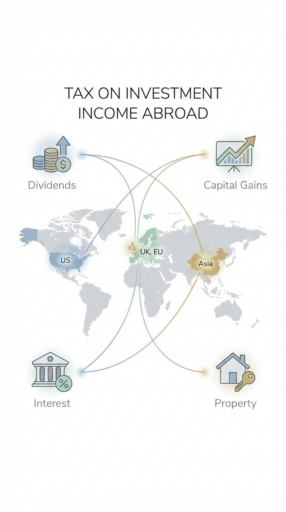

The tax on investment income abroad often applies to expats, even when investments are held outside their country of residence.

This is because many countries tax residents on their worldwide income, including foreign dividends, interest, capital gains, and rental income.

How much tax applies is driven primarily by tax residency status, the type of investment, and the tax treaties between countries.

This article covers:

- Does foreign income count as taxable income?

- How do I know if I am a tax resident?

- Do I have to pay tax on foreign dividends?

- How do tax treaties avoid double taxation?

- Which countries do not tax foreign source income?

Key Takeaways:

- Tax residency drives your worldwide tax obligations.

- Most countries tax residents on all foreign income.

- DTAs and foreign tax credits reduce double taxation.

- Not reporting foreign income can trigger penalties and interest.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

Do I need to pay tax on foreign investment income?

In most cases, yes, foreign investment income is taxable, with tax liability determined by your tax residency and the tax rules of the countries involved.

The amount of tax owed may also vary based on the type of investment income and whether a tax treaty applies.

Foreign investment income may include:

- Dividends from overseas stocks

- Interest from foreign bank accounts or bonds

- Capital gains from selling foreign assets

- Rental income from overseas property

- Distributions from foreign funds or trusts

Many countries tax worldwide income once an individual qualifies as a tax resident.

As a result, income earned abroad can still be subject to tax in the country of residence, even when the investment is held outside that country.

How do you determine an individual’s tax residency status?

Tax residency is determined by where an individual lives and maintains economic and personal ties, rather than by nationality or where investments are held.

Tax authorities use residency rules to establish whether a person is subject to tax on local income only or on worldwide income.

Common factors used to determine tax residency include:

- Number of days spent in a country

- Permanent home or habitual residence

- Center of economic interests, such as employment, investments, or business activity

- Family and social ties

- Visa, residency, or legal status

Tax residency matters more than the location of the investment because most countries tax residents on their global income.

How are foreign investments taxed?

Foreign investments are taxed according to the type of income they generate, with different rules applying to dividends, interest, capital gains, rental income, and foreign funds.

Once foreign investment income is taxable, the specific tax treatment is determined by how the income is classified under local tax law rather than where the investment is located.

- Dividends and interest are commonly subject to withholding tax in the source country and may also be taxed in the country of residence

- Capital gains are typically taxed when the asset is sold, with rates varying by jurisdiction and holding period

- Rental income is usually taxed in the country where the property is located, with additional reporting obligations for residents

- Foreign funds and pooled investments may be subject to special reporting requirements or higher tax rates in certain countries

Some jurisdictions apply preferential tax rates to specific categories of investment income, while others tax foreign and domestic investments at the same rates.

What is double taxation of foreign income?

Double taxation occurs when the same income is taxed by two countries. In particular:

- The country where the income originates (source country)

- The country where the taxpayer resides (residence country)

For example, dividends may be taxed at source through withholding tax and again when declared in your home country.

What are the benefits of a double tax agreement?

A Double Tax Agreement (DTA) or Double Taxation Avoidance Agreement (DTAA) helps prevent income from being taxed twice.

Key benefits include:

- Reduced or eliminated withholding tax rates

- Tax credits for taxes paid abroad

- Clear rules on which country has taxing rights

- Greater certainty for expats and investors

Common examples of country pairs with double tax agreements include:

- United States – United Kingdom

- United States – Canada

- United Kingdom – Australia

- Germany – France

- Singapore – India

- Japan – Philippines

DTAs are especially important for expats with investment portfolios, employment income, or assets spread across multiple countries.

Do I need to report foreign investment income?

In most jurisdictions, yes. Reporting foreign investment income is required even if no tax is ultimately owed.

Governments require reporting to track worldwide income, enforce tax compliance, and prevent tax evasion.

Reporting foreign investment income is not optional for tax residents in most CRS/OECD countries.

While the Common Reporting Standard (CRS) provides the framework for automatic information exchange between countries, the legal obligation to report comes from your tax residence laws, not CRS itself.

Reporting ensures that taxpayers can claim foreign tax credits, exemptions, or treaty benefits accurately.

Foreign income reporting is often required when:

- You are a tax resident

- You hold foreign financial assets above reporting thresholds

- You claim tax credits or exemptions

Failure to report foreign income can result in penalties, interest, or audits, even if the income itself is exempt.

How to declare foreign investment in ITR?

To declare foreign investment in your ITR, begin by preparing all records of foreign income and assets.

Once your information is ready, follow these steps:

1. Disclose foreign income – Enter dividends, interest, capital gains, rental income, or distributions in the appropriate section of your ITR.

2. Report foreign assets – List overseas bank accounts, investments, and other holdings as required by your tax authority.

3. Convert to local currency – Use official exchange rates to report all foreign income and assets in your domestic currency.

4. Claim foreign tax credits – Include taxes already paid abroad to reduce your local tax liability where applicable.

5. Attach supporting documents – Provide evidence such as income statements, tax paid, and account records if required.

6. Complete separate disclosure forms – Some countries require additional forms specifically for foreign assets, apart from the main ITR.

Following these steps ensures compliance, avoids penalties, and allows you to claim applicable exemptions or credits.

Where Foreign Investment Income Escapes Taxation

Some countries such as UAE and Panama do not tax foreign-sourced investment income, which makes them attractive for expats looking to optimize their portfolios.

These jurisdictions typically use a territorial tax system, meaning only income earned locally is subject to tax.

Notable examples:

- Monaco – No personal income tax for residents, including foreign investment income

- Singapore – Taxes only Singapore-sourced income; foreign dividends, interest, and capital gains are generally exempt

- Hong Kong – Territorial system exempts foreign-sourced investment income

- United Arab Emirates – No personal income tax on investment income

- Panama – Only Panama-sourced income is taxed; foreign investment income is exempt

Key considerations:

- Residency requirements vary, often including minimum stay periods or economic activity thresholds

- Some countries exempt foreign income but levy other taxes like inheritance, wealth, or corporate taxes

- US expats remain subject to IRS worldwide taxation, so reporting and compliance are still necessary

By understanding these jurisdictions, expats can strategically plan residency and investments while remaining fully compliant with home-country tax rules.

Conclusion

Managing foreign investment income as an expat requires compliance and a strategic understanding of how residency, investment types, and international tax treaties interact.

A financial advisor can help you ensure foreign investment income complies with local rules and leverages international tax treaties efficiently.

Proactive record-keeping, timely reporting, and leveraging available tax credits can also significantly reduce exposure to unnecessary taxation and penalties.

Ultimately, staying informed and planning ahead transforms foreign investment from a potential tax headache into a tool for building global wealth efficiently.

FAQs

What is the foreign earned income exclusion for expats?

The foreign earned income exclusion allows eligible US expats to exclude a portion of earned income from US taxation if they meet physical presence or bona fide residence tests.

It does not apply to investment income, such as dividends or capital gains.

How to avoid PFIC status?

US taxpayers can avoid PFIC issues by steering clear of non-US mutual funds and other pooled foreign investments, and instead using US-domiciled ETFs or investment vehicles.

It is also essential to maintain thorough records and file all required forms on time.

PFIC rules are complex and can result in punitive tax rates, so careful planning and compliance are critical to minimize risks.

How much income is tax free for US expats?

US expats have no tax-free threshold for foreign investment income, which is fully taxable.

However, earned income from work abroad can be excluded using the FEIE, which is $132,900 for the 2026 tax year, while foreign tax credits may reduce tax on income taxed abroad.

What happens if I don’t declare foreign income?

Failing to declare foreign income can lead to significant financial penalties, interest on back taxes, and loss of treaty benefits.

It also increases the risk of audits, and in severe cases, may result in criminal charges, as many countries treat non-disclosure of foreign assets as a serious compliance violation.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.